- AVAX’s price trend has been bearish throughout February

- Bullish divergence could see a nearly 10% price hike

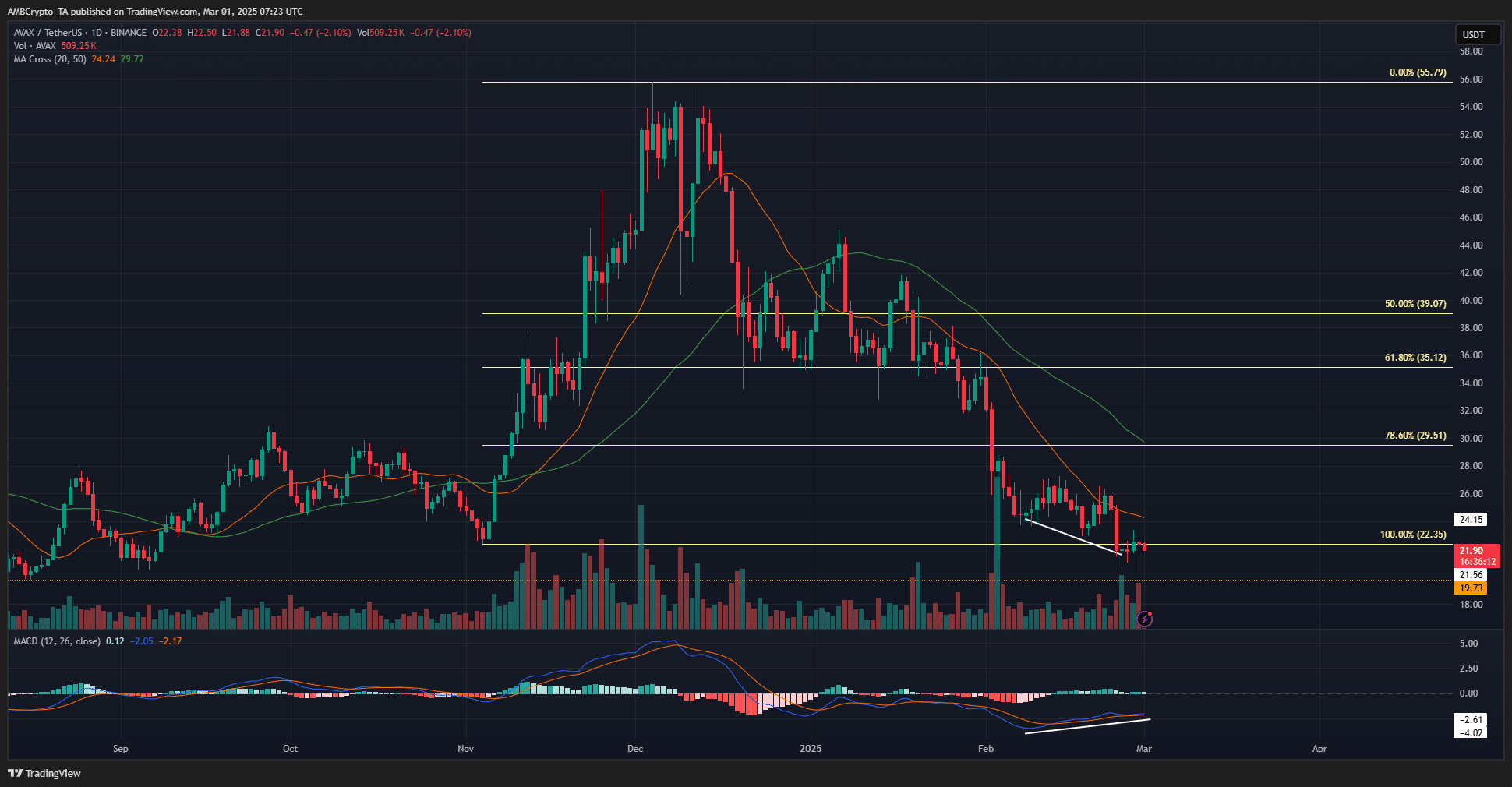

Avalanche [AVAX] has retraced all the gains it made since November. At press time, it seemed to have a strong demand zone just below $20, but it was unclear if this zone could reverse the strong downtrend behind AVAX.

On the daily chart, the altcoin has been trending downwards since late January, when the asset made a lower low below the $35 support level. Its momentum remained firmly bearish, but a bullish divergence began to form as it approached the $20-support.

AVAX faces resistance at the 20-day moving average

Source: AVAX/USDT on TradingView

The market structure and trend have been bearish in February. The 100% retracement level that marked the November lows at $22.35 has been flipped to resistance too. The next support level is now at $19.73 – A significant support level from November 2023.

