- Crypto.com dropped its suit against the SEC the same day its CEO met the new President-elect.

- The lack of spot demand in recent days could be a sign of losses to come.

Cronos [CRO] the Cronos chain native token and one of Crypto.com’s products, has been consolidating beneath the $0.2 mark over the past month.

Before November, the token had been in a long-term downtrend and had fallen below the $0.083 support.

Crypto.com’s CEO Kris Marszalek had traveled to Florida to meet Trump on the 17th of December, leading to the token gaining 16% within hours.

On the same day, the exchange also voluntarily dismissed its lawsuit against the SEC, as it intended to work with the incoming administration on a regulatory framework for the industry.

Should you buy CRO crypto or sell it?

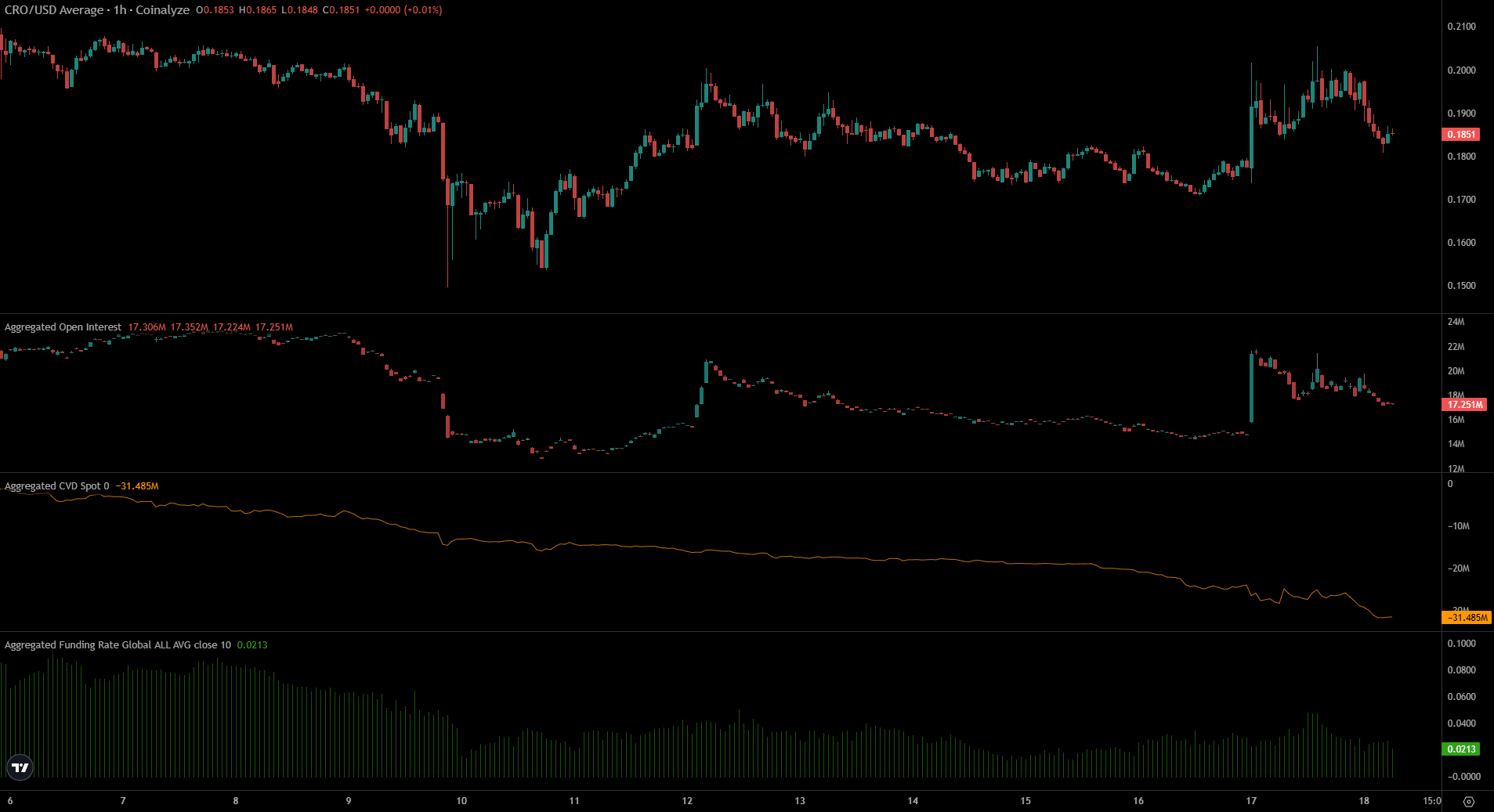

Source: CRO/USDT on TradingView

Within a week, CRO had gained 210% after the U.S. Presidential election results came in and shot higher to the $0.2 mark. Since then, it has formed a range between $0.17 and $0.2.

The trading volume during the rally was high and has fallen during the consolidation.

