- AVAX’s price action showed signs of a potential pivot into a bullish phase after months of decline

- Healthy address growth and expanding DeFi ecosystem could spur Avalanche’s potential

AVAX is one of the top altcoins that have benefitted this week as altcoins started receiving more attention. As a result, its bullish performance ignited hopes of further recovery from the bearish trend that has prevailed since March.

AVAX, at the time of writing, was on its fifth day of being in the green. In fact, this was its first significant bullish attempt in the last 4 weeks. At the time, it was valued at $23.59, representing a 19% upside from its weekly low.

Source: TradingView

The last time the market thought AVAX had bottomed out was in June. This was followed by a 50% upside. This time, AVAX is attempting a recovery from a lower price point which could make it even more appealing. On top of that, its RSI just crossed above the 50% level, suggesting that long term momentum could be shifting in favor of the bulls once again.

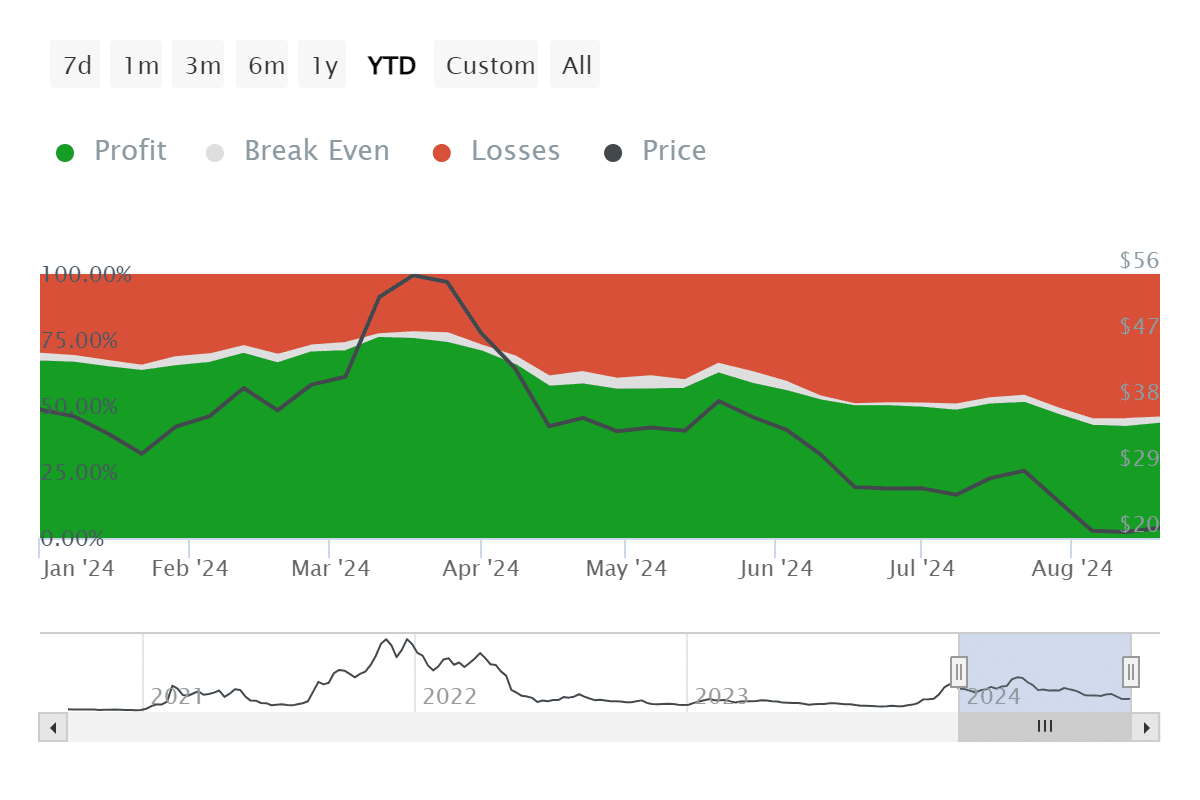

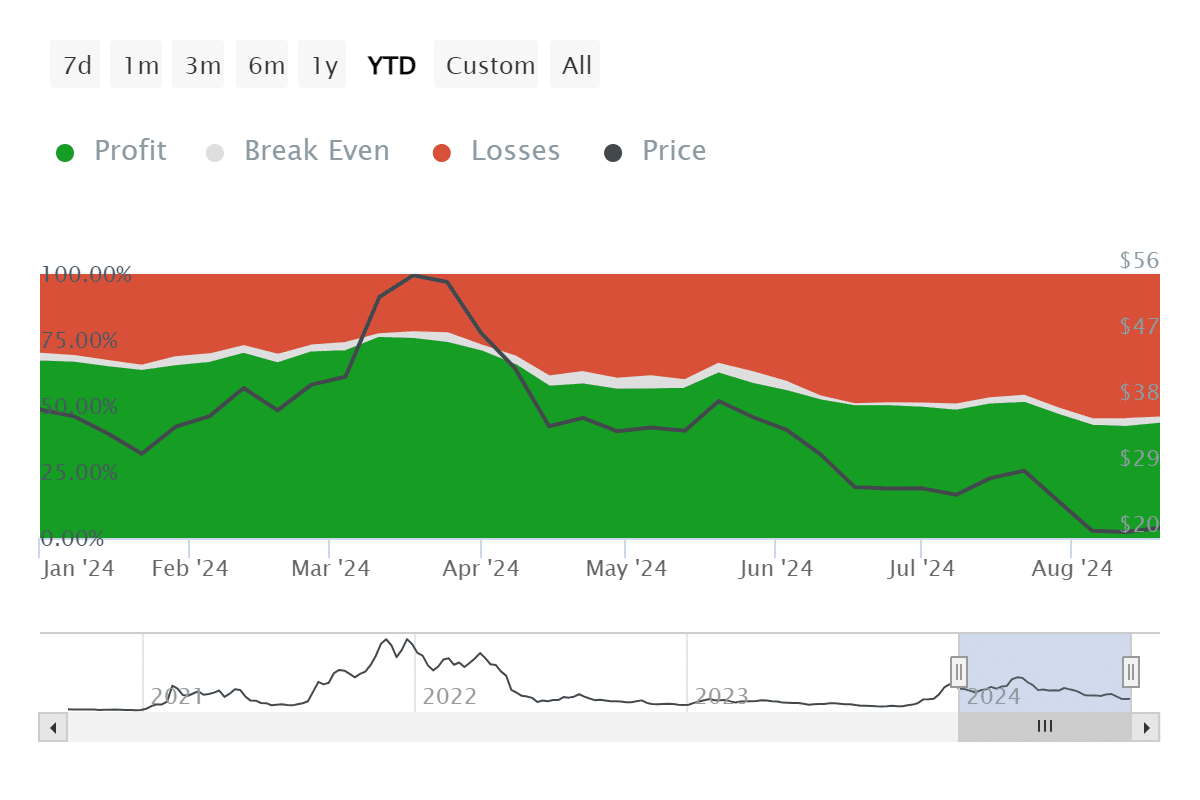

AVAX’s $22.95-level represents a 42% discount from its YTD high. Buyers purchasing at or near the press time price level may thus still have a chance to earn decent profits if the rally extends further. As far as profitability is concerned, 3.87 million addresses (44.09%) holding AVAX were in profit after the most recent rally.

On the contrary, 4.76 million addresses (54.15%) were at a loss and 154,800 (1.78%) addresses were at breakeven.

Source: IntoTheBlock

Now, although the statistics confirmed that a majority were at a loss, it also revealed that a significant number of holders were in profit despite recent lows.

This can be interpreted as a sign of heathy demand, even at its recent levels.

