- Toncoin’s rally slowed after Pavel Durov’s release, but strong on-chain metrics suggest underlying strength.

- Despite cooling momentum, rising TVL and strong holder confidence indicating sustained growth.

Just days after receiving judicial approval to leave France, Telegram founder Pavel Durov has returned to Dubai — marking a significant moment in his ongoing legal battle.

Durov, who was arrested at a Paris airport last August and banned from leaving the country, confirmed his return on Monday, stating, “It feels great to be home.”

The investigation concerns alleged criminal activity on Telegram, though Durov maintains the platform has consistently exceeded its legal obligations.

While his departure signals a shift in the legal narrative, it also raises questions about Toncoin’s [TON] future.

The token surged over 20% following news of his release — but with the hype cooling, the spotlight now shifts to the numbers.

Toncoin’s rally slows after weekend surge

TON saw a sharp recovery in recent days, briefly rallying from $2.59 to $3.66 — an over 40% gain — following news of Durov’s travel approval.

However, the bullish momentum has begun to cool, with Toncoin trading at $3.41 at press time, down 1.25% in the last 24 hours.

The RSI has dropped from overbought levels and sat at 53.31, signaling weakening buying pressure.

Source: TradingView

Meanwhile, OBV remained negative at -835K, suggesting that recent gains may have lacked strong accumulation. Volume spikes seen during the weekend were tapering, indicating potential hesitation among traders.

Unless broader participation picks up, TON risks slipping into consolidation or a short-term retracement.