This was not unusual. The token was likely to need more time before pushing higher. The technical indicators remained bullish. The CMF was at +0.23 to signal strong capital inflow to the market.

Meanwhile, the RSI remained above neutral 50 but did not form any divergence yet.

A revisit of the $0.16-$0.17 region would offer a buying opportunity. A breakout beyond $0.2 would be ideal for investors, but traders can use a test of this resistance to take profits.

Short-term sentiment is not consistently bullish

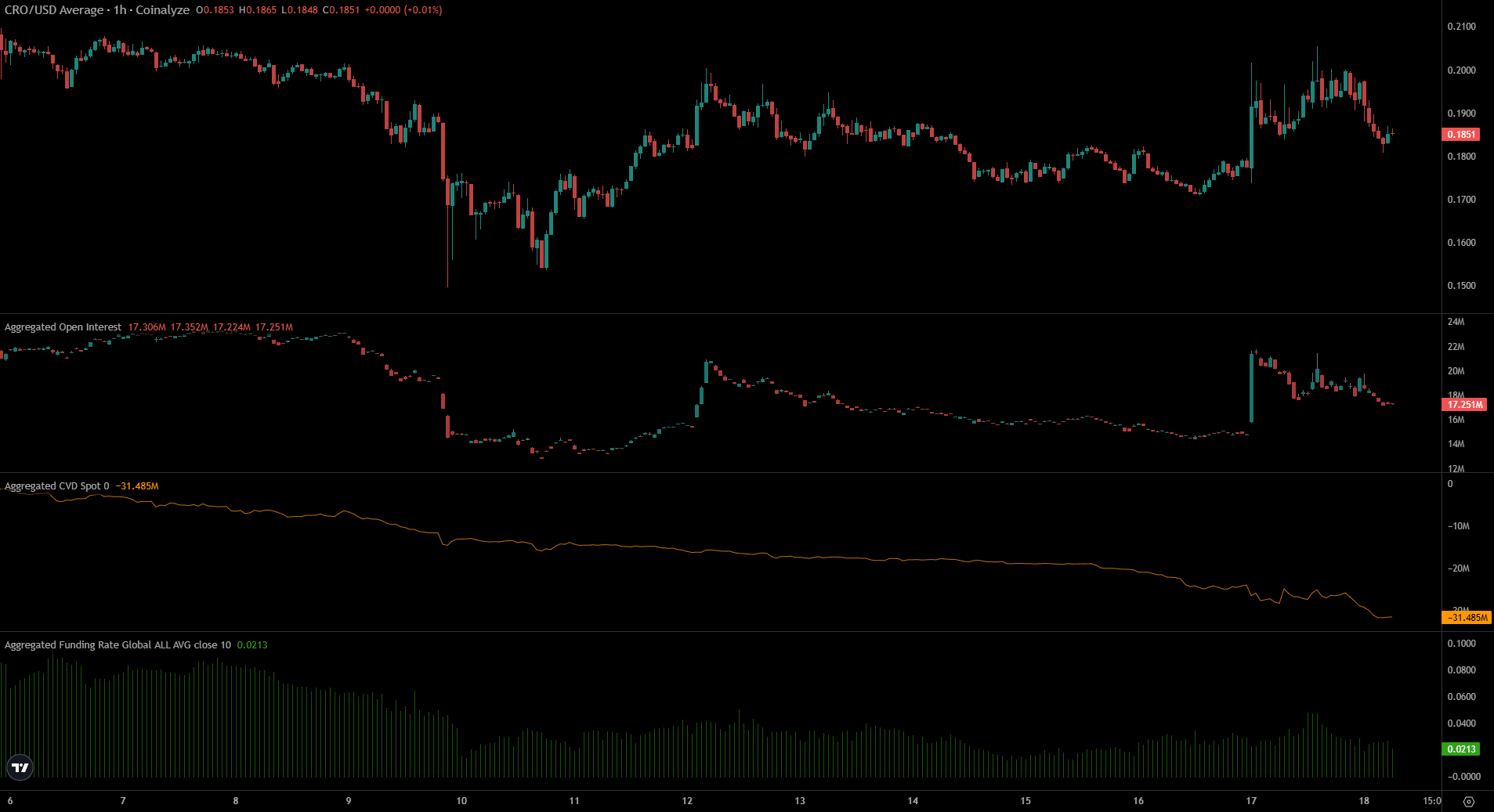

Source: Coinalyze

AMBCrypto observed that over the past week, certain trading sessions saw a huge increase in the Open Interest.

These came alongside high trading volumes such as on the 12th and the 17th, reflected in the price chart as well as the Coinalyze data above.

Read Cronos’ [CRO] Price Prediction 2024-25

The OI tended to fade after these strong moves, a sign that speculators flooded in during quick gains but were also quick to leave.

The spot CVD was in a downtrend as well, showing sustained selling over the past few days.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion