- Short-term holders offloaded significant volumes over the past 24 hours, while large investors, including whales, remained on the sidelines, waiting for more favorable entry points.

- The buying ratio peaks at a new high last reached in April, opening buying opportunities.

Bitcoin’s [BTC] has slipped into a corrective phase, dropping 4.43% in the past 24 hours to trade below $100,000. This pullback has trimmed its monthly gains to 4.94%.

If bullish momentum takes hold, Bitcoin could surpass its previous all-time high and move toward $108,500 before trending higher. According to AMBCrypto’s analysis, recovery may depend on large holders stepping in at key price levels despite ongoing bearish market conditions.

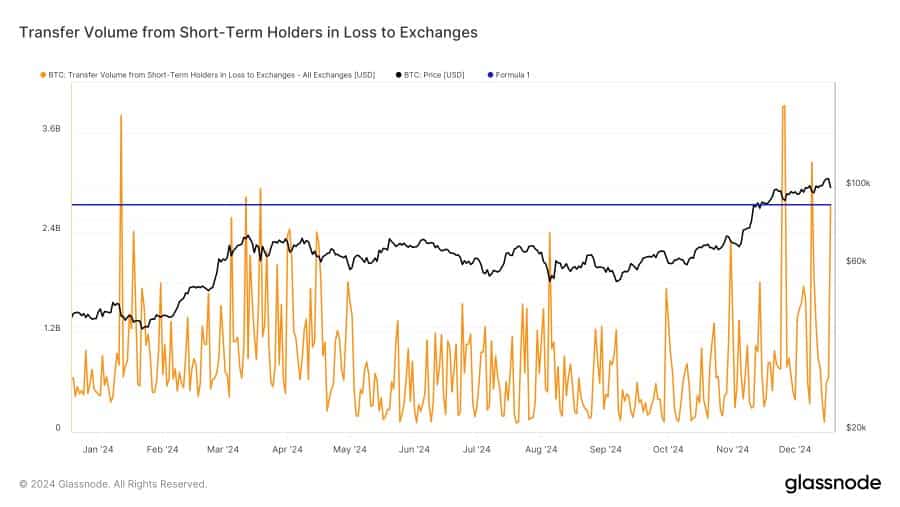

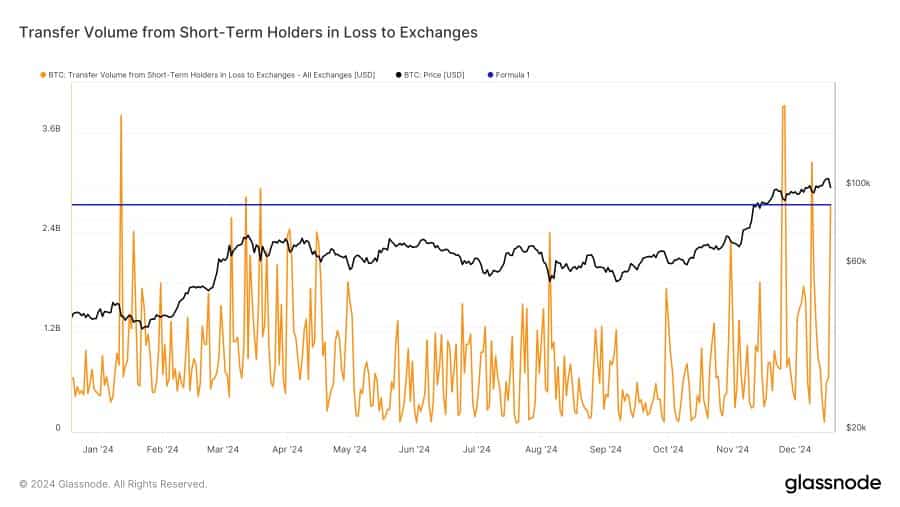

Short-term holders fuel Bitcoin’s recent decline

Analyst Jam Van Straten attributes Bitcoin’s recent downturn primarily to short-term holders who frequently trade the cryptocurrency. This group has collectively offloaded about 26,000 BTC, valued at $2.7 billion.

These sell-offs include trades made at both losses and profits, reflecting the volatility of their trading activity.

Source: X

Van Straten noted that large investors, or whales, remain on the sidelines, holding significant liquidity as they wait for an ideal entry point.

He explained:

“Big players are waiting for the price and not chasing it.”

This suggests that these influential traders are unlikely to act until market conditions align with their strategies. Once whales re-enter the market, their buying activity could drive Bitcoin to recover and potentially trade higher.

Buying momentum could soon resume

Santiment reports that discussions about buying Bitcoin’s recent dip have reached record-high levels, a sentiment that was last seen on the 12th of April 2024, eight months ago.

Since then, Bitcoin has surged by over 81%. If history repeats itself, the current sentiment could fuel a similar rally, pushing BTC into higher price regions beyond its current levels.

Source: X

With this potential upside in view, whales are likely to resume purchases. If buying momentum remains strong, Bitcoin could trend even higher.

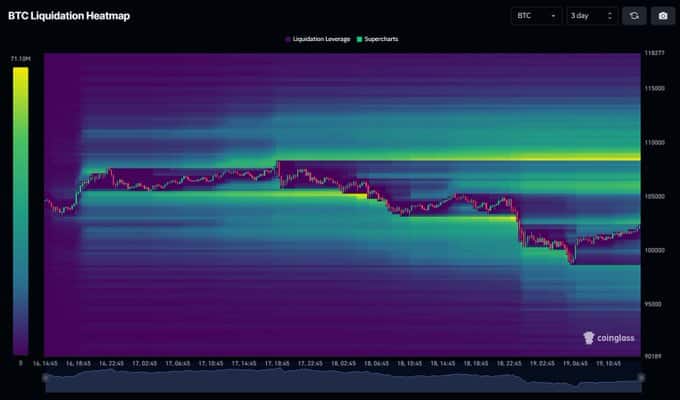

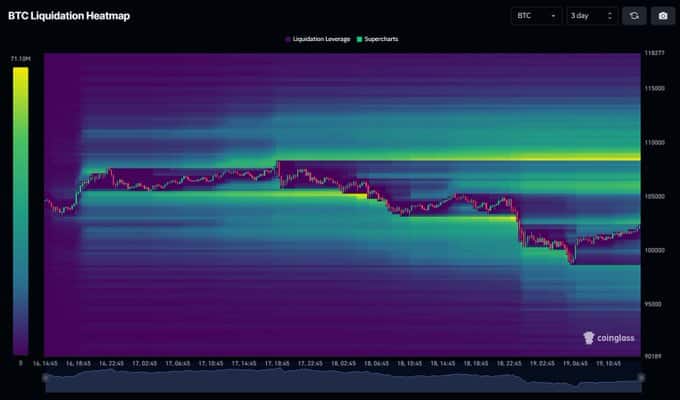

Further analysis reveals that BTC is ready to trade above its previous highs, driven by the formation of a large liquidity cluster around the $108,500 level, as pointed out by analyst Mister Crypto.

Source: X

Liquidity clusters act as magnets for price movements, as assets often gravitate toward these regions to clear out pending orders before continuing their trajectory.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This setup suggests that Bitcoin has a strong likelihood of regaining buyer interest, especially as bullish conversations continue to dominate the market.