- Fantom social volume peaks coincide with increased whale accumulation, suggesting strong institutional interest

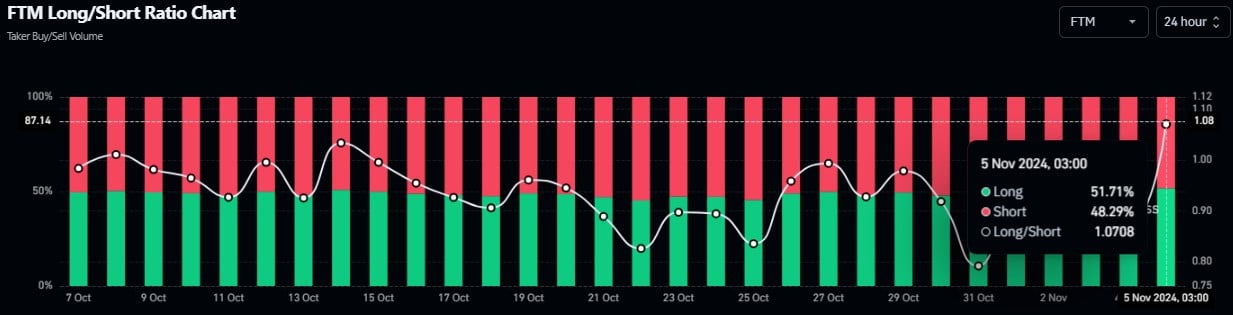

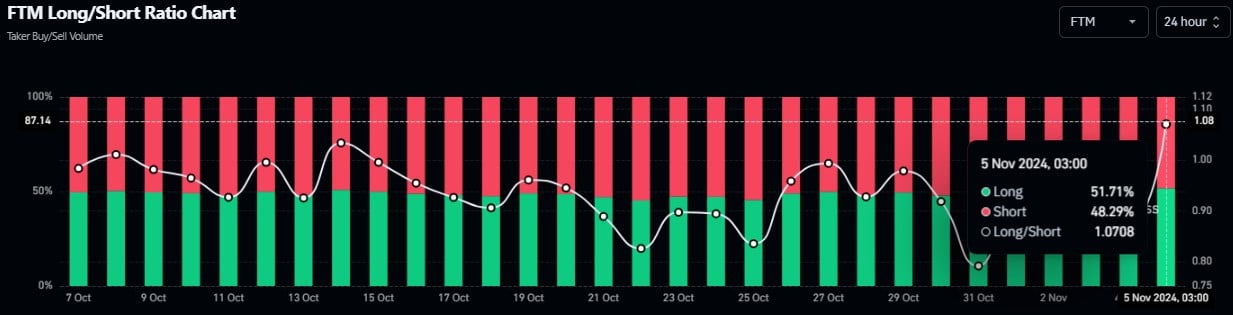

- Long/short ratio shift above 1.07 indicates growing bullish sentiment.

