- INJ bulls held $21.65 support as analysts predict a potential 12x move to $380.

- Futures Open Interest trended up, and trading volume jumped 9.54%, signaling strong market confidence.

Injective [INJ]was trading at $27.77 at press time, showing a 0.46% decline over the last 24 hours and a 1.66% drop over the past week.

The 24-hour trading volume is $221.5 million, with a market cap of $2.73 billion and a circulating supply of 98 million INJ.

The chart shows INJ breaking out of a prolonged downtrend after forming a rounded bottom pattern. This structure led to a strong rally, with buyers continuing to defend the $21.65 support level.

Source: X

Holding above this key support is essential to maintain the bullish continuation pattern. Analysts point to a logarithmic price target of $380, a 12x gain from current levels if the trend remains intact.

Technical indicators suggest mixed momentum

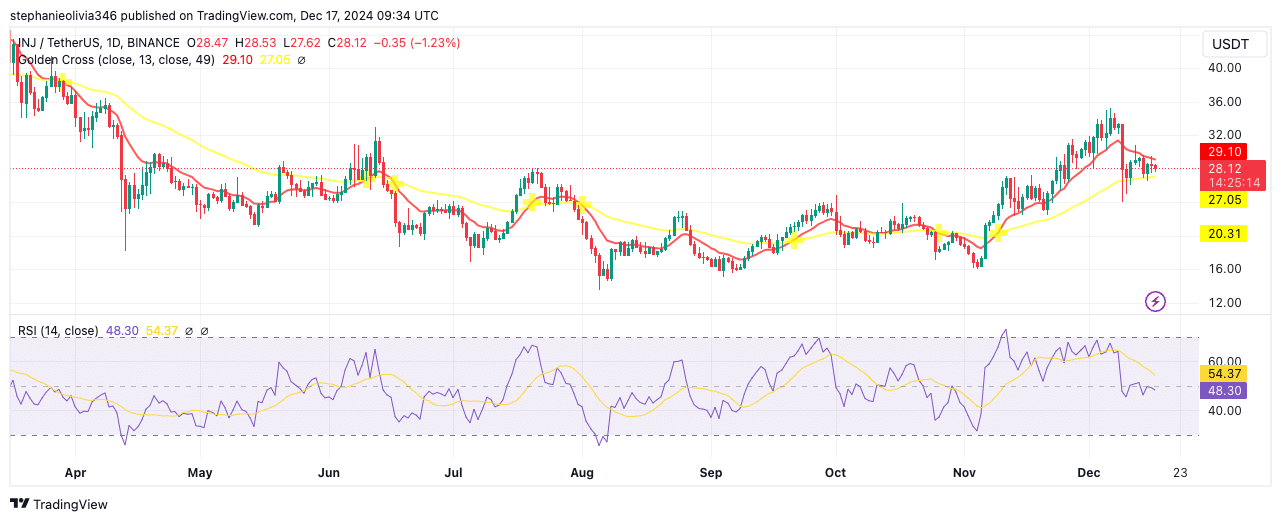

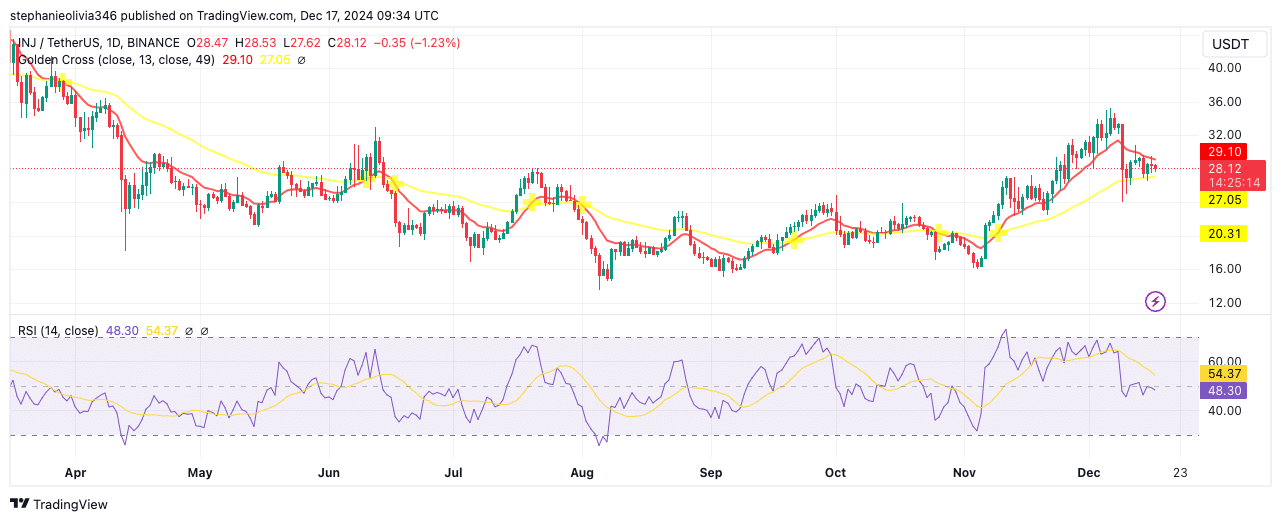

Technical signals for INJ show mixed momentum. In November, the 13-day moving average (MA) crossed above the 49-day MA, forming a Golden Cross and signaling a bullish trend.

