- More than 194B SHIB tokens have been withdrawn from spot exchanges within two days.

- Whales seem to be behind these outflows after large holder netflows flipped negative.

Shiba Inu [SHIB)] was under bearish pressure after posting a 1.17% decline in 24 hours. The memecoin was trading at $0.0000212, amid a 25% drop in trading volumes at press time.

Despite this underperformance, several metrics support the likelihood of a trend reversal and a rally in the short term.

Selling pressure eases

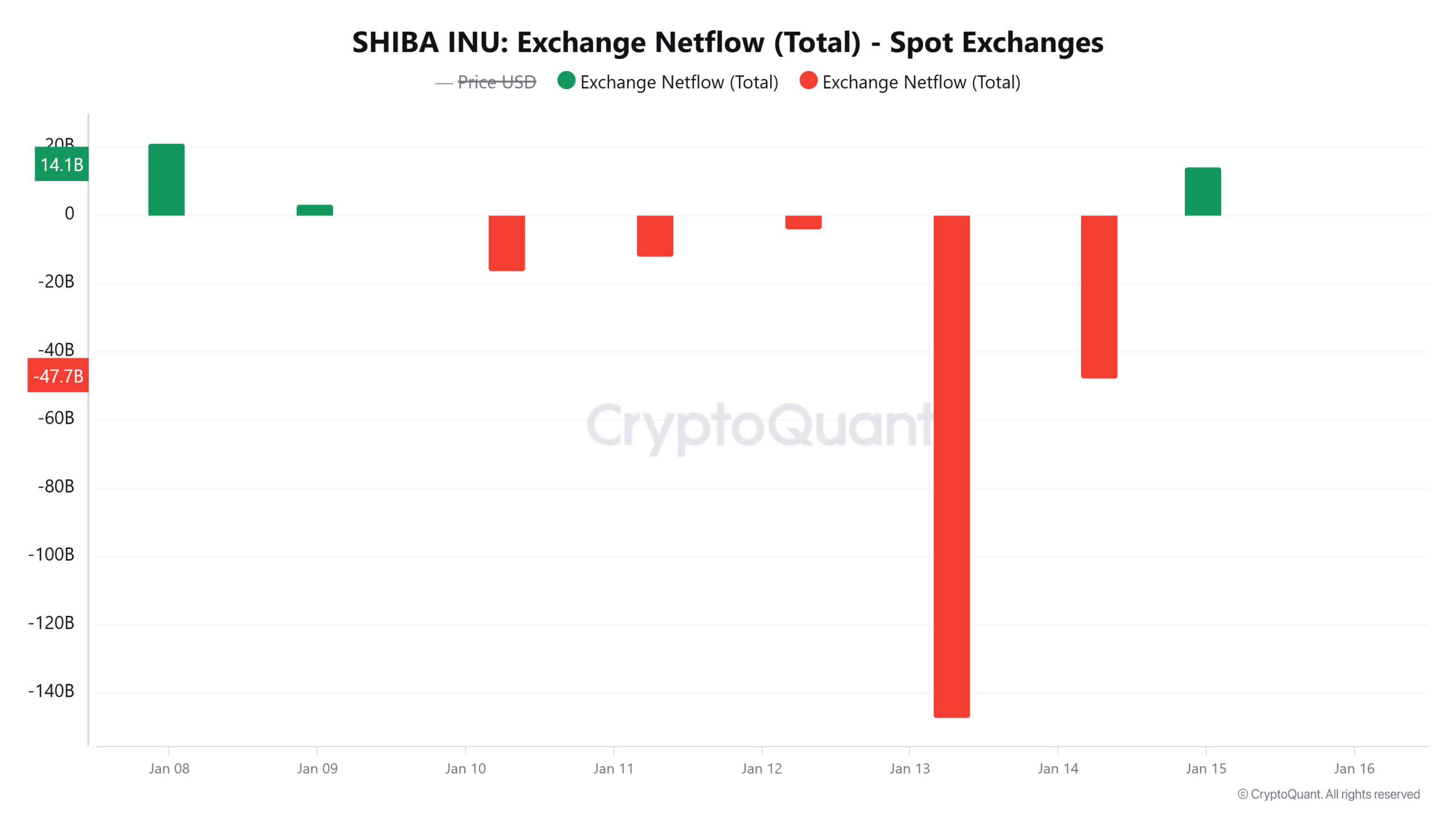

Data from CryptoQuant shows that between January 13th and 14th, 194 billion SHIB tokens were withdrawn from spot exchanges.