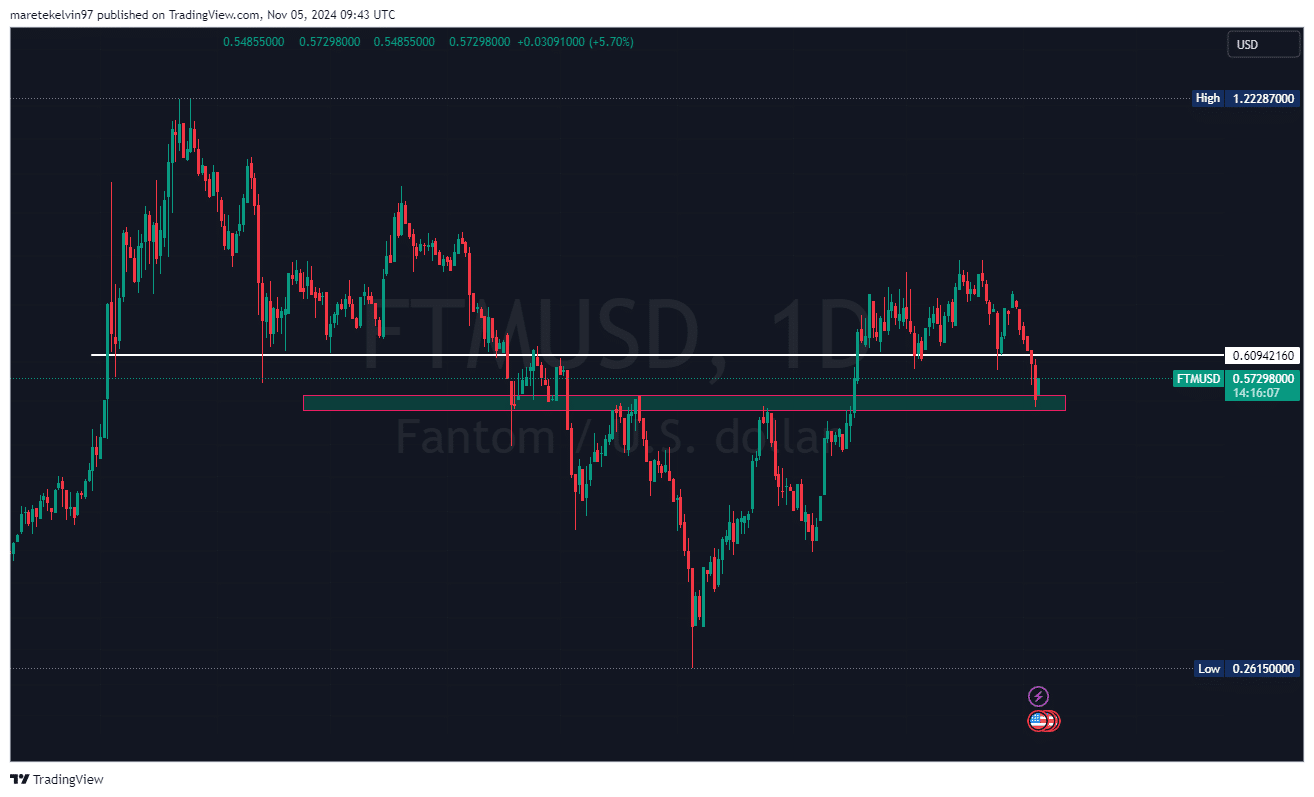

Fantom [FTM] has established a critical support level around $0.54, showing resilience after recent market volatility.

The altcoin price action demonstrates a clear consolidation pattern, with current trading activity centered around this key psychological level.

This comes after FTM experienced a significant recovery from its previous lows.

