- Ethereum’s volume has surged 85% in under two weeks, reaching $7.3 billion.

- However, a consolidation phase appears more likely before ETH bulls can target $4K.

In 2024, Ethereum’s [ETH] on-chain trading volume largely followed the broader crypto market’s pattern, marked by a steady downtrend, though occasional surges in activity were seen in the second and third quarters.

However, November marked a significant turning point. A combination of factors – including large inflows into Bitcoin [BTC] and Ethereum’s ETFs and the unexpected Trump victory in the U.S. Presidential election – has sparked a shift.

In just two weeks, Ethereum’s on-chain volume surged by 85%, jumping from $3.84 billion on the 1st of November to $7.13 billion on the 15th of November, signaling a potential reversal in its previous downtrend.

Keeping volatility in-check would be the first step

A week into the election rally, ETH had already surpassed $3,300, reaching a daily high of 5%, except on election results day, when it saw a significant 12% surge.

Historically, such rapid gains in a short time have often been a warning sign of a potential correction ahead.

In the following seven trading days, ETH experienced a reversal, bringing its price back to around $3K, erasing much of the substantial gains made during the rally.

However, as the crypto industry often dictates, every downturn presents an opportunity for investors to target the local bottom and buy the dip. ETH bulls seized this opportunity, posting a near 10% jump the following day, pushing the token’s price to $3,357 (at the time of writing).

While this seems bullish, Ethereum has displayed more volatility with erratic price movements compared to other altcoins.

In contrast, top assets like Ripple [XRP] and Cardano [ADA] have shown much stronger resilience, positioning them as the standout “tokens of the month.”

Interestingly, this shift has occurred while Bitcoin has been consolidating in the $90K range for the past five days.

Typically, such consolidation at psychological levels for BTC has resulted in capital flowing into Ethereum, the largest altcoin.

However, ETH’s underperformance relative to its rivals may signal the start of an underlying shift, potentially threatening its ability to break the key $3,400 resistance level, which has historically been significant.

Surge in Ethereum volume might not be enough

On the daily price chart, Ethereum last tested the $3,400 range about four months ago, in mid-July. Since then, it has been in a slump, trading between the $2,200 and $2,600 range.

Certainly, the post-election cycle has positioned ETH for a breakout from its tug-of-war to breach $3K, bolstered by a massive surge in Ethereum volume, as noted earlier.

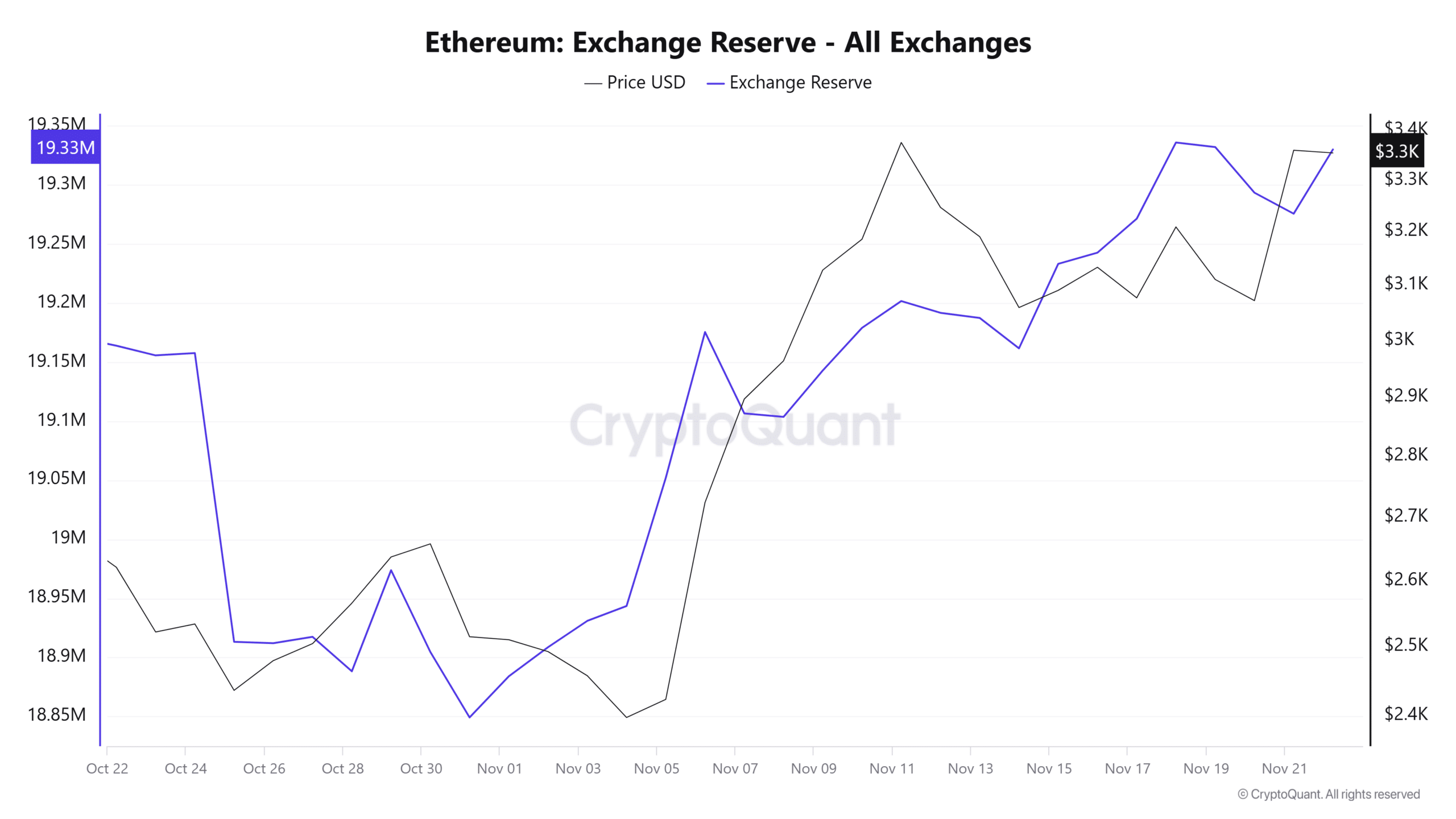

However, despite this momentum, Ethereum’s exchange reserves are steadily increasing, indicating rising selling pressure. This could lead to a period of consolidation in the coming days.

Source : CryptoQuant

The reasoning is clear: consolidation happens when buying and selling activity balance each other out, often pushing a coin into a neutral zone.

With on-chain volume reaching $7.3 billion in just under two weeks, and selling pressure starting to mount, Ethereum may be entering such a phase.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Thus, a consolidation phase before a potential breakout seems like an ideal setup for Ethereum – unless a few key conditions are met.

First, large HODLers must enter the accumulation phase to absorb the selling pressure. Second, Bitcoin needs to break the $100K resistance level to restore broader market confidence.

While the surge in trading volume signals increased network activity, if demand continues to rise, ETH could push towards the $3,400 level.

However, a consolidation phase before a breakout to $4K seems more likely, unless these conditions are fulfilled.