- Stellar’s $0.39 support aligns with key Fibonacci levels, signaling oversold conditions and rebound potential.

- XLM Long/Short Ratios show bullish trader confidence despite declining trading volume and heightened market volatility.

Stellar’s [XLM] was trading at $0.3728 at press time, reflecting a 24-hour price decline of 8.28% and a 10.36% drop over the past week.

Despite the short-term losses, analysts suggest the cryptocurrency is nearing a crucial support level at $0.3851, which could pave the way for a strong rebound.

This support zone has historically attracted buyer interest, as noted in a recent analysis. The suggested upside targets are $0.6396 and $0.8278, offering substantial growth potential if the price successfully reverses from the current downtrend.

Maintaining the $0.3851 level will be critical for any bullish recovery to materialize.

Source: X

Technical indicators suggest oversold conditions

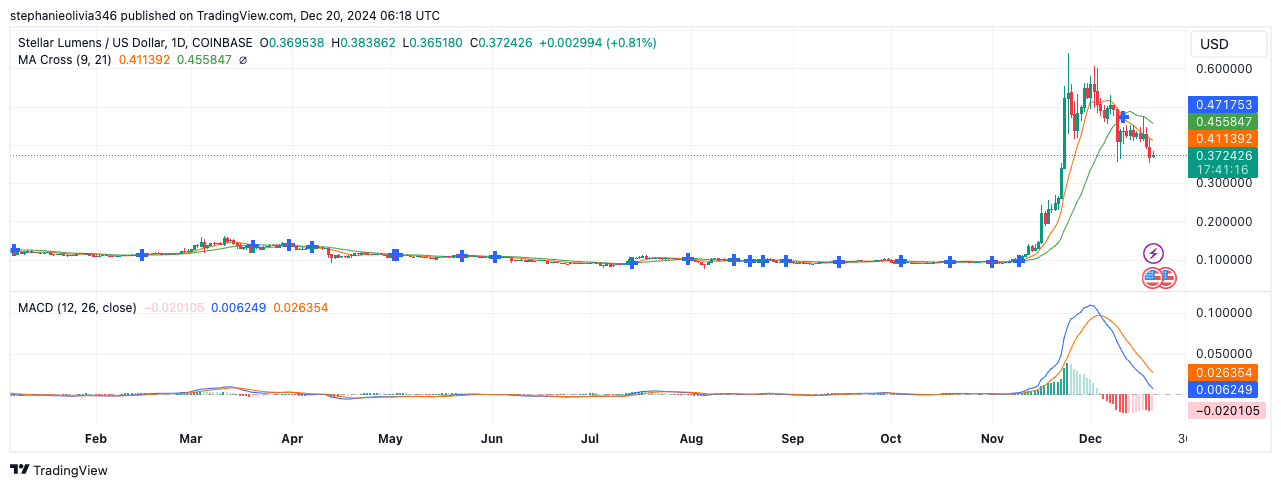

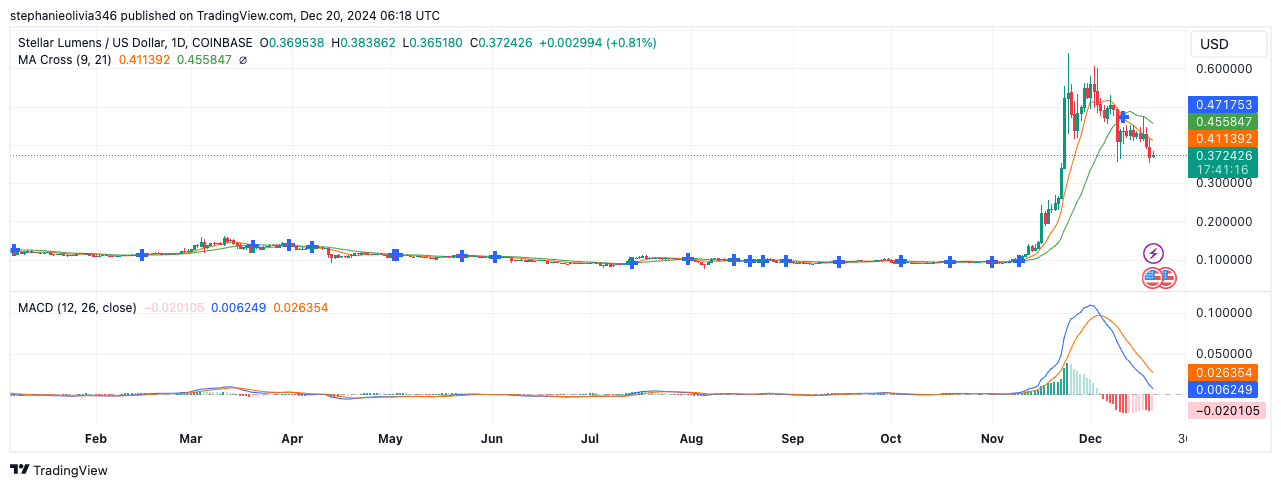

The recent price decline comes amid a broader corrective downtrend following a significant rally in late November.

