- Mantra OM pumped 15% amid renewed interest from whales.

- There has been a strong accumulation trend in the past week amid its pullback.

Mantra [OM] appeared ready to reverse the 24% losses incurred during the mid-October pullback. It pumped up by 15% in 24 hours as a familiar whale ramped up accumulation.

According to Spot On Chain, a smart trader was stacking the altcoin after a 7-month break. The whale withdrew $3.8 million OM from Binance, with a $15 million unrealized profit. Will others follow suit and extend the uptrend?

Mantra OM defends 50% Fib level

Source: OM/USDT, TradingView

The 24% pullback in mid-October eased at the 50% Fib level ($1.2).

The level was also close to the dynamic support of the 50-day EMA (exponential moving average, blue line), making it a key short-term support.

Should OM extend its recovery to the recent high of $1.6, an extra 13% potential gains could be feasible. The stochastic RSI reading further supported the potential recovery. It edged from the oversold territory, signaling a likely price reversal.

However, a breach below the 50% Fib level will invalidate the above bullish prospects. In such a scenario, OM could retrace further to the $1 level.

Mantra OM sees renewed accumulation

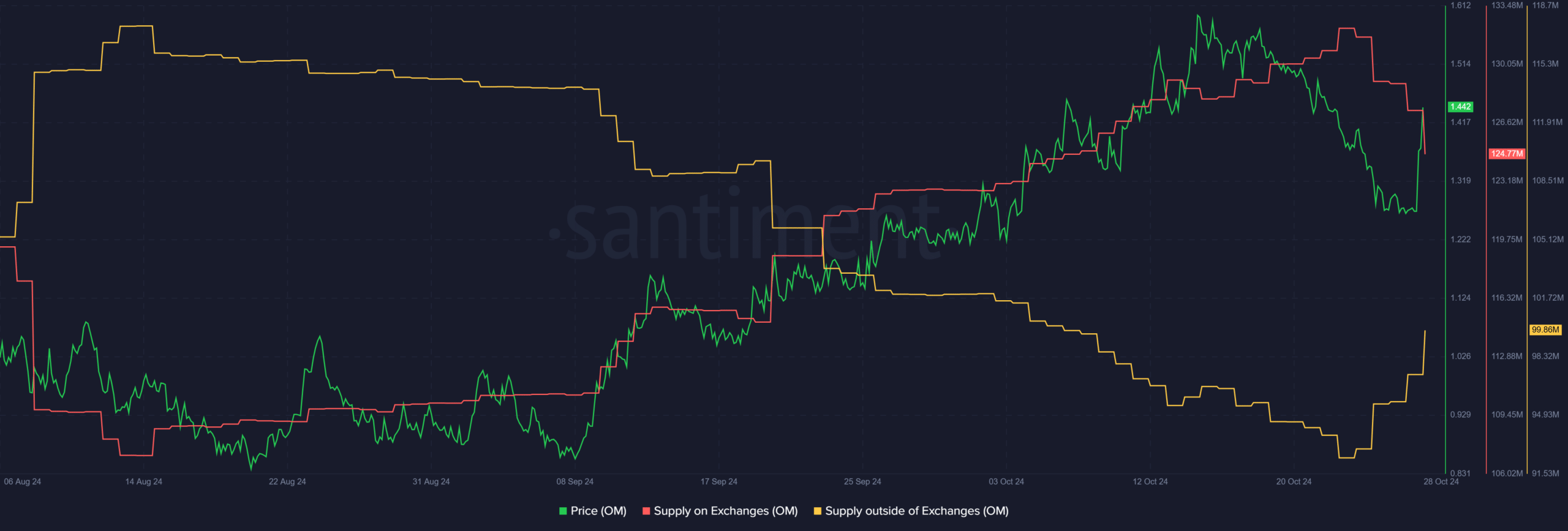

Source: Santiment

Santiment data further illustrated the Spot On Chain update on the OM accumulation spree. Over 5 million Mantra OM has been stacked and moved from exchanges in the past five days, as shown by a spike in Supply Outside of Exchanges.

This meant that speculators bought the mid-October pullback and continued to stack more OMs at the time of writing.

Additionally, supply on exchanges (red) declined sharply over the same period. This hinted at reduced sell pressure and a possibility of allowing OMs’ prices to recover.

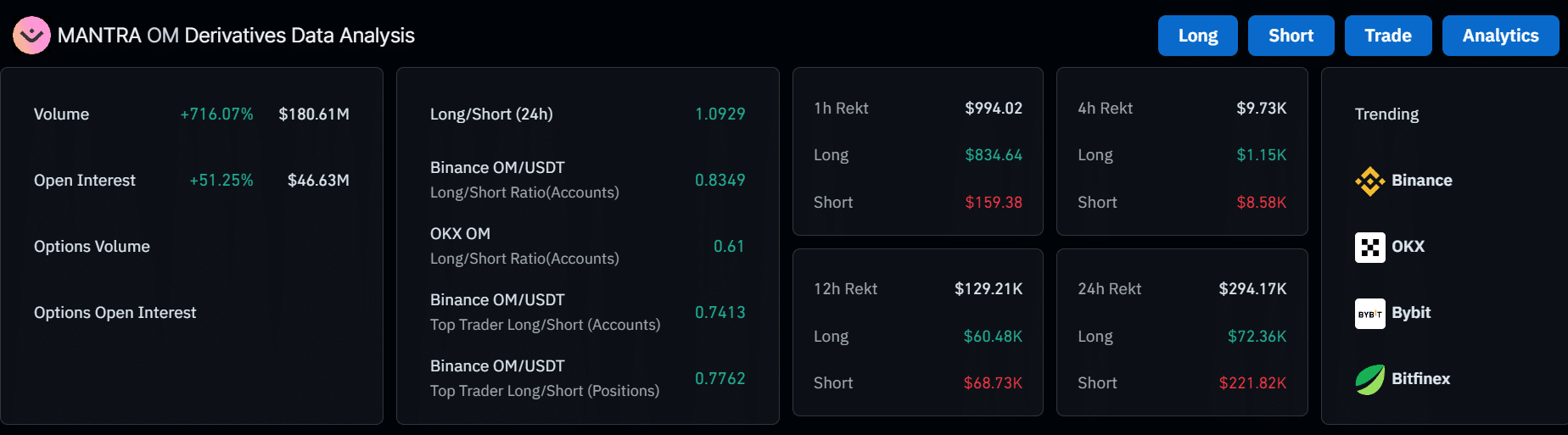

The same sentiment was evident in the Futures market. OM’s volume was up over 700%, while Open Interest (OI) surged 51%, indicating increased speculative interest in the derivatives market. This could boost the altcoin’s recovery prospects.

Read Mantra [OM] Price Prediction 2024-2025

Source: Coinglass

In short, OM could attempt to accelerate its recovery, given the strong accumulation trend and reduced sell pressure. However, the altcoin movement might also depend on the direction of Bitcoin [BTC] ahead of the US elections.