Interestingly, as AVAX approached the $20-psychological level, it formed a divergence with the momentum indicator. The price made lower lows while the MACD indicator made higher lows. This suggested that a price bounce may be likely in the coming days.

This would not be enough to reverse the downtrend. A market structure shift would happen when the AVAX token can set higher swing highs and lows. Hence, the immediate resistance for AVAX to breach would be $26.54, just above the 20 DMA at $24.24. As things stand, however, such a move does not seem imminent.

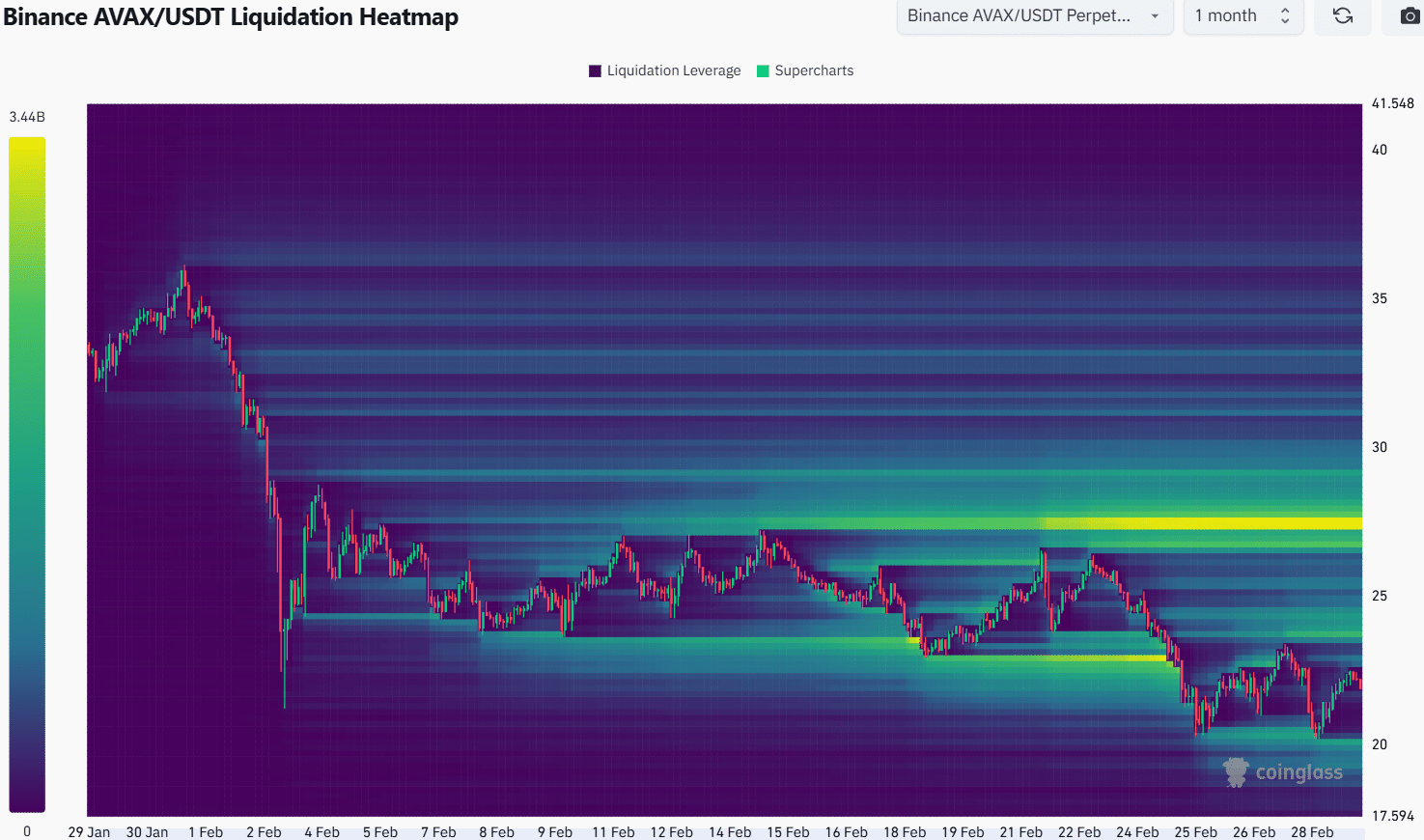

Source: Coinglass

Liquidation data from Coinglass also highlighted that the $27.4-level is a strong magnetic zone. Below it, the lower timeframe local highs at $23.4 meant that the $23.7-$24 region is also a short-term target.

To the south, the $20-zone also had a cluster of liquidation levels. Considering the bullish divergence and Bitcoin’s [BTC] bounce above $85k, there’s a chance that AVAX would move towards $24 next. Traders must be careful as a BTC drop could take the price to $19.7-$20.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion