- Ethereum made recent gains that were likely not on the back of organic demand.

- The liquidity hunt in the coming days could see prices reach $2.9k.

Ethereum [ETH] presented a good case for buyers a couple of days ago when institutional interest ramped up and whales began to accumulate more of the token.

Some gains were made over the past two days, bringing prices up to $2672 at press time.

In other news, Vitalik Buterin backed a proposal to have multiple-block proposers in the network. This proposal was made to combat the risks of centralization and manipulation.

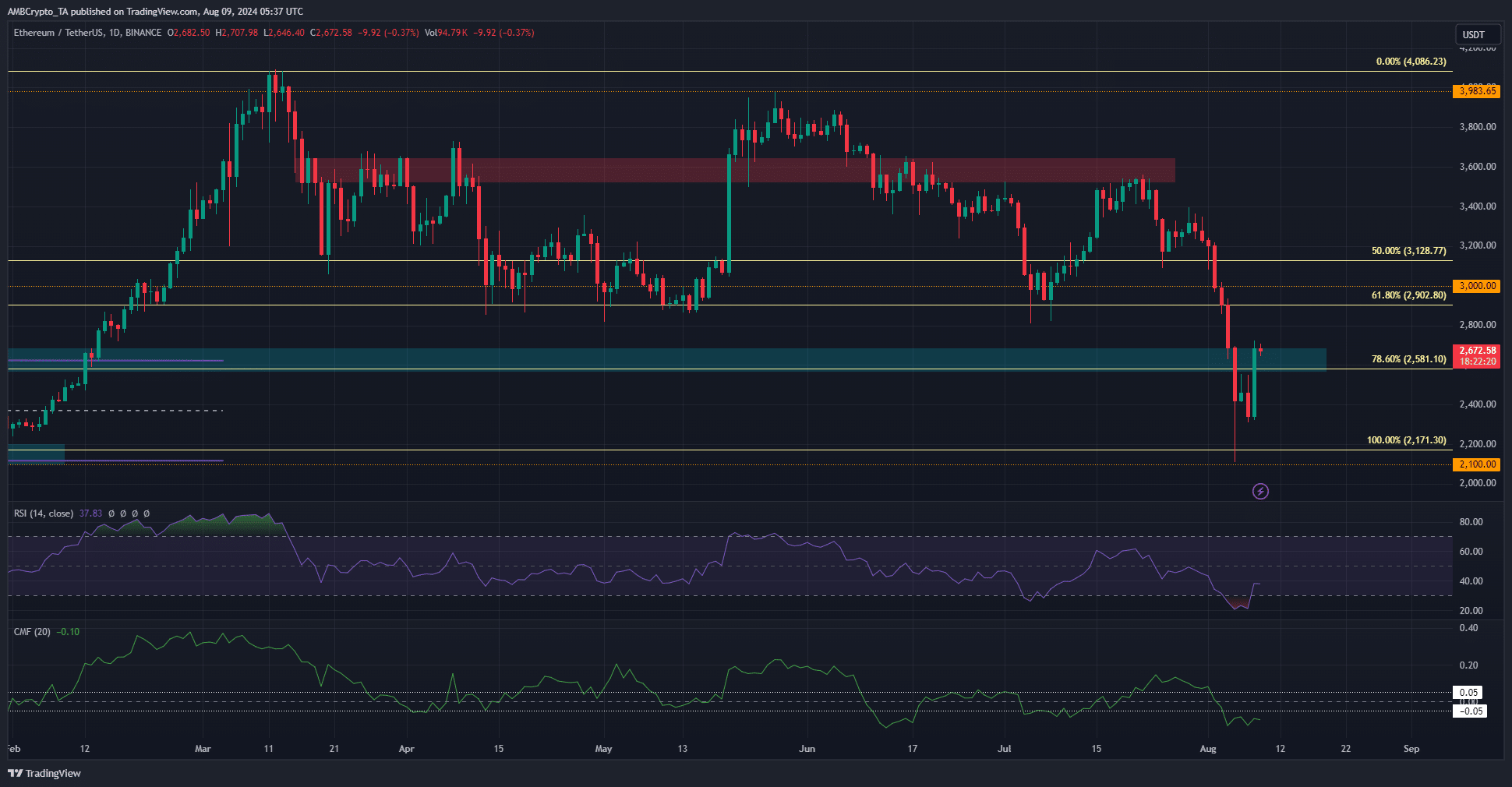

Resistance overhead appeared ominous for Ethereum buyers

Source: ETH/USDT on TradingView

The $2580-$2680 was a resistance zone that opposed the bulls in January and February earlier this year. Hence, it is imperative that the bulls flip this zone to support in the coming days.

The technical indicators were not encouraging. The daily RSI was at 37, showing firm downward momentum. The CMF was at -0.1 to show heavy capital flow out of the market. This subtracted from the recent price gains.

The inference was that the price rally from the $2.1k lows was driven by the liquidity from late short-sellers, and not by strong demand. Hence, another move southward after this liquidity hunt could ensue.

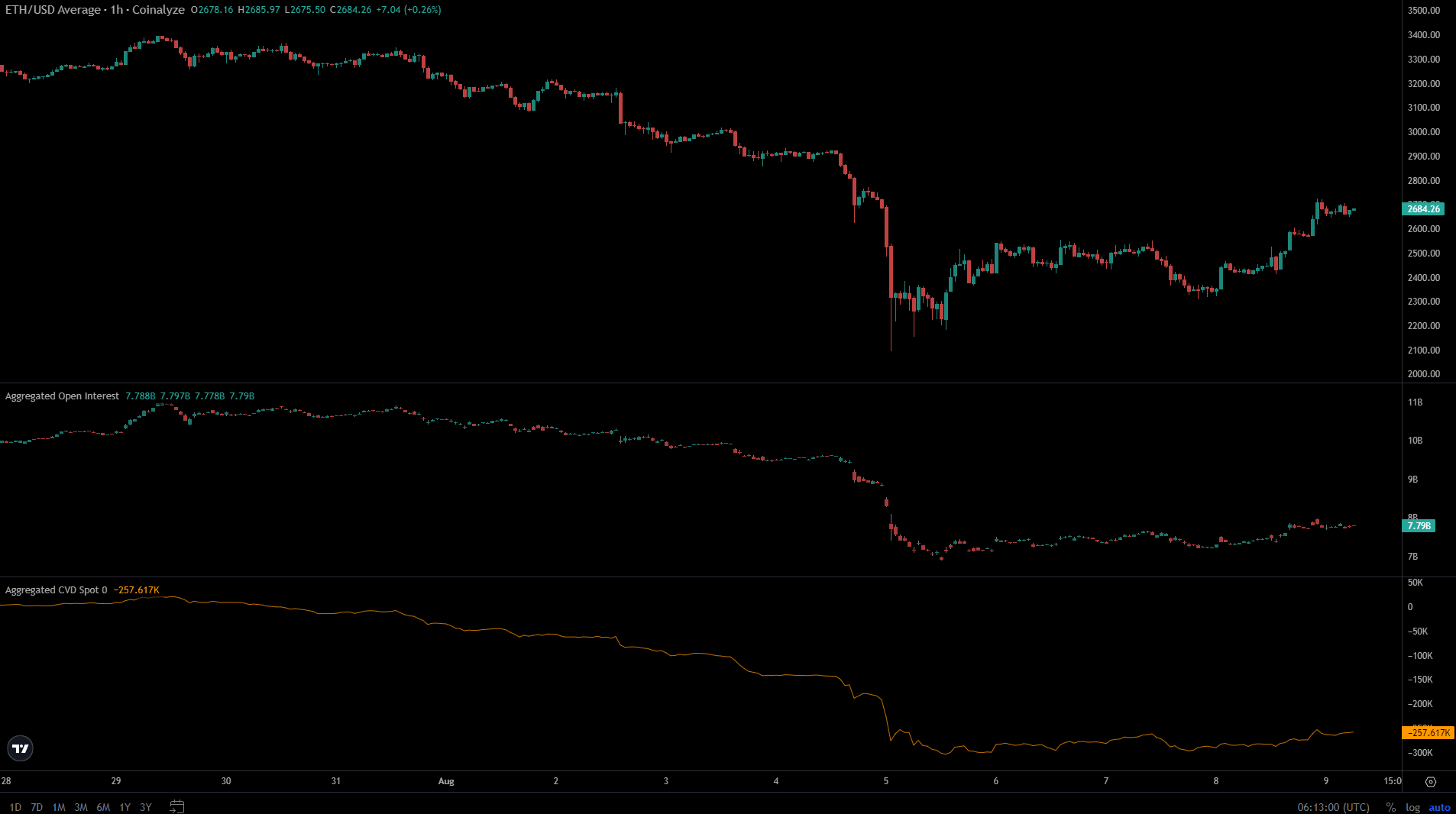

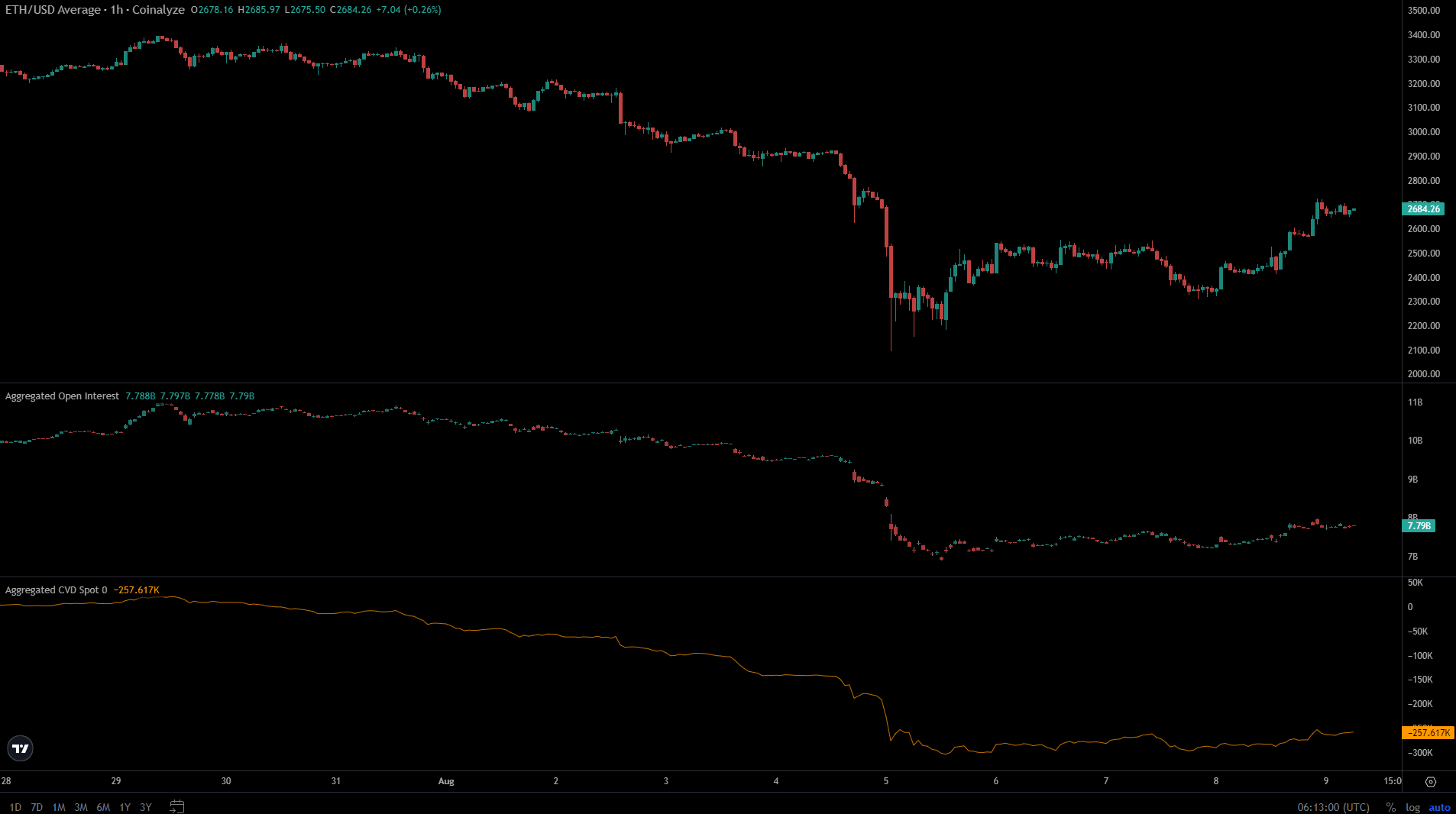

Lack of conviction from speculators

Source: Coinalyze

Since reaching Monday’s lows, ETH has bounced by 27%. Yet, the Open Interest crept upward from $7.07 billion to $7.79 billion, a meager increase compared to the price gains.

