- Bitcoin has registered a strong uptrend lately, with analysts eyeing a parabolic rally to $276,400

- Last 24 hours saw BTC hike by 2.08% on the charts

After weeks of sideways movement and even consolidation on the price charts, the law few days finally saw Bitcoin [BTC] spread its wings. In fact, the cryptocurrency’s bullish rally pushed the cryptocurrency to as high as $105k for the first time in 2025.

At the time of writing, however, BTC had retraced somewhat, with the cryptocurrency down to just over $103k.

Even so, its worth pointing out that its latest price pump allowed Bitcoin to break out of a cup and handle pattern – Highlighting potential for strong upside. Needless to say, with another breakout possibly emerging, analysts are now left eyeing more gains.

Source: Ali on X

In fact, crypto analysts like Ali Martinez are hypothesising that a rally to $276,400 may be in order in 2025.

Simply put, although the market has seen pessimism after a prolonged consolidation, this sudden upswing is a sign that rallies can emerge even when some participants turn bearish.

How bear zones build strong Bitcoin rallies

According to CryptoQuant, strong Bitcoin rallies can emerge from bear zones if market participants are patient enough. This was seen over the past week too, at a time when BTC dropped below $90k on the charts.

Source: Cryptoquant

As per this analysis, when we look at Bitcoin’s pullbacks, a fascinating pattern emerges. When the market dips into the bear zones, and investors lose hope, the market sees a rebound.

Thus, patience is a strong opportunity for investors. Historically, after quiet periods, Bitcoin tends to register a strong upswing on the charts. Therefore, after every major pullback, the market pauses, takes a breath, and then enters a stronger uptrend.

While red zones might initially discourage investors, historical patterns revealed that the rebounds from these levels are often far more impressive.

What do BTC’s charts say?

While the analysis provided above offers us a promising outlook, it’s essential to determine what other market indicators suggest too.

According to AMBCrypto’s analysis, Bitcoin is currently in a bullish phase with bulls having market control.

