- Whale accumulation was underway, positioning ADA for its next major price surge.

- In the derivatives market, traders were heavily betting on an upswing, with long positions dominating sentiment.

Cardano’s [ADA] performance remains outstanding of late, boasting a 216.78% gain over the past month. Its recent 20.55% increase in the last 24 hours further reflected the ongoing bullish momentum.

This rally is primarily driven by whale accumulation and increased buying activity in derivatives markets. Insights from AMBCrypto suggested there could be more upsides ahead.

Whale accumulation behind ADA’s rally?

Analyst Ali Charts noted on X (formerly Twitter) that Cardano’s ADA recent rally has been significantly influenced by whale activity, with large holders accumulating substantial amounts of the asset.

According to the analyst, the current rally is “nothing compared to what is coming,” citing multiple bullish indicators.

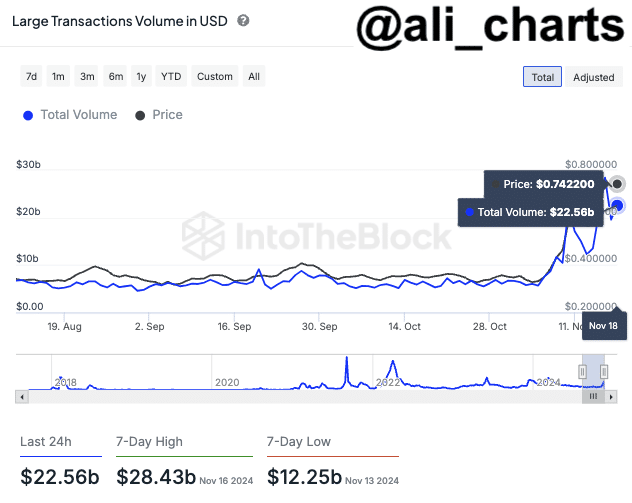

Ali Charts highlighted a surge in ADA’s transaction volume, which has consistently maintained levels of $22 billion per day over the past week, peaking at $28.43 billion—its highest in seven days.

This increase in activity is linked to whales and institutional investors increasing their positions.

Source: X

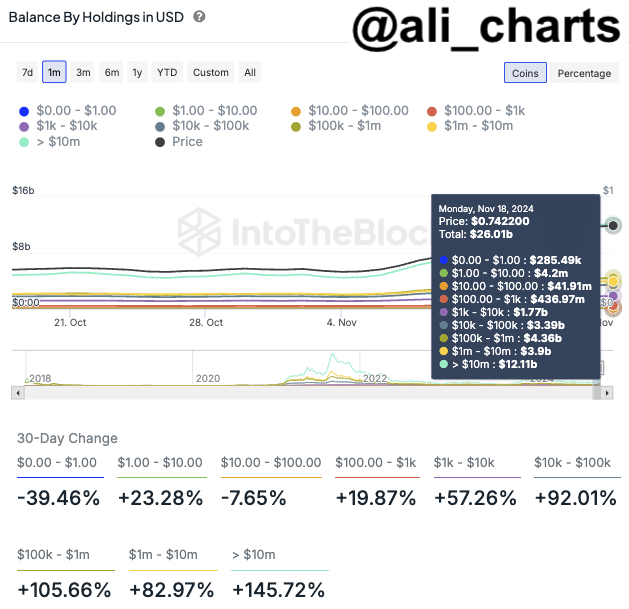

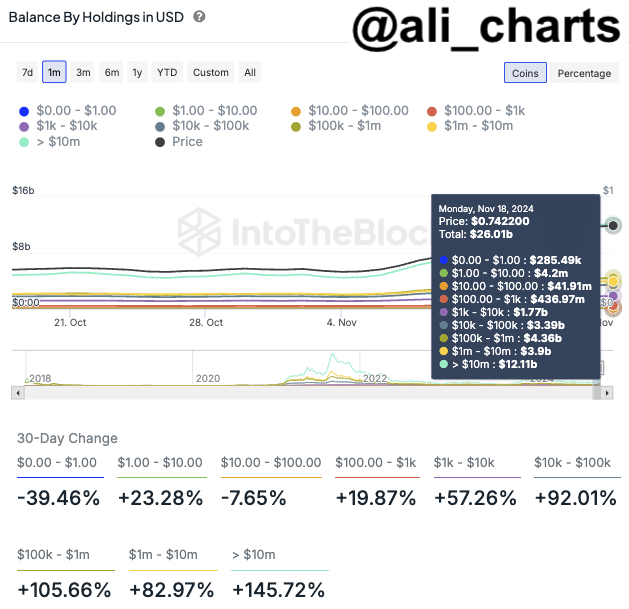

The analyst pointed to a notable rise in the “Balance By Holding in USD,” which tracks ADA holdings across wallet balances. This increase reflected a major accumulation by large holders.