Profitability and on-chain valuation signal underlying strength

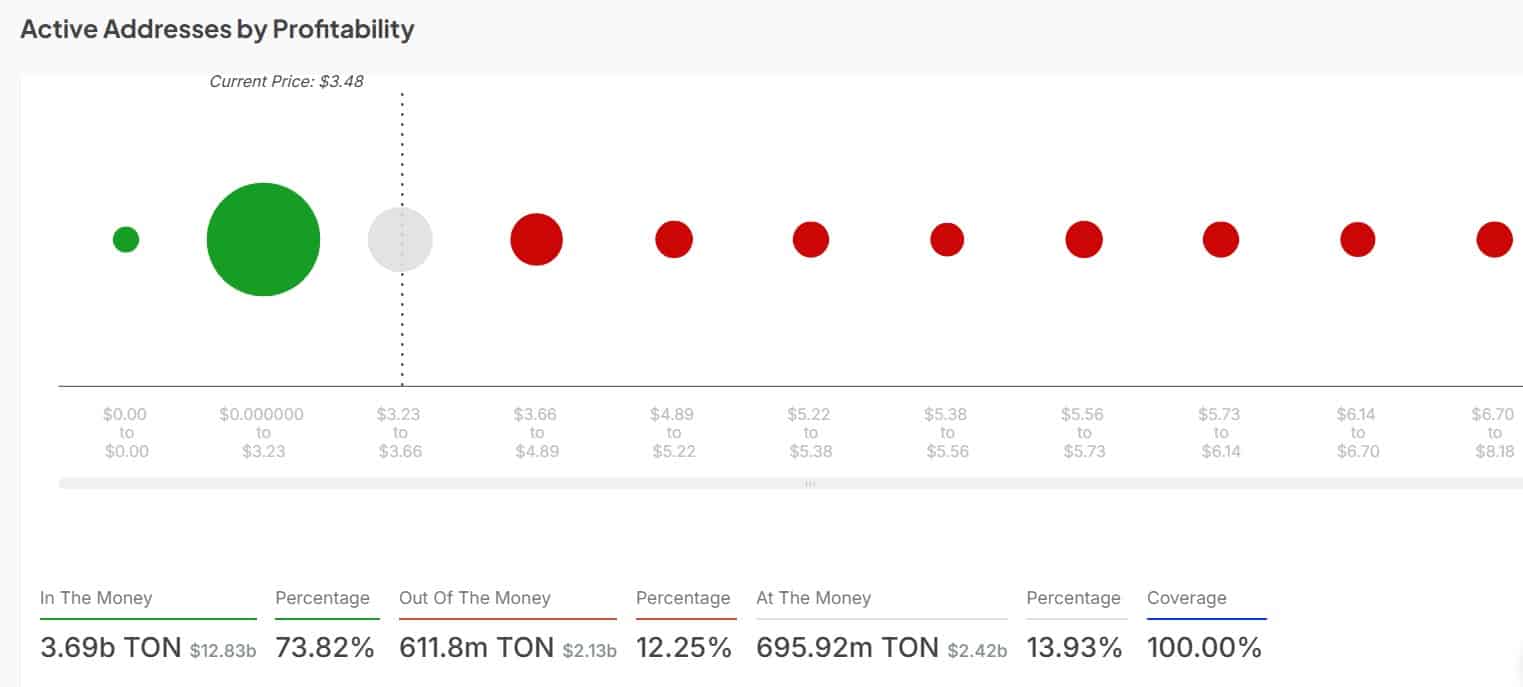

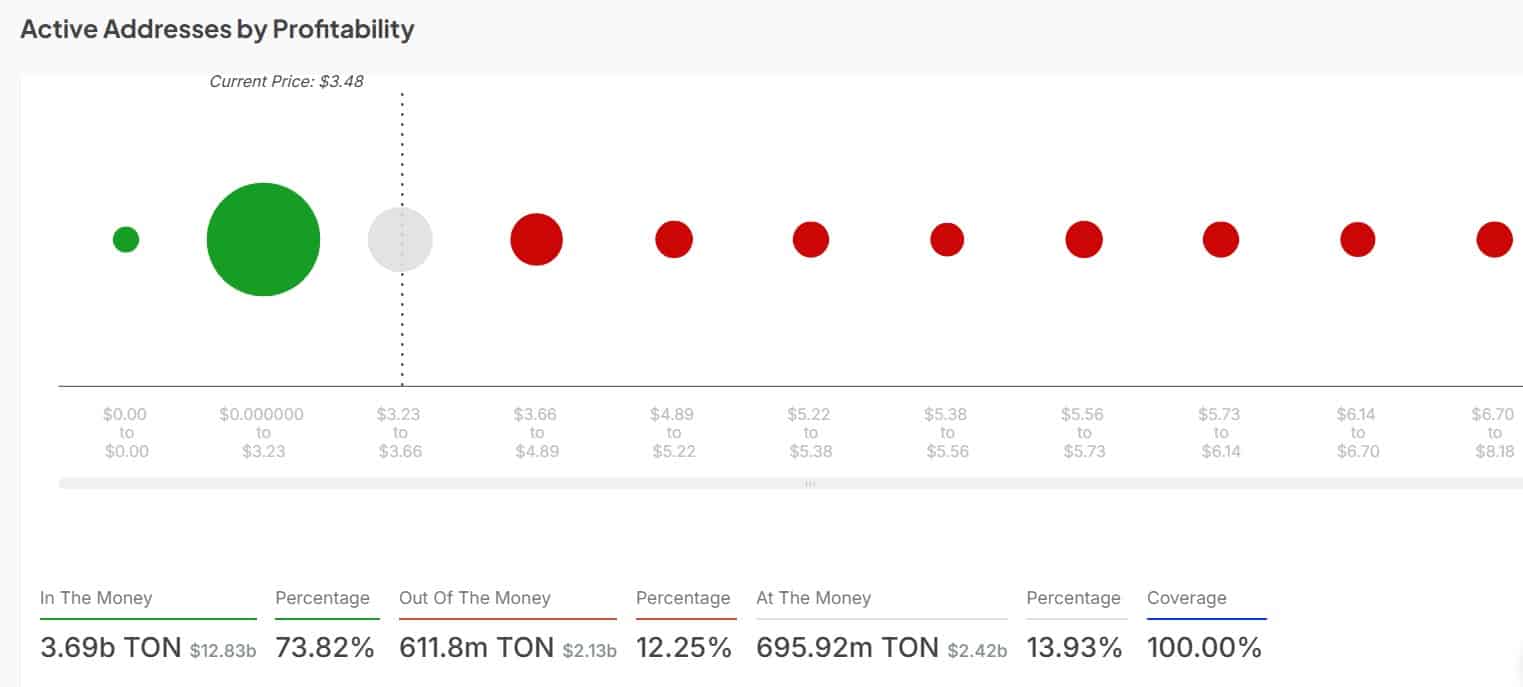

Source: IntoTheBlock

TON’s profitability metrics suggest strong holder confidence, with 73.82% of tokens “in the money” — meaning most holders bought below the press time price of $3.48.