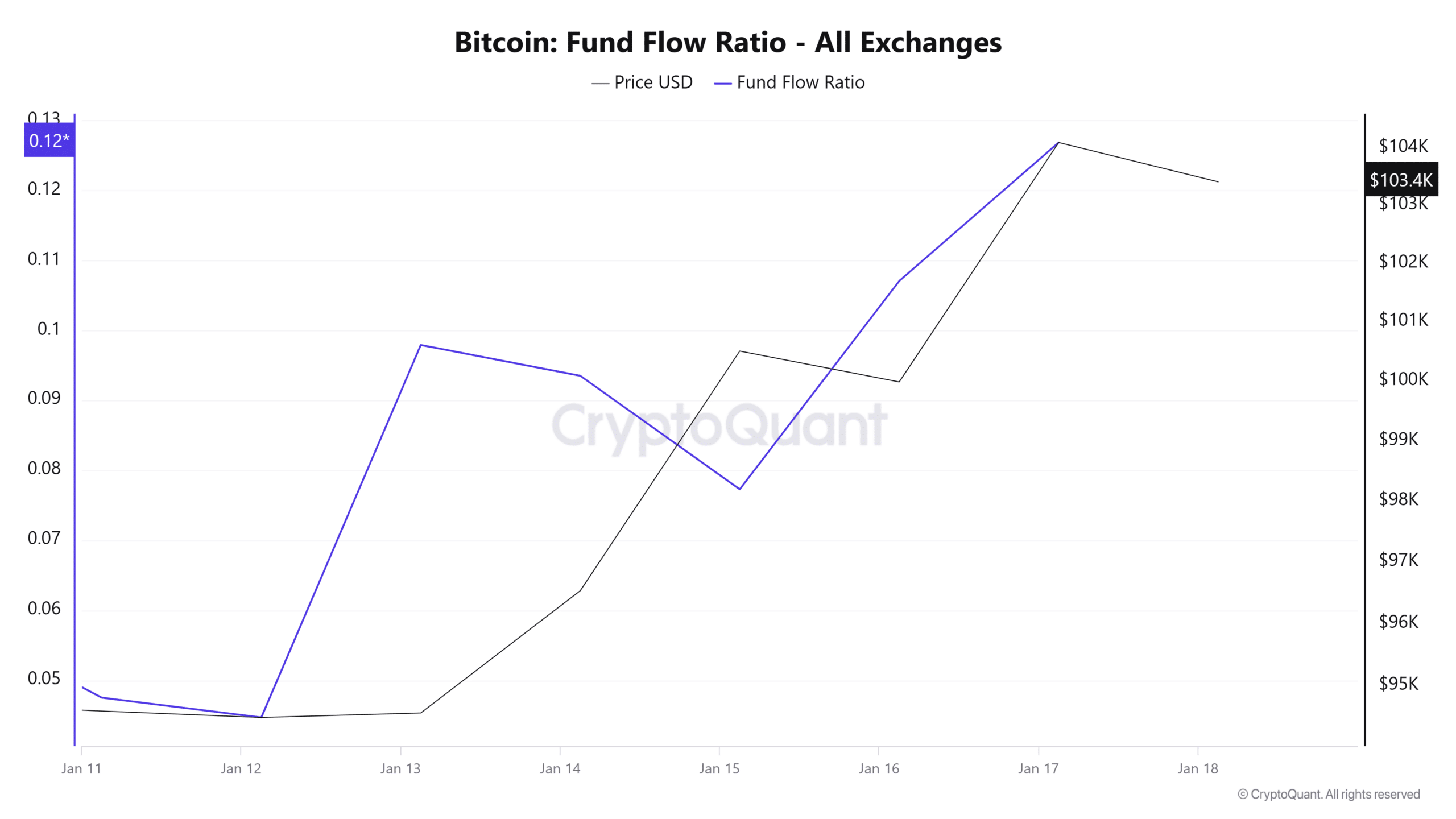

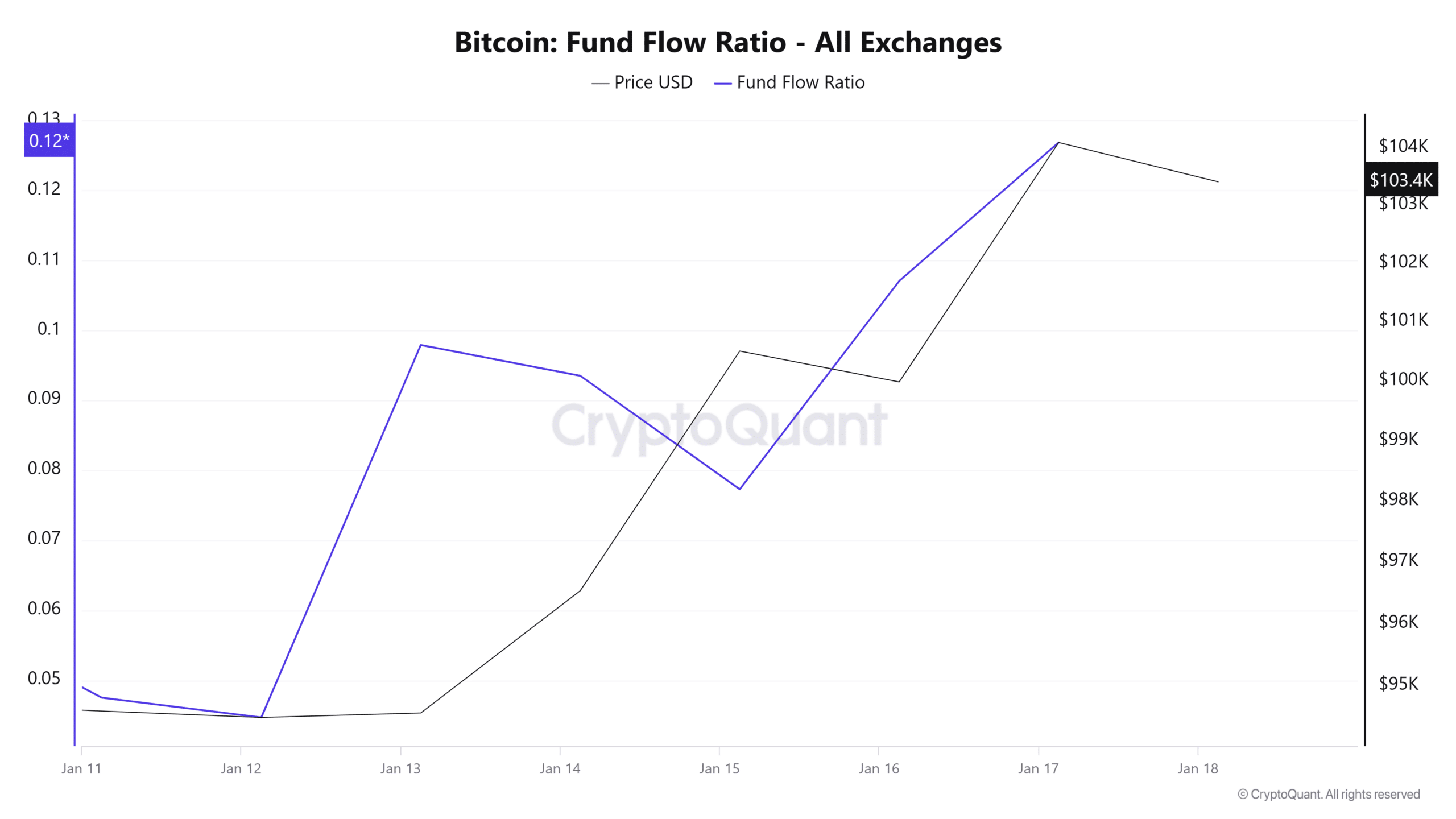

Source: Cryptoquant

For example, Bitcoin’s fund flow ratio spiked over the past week to 0.12.

When this rises, it signals a surge in capital inflows into BTC as investors acquire more tokens. This can be seen as a sign of greater buying pressure and accumulation trends.