These withdrawals point towards reduced selling interest, which could result in a weakened downtrend.

Source: CryptoQuant

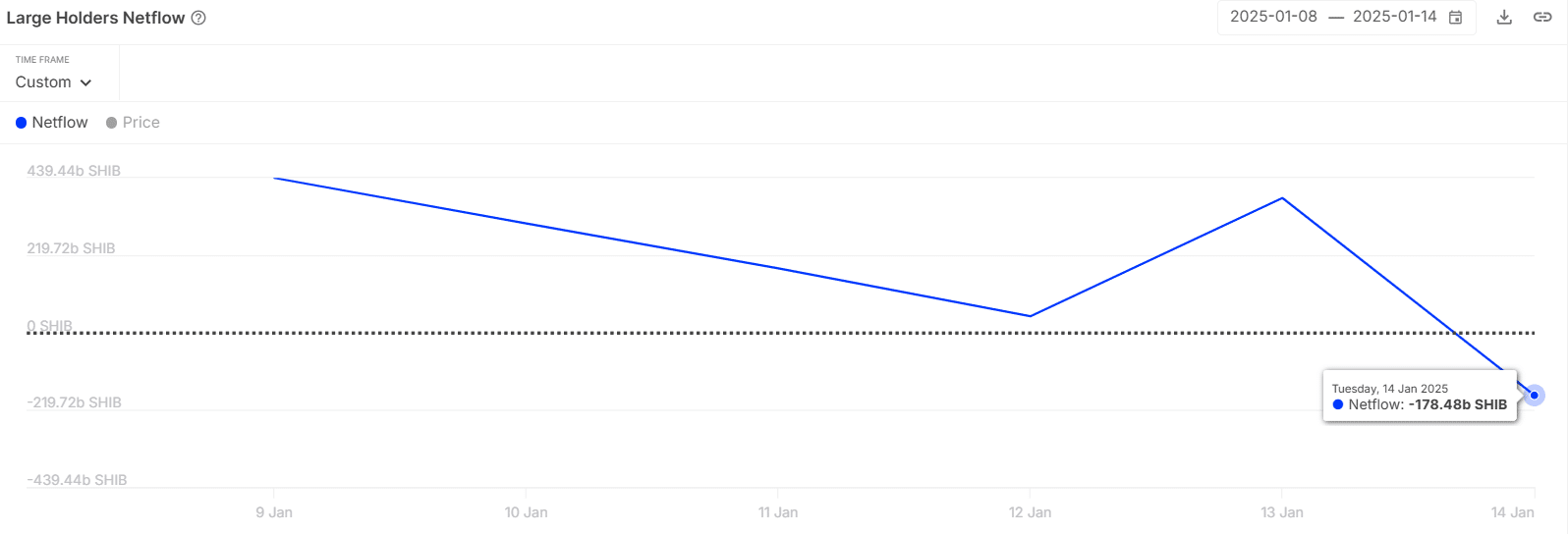

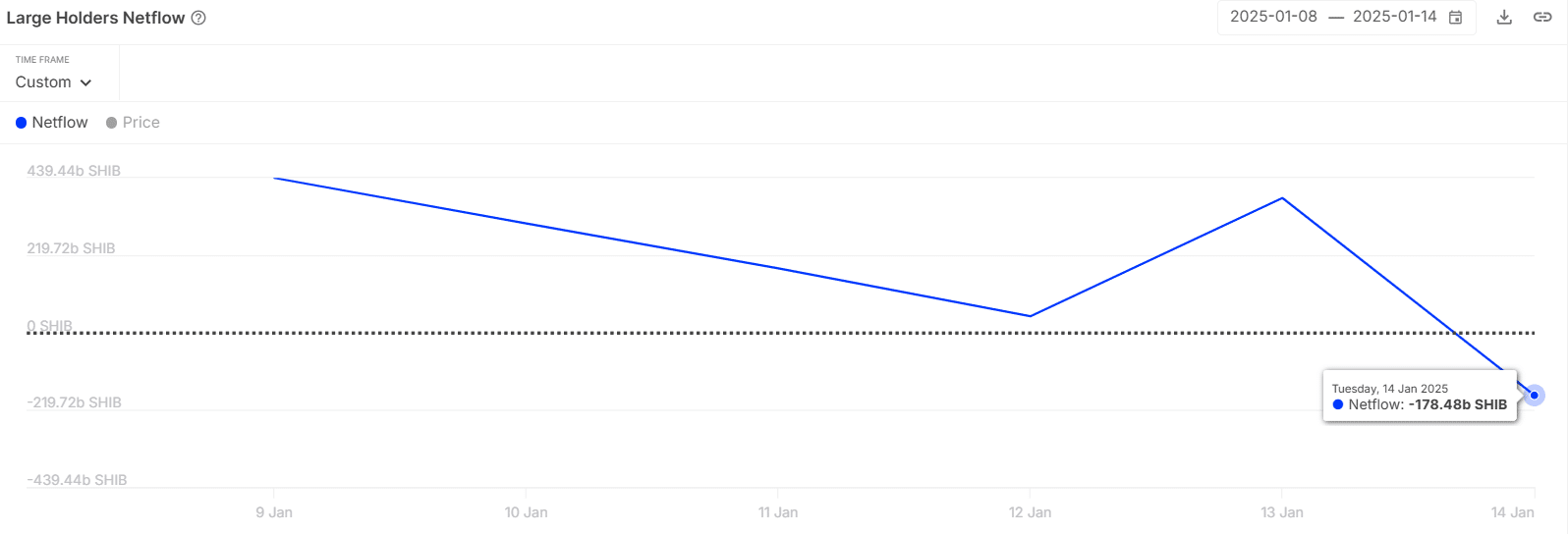

Most of these withdrawals appear to be from whale addresses or large SHIB holders. According to IntoTheBlock data, large holder netflows flipped negative, dropping from 382B SHIB to -178B SHIB.

These netflows are approaching a weekly low, suggesting that large addresses are holding fewer SHIB tokens on exchanges.

Source: IntoTheBlock

When whales move their tokens from exchanges, it indicates an accumulation phase. These addresses tend to buy when prices are low and sell at the top. Therefore, their accumulation behavior at the current price could indicate that SHIB has bottomed.

However, the easing selling pressure has not benefited SHIB, which is still showing bearish signs.

