- LINK has made impressive strides in network activity, but the exit of whales has put a dampener on the surge

- Can retail capital and Trump’s advocacy give LINK the boost it needs?

Just two weeks ago, Chainlink [LINK] lit up the charts with a massive 21% single-day surge, thanks to a $1 million purchase by World Liberty Financial (WLF).

This explosive rally, supercharged by the “Trump pump,” pushed LINK into the spotlight as a key player in the intersection of politics and crypto. However, as quickly as the hype surged, it soon fizzled. And, that had a corresponding effect on the altcoin.

At the time of writing, LINK had retraced to around $22.8, with a bearish MACD crossover hinting at further downside. Hence, the question – How will the altcoin fare in the upcoming year?

LINK’s comeback is FOMO worthy

Over the last four years, Chainlink has made incredible strides. The number of addresses on its network has surged from 213k to 690k. Also, in December, its total value locked (TVL) crossed $1 billion for the first time.

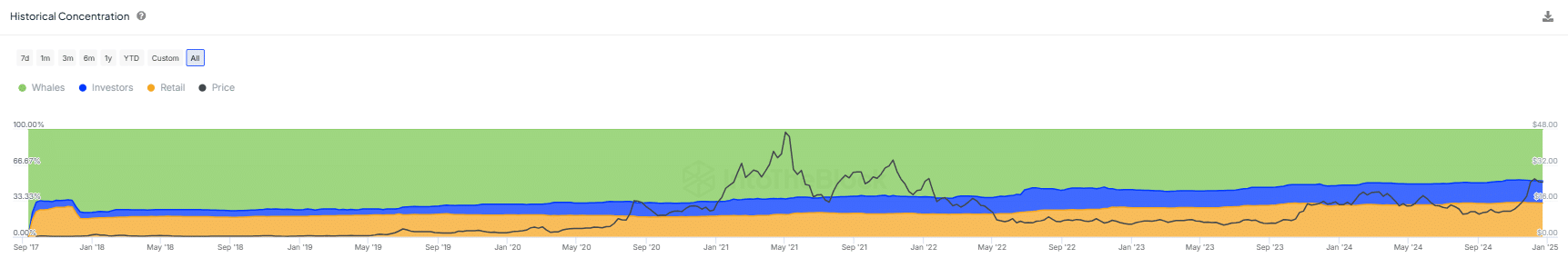

What’s even more intriguing is the shift in LINK’s token distribution. Once dominated by big holders controlling 70% of the supply, that figure has since dropped to 48%. Meanwhile, retail investors have been stepping up too, with the same now holding 32% of LINK’s supply.

Source: IntoTheBlock

But, why is this significant? A recent AMBCrypto report highlighted Ethereum’s [ETH] increasing centralization, with whales wielding outsized control and keeping the price from breaking the $4k barrier. So, LINK’s move towards a more balanced distribution could set it apart in the long term.

However, there’s a catch – Despite LINK’s strides in decentralization, its price has struggled to regain its all-time high of $53 set three years ago. Even with strong volume and network growth, LINK hasn’t been able to break into the top 10.

This means that external market factors, along with a notable number of whale wallets exiting, could be putting downward pressure on LINK’s price.

That being said, the recent “Trump pump” served as a powerful catalyst, sparking a rush of fresh FOMO among new players. The question is thus is –

Will it last?

In the last 30 days, LINK has surged thanks to impressive double-digit growth, outpacing many of its competitors. Zooming out, with a 50% hike in price year-to-date (YTD), it’s staying neck-and-neck with Ethereum.

However, where Chainlink really stands out is its broader appeal. President-elect Donald Trump’s backing has sparked fresh interest, while the reduction in whale manipulation has paved the way for a more organic market.

On top of that, LINK’s Oracle network is expanding its use case across various industries, making it a real-world utility.

Is your portfolio green? Check out the LINK Profit Calculator

With all these factors at play, Chainlink is positioning itself as a top contender in the altcoin race. It is attracting both short-term traders looking for a solid diversification play and long-term HODLers seeking steady growth.