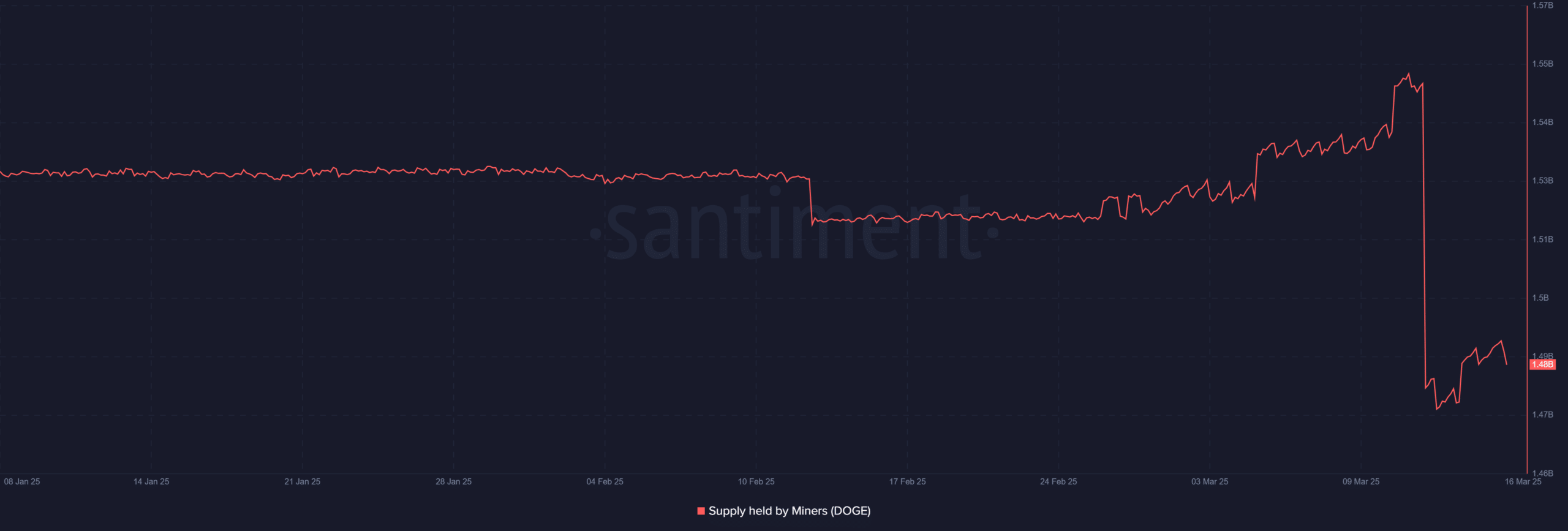

- Dogecoin miner reserves plunged from 1.55 billion to 1.48 billion DOGE, indicating a large-scale sell-off.