Whales—wallets holding up to 1% of the asset’s total supply—have shown a massive growth.

Specifically, wallets holding between $1 million and $10 million worth of ADA have increased their balances by 82.97%, while those holding over $10 million have seen a 145.72% rise in the last 30 days.

Source: X

Price movement signals possible ADA rally

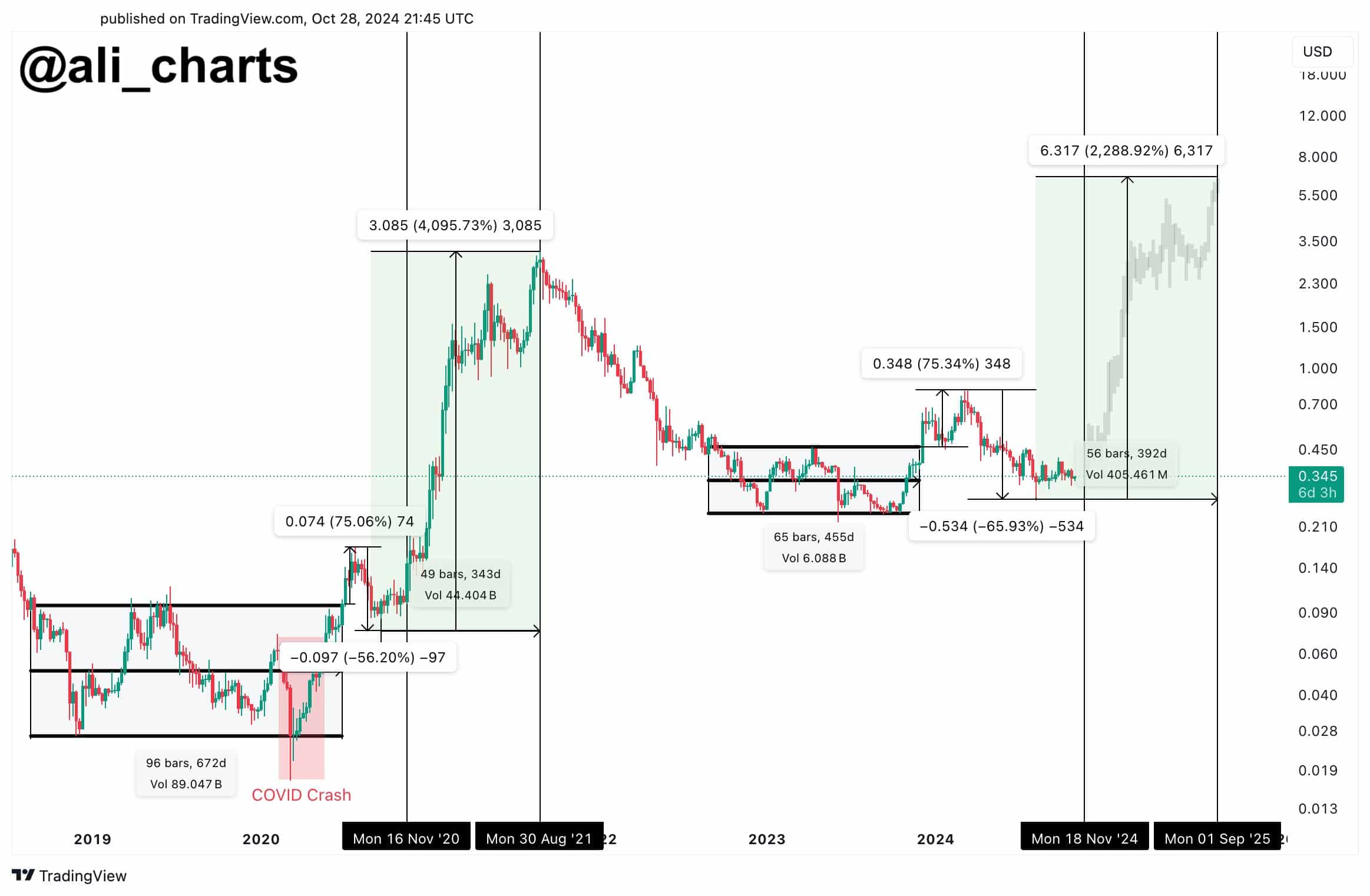

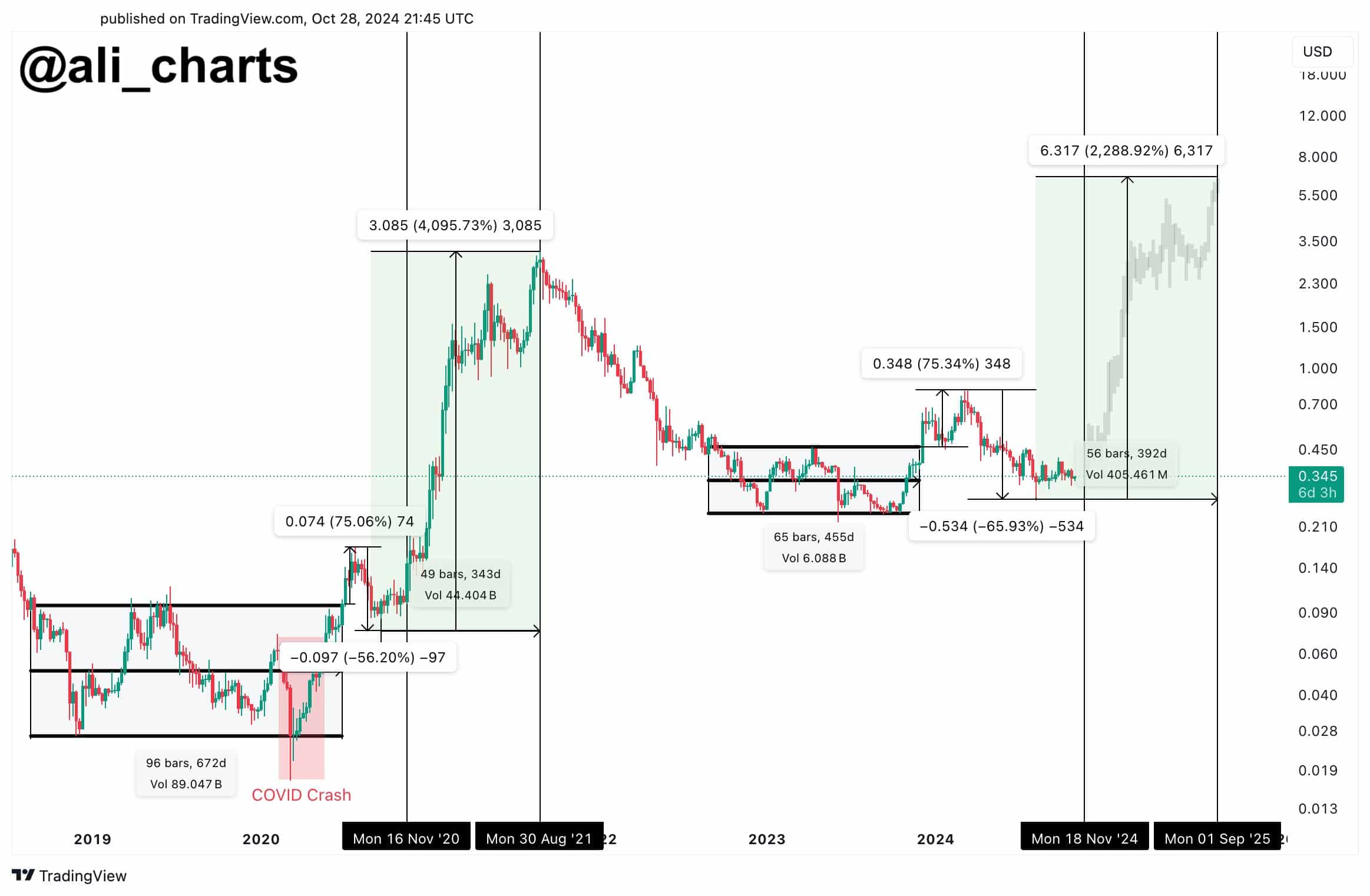

Ali Charts observed that ADA’s price movement resembled a fractal pattern, mirroring its 2020 trajectory.

This pattern includes the accumulation phase, the COVID-19 crash, and the subsequent November 2020 rally that propelled ADA to its all-time high of $3.085.

ADA appeared to be on a similar path, having exited an accumulation phase, experienced a crash, and now showing signs of trending upward.

If this fractal plays out, ADA could potentially rally by 2,288.92%, reaching $6.30—a move that is already be underway.

Nonetheless, there’s a chance that ADA could temporarily slow down as it gathers additional momentum to climb higher.

In such a scenario, the asset might retrace to $0.80, where significant buying interest could reignite the rally.

Source: X

At this level, data shows a major buy order for 1.19 billion ADA spread across approximately 48,000 addresses. This highlights strong investor interest and suggests a potential catalyst for the next price surge.

Derivative traders fuel bullish pressure

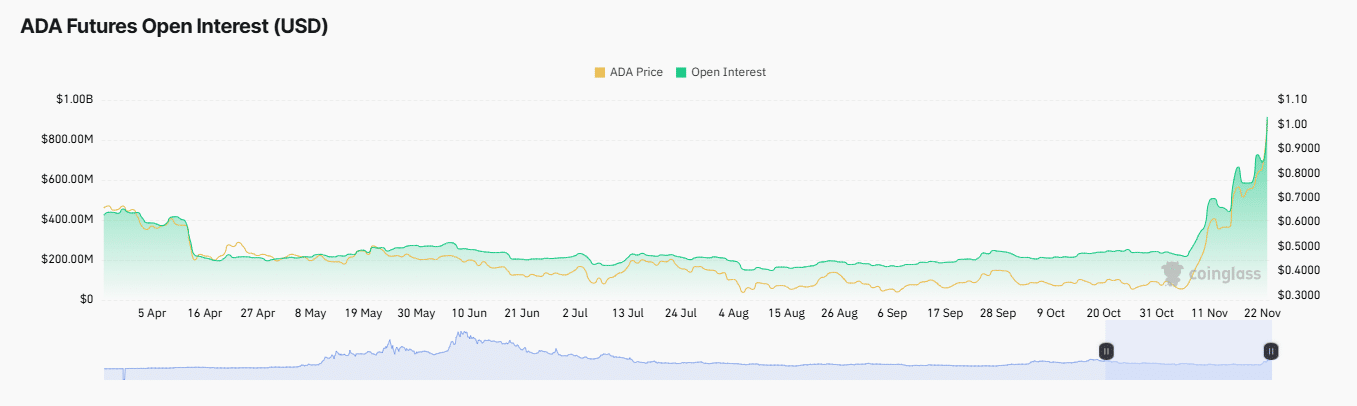

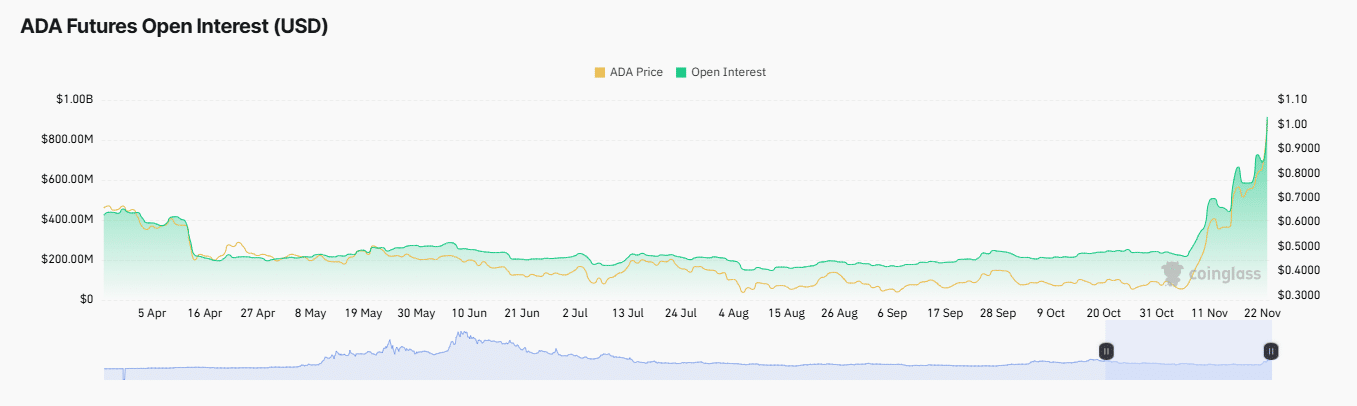

AMBCrypto’s look at Coinglass revealed growing interest among derivative traders, with a significant increase in long positions. This trend is expected to persist as bullish sentiment strengthens.

Open Interest, used to gauge market sentiment based on the total value of unsettled derivative contracts, had shifted to decisively bullish at press time. It rose by 35.37%, reaching $1.02 billion.

Source: Coinglass

Read Cardano’s [ADA] Price Prediction 2024–2025

Simultaneously, a number of short liquidations totaling $11.12 million occurred as traders betting on a price decline were forced to close their positions amid ADA’s upward trend.

Adding to the bullish outlook is the rising Funding Rate, at 0.0572% at press time. A positive and increasing Funding Rate, as seen in this case, indicates dominance by long traders, further reinforcing expectations of a rally.