- The altcoin market has evolved significantly, with big wallets making strategic moves to fuel their growth.

- With all eyes now on this expanding space, the question is: which altcoins should you target?

Between late November and early December, Bitcoin’s [BTC] dominance plunged from 61% to 54%, coinciding with its record-breaking $99K close.

This sharp shift signaled a local top, as spooked investors either flocked to alternative assets or exited the market entirely. In the chaos, many altcoins seized the opportunity to shine.

Ripple [XRP], Ethereum [ETH], Cardano [ADA] and Binance Coin [BNB] were among the big names that capitalized on the moment.

However, the real surprise came from Tron [TRX], which recorded the longest green candlestick in its history, surging an incredible 96% in a single day.

Now, with BTC back in the spotlight, hitting new all-time highs, the market is as volatile as ever.

The unpredictability of BTC’s price action – often going against mainstream expectations – leaves no clear indication of where it will head next.

So, when the next local top arrives, which altcoins should investors be watching? Could now be the perfect time to dive in and grab the ‘dip’ before the market moves again?

The new year will demand greater diversification from you

The crypto market is on the move again. In the past 24 hours, Bitcoin has seen a surge in capital, driving its price higher, pushing all holders into profit, and wiping out $118 million in short positions.

With its market share now at 57%, it’s clear that Bitcoin is slowly reclaiming its dominance. But volatility is far from over, presenting an ideal opportunity for altcoins to capitalize.

Why does this matter? As the market matures, risk management becomes essential. The key is to lock in profits and avoid overexposure, which means shifting focus to altcoins.

In the year ahead, diversification will be your best ally. Your risk appetite will be tested more than ever, making it vital to stay ahead with a balanced approach.

This is exactly the strategy whales have used on the Tron network. As Bitcoin surged over the years and risk increased, altcoins like Tron started attracting attention.

So, what began as a small wallet holding a few TRX coins has now ballooned into massive holdings, forming what we know as whales.

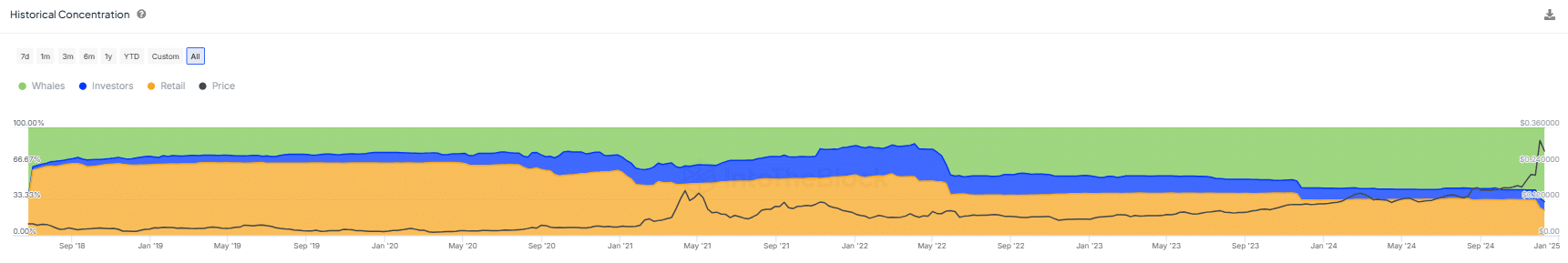

These whales now control nearly 70% of the total supply, as shown in the green chart, with their holdings growing year after year.

Source : IntoTheBlock

More importantly, this strategy isn’t unique to Tron – it’s a trend seen across most top altcoins, with only a few exceptions.

So, as Bitcoin continues to hit new highs, this trend is set to grow, with altcoins becoming both more “affordable” and increasingly viewed as a “safe haven” for strategic investors.

So, which altcoins should you keep your eye on?

Timing is everything in crypto, and right now, many altcoins are quietly accumulating, building momentum against Bitcoin.

If history has taught us anything, once BTC hits a local top, altcoins are primed to break out – making “buying the dip” now a strategy that could pay off big in the long term.

That said, be prepared for a bumpy ride. This market can be volatile, with corrections similar to those we’ve seen in the past. Take LINK, for example – it experienced over 15 corrections in less than a year during 2020-2021.

Right now, it’s sitting at $29, which is the same price it was two years ago. But even with that, 84% of LINK holders are still in the green, and almost half of its supply is held by just 18 whale wallets.

Now, here’s where it gets interesting. Whales might bring some stability to altcoins, but those massive holdings also mean they can cause some serious price swings.

With so much of the supply controlled by a few wallets, those whales can move the market however they want.

So, what’s the best strategy going forward? It’s time to shift focus toward low and mid-cap tokens with less whale influence.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Why? Because the new year is going to bring even more volatility.

As Bitcoin makes its moves, risk is going to go up, and with whales dominating the top altcoins, diversifying into smaller, less-concentrated tokens could be the best way to protect your portfolio while also capitalizing on gains from top alts.