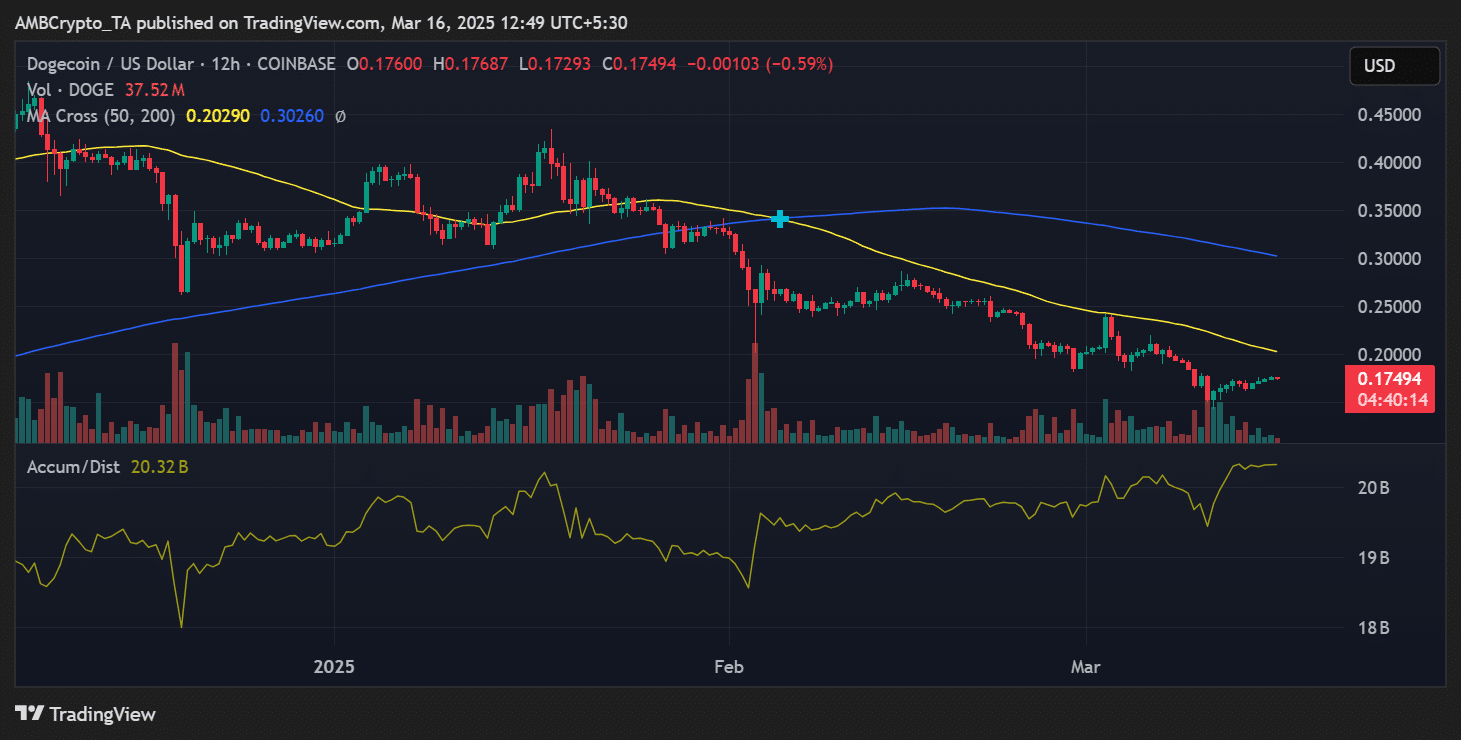

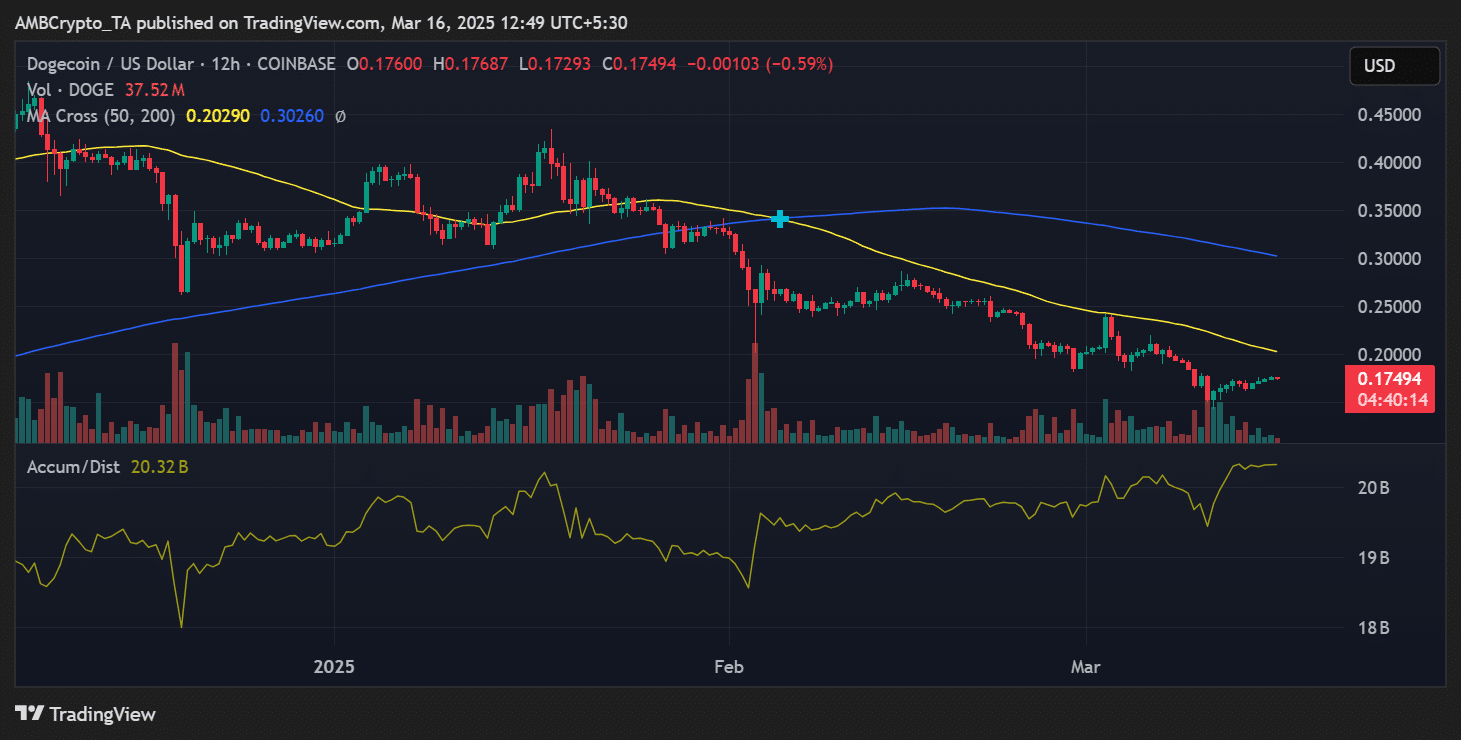

- Despite the miner exodus, DOGE remains near $0.174, showing signs of stability amid increasing accumulation.

Dogecoin [DOGE] miners have made a significant move, offloading a large portion of their holdings.

As seen in the supply held by miners chart, this sell-off marks one of the most notable reductions in miner reserves in recent times.

The event raises concerns about its impact on DOGE’s price trajectory and overall market sentiment.

With DOGE struggling below key moving averages, could this miner exodus spell further downside, or will the market absorb the selling pressure?

Massive miner sell-off: A bearish signal?

Santiment’s chart revealed that Dogecoin miners had reduced their holdings from approximately 1.55 billion DOGE to 1.48 billion DOGE in just a short span.

Source: Santiment

This sharp decline suggests that miners are liquidating their assets, possibly to cover operational costs or in response to market conditions.

Historically, large miner sell-offs have led to downward price pressure as increased supply meets static or weakening demand.

DOGE price reaction: Resilient or vulnerable?

DOGE trades at $0.174 as of this writing, reflecting a minor decline following the miner dump.

The 50-day moving average [$0.202] and 200-day moving average [$0.302] continued to act as strong resistance levels, further restricting upward momentum.

Also, miner sell-off picked up more steam when the DOGE price saw an upward adjustment after a series of declines.

Source: TradingView

Despite the miner sell-off, accumulation among investors has remained stable, as seen in the accumulation/distribution chart, which sat at 20.32 billion at press time.

This indicated that while miner activity adds to the selling pressure, broader market participants were still engaged in Dogecoin accumulation.

Will Dogecoin hold the support levels?

For Dogecoin to stabilize, it must hold above the $0.165 support level, a key zone where buying activity has historically stepped in.

However, if selling pressure from miners persists, DOGE could revisit the $0.15 zone. On the flip side, any increase in demand could see DOGE reclaim $0.18 before attempting a push towards the $0.20 mark.

Final thoughts

The miner sell-off injects volatility into DOGE’s price action, making near-term movements uncertain.

While the price has not collapsed under the pressure, traders should closely monitor further miner activity and key resistance levels.

A break below $0.165 could trigger a sharper decline for Dogecoin, while a successful recovery above $0.18 would indicate resilience in the face of miner exits.

Investors should remain cautious and watch for shifts in on-chain data that could signal a change in trend.