- The asset is currently trading within a bullish framework that could propel it beyond its previous ATH if the trend materializes.

- On-chain metrics reveal strong buying interest among market participants, further reinforcing the asset’s bullish outlook.

Over the past 24 hours, bullish momentum has lifted Binance Coin’s [BNB] price by 5.21% from the previous day’s close. This recovery follows a 3.46% decline earlier in the week that had weighed on its performance.

An analysis by AMBCrypto suggests that the asset retains significant potential for further gains, supported by robust market sentiment.

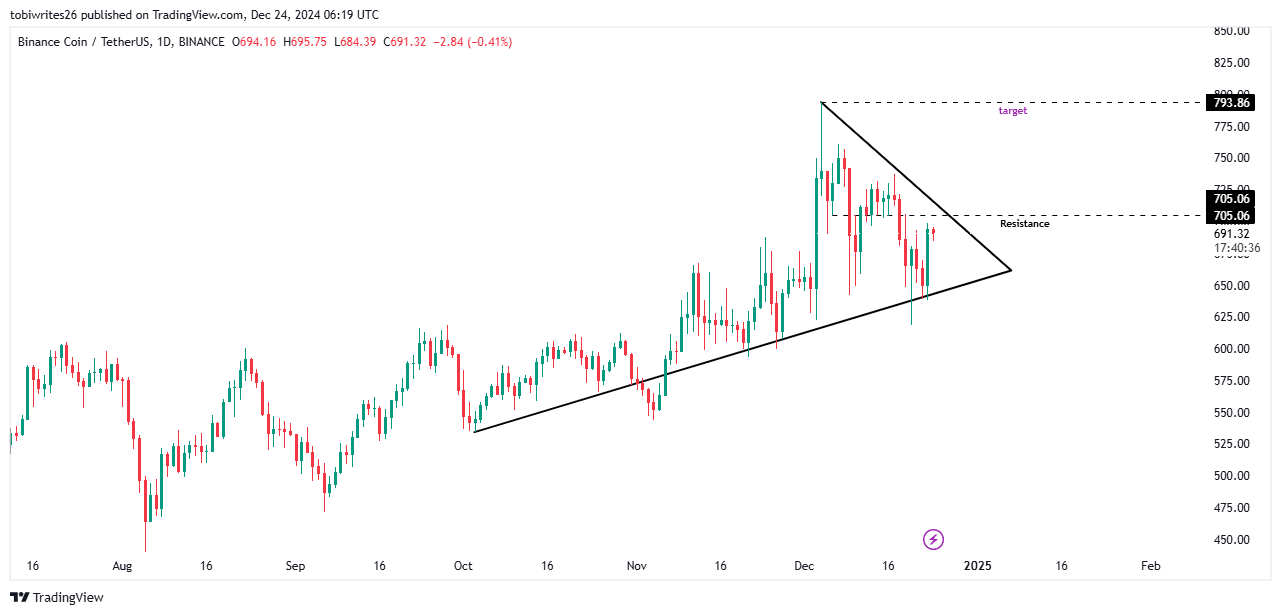

Bullish structure targets a new high

BNB is currently trading within a bullish symmetrical triangle pattern which is an accumulation phase dominated by buying. This pattern is characterized by price fluctuations between converging support and resistance levels.

If this trend holds, BNB is to revisit its previous all-time high of $793.86, with the possibility of approaching the $800 region. However, the asset will encounter a significant resistance zone at $705.06, which could temporarily stall its upward momentum.

Source: Trading View

In the past 24 hours, a notable price spike has led BNB closer to breaking out of the pattern, contributing to a 5.25% increase in market capitalization to $99.59 billion. Trading volume has also surged by 29.39%, reaching $1.6 billion.

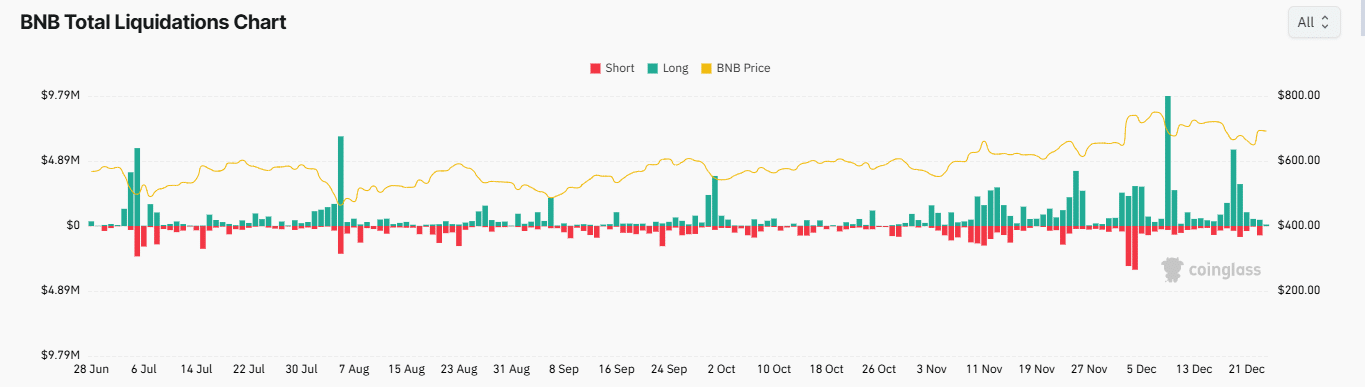

Shorts record losses as long contracts surge

Coinglass liquidation data reveals a market bias toward rising prices, with more short contracts being liquidated than long positions.

