- Memecoins are akin to collectibles according to SEC.

- The U.S. SEC clarifies that memecoins are not securities under the Securities Act of 1933.

Under the new administration, the Securities and Exchange Commission (SEC) has come out to provide clarity for various crypto assets.

In the latest move, the agency has provided a much-awaited clarification regarding memecoins over its ‘securities’ status.

According to the SEC, memecoins are more like collectibles than securities. Through the official report, SEC staff added that,

“Memecoins are akin to collectible and the assets have limited or no use or functionality”

What this means is that memecoins drive value from their community hype, and cultural appeal, rather than fundamental utility.

Therefore, unlike other crypto assets such as Bitcoin which has strong and wide applicability, memecoins are speculative assets rather than serious investments.

Why are memecoins not securities?

With the SEC ruling that memecoins are like collectibles, the commission emphasized that memecoins cannot be treated as securities.

According to the SEC’s statement, memecoins do not qualify as securities under the Securities Act of 1933. The Division of Corporation Finance argued that memecoins do not offer rights to future income, profits, or assets, which is a major factor in determining if an asset is a security.

As such, memecoins’ value is primarily driven by market speculation and social hype. Therefore, since they fall outside the definition of securities, issuers, and traders are not required to register transactions with the SEC.

Thus, buyers and holders are not protected by securities laws. Although memecoins are not protected under securities law, fraudulent conduct is subject to prosecution by federal or state laws.

U.S. bill restricting politicians and state officials

While the SEC was providing legal clarity over memecoins, lawmakers are working on a bill to restrict politicians from offering memecoins.

The bill, called the Modern Emoluments and Malfeasance Enforcement (MEME) Act, aims to restrict public officials including the president and their immediate family from offering, launching, or endorsing a memecoin.

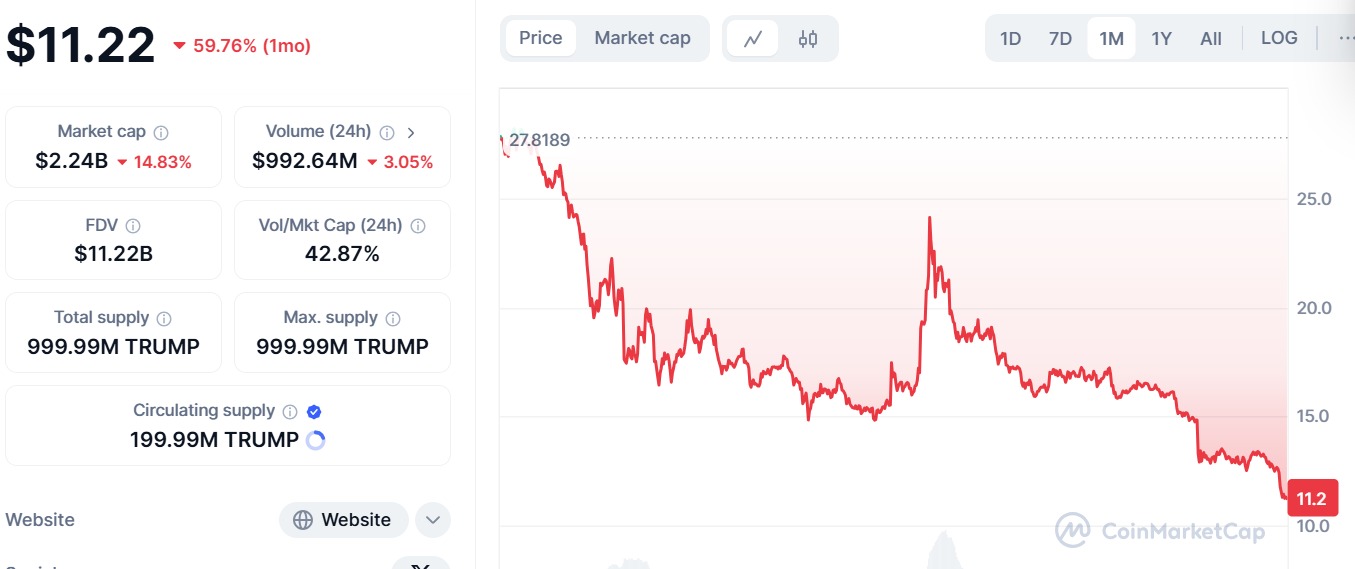

Source: Coinmarketcap

This follows the scandalous launch of Official Trump [TRUMP]and Official Melania Meme [MELANIA].

The two memecoins have plunged since the launch a month ago, leading to billions of losses. Trump memecoin has declined 59.8% over the past month, while its market cap declined from $5 billion to $2.2 billion.

Under this precedent, the bill will prohibit all public officials from engaging with memecoins.

U.S. Representative, Sam Liccardo, accused Trump and his family of criminal activities, arguing they enticed investors to buy the memecoins for personal profits.

What this SEC statement means for the crypto

Notably, the SEC’s legal clarity around memecoins is a major milestone for the crypto market. This will provide crypto exchanges, developers, and holders with a clear path to follow moving forward.

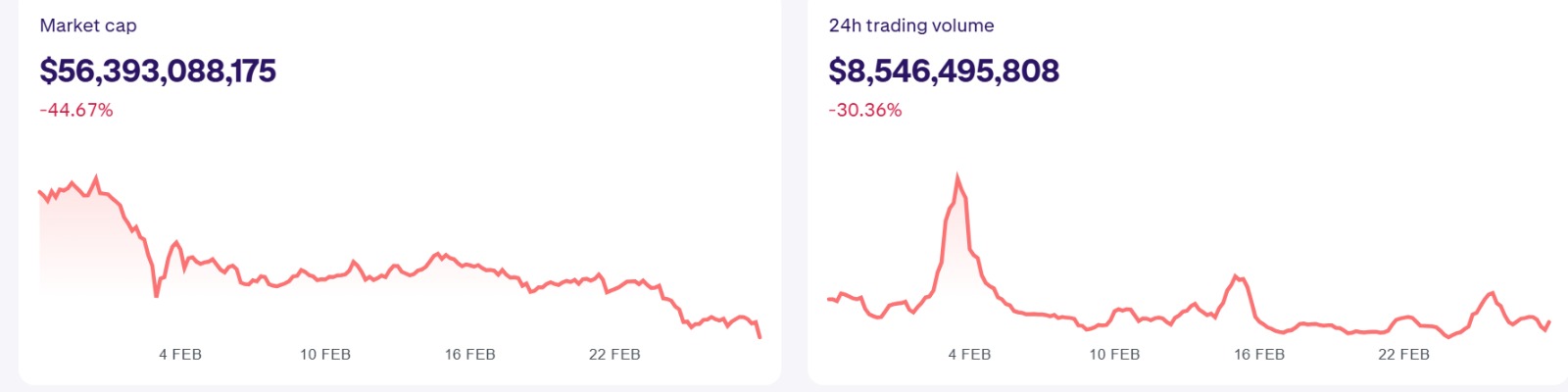

Source: Kraken

In turn, it will create a healthy environment, allowing big players to enter memecoin markets. Usually, the entrance of big players boosts memecoins, which have suffered over the past month.

Significantly, the SEC’s statement comes at the right time. Memecoins have been struggling, with their market cap dropping by 44.67% to $56 billion.