However, the price has now dipped below the 13-day MA at $29.06 while staying above the 49-day MA. If the price fails to hold above the 49-day MA, the next key support is near $20.31.

Source: TradingView

The Relative Strength Index (RSI) was at 47.63, showing neutral to bearish momentum as it stayed below 50. The downward slope in the RSI reflects weakening buying interest.

For buyers to regain control, the price would need to break back above the $29.06 resistance, with a potential upside toward $32 in the near term.

On-chain data shows a drop in INJ’s activity

Data from IntoTheBlock shows a decline in network engagement for Injective. For the week of December 16, there were 654 addresses, including 123 new addresses and 422 active addresses.

New addresses fell by 21.66%, while active addresses dropped 11.34% over the past seven days.

Source: IntoTheBlock

The slight rise of 1.87% in zero-balance addresses suggests some users may have moved funds or closed positions. While overall user activity has declined, the network’s fundamentals remain supported by existing users.

Futures data shows steady market interest

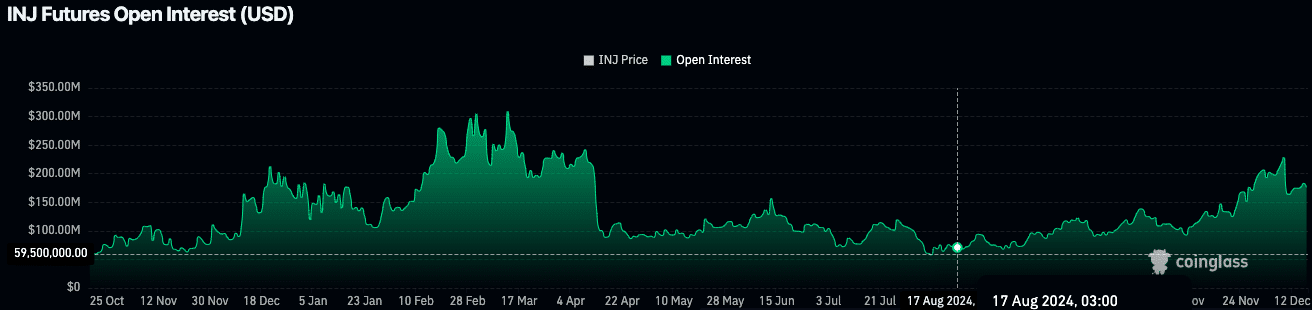

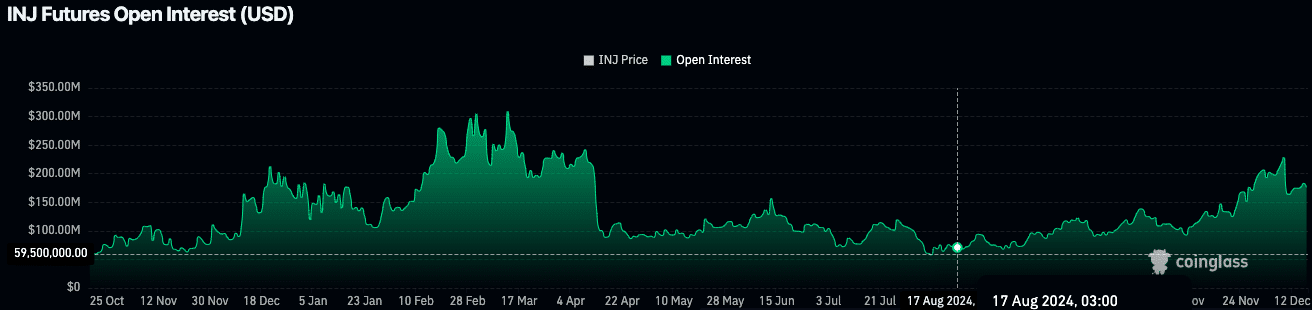

According to Coinglass, Open Interest (OI) for INJ futures is at $174.37 million, reflecting a 0.80% decline. This indicates mild profit-taking or reduced short-term activity.

However, OI has shown an upward trend since October, suggesting consistent participation from traders.

Source: Coinglass

Trading volume has increased by 9.54% to $271.95 million, showing ongoing interest in futures markets.

Rising trading volume, alongside steady open interest, points to sustained investor confidence in INJ.

Read Injective’s [INJ] Price Prediction 2024–2025

With technical patterns still in play, rising futures interest, and strong trading volume, INJ’s setup remains poised for further upward movement.