- BTC’s price decline persists despite strong dip-buying interest from retail traders, raising concerns about further downsides.

- Liquidations have spiked as Bitcoin struggles to regain momentum, suggesting increased volatility in the coming sessions.

Bitcoin [BTC] has faced a continued price decline over the past few days, even as retail traders aggressively buy the dip.

The market has exhibited a strong contrarian behavior, with prices moving opposite to the crowd’s expectations.

Historically, rebounds occur once retail enthusiasm for dip-buying fades. However, the current trend suggests that optimism among retail investors remains high despite the ongoing drawdown.

Retail sentiment and buying activity

According to social sentiment data, mentions of ‘buying the dip’ have surged over the past few days, coinciding with Bitcoin’s continued decline.

Historically, price bottoms tend to form when retail interest wanes, yet the persistent optimism has not yielded the expected bounce.

Source: Santiment

Traders expecting an immediate reversal have instead seen Bitcoin’s price fall further, reinforcing the market’s tendency to punish overconfidence.

Bitcoin liquidations and market impact

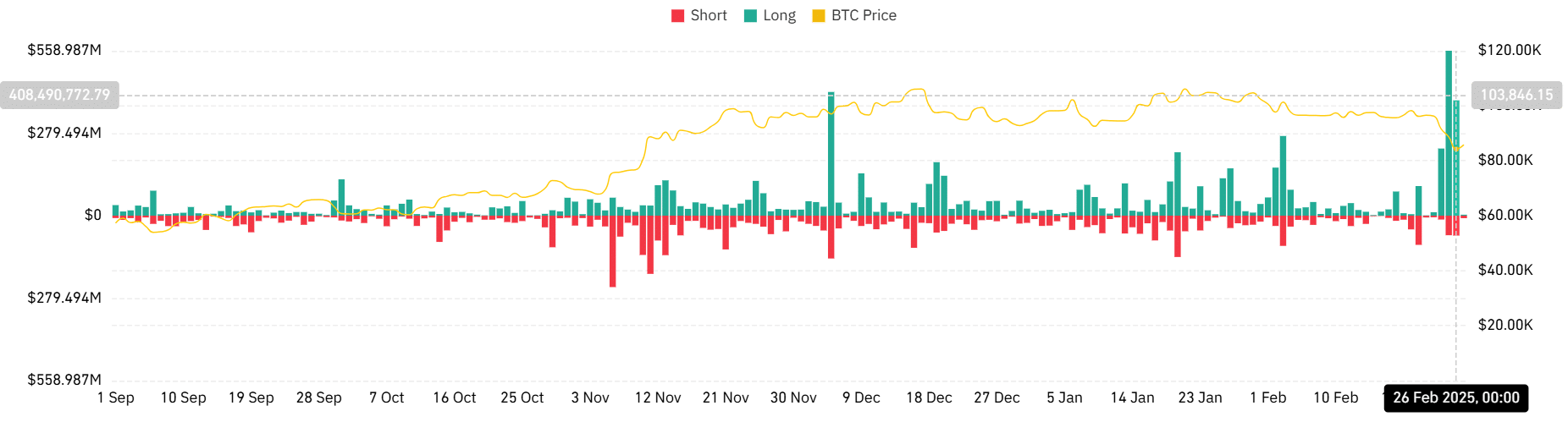

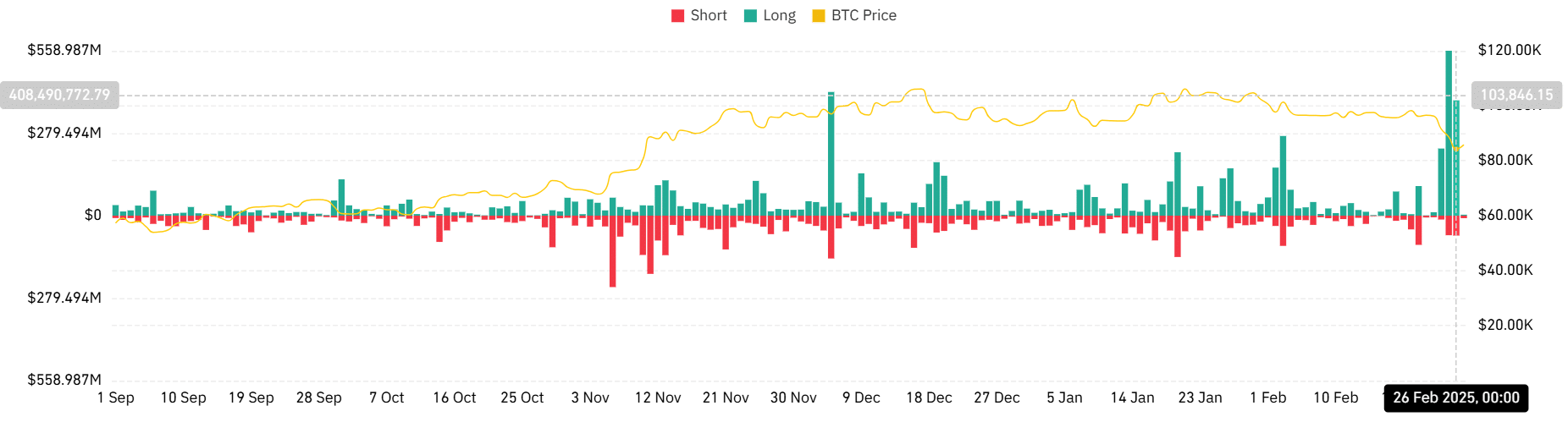

Liquidation data revealed that leveraged traders have taken heavy losses, with significant long liquidations occurring as Bitcoin failed to reclaim key support levels.

The liquidation heatmap indicated that the latest price drop was exacerbated by cascading liquidations, further driving prices lower.

The analysis showed that on the 25th of February, Bitcoin saw its highest long liquidation in the last five months. Long liquidation spiked to around $559 million, with short liquidation volume around $66 million.

The liquidation continued on the 26th of February with a $391 million long liquidation, the third-highest in the last five months.

Source: Coinglass

This pattern has been a recurring theme, with overleveraged traders facing forced exits, compounding the bearish pressure.

