- BTC’s price tumbled over 5%, driven by regulatory uncertainty, institutional repositioning, and security concerns in the crypto space.

- Accumulation patterns showed that investors were still engaging, with new demand zones forming between $84K–and $92K.

Bitcoin [BTC], the world’s largest cryptocurrency by market value, has experienced a significant decline, falling over 5% to a three-and-a-half-month low.

As of the 28th of February, Bitcoin was trading below $80,000 for the first time since the 11th of November 2024.

This downturn is influenced by uncertainties surrounding U.S. President Donald Trump’s impending tariffs and crypto policies. This was accompanied by diminished investor confidence following a substantial $1.5 billion hack involving Ethereum [ETH].

Factors contributing to the Bitcoin slide

Several key factors have contributed to Bitcoin’s recent slide:

Policy Uncertainty: President Trump’s announcement of a 25% tariff on imports from Canada and Mexico, set to commence on the 4th of March, has introduced significant uncertainty into global markets.

This policy move has raised concerns about potential inflation and its impact on economic growth. It has led investors to reassess their positions in risk-sensitive assets, including cryptocurrencies like Bitcoin.

Security Breaches: The cryptocurrency market’s confidence was further shaken by a massive security breach, where hackers stole approximately $1.5 billion worth of ETH from the Bybit exchange.

This incident, described as the largest crypto heist to date, has heightened apprehensions regarding the security of digital assets and the platforms that support them.

Investor Sentiment: The initial optimism following President Trump’s election, fueled by expectations of a crypto-friendly regulatory environment, has waned.

The absence of concrete policy developments, such as the anticipated establishment of a strategic Bitcoin reserve, has led to a cooling of the market euphoria that previously drove prices upward.

Insights into investor behavior

Despite the recent slides, on-chain data revealed notable accumulation trends among Bitcoin investors:

September to October 2024: During this period, significant accumulation occurred within the $60,000 to $67,000 price range.

Addresses with cost bases in this bracket have maintained their holdings, indicating a strong belief in Bitcoin’s long-term value.

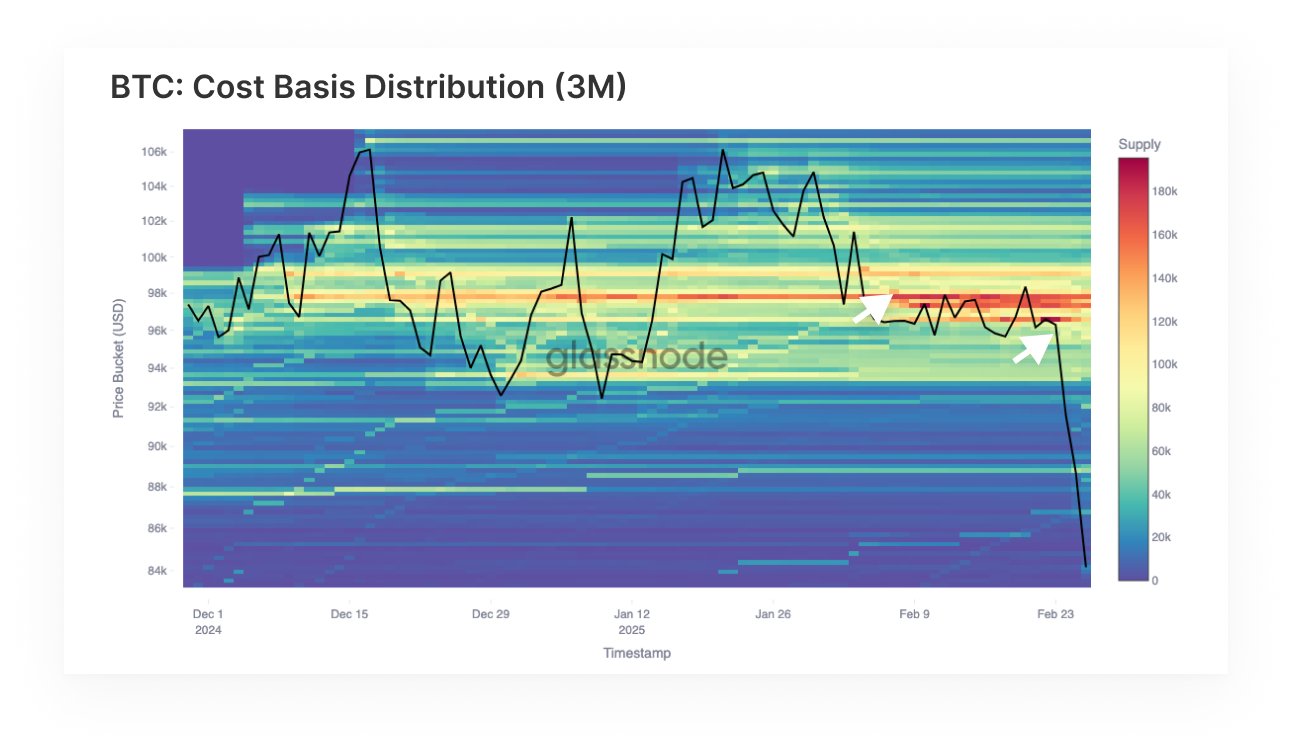

Source: Glassnode

December 2024 to February 2025: A new accumulation zone emerged between $96,000 and $98,000.

