- Bitcoin fees surged by over 200% this week, reaching $15.5 million, with Runes contributing to the hike

- Miner fees spiked to over $4 million, marking the highest daily revenue since August

Over the last 48 hours, Bitcoin climbed past the $68,000 price range. However, this was not the only notable development surrounding the cryptocurrency this week.

Analysis revealed that fees on the network spiked by over 200%. And, this surge was not driven solely by BTC transactions. Instead, a significant portion of the fee hike can be attributed to memecoin transactions, particularly involving Runes.

Bitcoin sees a fee hike

According to data from IntoTheBlock, Bitcoin fees saw a major spike this week, rising by an impressive 206%, bringing the total fees to $15.5 million. This fee hike coincided with Bitcoin’s price moving into the $68,000 range after remaining below this level for over two months.

While a hike in BTC transactions contributed to the fee spike, the activity surrounding Bitcoin’s Runes played a crucial role in driving the higher transaction fees.

Runes transactions boost Bitcoin fees

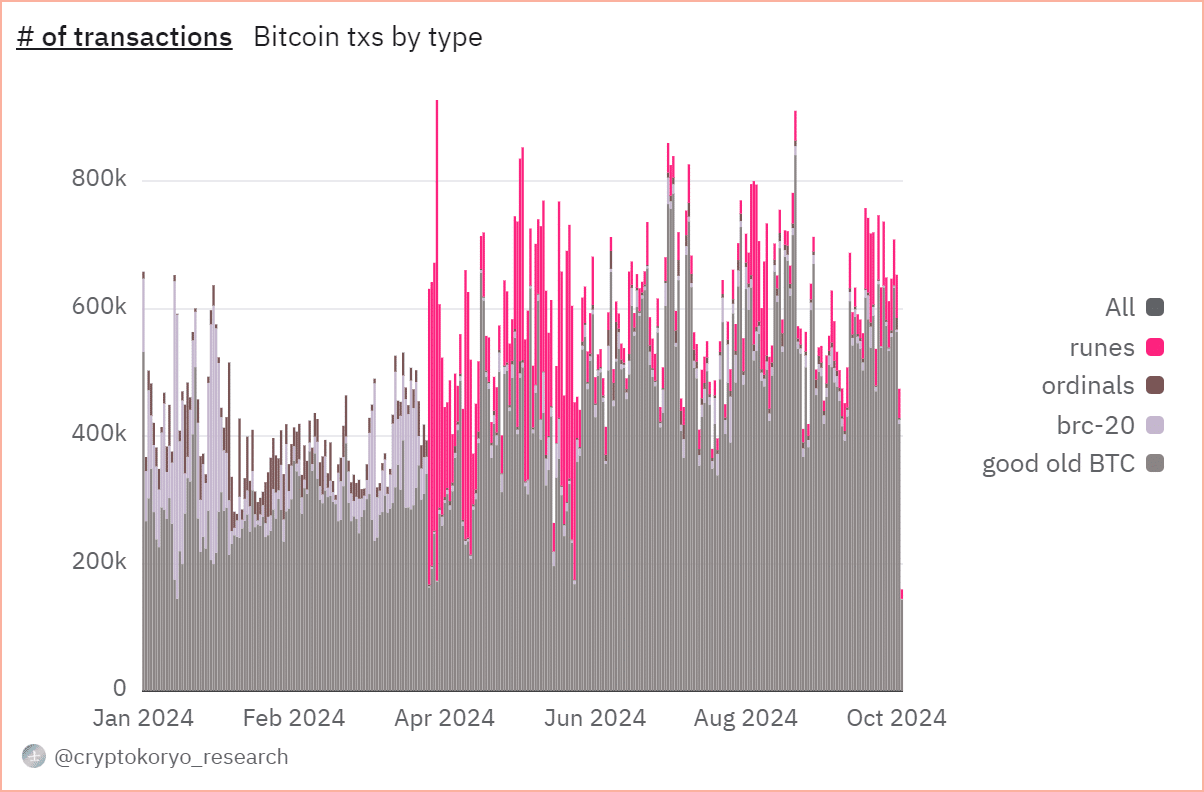

An analysis of Runes transactions on Dune Analytics revealed that activity has picked up significantly over the past few days. As of 18 October, Runes accounted for over 45,000 transactions on the network.

These transactions made Runes the second-most traded asset on the network, following Bitcoin itself. On some days over the past week, Runes transactions constituted more than 10% of all transactions, while BTC transactions continued dominating the network.

In the most recent trading session, Runes contributed to over 9% of all transactions on the network.

Source: DuneAnalytics

In addition to transaction volume, Runes notably impacted the fees generated. At the close of the most recent trading session, Runes transactions accounted for over 3% of the total Bitcoin fees.

