- Litecoin’s technical breakout above its descending channel confirms a bullish reversal amid rising investor conviction.

- Market sentiment signals further price uptrend as Open Interest rises alongside decreasing exchange netflows.

Litecoin [LTC] has seen renewed interest from large-scale traders amidst recent volatility in the crypto market.

At press time, LTC was trading at $125.29, a 12.86% price surge despite a decrease in trading volume in the last 24 hours. With this breakout and Litecoin’s market sentiment, will the altcoin maintain its bullish momentum?

Litecoin’s price action

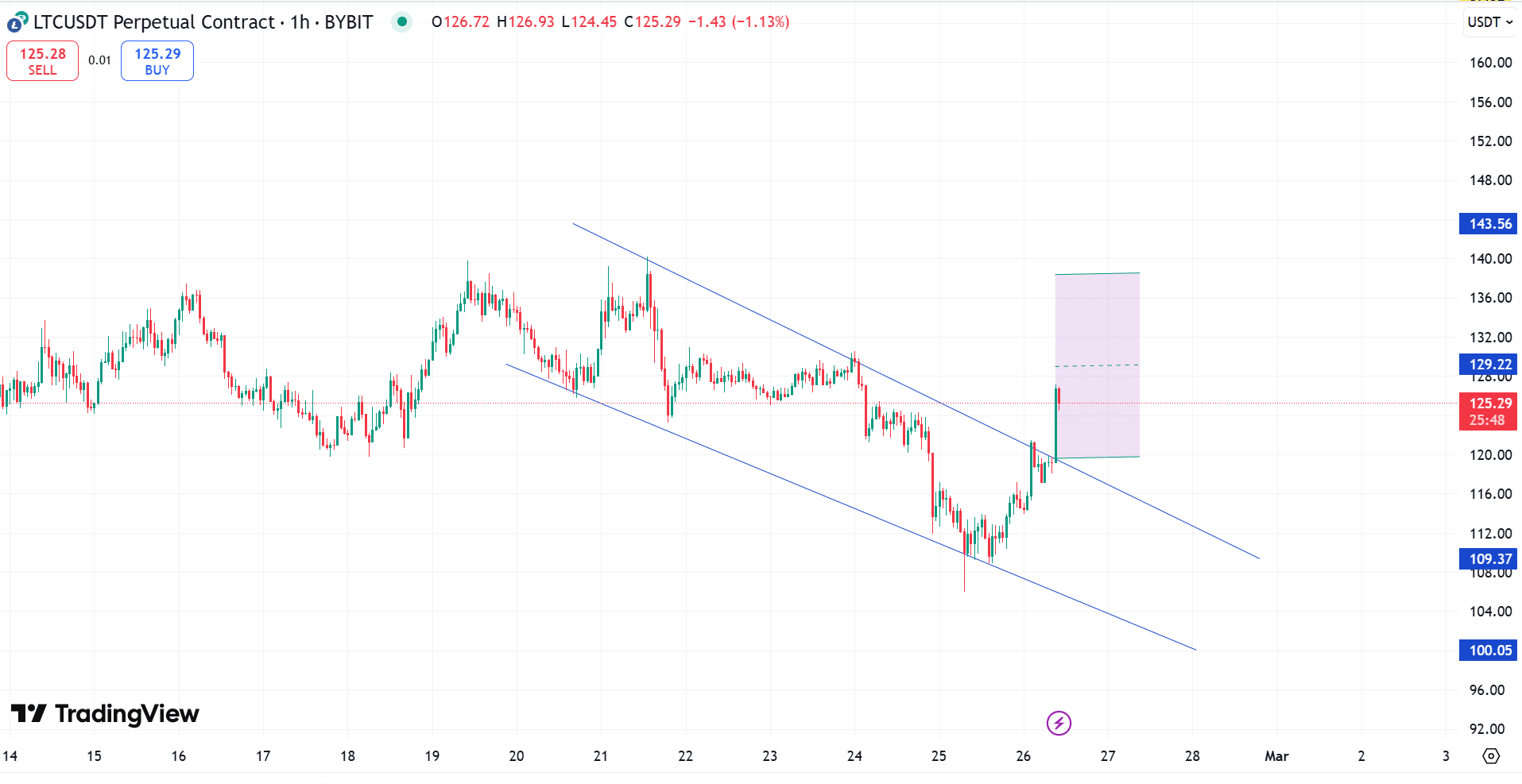

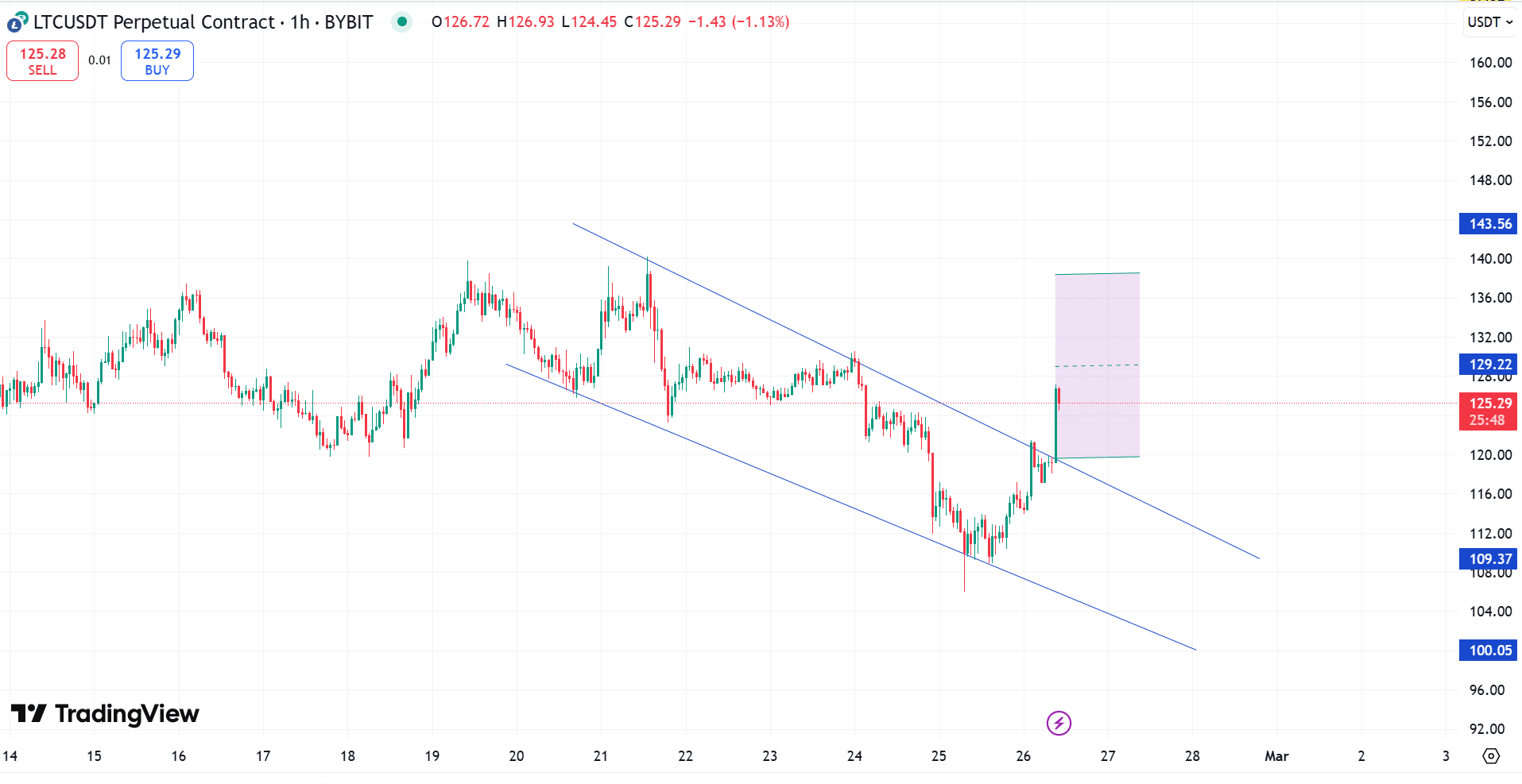

Litecoin has been trading in a descending channel on the hourly chart until a breakout above $120.00 on its descending resistance trendline.

The breakout candle above this level signaled a strong uptrend momentum, reflected by its 12.86% price surge.

If the momentum sustains, LTC could aim for the $129 key resistance zone in the short term, while targeting $143 in the mid-term.

Source: TradingView

Technical indicators signal bullish momentum strength as the short-term, mid-term, and long-term moving averages signal a strong “Buy” based on TradingView data.

According to Cryptowaves, LTC’s 24-hour relative strength index (RSI) stood at 53 and rose to 58 in the 4-hour timeframe, at press time.

Market sentiment & on-chain insights

Litecoin’s Open Interest has risen 12.09% in the past day. As of this writing, the Long-short ratio was 2.19, suggesting that more traders were buying LTC.

The 7-day exchange netflow ($33.14M) showed minimum selling pressure as the majority of investors were at a profit, according to IntoTheBlock data.

Source: IntoTheBlock

Whale activity and trends

According to Ali Martinez on X (formerly Twitter), large investors have accumulated 930,000 LTC in the last two weeks, suggesting long-term conviction amid market uncertainties.

With the LTC ETF approval odds rising, investors could be positioning themselves for Litecoin’s bullish rally, as evidenced by its rising total value locked(TVL).

Source: X

What’s next for LTC?

LTC must sustain its bullish momentum above the descending channel to hit the $129 target and beyond. However, a dip below the $120 key resistance level could result in a pullback toward $110.

With a Bitcoin correlation of 0.11, LTC is independent of BTC’s price action. Therefore, with its strong buying volume and whale accumulation, LTC could be poised for a long-term uptrend.