While some investors in this range have begun redistributing their holdings, the density of this supply cluster suggests it could act as a formidable resistance level if prices revisit this territory.

Short-term analyses also highlight emerging demand clusters between $84,000 and $92,000. The critical question remains whether this new demand is sufficient to counterbalance the prevailing sell-side pressure.

Analyzing the institutional involvement

Institutional participation in the Bitcoin market has been a significant driver of its price dynamics:

Strategy’s Aggressive Acquisition: Formerly known as MicroStrategy, the company has expanded its Bitcoin holdings by nearly $2 billion, bringing its total reserves to approximately 499,096 bitcoins.

This aggressive accumulation strategy underscores a strong institutional belief in Bitcoin’s future appreciation.

Market Volatility Concerns: Despite such endorsements, the broader institutional sentiment remains cautious. Factors such as policy uncertainties, security issues, and market volatility contribute to a hesitant approach among potential institutional investors.

Bitcoin’s future outlook

The cryptocurrency market stands at a crossroads, influenced by different policy decisions, security considerations, and investor sentiment:

Regulatory Developments: The market is closely monitoring the Trump administration’s forthcoming policies on digital assets. Clear and supportive regulations could rejuvenate investor confidence and potentially reverse the current downward trend.

Market Sentiment: While short-term volatility presents challenges, the underlying accumulation patterns suggest a segment of investors remains optimistic about Bitcoin’s long-term prospects.