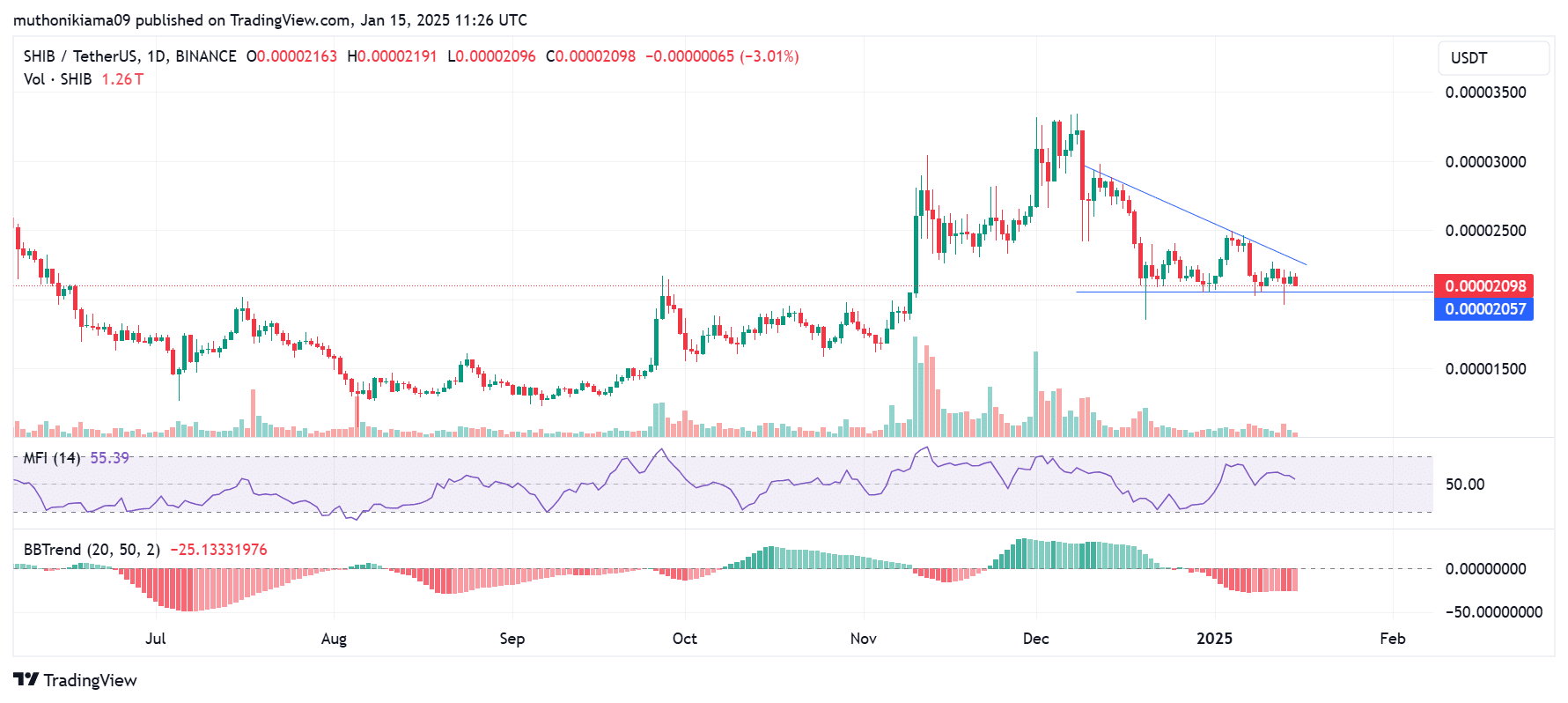

SHIB’s descending triangle shows a bearish outlook

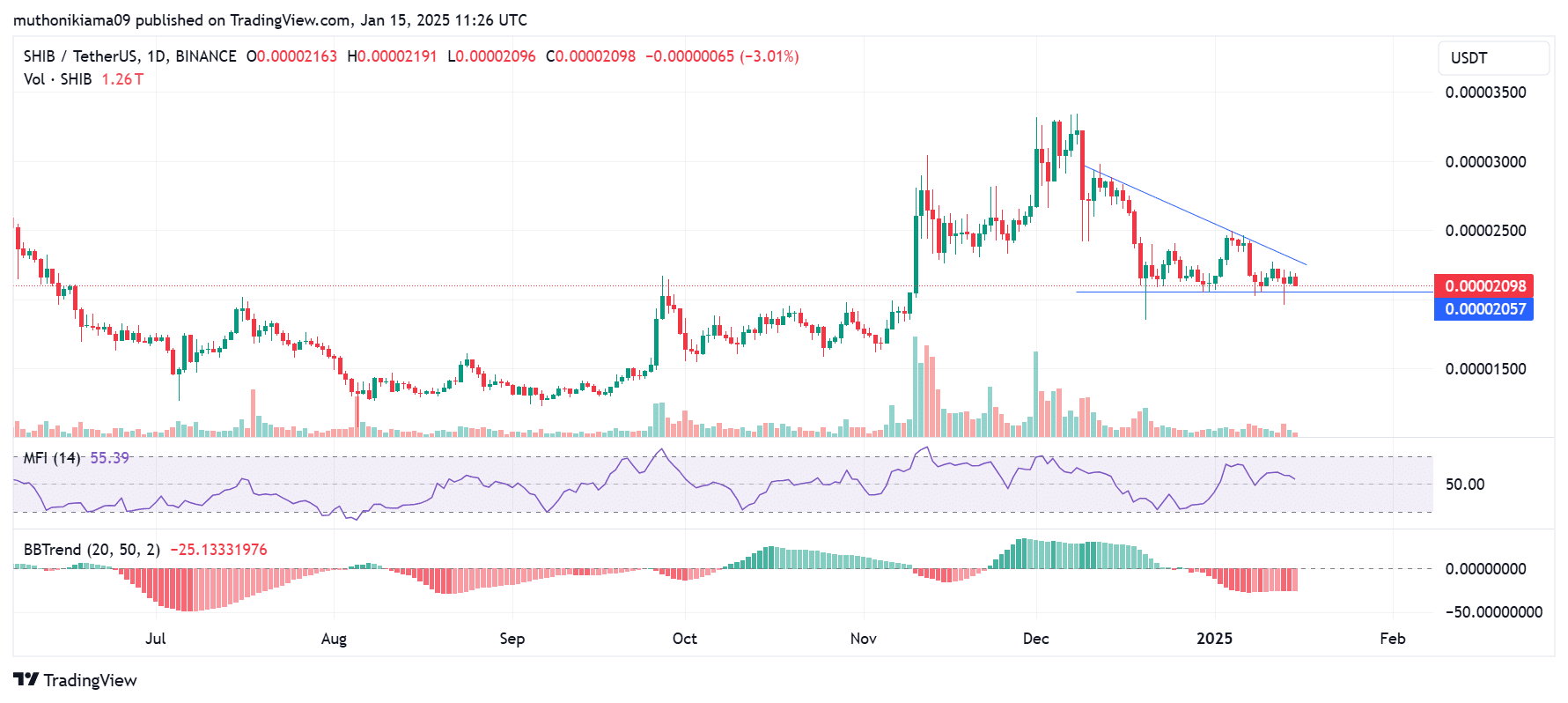

Shiba Inu’s one-day chart shows persistent bearish trends. The memecoin was trading within a descending triangle pattern, indicating a strong downtrend.

Source: TradingView

The Money Flow Index (MFI) stood at 55, and it was tipping south, indicating that whale accumulation has yet to offset the sell-side pressure.

A similar bearish outlook is also seen in the BBTrend indicator, which is red and negative, confirming a negative sentiment.

