- FLOKI hit a key support on the Bollinger Bands indicator and may be eyeing a major push to the upside

- Spot market sells of FLOKI might be threatening its push north

The bearish market sentiment FLOKI carried over from last month’s 30.90% decline has continued so far. In the last 24 hours, it registered a drop of 10.99% – A move that might soon be corrected.

In fact, at the time of writing, several market confluences seemed to be in line with the possibility of FLOKI’s move to the upside. However, the asset is likely to remain low as counter-pressure occurs in the market.

Support level could ignite a push up

At press time, FLOKI seemed to hit the lower level of the Bollinger Bands indicator. The Bollinger Bands (BB) is an indicator used to determine potential price trends with three band levels – The upper band, which acts as resistance; the lower band, which acts as support; and the middle band.

FLOKI is currently trading at the support level, or lower band, hinting that a possible reversal could be incoming. With the price forming a green candlestick, if it sees further rise, it is likely FLOKI will rally by 48% to $0.00007227—the upper band—where it could face notable selling pressure.

Source: TradingView

This bullish sentiment is being backed by the rebound of the Relative Strength Index (RSI) indicator, just before it crosses into the oversold region below 30. A sustained move up for the RSI would imply that FLOKI’s bounce off the lower BB is strengthening.

However, not all market sentiment seemed to be in line with a rally. The Money Flow Index (MFI), which measures liquidity inflows and outflows in the market, revealed that there’s been a massive outflow of liquidity in the last 24 hours.

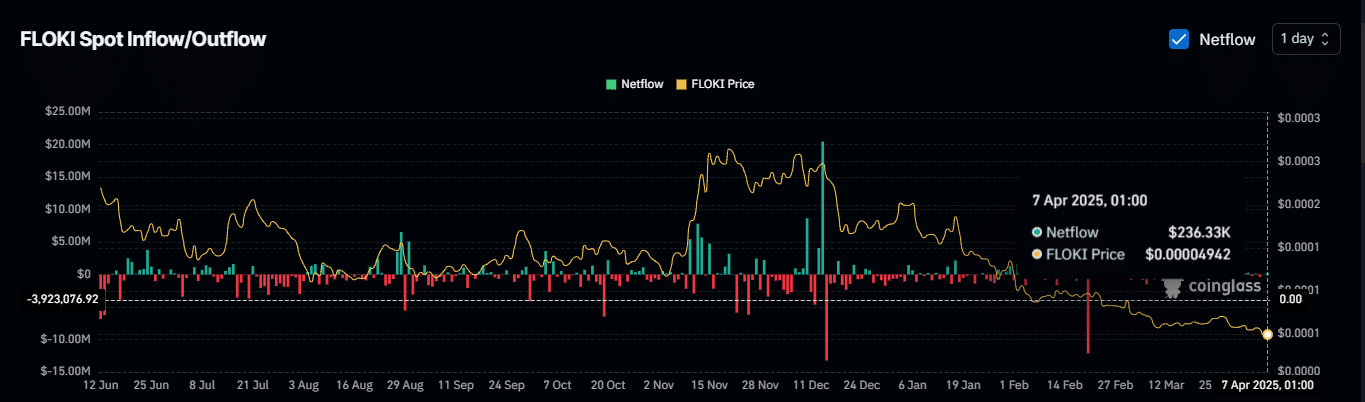

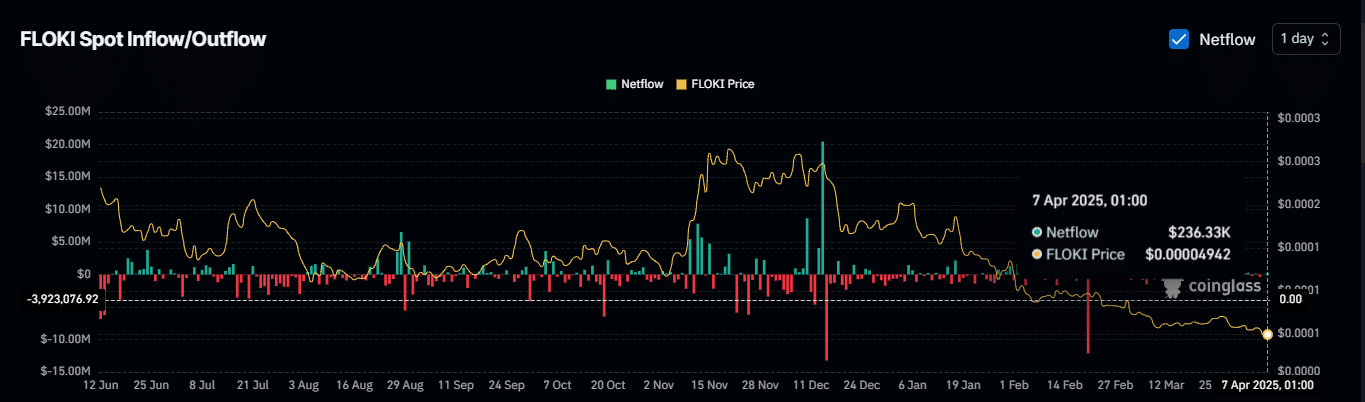

The MFI falling lower confirmed that market participants are likely selling the memecoin. The spot market netflows data underlined a possible value for the amount of FLOKI sold during this timeframe.