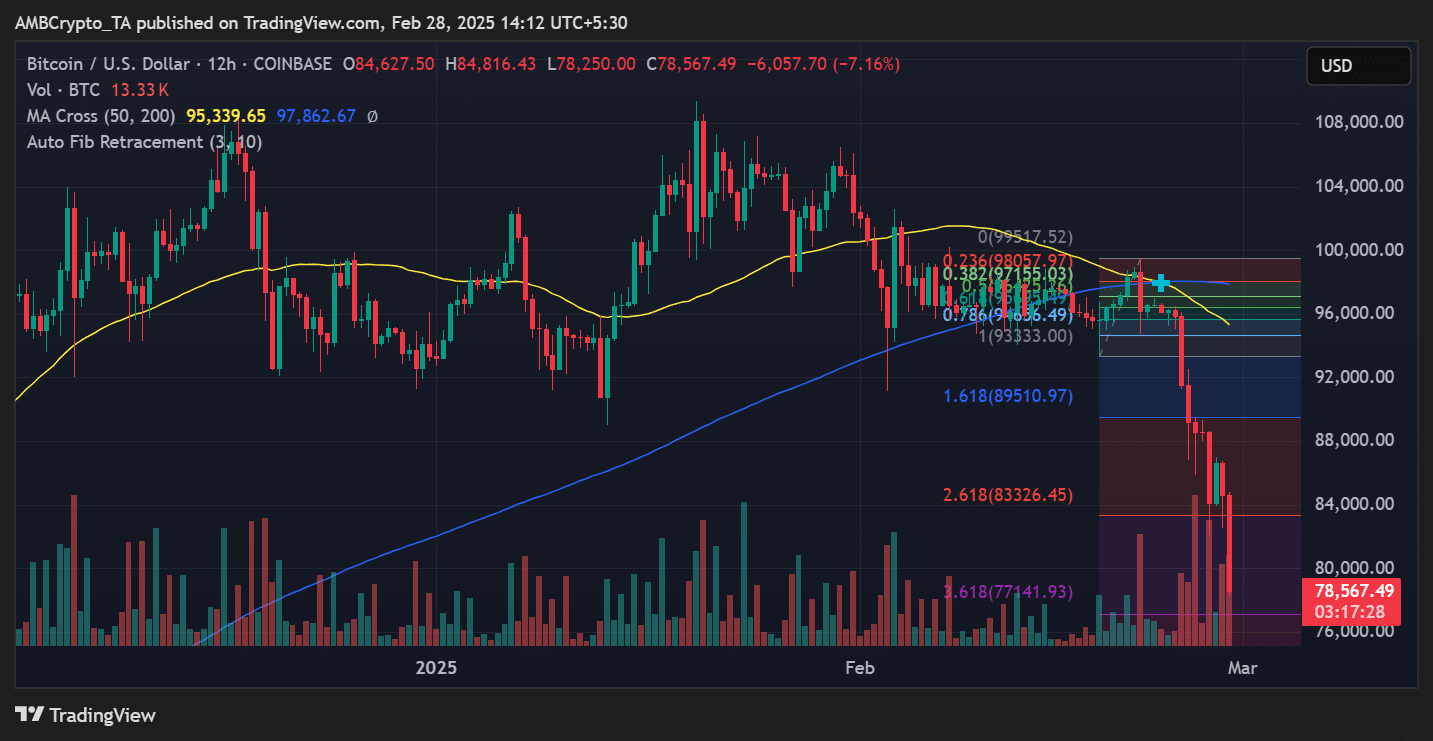

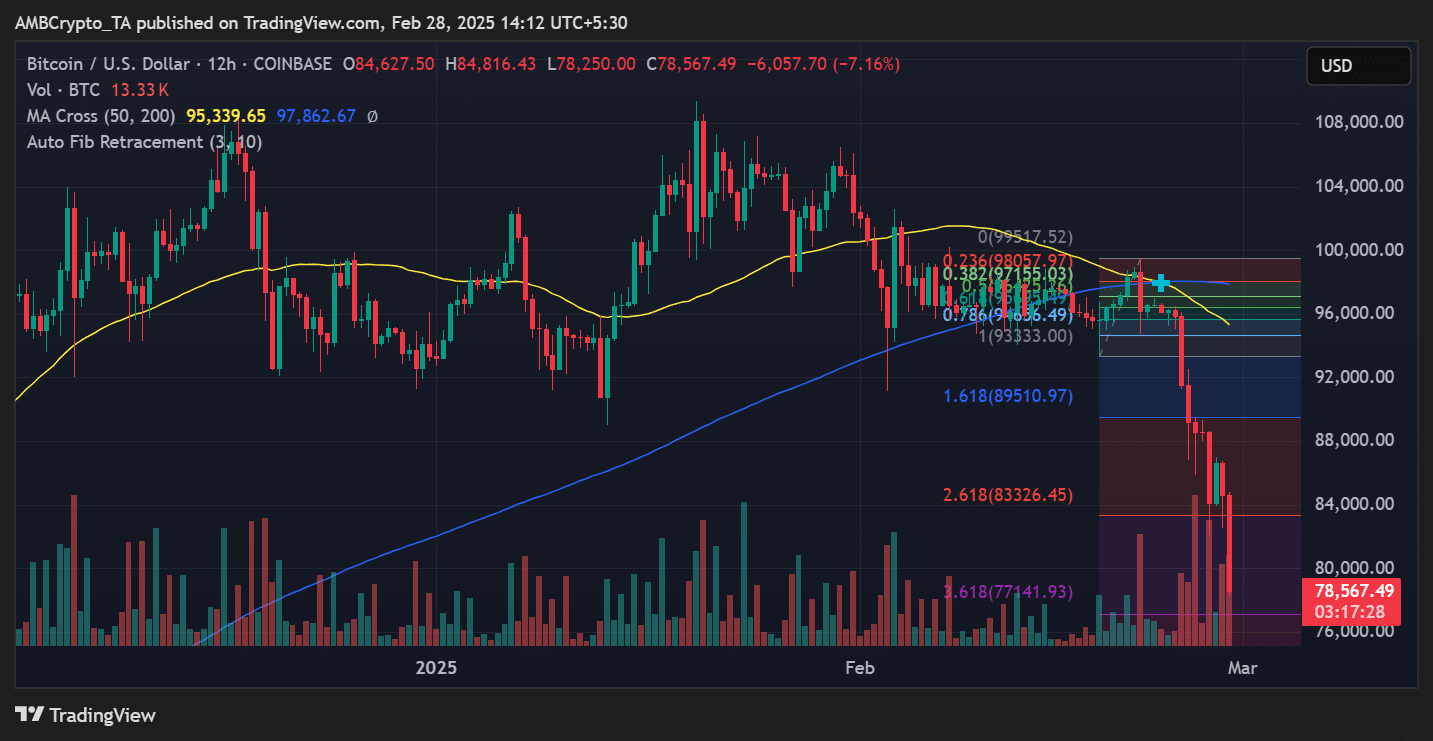

The interplay between emerging demand zones and existing resistance levels will be pivotal in determining Bitcoin’s price trajectory in the coming months.

Source: TradingView

In conclusion, Bitcoin’s recent slide below the $80,000 threshold reflects a complex interplay of policy-induced uncertainties, security concerns, and shifting investor sentiments.

As the market navigates these challenges, the actions of both institutional and individual investors will play a crucial role in shaping the future landscape of the cryptocurrency sector.