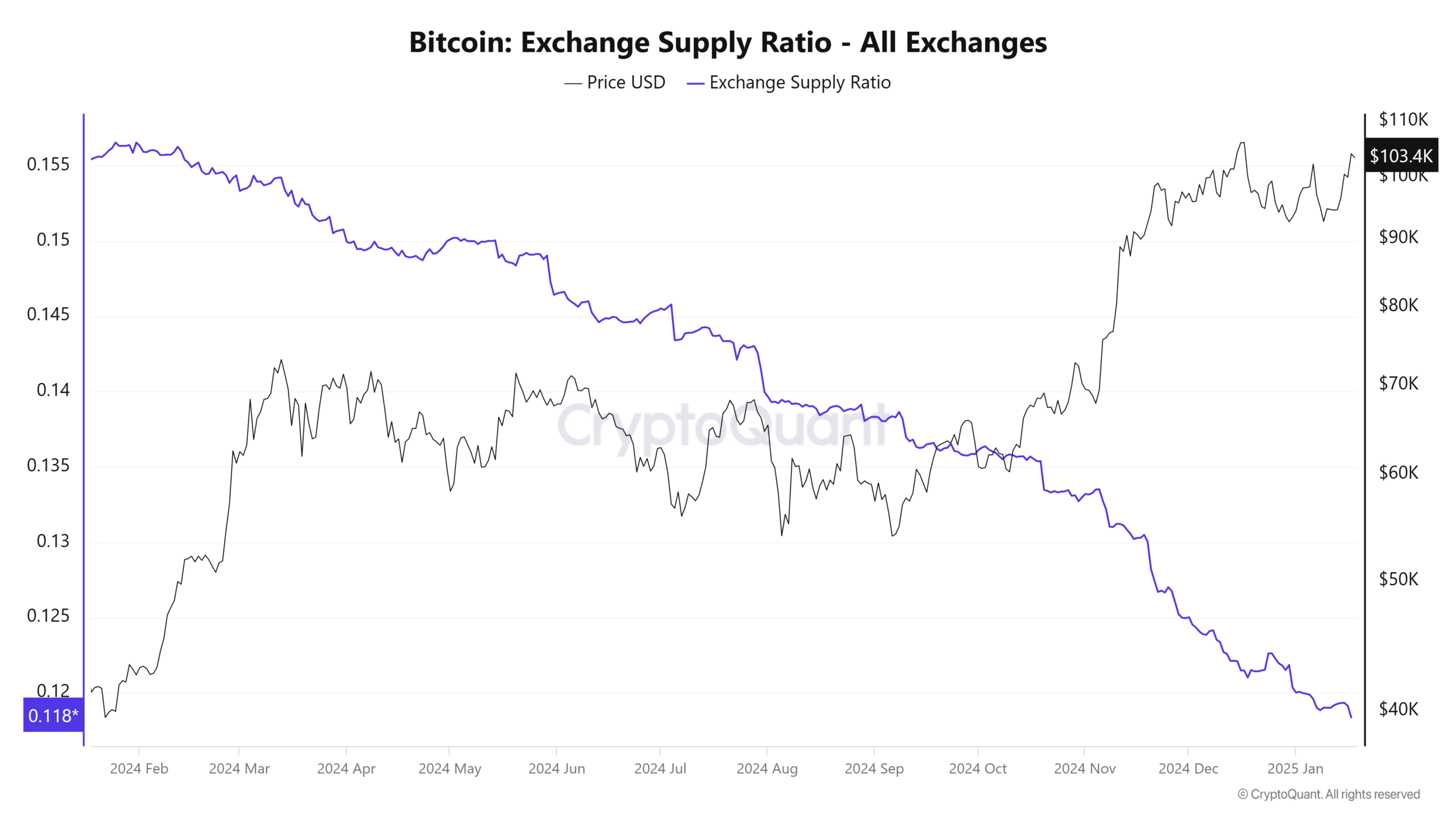

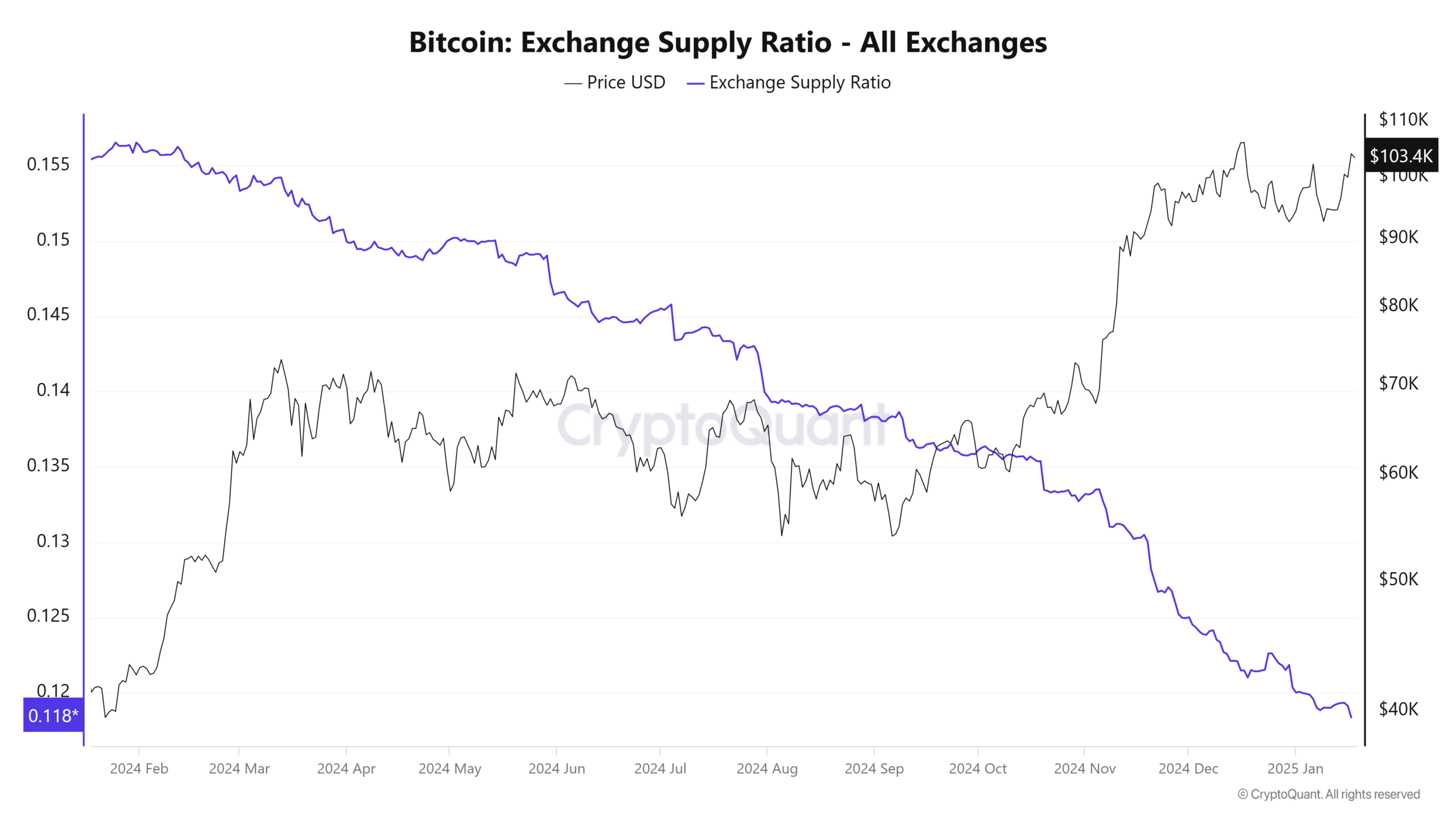

Source: CryptoqQuant

Additionally, Bitcoin’s Exchange supply ratio has declined to hit a yearly low – A sign that investors are keeping their BTC off exchanges.