Avalanche addresses hit historic highs

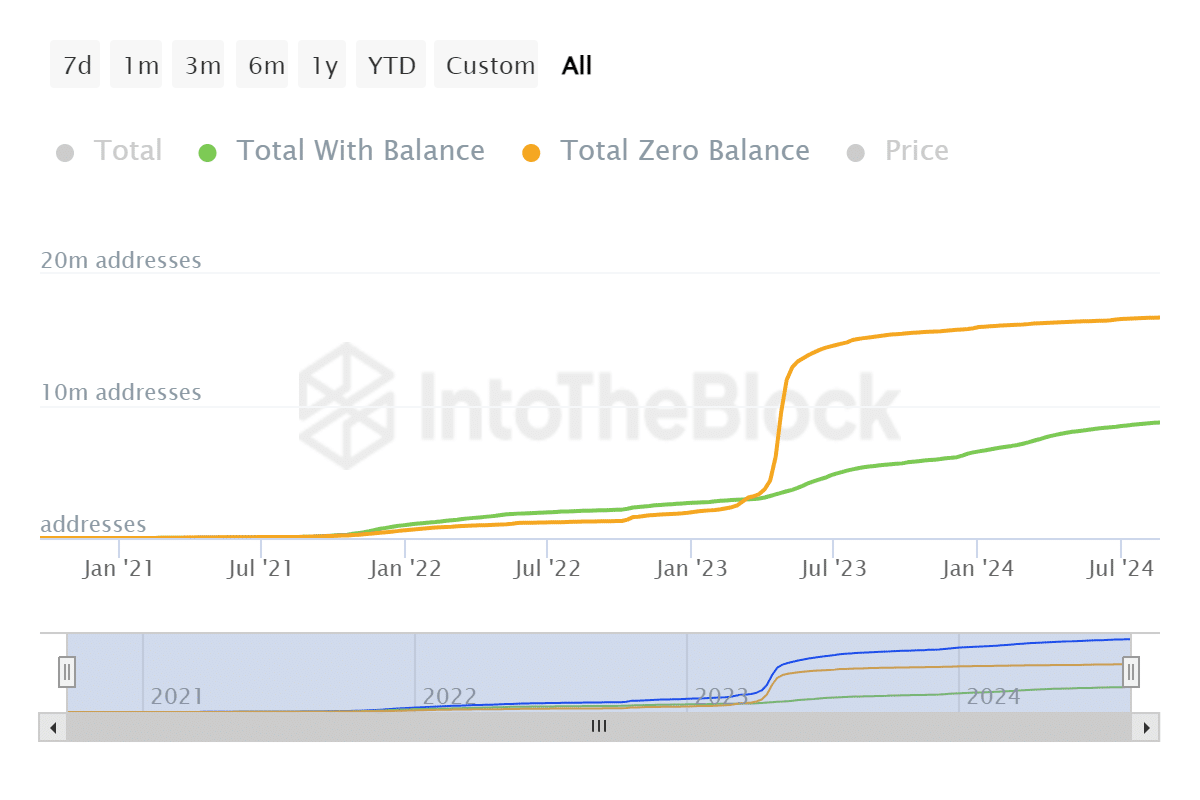

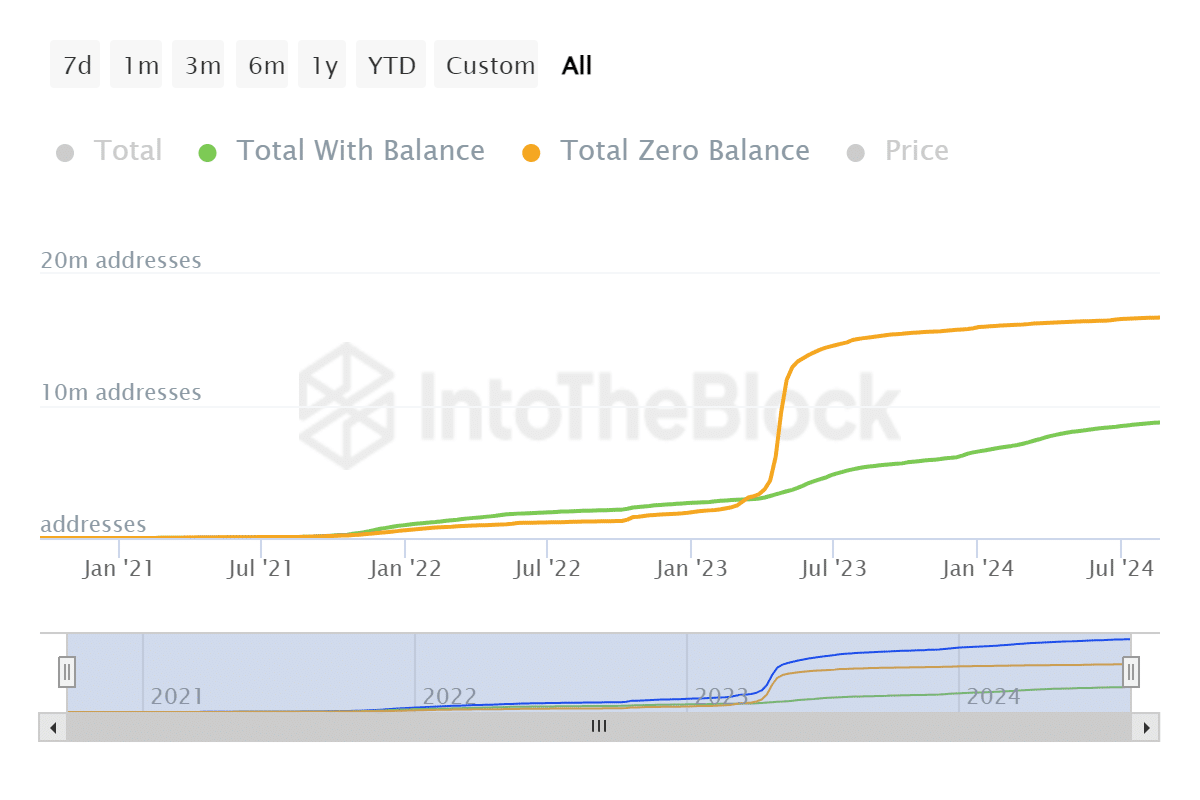

Although AVAX was heavily discounted this year, its native blockchain Avalanche has been gaining in other areas.

Most notably, address growth has been positive over the years, with the total number of addresses with balance hitting 8.75 million addresses. That’s not all either as total addresses with zero balances peaked at 16.7 million.

Source: IntoTheBlock

For perspective, Avalanche’s total addresses with balance grew by 2.22 million on a year to date basis. On the other hand, addresses without balance were only up by 750,000 addresses.

Avalanche will maintain this positive growth trajectory with developments like the following too. For example – Agora just launched its AUSD stablecoin on the Avalanche network. This development highlights the growing expansion of the Avalanche DeFi ecosystem.

Additionally, Avalanche also recently became the first blockchain to have a video game developed on its network – Launched on Xbox and Playstation 5.