Only 12.25% of addresses remained “out of the money,” indicating minimal overhead resistance.

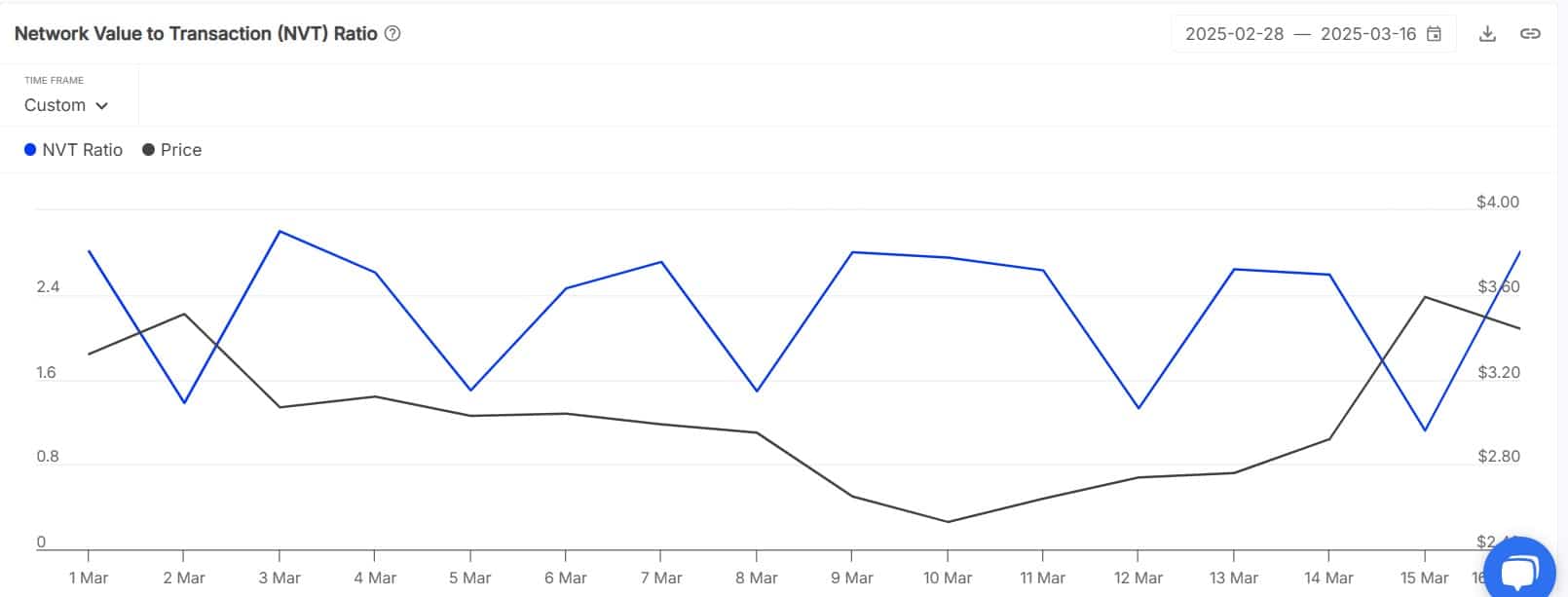

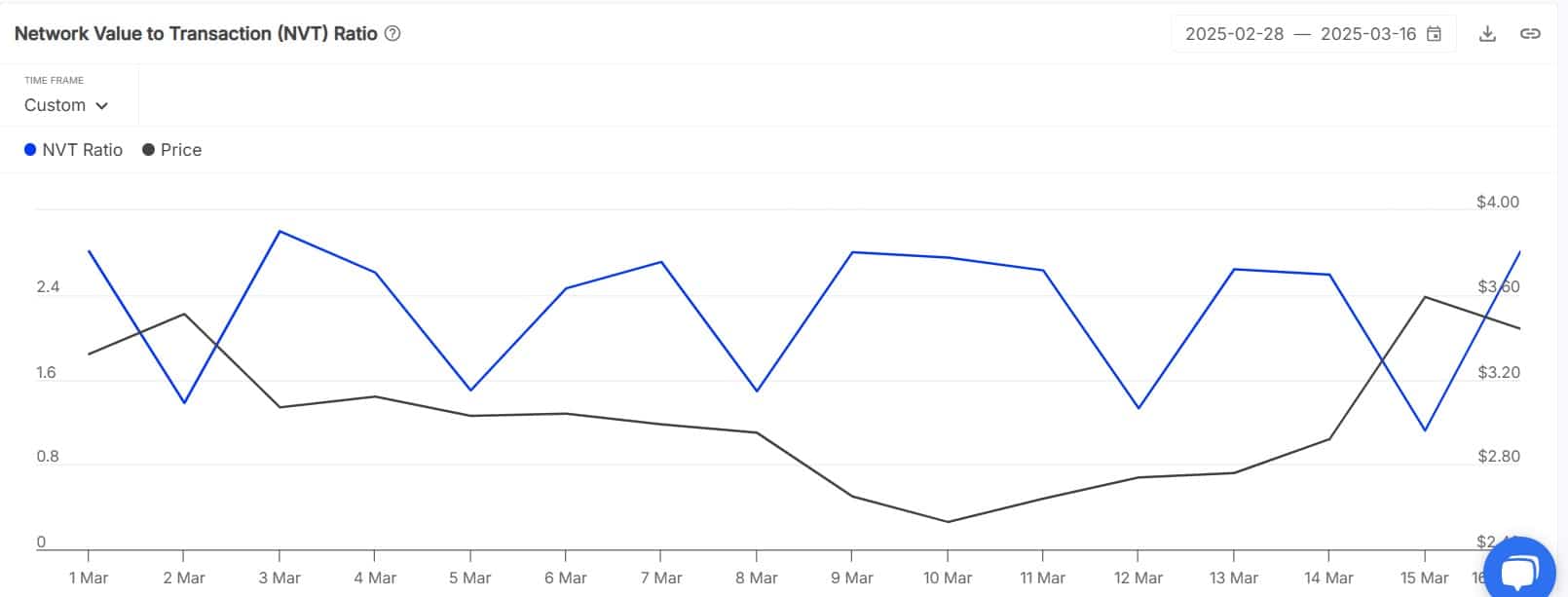

Source: IntoTheBlock

Meanwhile, the NVT ratio has shown volatile swings, but a clear decline in early March followed by a price breakout suggests undervaluation was corrected.

As the price surged from the 13th to the 15th of March, the NVT ratio dipped, indicating that transaction volumes supported the rally.

With NVT rising again and a majority of addresses in profit, TON appears structurally resilient, although further upside may depend on sustaining high transaction volumes.

Will TON’s rally persevere?