Source: TradingView

Fantom large players moves in

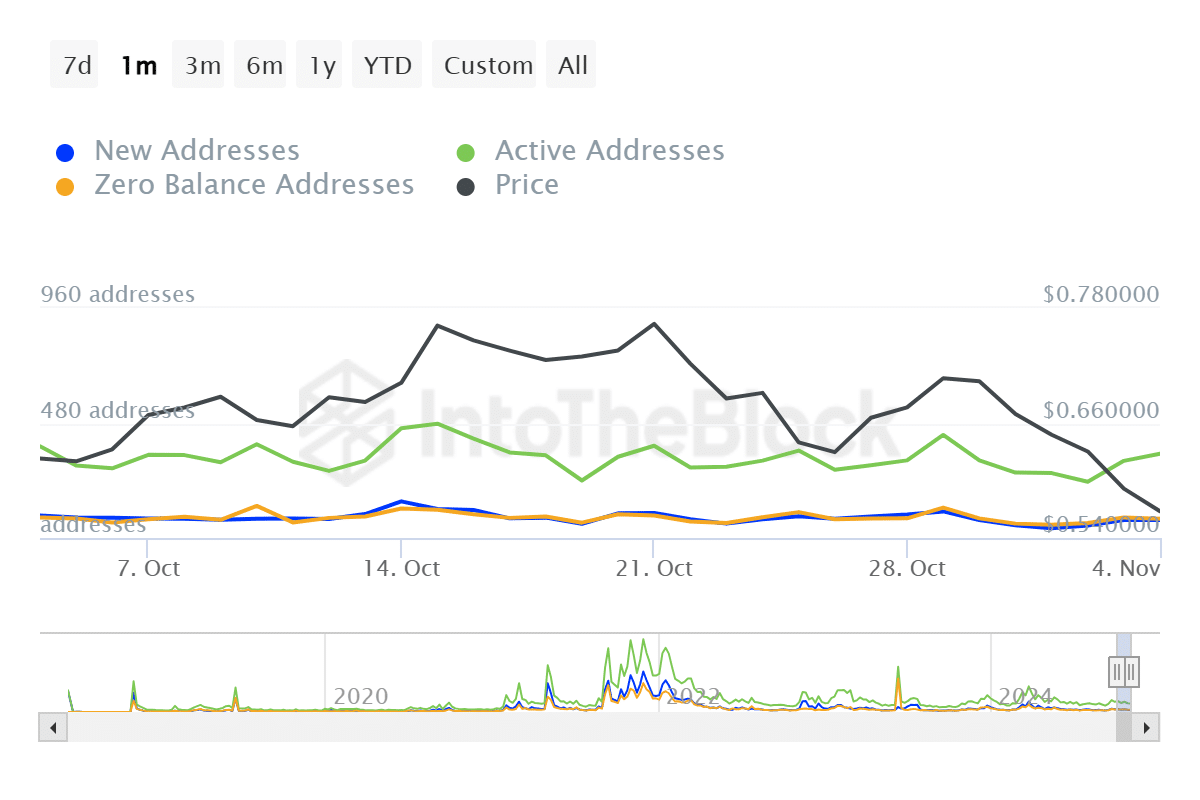

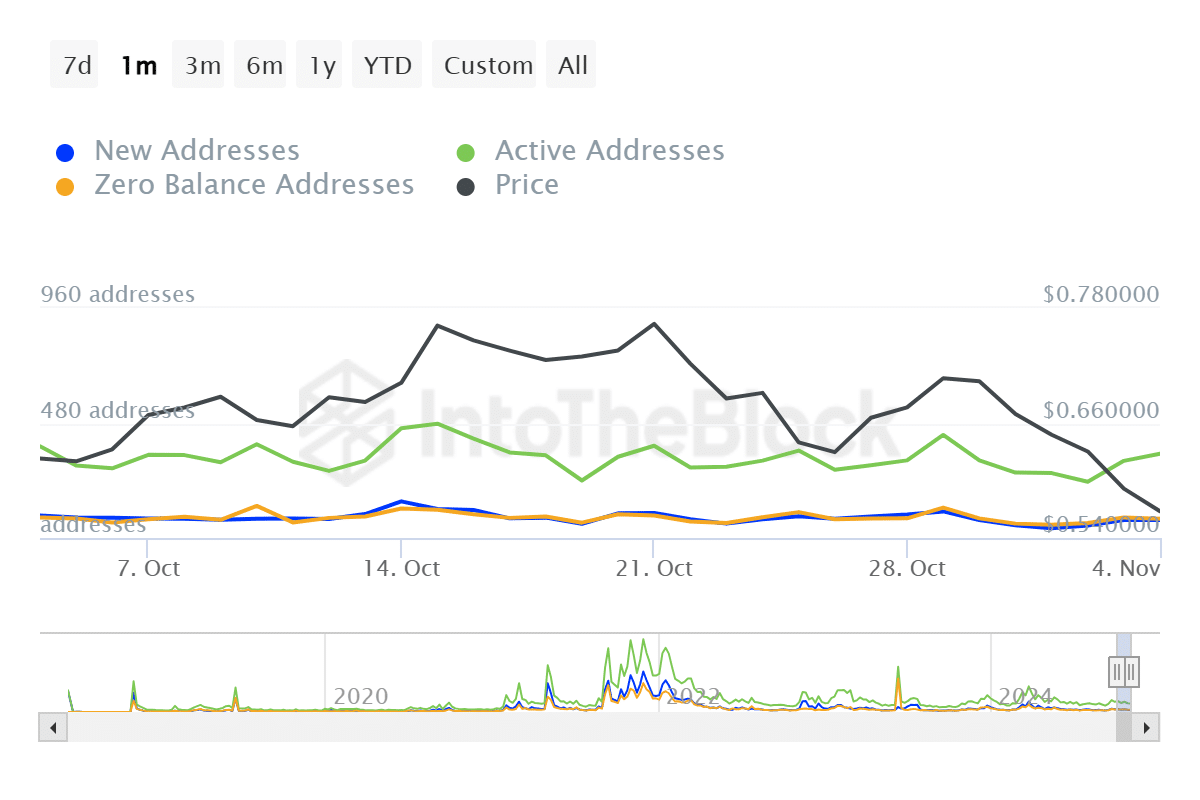

AMBCrypto analysis on the recent IntoTheBlock data indicates a notable surge in whale addresses, with active addresses maintaining steady growth.

The network has seen approximately 960 active addresses, suggesting sustained institutional interest. This activity pattern typically precedes major price movements, as large holders often accumulate during consolidation phases.

