- Memecoins plunged over 50%, undermined by fading hype and low retail interest.

- Negative MVRV ratios showed underwater positions, pressuring DOGE holders to capitulate.

The cryptocurrency market has entered a sharp correction, with memecoins experiencing some of the steepest losses.

According to Delphi Digital’s latest market breakdown, the memecoin sector has suffered an average decline of 51.74% between 31st of December and 24th of February.

This is significantly worse than Bitcoin’s [BTC] performance, which has remained relatively stable compared to riskier assets.

Source: X

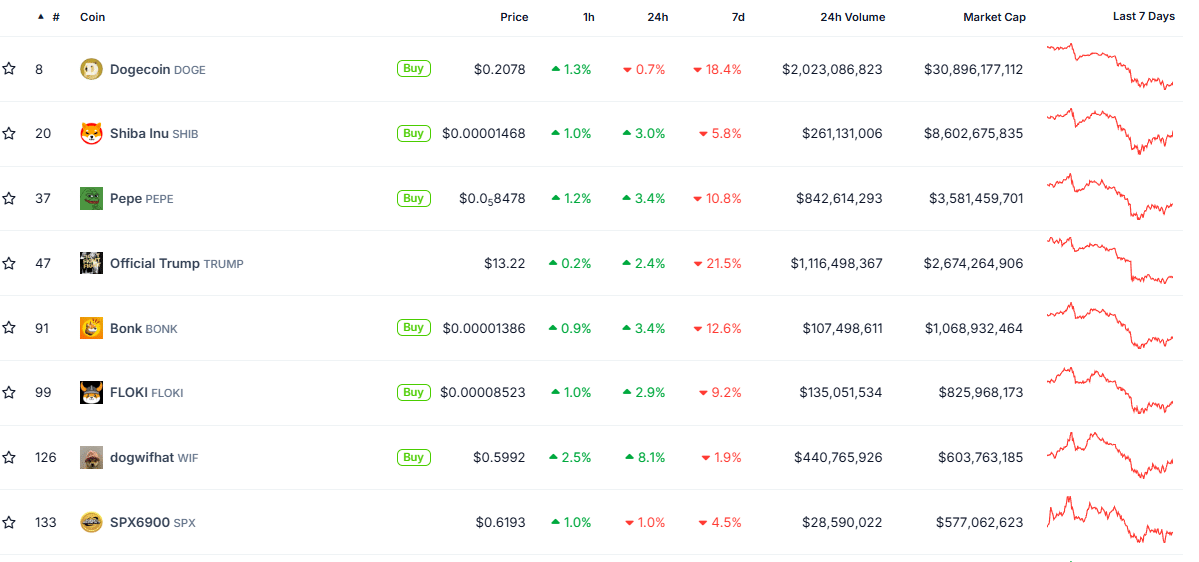

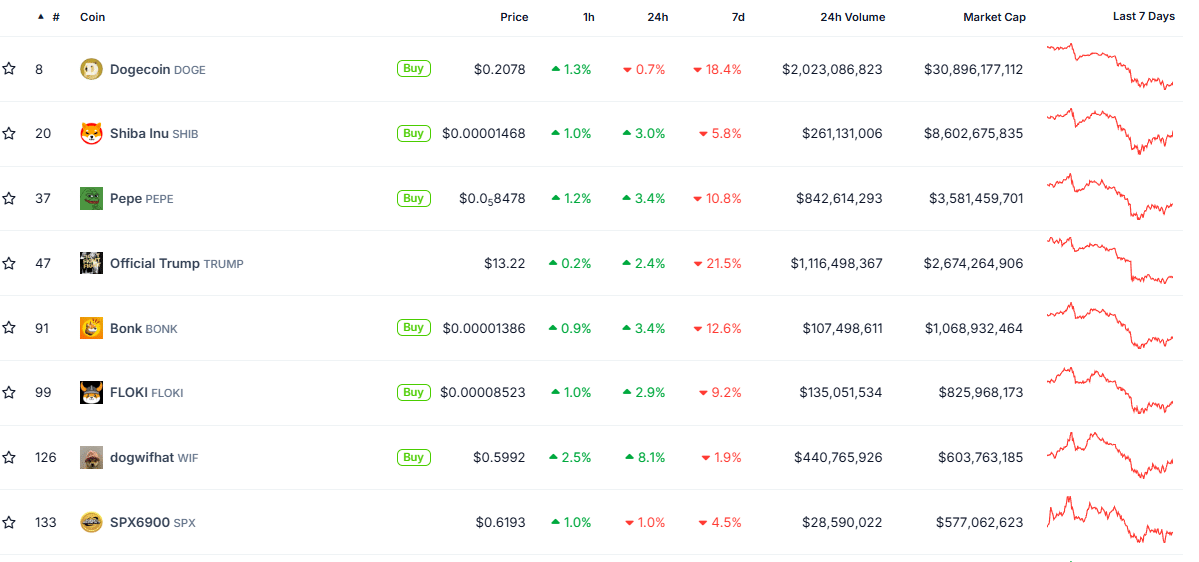

As speculative interest fades, assets like Dogecoin [DOGE], Shiba Inu [SHIB], and PEPE have posted staggering losses, raising concerns about the sustainability of the memecoin market.