This showed that speculators lacked bullish conviction.

Still, the spot CVD saw a slow uptrend initiated, which was a piece of good news for the bulls.

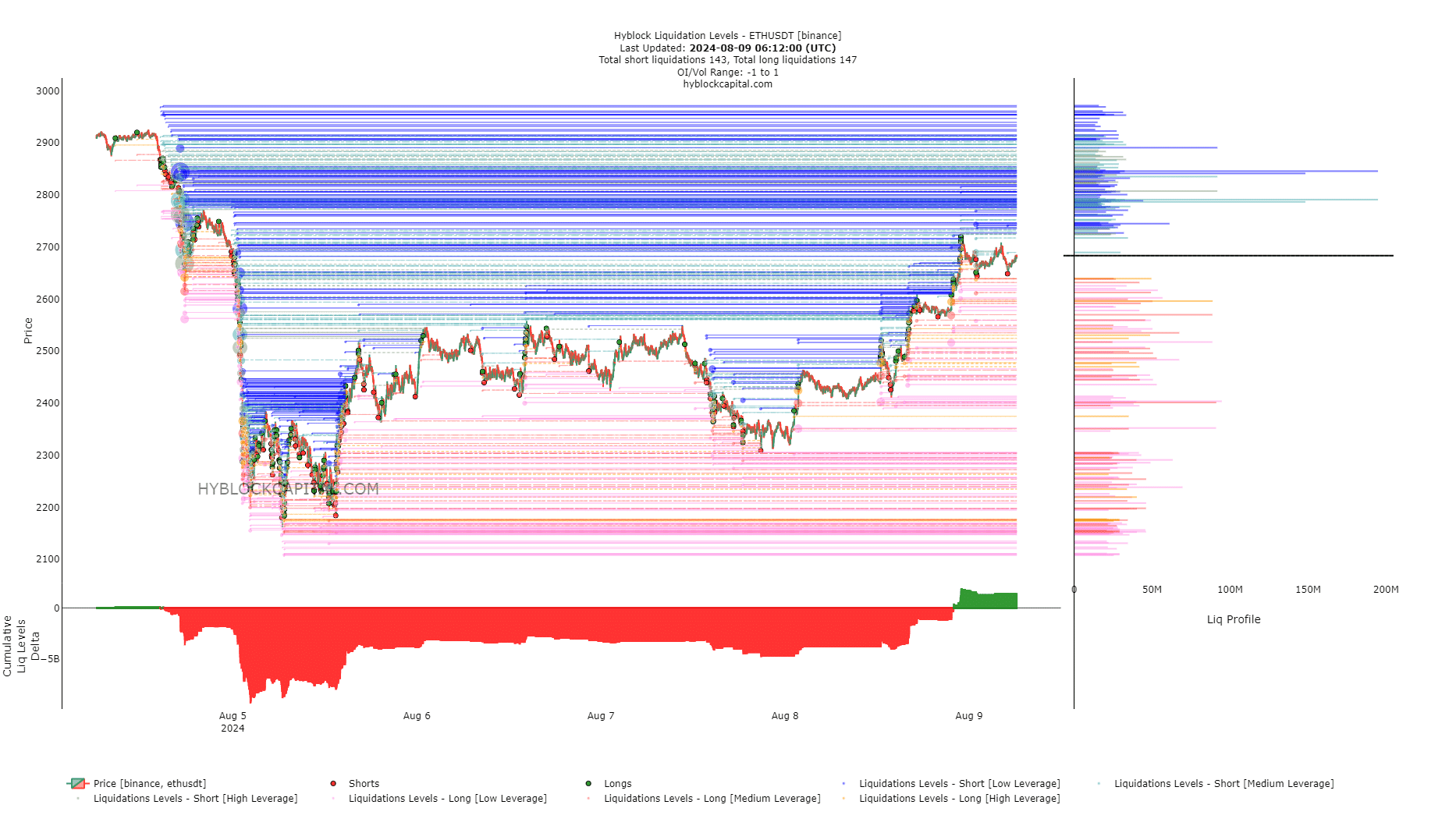

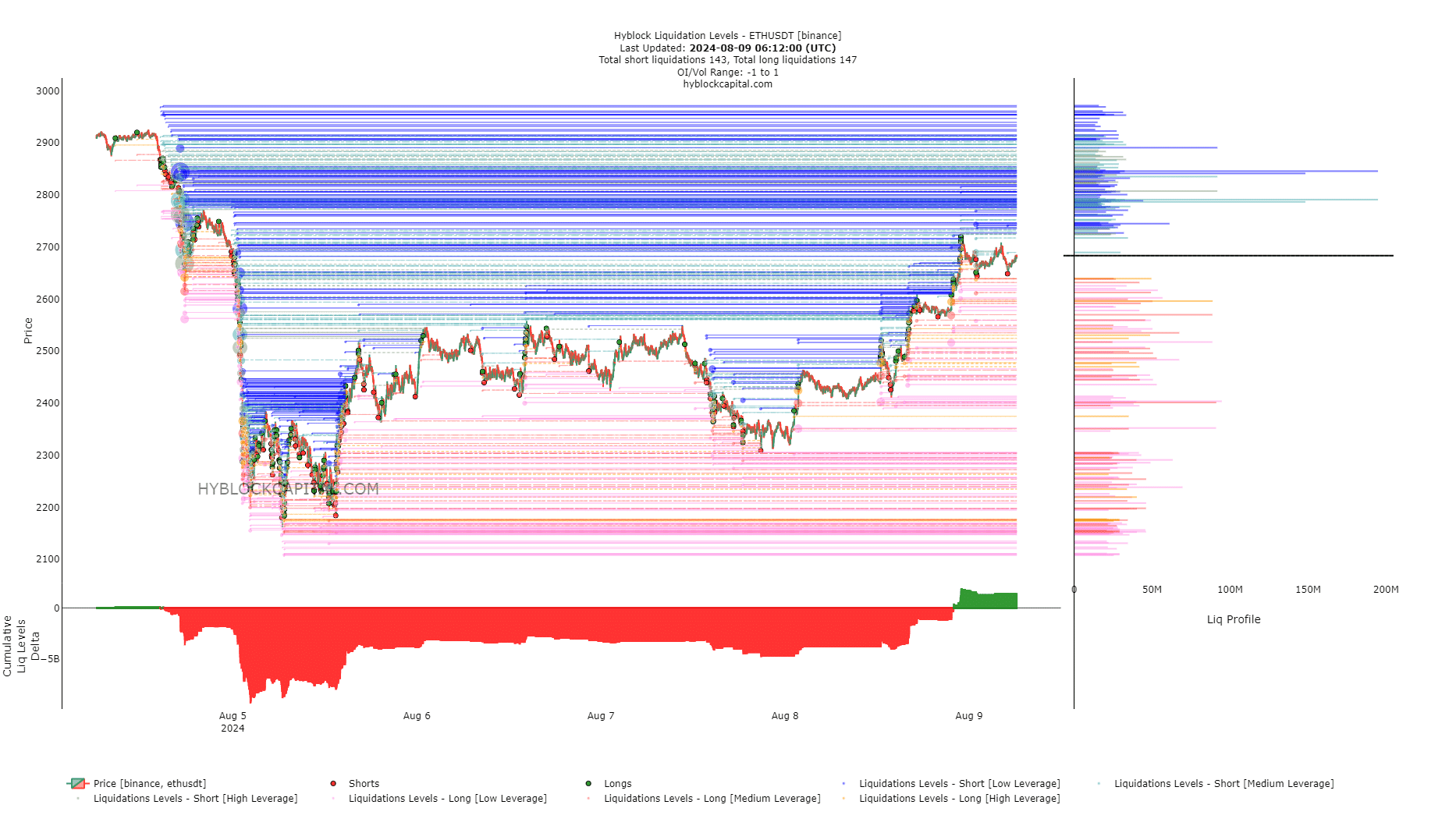

Source: Hyblock

AMBCrypto’s analysis of the liquidation levels chart revealed that long positions were starting to gain dominance. The Cumulative liq levels delta was turning increasingly positive.

Read Ethereum’s [ETH] Price Prediction 2024-25

To the north, the $2791 and $2845 are the biggest liquidation levels.

However, since the delta wasn’t overwhelmingly positive, further price gains in the near term can be anticipated. Beyond $2845-$2900, the bulls are likely to struggle, and prices could take a downward turn from there.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.