Source: Cryptoquant

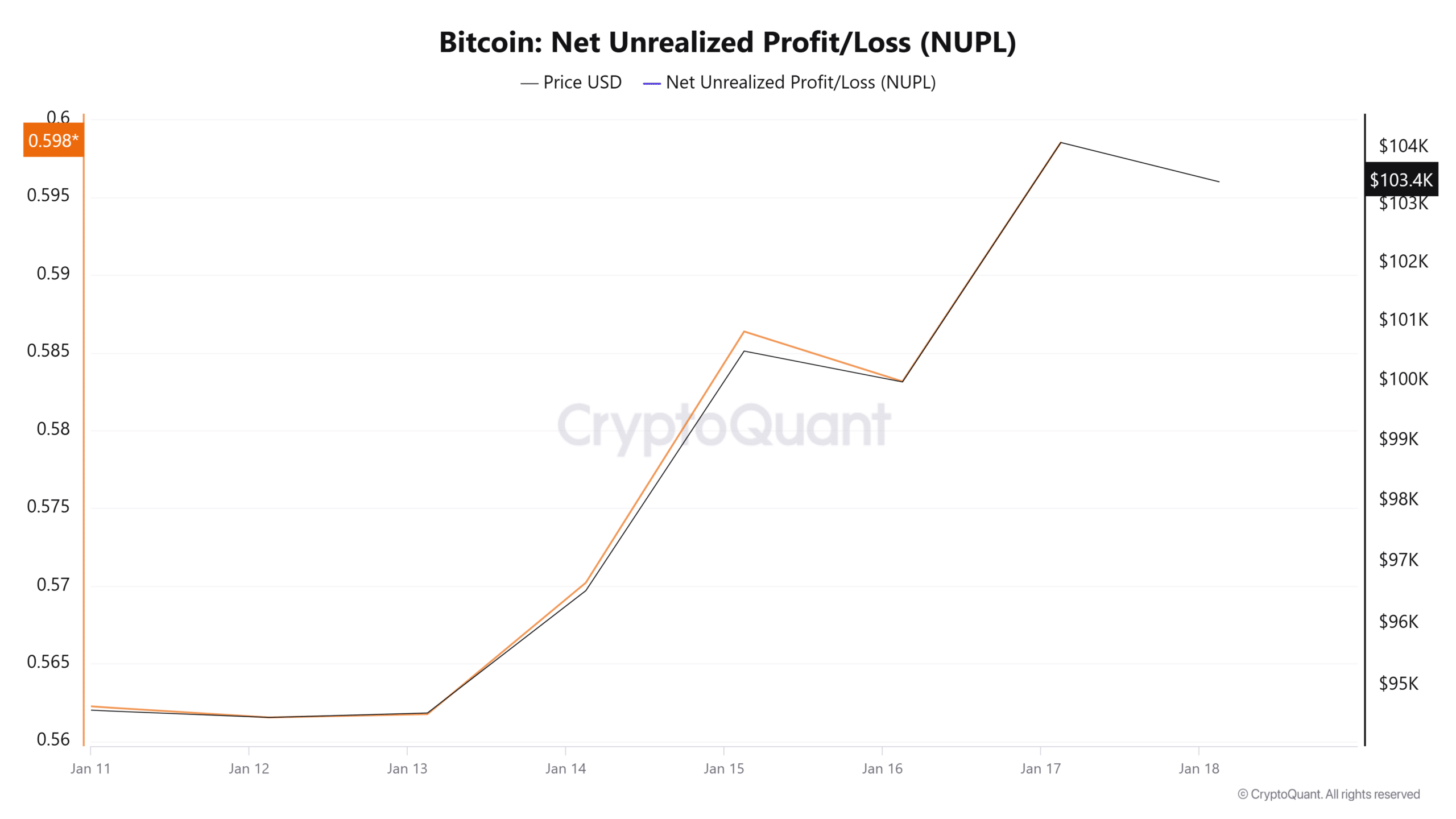

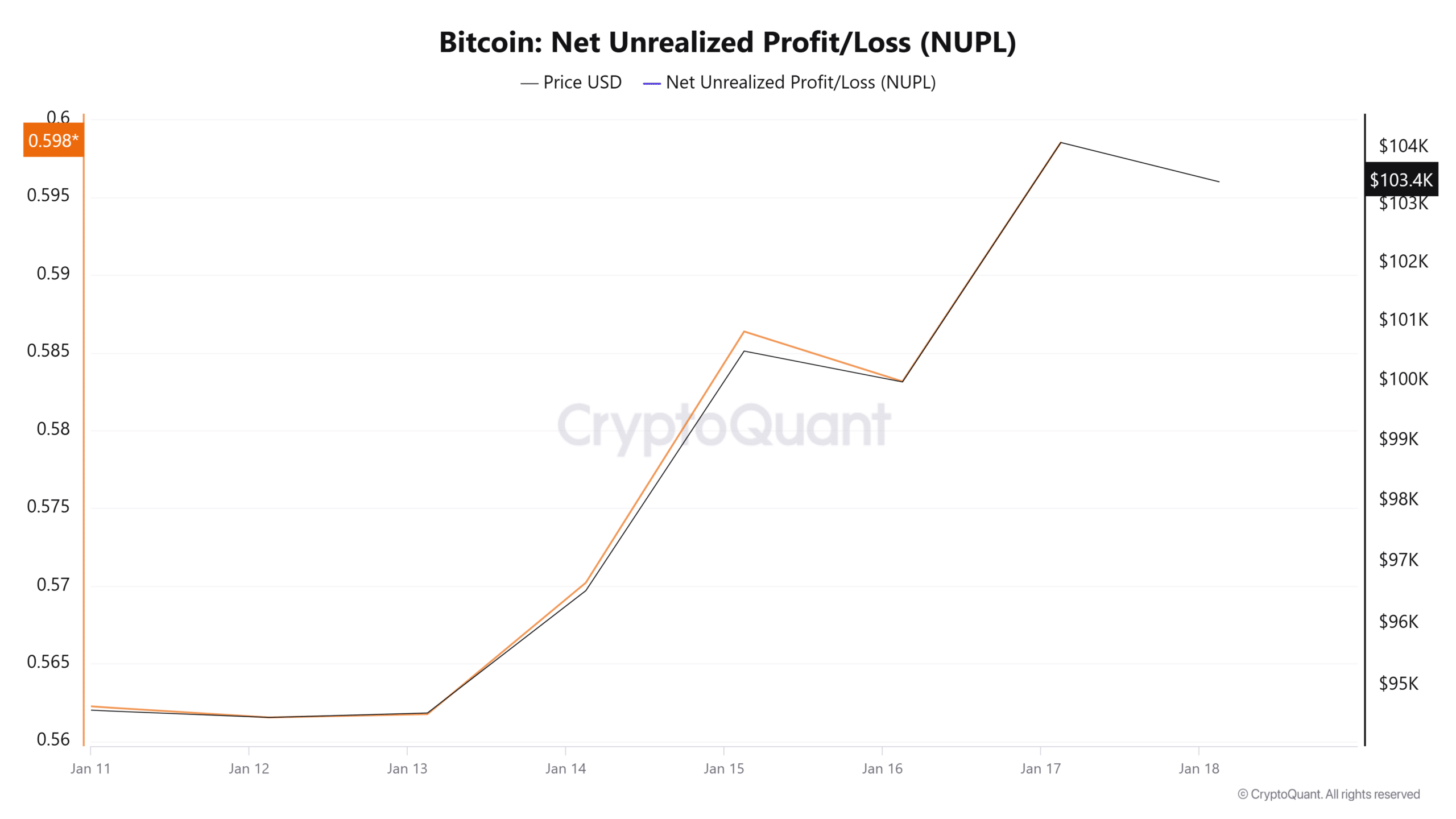

Finally, Bitcoin’s NUPL has spiked over the past week to hit 0.59.

Historically, NUPL values between 0.5 and 0.6 are seen during the middle stages of bull markets, right before a parabolic price rally.

How far can Bitcoin go?

Simply put, the dip witnessed earlier this week has strengthened BTC for a potential parabolic rally as investors bought the dip. Accompanied by positive sentiment and optimism, Bitcoin may be well-positioned for more gains now.

Therefore, if these market conditions continue to hold, Bitcoin will reclaim $108k and hit a new ATH in the near term. Therefore, a rally past $200k, as predicted by Martinez, may be far-fetched in the short term. However, it is probable in the long term.