Memecoins plunge over 50% in two months

The worst-hit memecoins include PEPE, DOGE, Melania Meme [MELANIA], and SHIB. Over three weeks, memecoin capitalization dropped from $116 billion to $67.7 billion.

PEPE lost about 80% from its peak. Whale activity triggered a huge sell-off, with 1.1 trillion PEPE tokens liquidated.

This sell-off has wiped billions from the memecoin market, which previously thrived on social media hype and speculative trading.

Data from CoinGecko showed that the overall memecoin market cap stood at $64.1 billion at press time, with a 1.1% drop in the last 24 hours, signaling continued bearish pressure.

Source: CoinGecko

A separate report from Glassnode indicated that the broader cryptocurrency market had entered a contraction phase after Bitcoin failed to break past $105,000 in January 2025.

Memecoins, which surged in late 2024 with massive 90%+ monthly gains, have since crashed, now posting an average loss of 37.4% in February 2025 alone.

Market sentiment has worsened, as shown by futures market data. Memecoin perpetual futures open interest has fallen significantly by 52.1%.

Additionally, Funding Rates for memecoins have shifted into negative territory. This signals a strong bearish sentiment among investors.

An on-chain breakdown

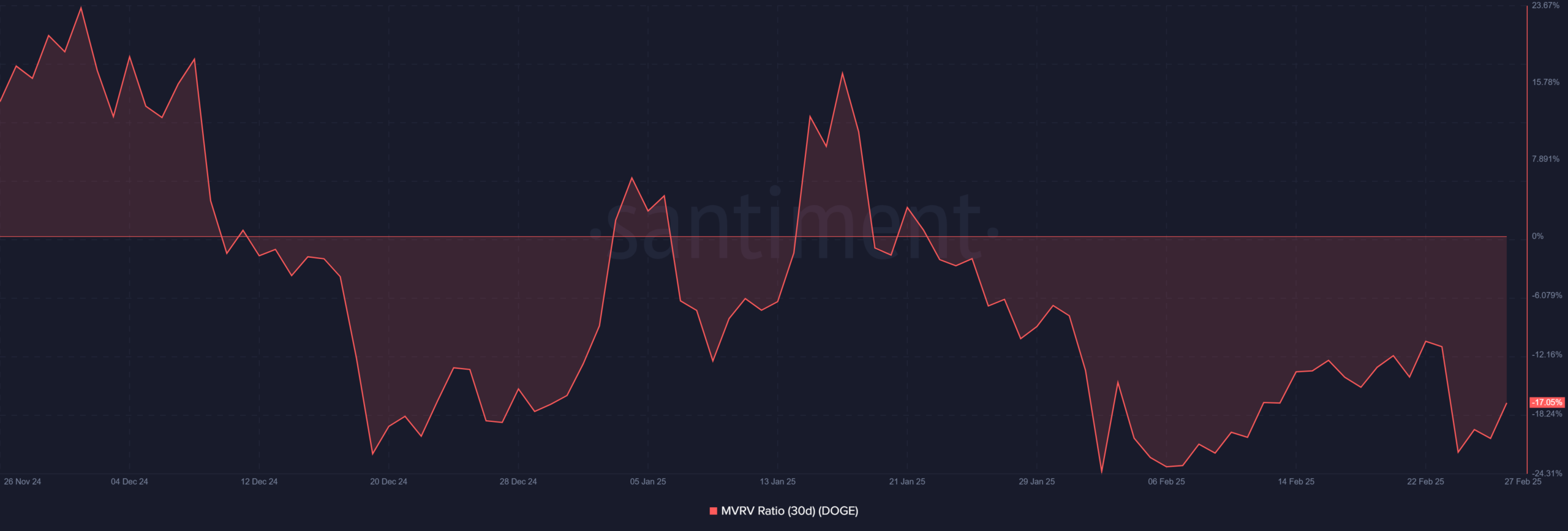

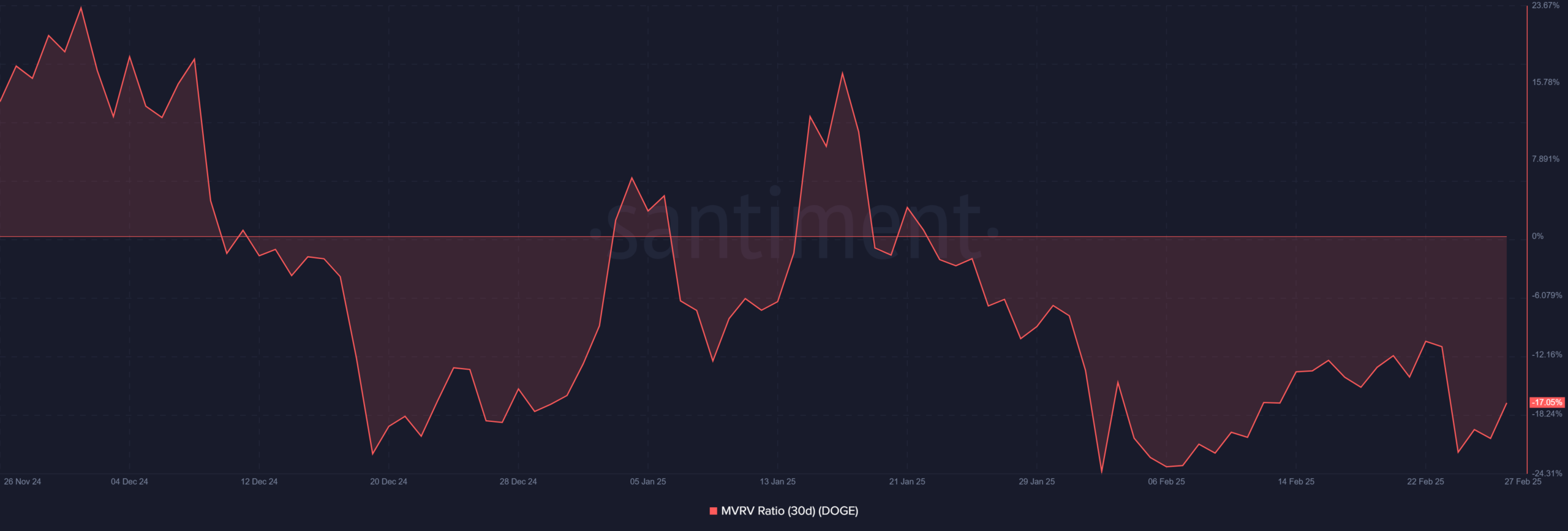

Among the hardest-hit memecoins, DOGE has seen a sharp decline, with its price down 13% in just a week. A deeper look into Santiment’s on-chain analytics reveals troubling signs for DOGE holders.

The 30-day Market Value to Realized Value (MVRV) Ratio, which measures the average profit/loss of recent buyers, has been negative throughout February.

The ratio turned negative in mid-December 2024 and remained consistently below zero through the 27th of February, signaling persistent losses.

Source: Santiment

During December 2024, the MVRV ratio peaked at +23.44%, but by the 2nd of February, it had plummeted to -24.07%, marking a 47.51 percentage point drop in just 60 days.

Historically, sustained negative MVRV ratios indicate bearish sentiment and weak buying pressure. This may be an indication that DOGE may struggle to recover in the short term.

This aligns with Dogecoin’s network activity and whale transactions have slowed to multi-month lows, raising concerns about its resilience. If DOGE fails to reclaim key support levels, deeper losses could follow.