Out of the $1.03 million in total liquidations, $578,680 worth of short contracts have been forcibly closed, compared to $447,480 in long contracts over the past 24 hours.

Source: Coinglass

Additionally, long contracts in the market have seen a significant increase. The long-to-short ratio, which compares the amount of long contracts to short contracts, is currently above 1.

As of the latest data, the ratio stands at 1.0202, indicating that more traders are betting on BNB’s price rising. This shift is reflected in the asset’s upward price movement and the growing losses for short positions, as shown in the liquidation data.

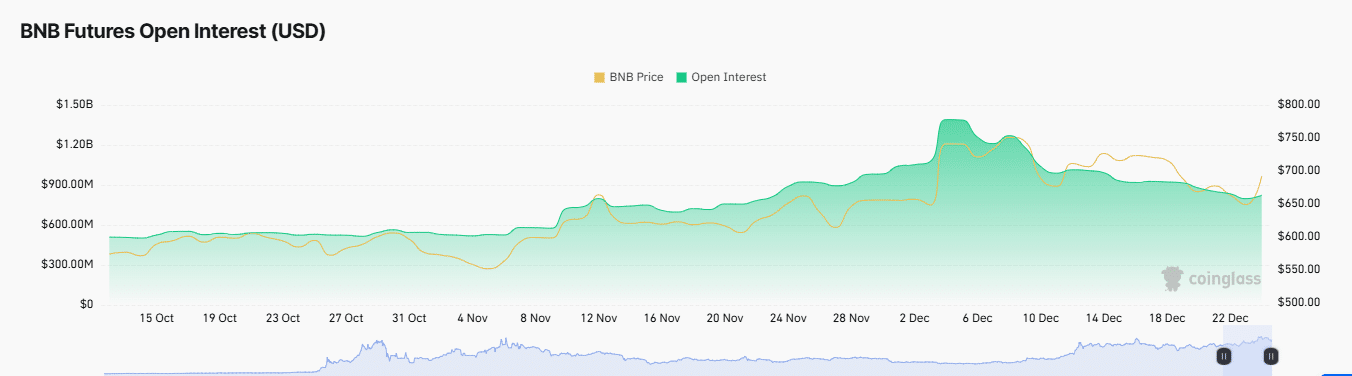

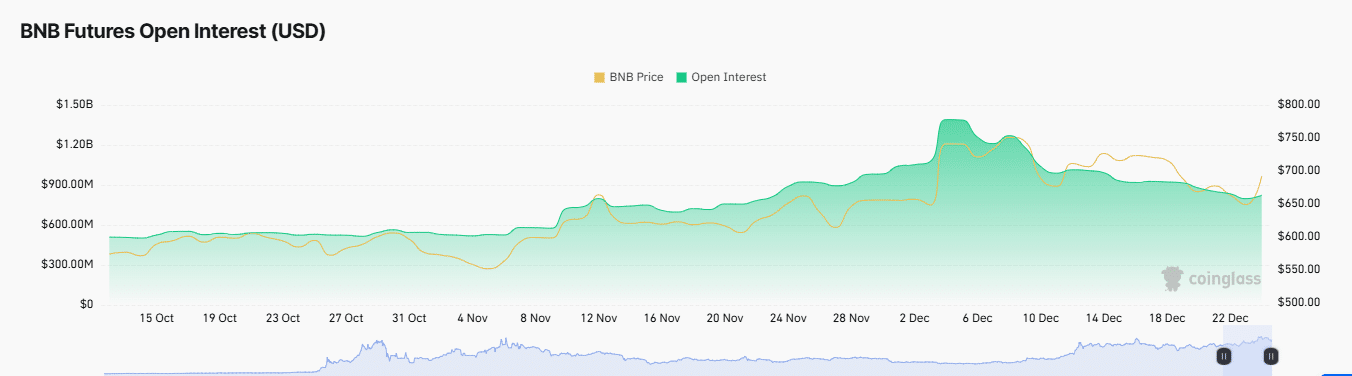

BNB open interest surges higher

After a period of consistent decline, Open Interest—the measure of unsettled derivative contracts in the market—has started to rise, increasing by 0.57% to approximately $817.75 million.

This shift suggests that more contracts are being opened in the market. Combined with the recent surge in trading volume and price, it hints at a higher likelihood of bullish sentiment driving these new positions.

Source: Coinglass

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Finally, there has been a noticeable change in BNB holders’ behavior. More traders are now opting to hold their positions rather than sell, with a significant portion of assets being moved to private wallets for safekeeping. In total, 2.15 million worth of BNB has been transferred.

Given the overall market sentiment, BNB remains bullish, and it is poised to potentially reach new price levels in the upcoming trading sessions.