Source: Coinglass

At the time of writing, the netflows were minimal, with only $263,000 worth of FLOKI sold. This minimal selling pressure, with no notable spike, could be a case of profit-taking or cutting losses – Meaning long-term holders remain confident in a possible market push to the upside, adding to the bullish outlook.

While some spot market participants are selling, others are placing long bets. In fact, FLOKI’s Futures market has been positive, as top exchange traders are buying and key indicators have been moving north.

Exchange traders are betting on a rally

In the FLOKI Futures market, significant buying activity was recorded among traders on OKX Exchange. At the time of writing, the long-to-short ratio was 1.69.

A long-to-short ratio above 1 confirms that there’s more buying than selling ongoing in the Futures market. Since this buying volume is coming from a notable exchange, it could positively impact the asset’s price.

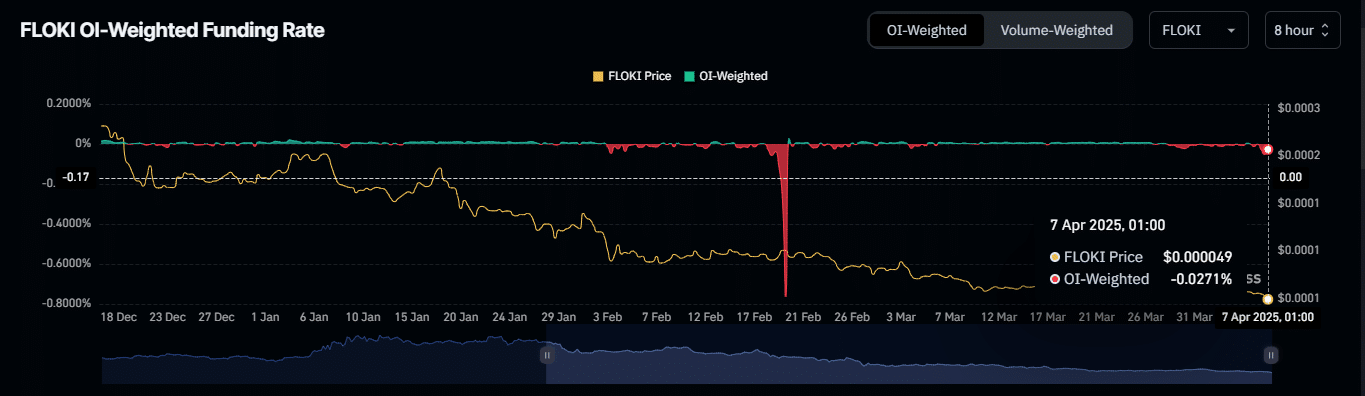

Source: Coinglass

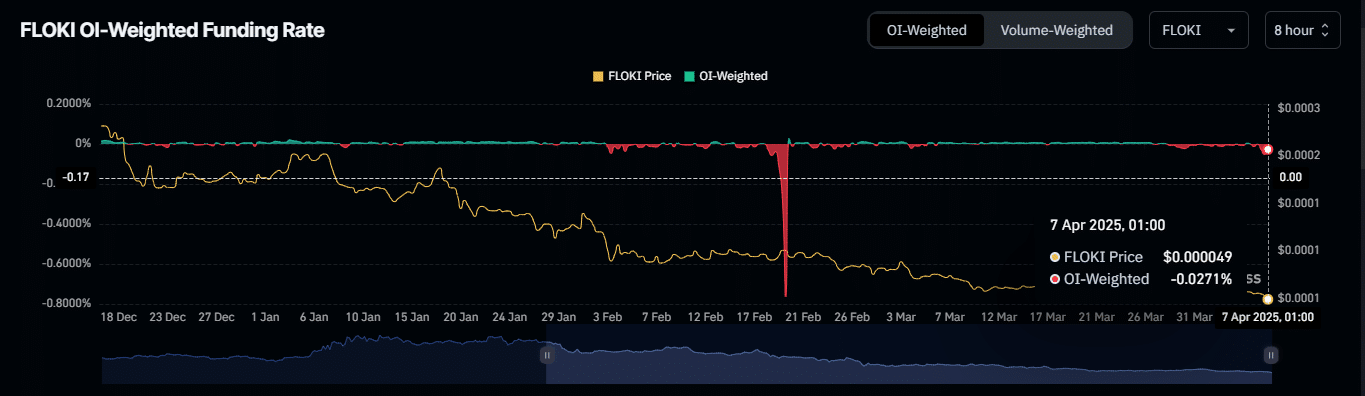

The bullish sentiment is gradually being established as the OI-weighted funding rate has been gradually rising from the negative zone.

The rate moved from -0.0518% to -0.0271% and is trending upwards again. If it continues into the positive zone, it’s likely that FLOKI will see significant gains, following the path outlined in the Bollinger Bands chart.