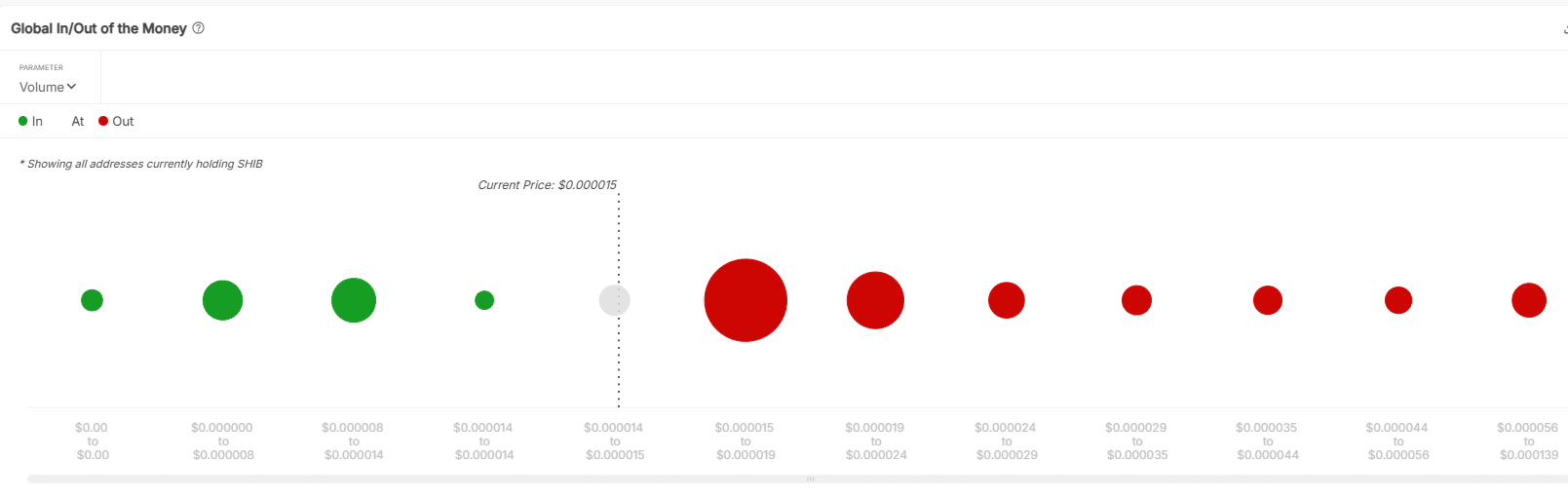

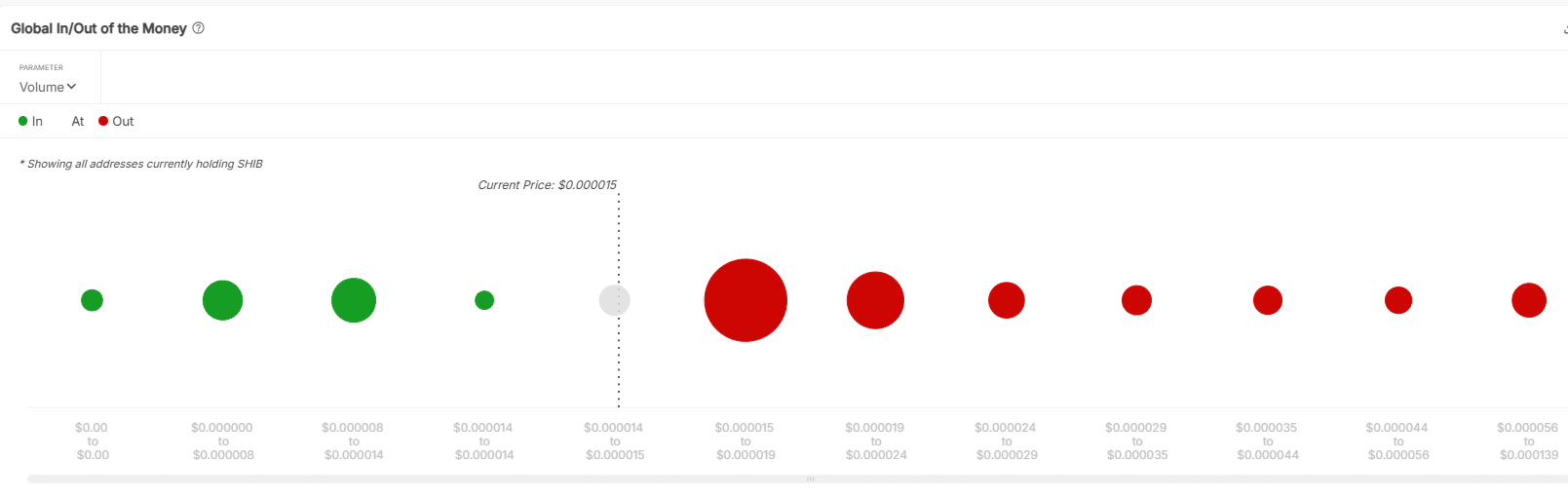

IntoTheBlock’s Global In/Out of the Money (IOM) analysis of Shiba Inu (SHIB) paints a similarly bearish picture.

Source: IntoTheBlock

The largest red bubbles are between $0.000015 and $0.000056, suggesting that many bought SHIB at higher prices. With SHIB at $0.000015 during press time, even a slight price drop could push more holders into losses.

Bitcoin’s stability amid market chaos

Despite the crypto market’s overall decline, Bitcoin has remained relatively stable compared to high-risk altcoins. Reportedly, Bitcoin’s leverage has been reaching critical levels, raising concerns about potential volatility.

At the press time, BTC was trading under $86,950, with technical indicators flashing bearish signals.

While Bitcoin still faces risks, institutional demand via ETFs has helped support its price, unlike speculative altcoins that lack strong backing.

More pain ahead?

The data suggests that memecoins are in a period of severe drawdown, with little sign of immediate recovery. Social media hype has cooled significantly, impacting retail participation and declining speculative interest overall.

Bearish Futures market sentiment and negative funding rates signal potential further downside.

Investors may rotate capital into BTC as a safer alternative, thus increasing Bitcoin dominance.

While memecoins have historically bounced back during bull cycles, the current correction raises questions about their long-term sustainability.

The sector could continue to struggle in the months ahead unless new narratives emerge to drive fresh speculative interest.