Fibonacci retracement analysis identifies the $0.3851 support level aligning with the 0.786 retracement level, typically signaling an oversold condition.

Additionally, the MACD (12, 26) indicator has formed a bearish crossover, with the MACD line dropping below the signal line. The histogram is negative, further confirming short-term bearish momentum.

Source: TradingView

However, technical analysts suggest that stabilization at support could serve as a launchpad for a bullish reversal, provided momentum indicators turn positive in the near term.

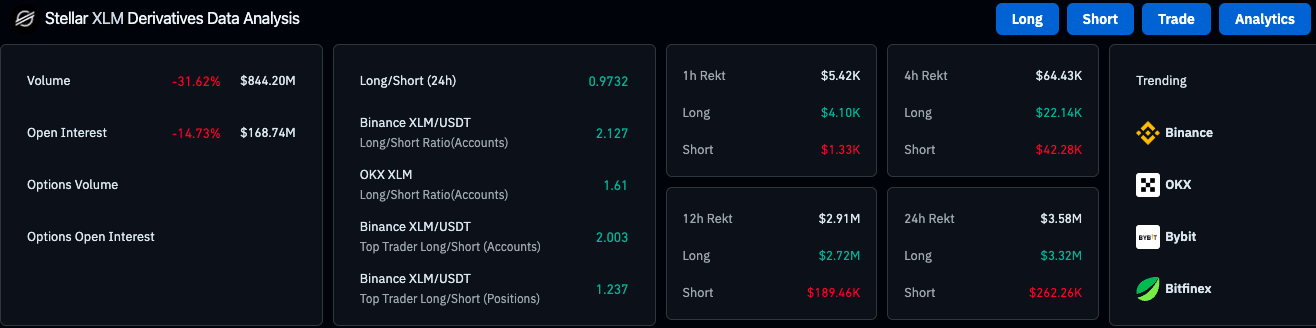

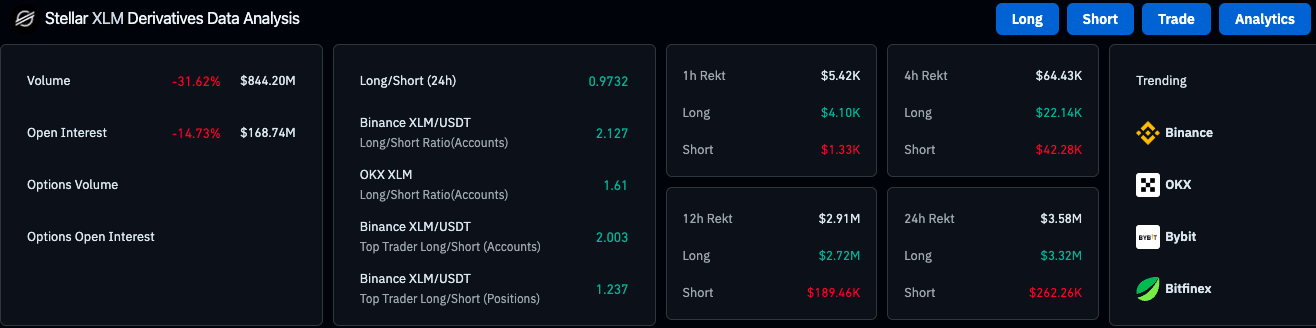

Derivatives data indicates bullish bias despite lower activity

XLM derivatives markets show a decline in activity, with trading volume down 31.62% to $844.20M and open interest falling by 14.73% to $168.74M.

Despite this reduction, the Long/Short Ratios on Binance and OKX reveal a bullish tilt. Binance accounts show ratios above 2.0, indicating that traders are favoring long positions over short ones.

Source: Coinglass

Liquidation data, however, points to heightened volatility, with $3.58M in 24-hour liquidations, primarily affecting long positions.

This imbalance suggests confidence among traders but underscores the importance of caution, as the market remains highly reactive.

On-chain data and broader ecosystem metrics

On-chain data from DeFiLlama reveals that Stellar’s Total Value Locked (TVL) currently stands at $46.53M, representing a 4.21% decline over 24 hours.

Stellar’s ecosystem boasts a stablecoin market cap of $143.09M and has raised $3M, highlighting its utility in decentralized finance.

Read Stellar’s [XLM] Price Prediction 2024–2025

As the market awaits a reversal confirmation, Stellar’s ability to hold the $0.3851 support will likely determine its next move.

With a circulating supply of 30 billion XLM, the cryptocurrency has a market cap of over $11.53 billion. This provides potential growth if the anticipated rebound occurs.