- As the U.S. government transitions towards pro-crypto policies, traditional finance is gearing up for change.

- Bank of America CEO has suggested a potential stablecoin once there’s legal clarity.

Throughout the past year, crypto adoption across states, governments, and traditional finance has soared. With a pro-crypto government in the U.S., various traditional finance-centered companies are gearing up to enter the crypto race.

The latest firm to signal such a move is Bank of America, with its CEO revealing plans to launch a stablecoin.

Bank of America set to launch stablecoin

According to Bank of America CEO Brian Moynihan, the bank is preparing to launch its stablecoin once there are regulations in place allowing it.

During his speech at the Economic Club of Washington DC, Moynihan revealed that the bank is interested in joining the fast-growing crypto space. However, he noted that the firm is waiting for legal and regulatory clarity.

He noted that

” it’s clear there’s going to be a stablecoin if it’s legal.”

Moynihan further noted that a dollar-pegged stablecoin issued by the bank will have various uses and applicability in daily activities.

The bank aims to use the same framework it used when it became the first to launch a mobile banking app, which was a success with over forty million users.

However, Moynihan noted that the exact role the stablecoin may play in payments remains unclear. This implies that the bank has yet to determine how to use stablecoins in its traditional finance setup.

Despite this lack of clarity, the announcement by the Bank of America, with over $3.3 trillion in assets, is a significant development in the crypto industry. If the bank adopts stablecoins, other banks may follow, leading to a banking revolution.

This revolution could also create more room for crypto adoption and growth.

Pro crypto policies and stablecoins regulations

With Moynihan revealing his plans for the bank’s entrance, the ball is now solely left to lawmakers. Legal clarity is needed for banks to enter the space.

Various bills have been considered by the U.S. Congress, including the ‘Genius Act’ and the ‘Stable Act’. These regulations will establish dollar-pegged crypto assets such as USDT and USDC.

However, there’s still a long way to go before these bills are approved and set for signature by the president.

What it means for the crypto market

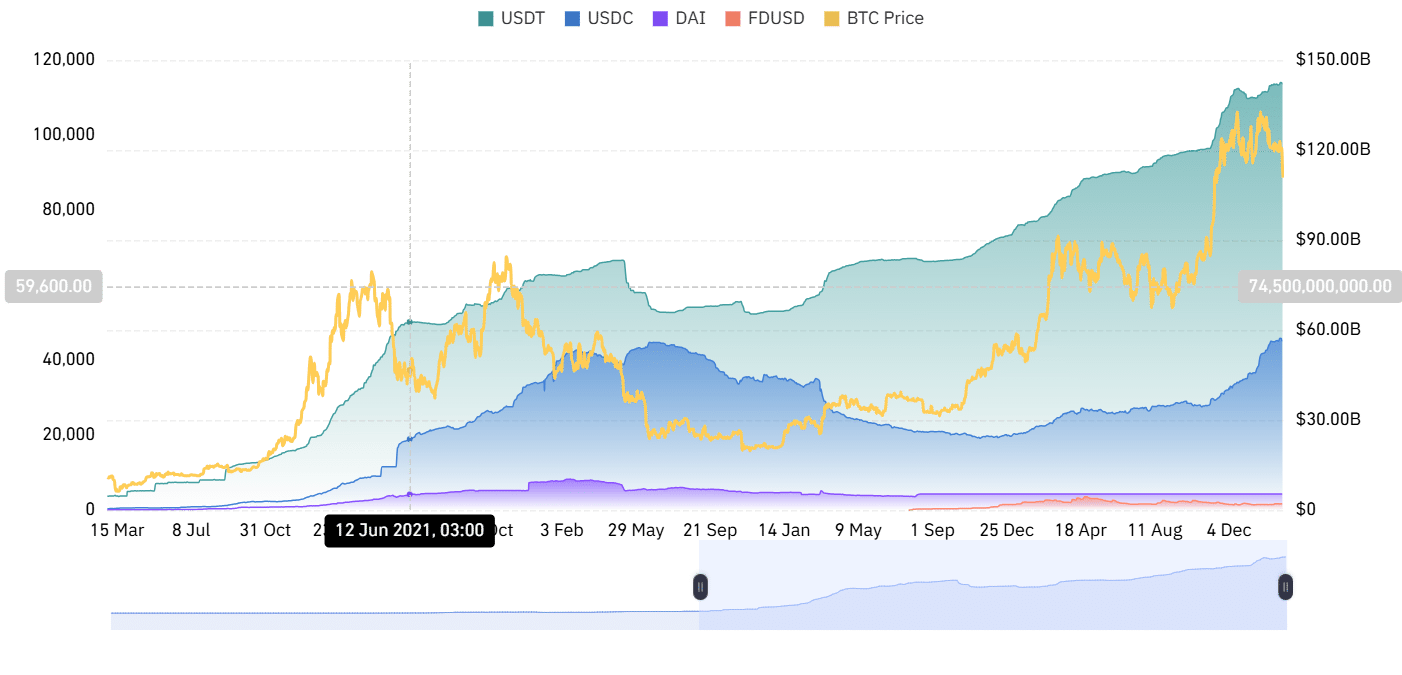

Source: Coinglass

A possible entrance of the Bank of America will have a massive impact on the crypto market. Firstly, it will boost the stablecoin market, which has experienced steady growth over the past years, hitting $231.7 billion.

This growth has seen stablecoins such as USDT reach a market cap of $142.1 billion, and USDC reach $52.9 billion.

With the stablecoin market cap growing, the entrance of another big player will push the market growth even further.

And, this growth will also translate to wider growth for the cryptocurrency market since stablecoins have become central in crypto transactions.