Source: IntoTheBlock

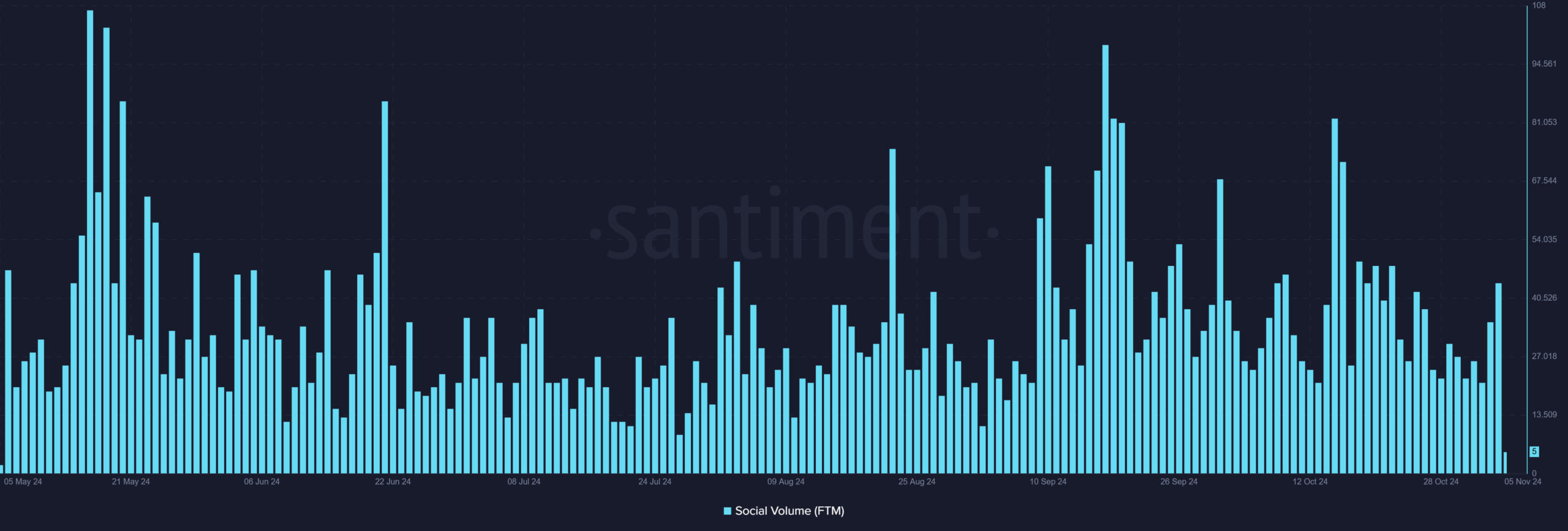

Social metrics heat up

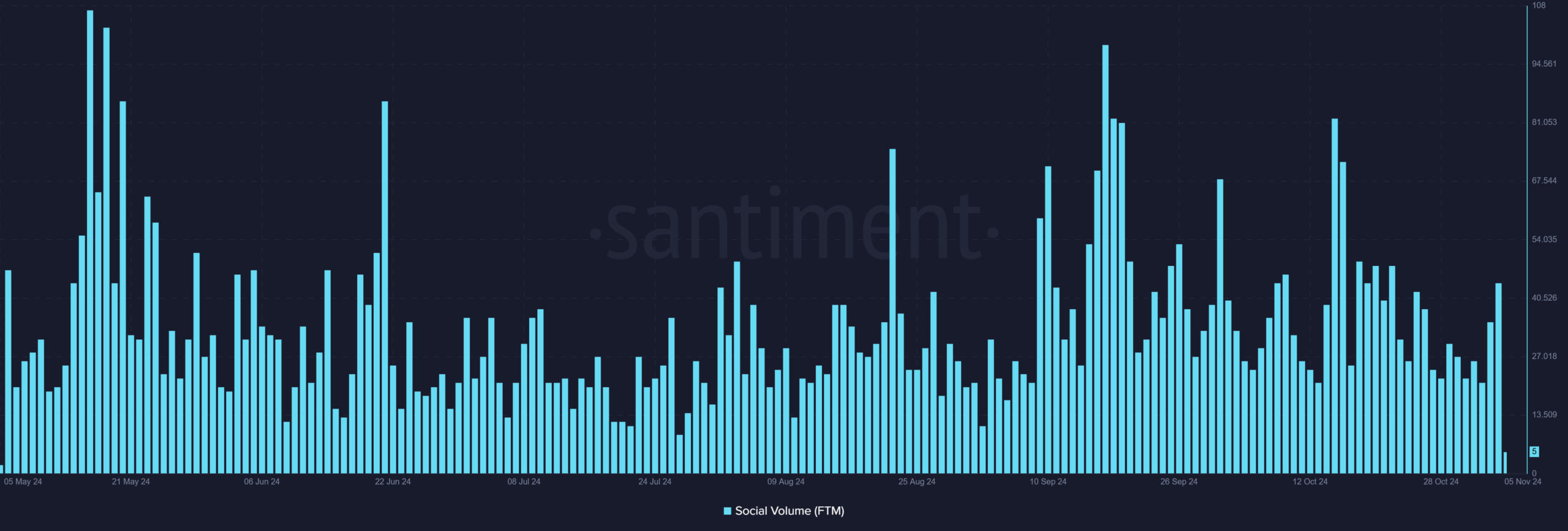

Besides, the altcoin social volume metrics indicate a remarkable uptick, reaching peaks not seen since September 2024.

This increased social engagement correlates strongly with previous Fantom price rallies. The current surge in its social volume, combined with elevated trading activity, suggests growing market attention.

Source: Santiment

Fantom bulls take the lead

Adding to the aforementioned positive sentiments, AMBCrypto further analysed Santiment’s long/short ratio data to access the market direction.

The altcoins long/short ratio has crossed above 1.07, indicating a clear bullish bias among traders. This shift in positioning is particularly significant given the recent Fantom consolidation phase.

The data shows that 51.71% of positions on Fantom are now long, while shorts have decreased to 48.29%, suggesting a potential trend reversal.

Source: Coinglass

What is ahead for FTM?

The convergence of increased whale activity, positive social sentiment, and bullish positioning creates a compelling case for upward momentum.

Read Fantom’s [FTM] Price Prediction 2024-25

Historical patterns suggest that when these metrics align, Fantom often experiences sustained price appreciation.

The current retest of the $0.57 support level could serve as a springboard for the next leg up, particularly if social engagement continues to rise.