- Dogecoin whales have sold another significant portion of their holdings in the past 24 hours, influencing downward pressure.

- DOGE could establish new lows as sentiment across several metrics remains bearish.

In the past 24 hours, Dogecoin [DOGE] recorded a 17.64% market decline, bringing its monthly loss to 36.43%, a clear sign that DOGE has continued to make a series of lower lows in the market.

Analysis showed that whales played a major role in the recent market decline of DOGE. Now, other retail traders have joined the bearish sentiment, likely contributing to further declines.

Whales sell-off causes bigger consequences

Whales, or large investors controlling between 100 million to over 1 billion DOGE, have sold 270 million DOGE in the past 24 hours, forcing a price decline and market losses.

Typically, a major sell-off like this implies that these cohorts are either trying to realize profits, break even, or cut their losses.

This is often followed by a series of downward price movements until significant buying activity is recorded.

Source: X

These whale sell-offs have impacted other market participants, who are closing their long contracts as the bearish wave takes control of the market.

Derivative trades remain bearish

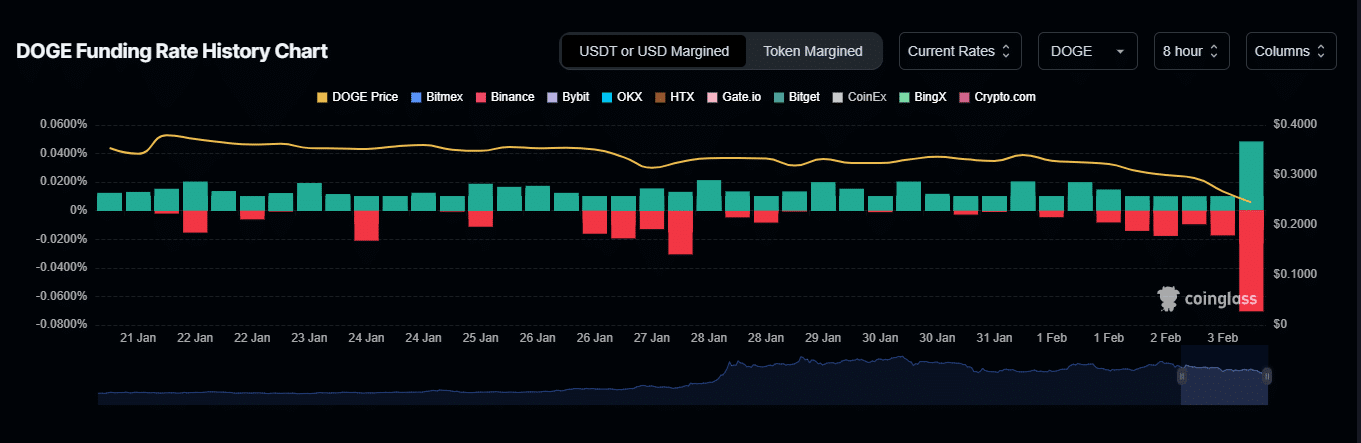

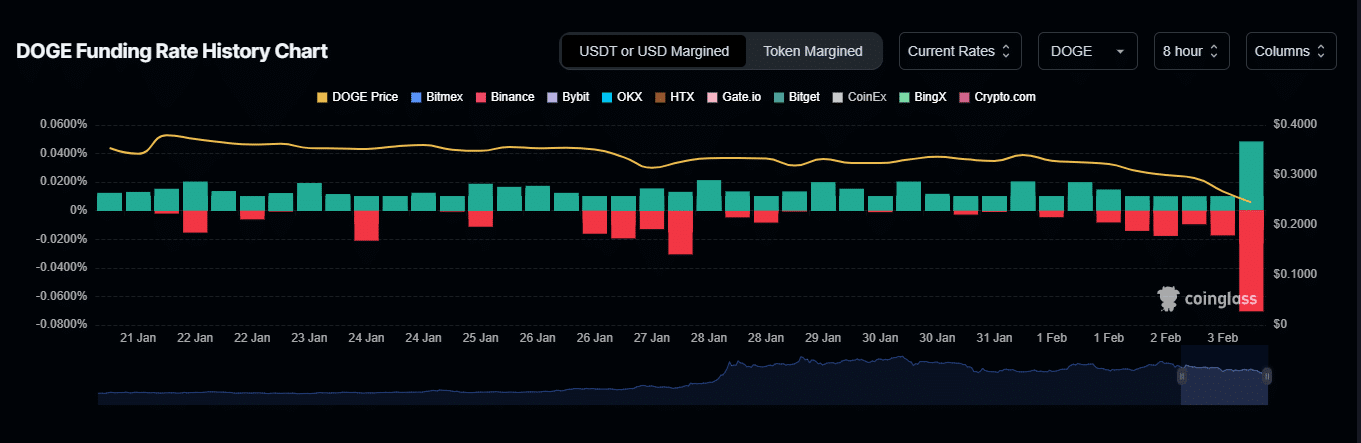

Derivative traders’ positions in the market have turned bearish as two key metrics—Funding Rate and Open Interest—have shifted negatively.

The Funding Rate, which shows whether buyers or sellers are in control based on which group pays the premium to maintain price balance in the spot and Futures market, indicates that sellers are in control.

This is confirmed by a negative Funding Rate. At press time, DOGE’s Funding Rate stood at negative 0.0245%, meaning perpetual contracts were dominated by sellers.

Source: Coinglass

The Open Interest (OI), which measures the amount of unsettled derivative contracts in the market, shares a similar sentiment.

At the time of writing, OI has declined by 30.08% to $2.53 billion, suggesting that derivative traders are closing their positions, and liquidity outflow is occurring, adding more downward pressure.

Dogecoin longs get burned

Bullish traders have incurred major market losses in the past 24 hours, given the current bearish trend. At the same time, the liquidation data opposed a market rally, as traders remained bearish across all timeframes.

In the past hour alone, $2.31 million worth of long liquidation positions have been closed, compared to $99,880 of short positions.

This large disparity between long and short contracts in lower timeframes highlighted the depth of the bearish trend.

Read Dogecoin’s [DOGE] Price Prediction 2025–2026

Overall, this bearish trend persists, with exactly $69.46 million worth of long positions on DOGE closed, while short positions account for just $18.94 million.

If this continues, there’s a high probability that DOGE will keep recording new lows and the market will experience further losses.