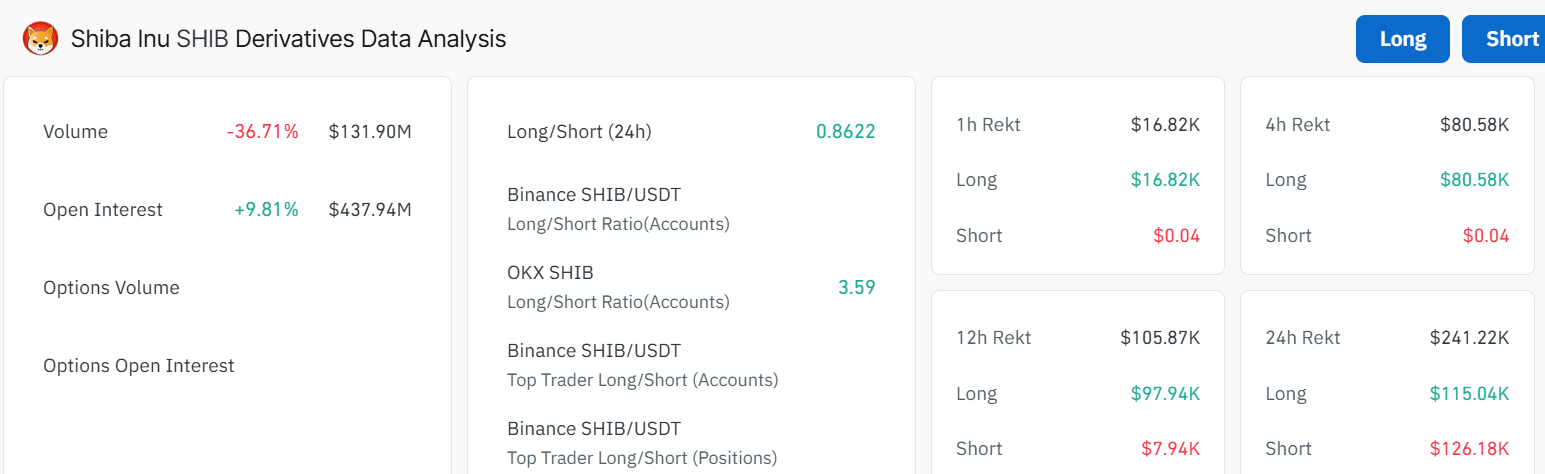

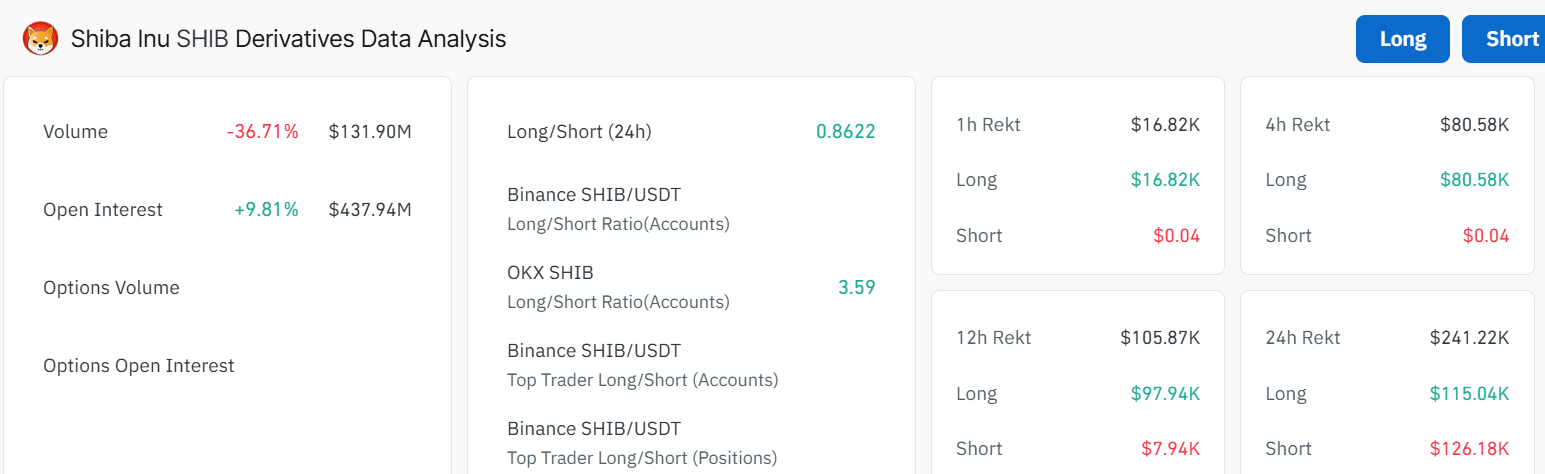

Derivatives data analysis

Data from Coinglass shows a slight uptick in Open Interest to $984M. This rise shows there are newly open positions in the derivatives market.

However, most of these positions appear to stem from short sellers who are betting that the price of the memecoin will drop further.

Source: Coinglass

Read Shiba Inu’s [SHIB] Price Prediction 2025-26

The influx of short positions is also evident in the Long/Short Ratio, which has dropped to 0.86. As short traders increase their positions, it indicates that the general market sentiment is negative.