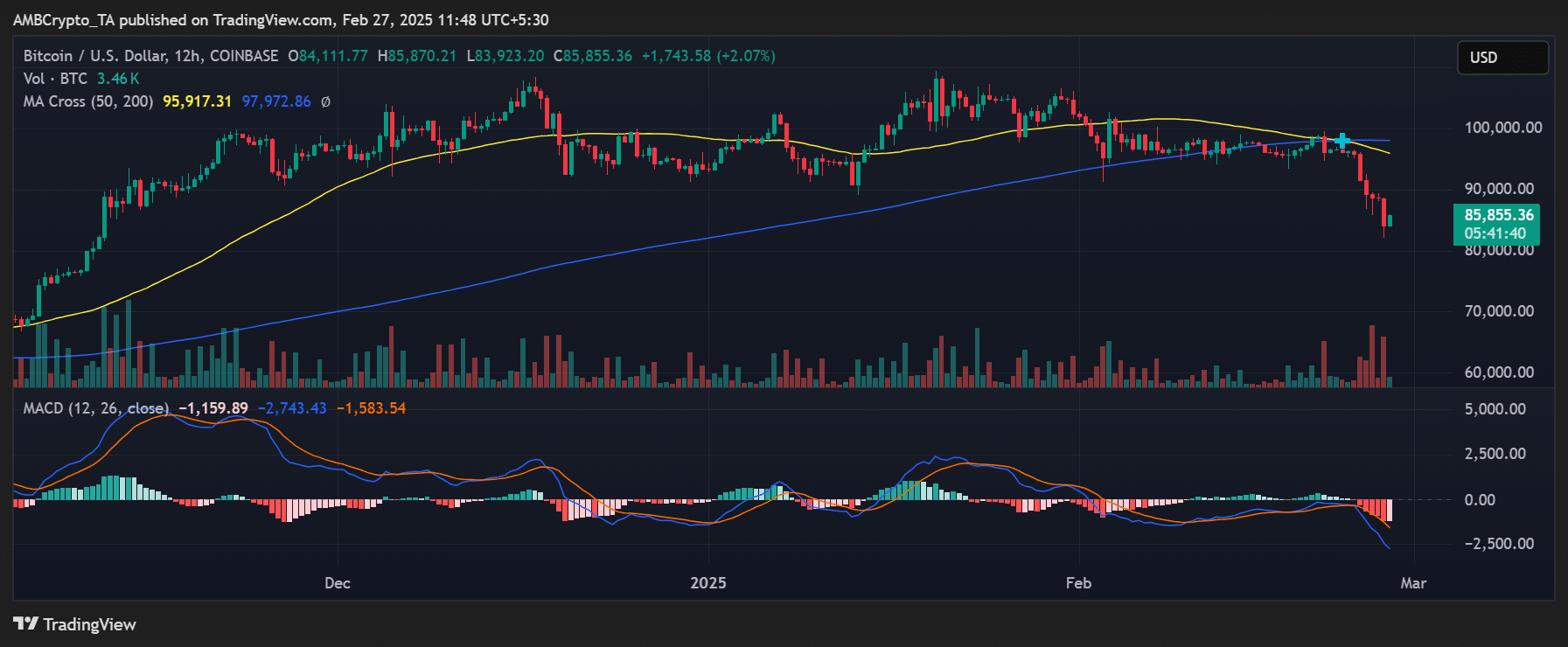

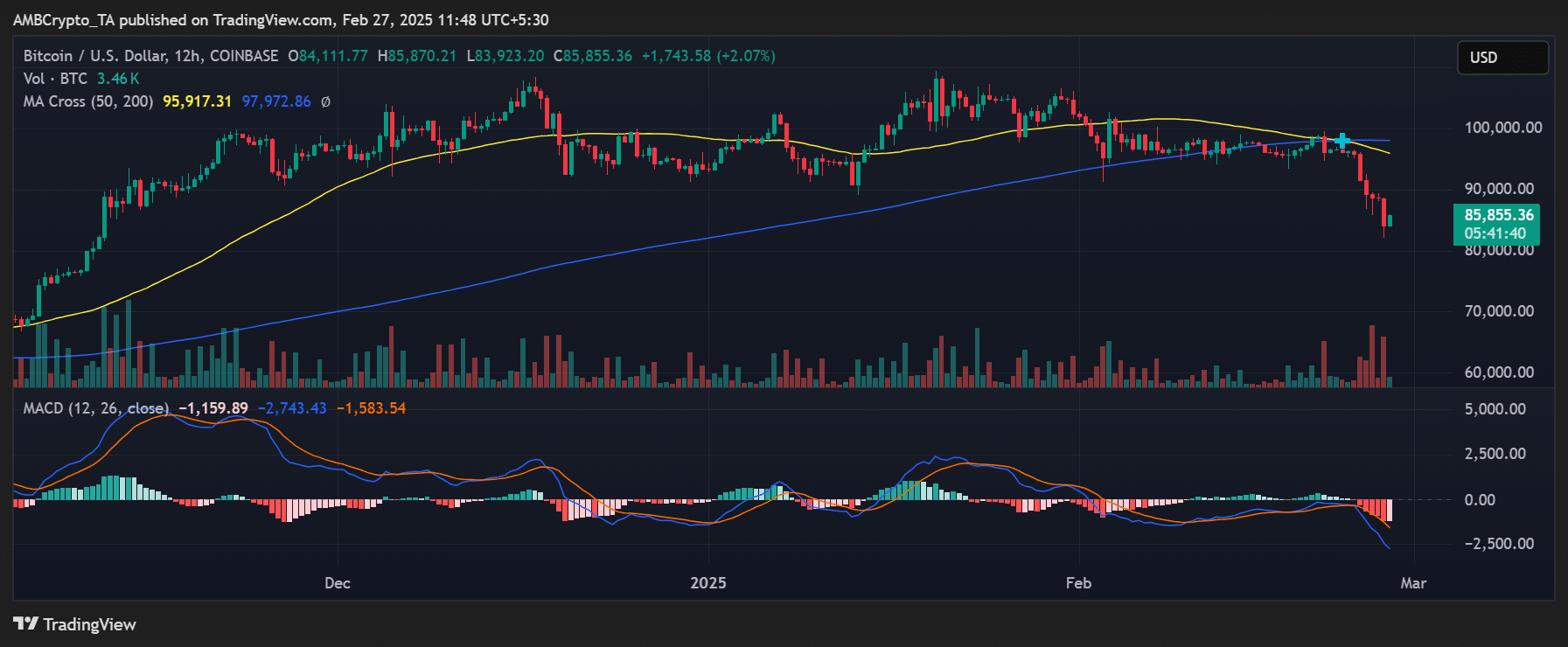

Bitcoin’s price trend and key levels

Bitcoin was trading around $85,855 as of this writing, marking a steep drop from recent highs. The price has broken below the $90,000 psychological level, and further downside could see a retest of $80,000.

Source: TradingView

Technical indicators, including the Moving Average Convergence Divergence [MACD], showed strong bearish momentum, while the 50-day and 200-day moving averages suggest continued weakness.

The next potential support lies near $83,000, a level where previous demand was observed.

What’s next for BTC?

For a sustainable reversal, retail enthusiasm needs to subside, allowing for a true market reset. If buying pressure from retail traders diminishes, a short-term relief rally could emerge.

However, given the current market structure, Bitcoin remains vulnerable to further downside before a meaningful recovery takes place.

Traders should monitor liquidation levels and retail sentiment trends to gauge when the market might stabilize and reverse its downward trajectory.