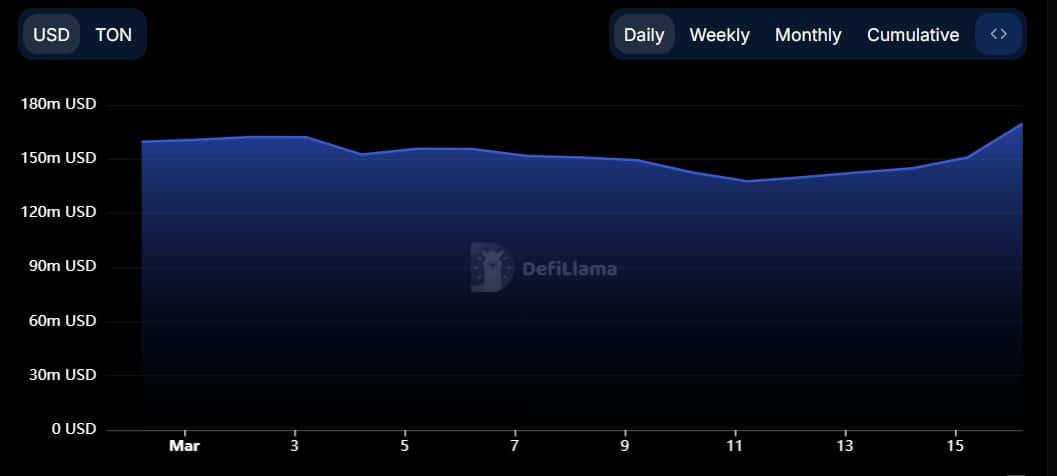

Source: DeFiLlama

According to DeFiLlama, TON’s TVL surged from $140M to nearly $170M between March 15-17, reflecting renewed investor confidence.

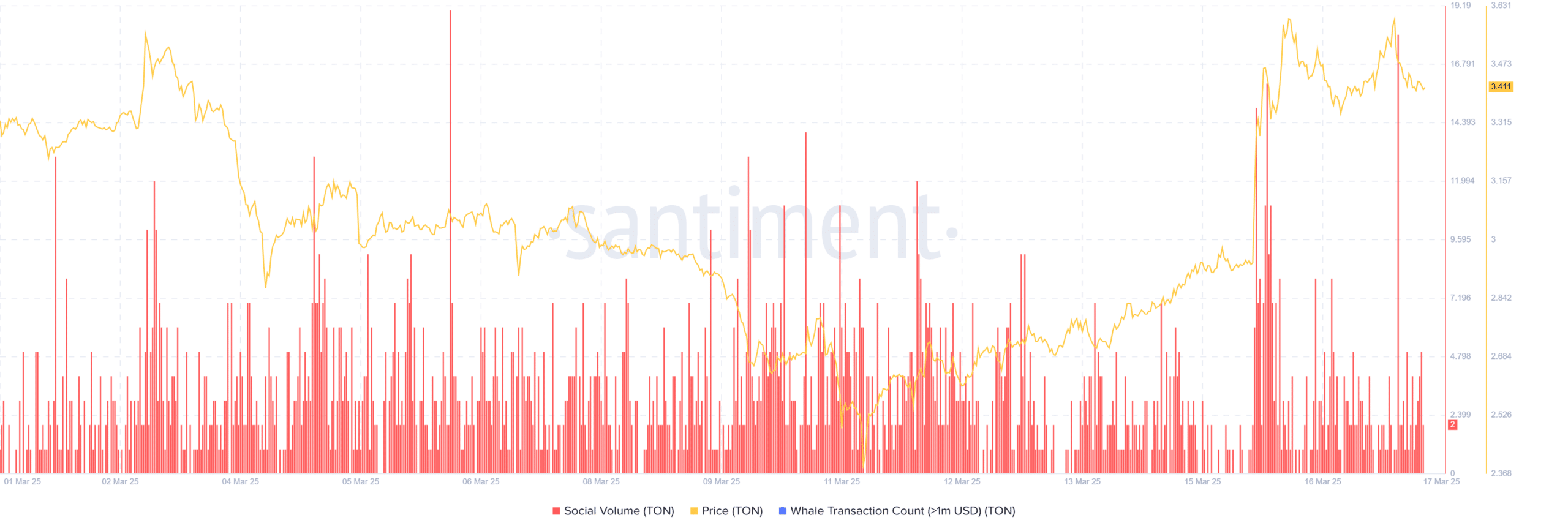

Source: Santiment

Simultaneously, Santiment data shows a sharp spike in whale transactions and sustained high social volume just ahead of the price breakout.

Surging on-chain activity and social buzz typically signals strong speculative momentum. The price also broke above $3.40 with increasing volume – further validating the rally.

While short-term pullbacks are possible, it seems that TON’s uptrend has legs. Unless sentiment sharply reverses or macro conditions shift, Toncoin appears poised to maintain its bullish trajectory.