However, throughout the week, Runes transaction fees reached as high as 7%, surpassing 12% during the previous week.

Miner fees see a spike after months

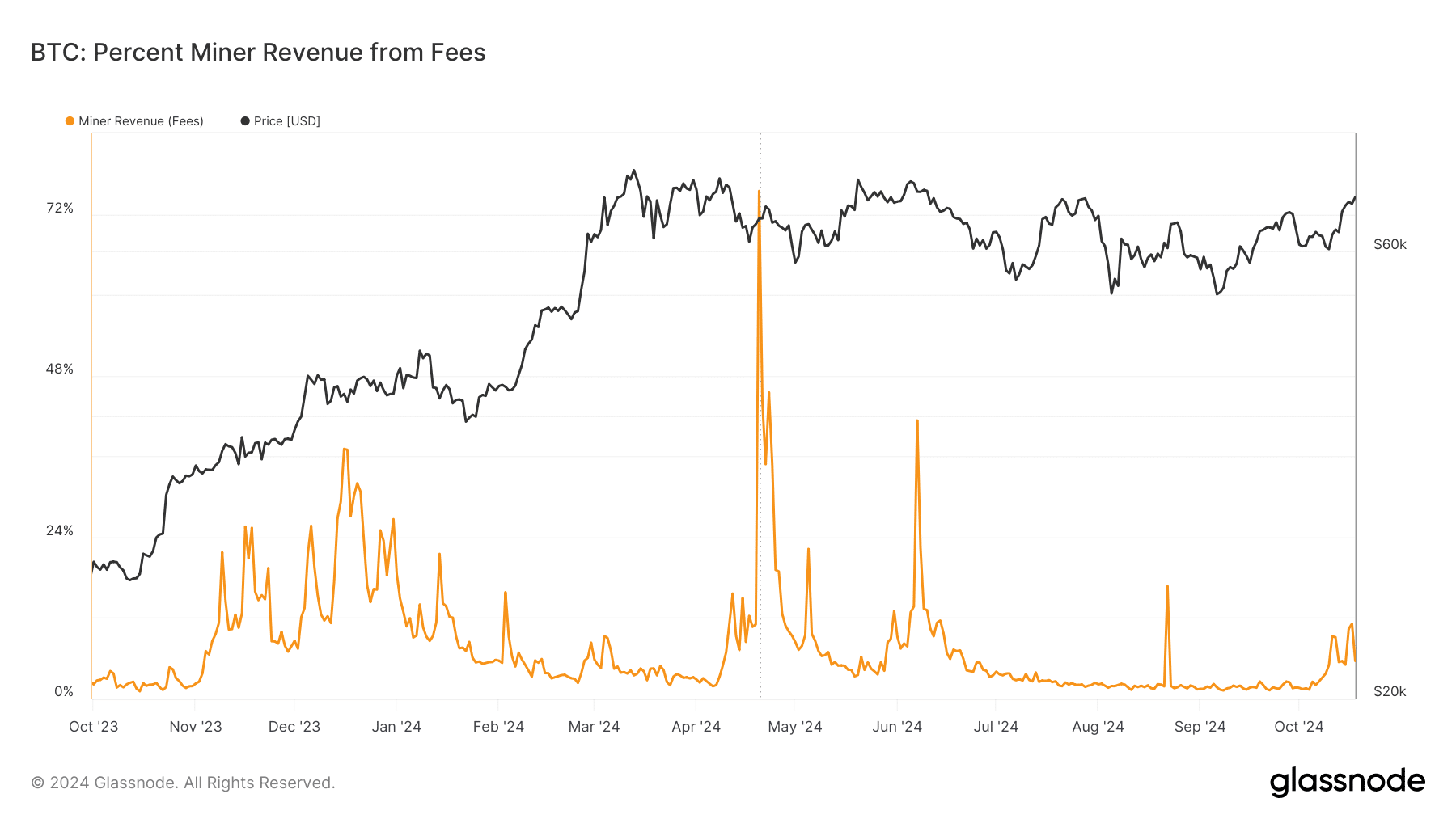

The uptick in Bitcoin fees has also benefited miners. In fact, data from CryptoQuant revealed that miner fees hit their highest daily level since August, with a spike to over $4 million on 17 October.

Although miner fees have since dropped to around $1.7 million, they remain among the highest in the last two months.

– Read Bitcoin (BTC) Price Prediction 2024-25

An analysis of miner revenue by Glassnode also indicated that transactions from Bitcoin and Runes contributed to the fee surge. Miner revenue from fees increased by more than 11%, marking the first time since August that miner fees saw such a significant spike.

As of now, miner fees make up around 5% of the total revenue.

Source: Glassnode