- NEAR Protocol rallied 6.69% this week, targeting $7.50–$9.00 after breaking out of a long-term downtrend.

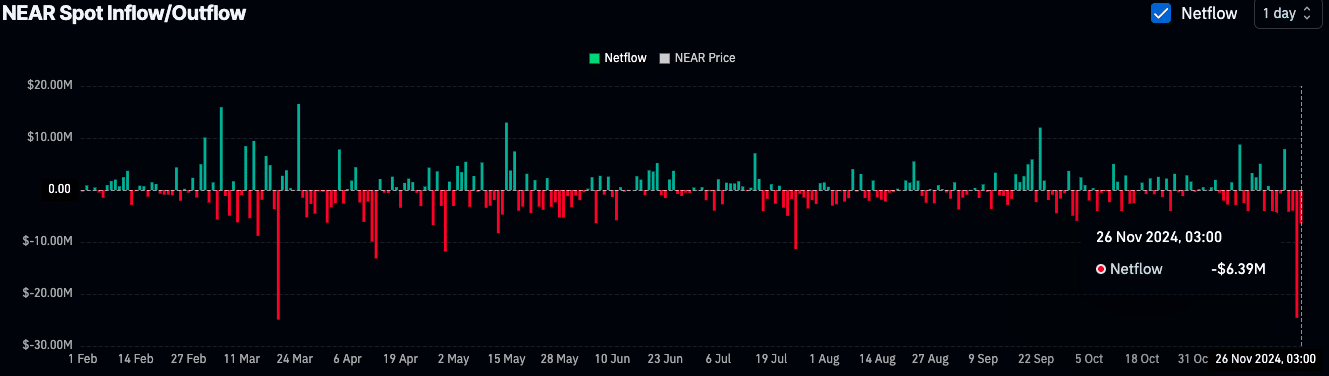

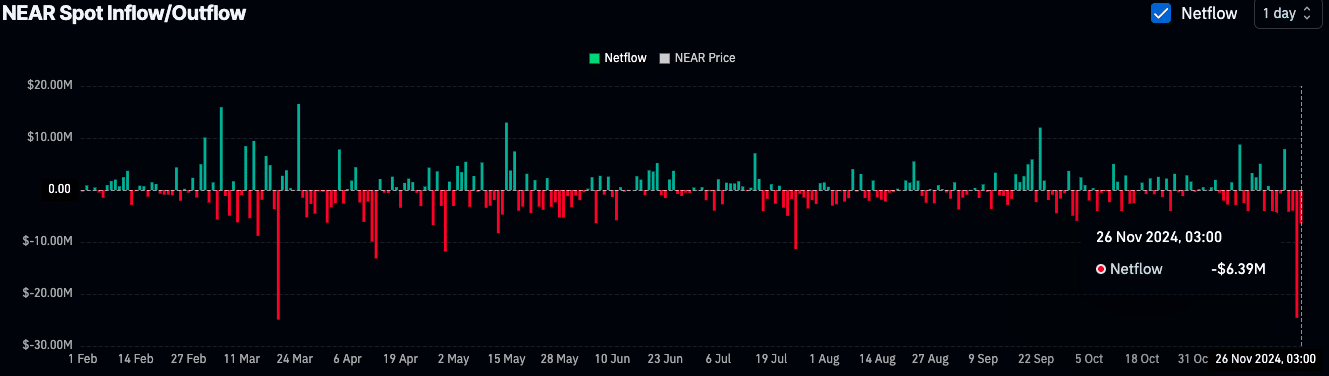

- On-chain data showed $6.39M outflows, signaling accumulation as Futures Open Interest stays elevated.

NEAR Protocol [NEAR] has continued to display bullish momentum, building on its breakout from a prolonged descending channel.

NEAR was trading at $6.28 at the time of writing, with a 24-hour trading volume of $1.18 billion and a market capitalization of $7.67 billion.

While the price has declined by 9.03% in the last 24 hours, it was still up by 6.69% over the past seven days.

After reaching a high near the $7.00 resistance level, NEAR experienced a minor pullback, which aligns with typical consolidation after a strong rally.

The price remains in an uptrend, supported by higher highs and higher lows, suggesting potential for further growth as it approaches the next key resistance zone.

As NEAR Protocol maintains its upward momentum, traders are closely monitoring the resistance zone at $7.50–$8.00.

A successful breakout above this range could pave the way for further gains, with $9.00 emerging as the next major target.

However, holding support at $6.00–$6.50 will be critical for sustaining bullish sentiment in the short term.

Breakout sparks uptrend

NEAR broke out of a descending channel in late October, ending a trend of lower highs and lower lows that lasted from May 2023.

The breakout occurred near the $5.00 level, a critical point that has since become a support area.

Source: X

Following the breakout, NEAR gained momentum, rallying from $4.00 in early October to a recent peak near $7.00, surpassing resistance levels at $5.50 and $6.00.

The zone between $6.00 and $6.50 now serves as immediate support.

Key resistance levels remain at $7.50–$8.00, with further upward potential targeting $9.00 if bullish momentum persists.

Cooling before the next move?

Technical indicators reflect NEAR’s current phase of consolidation. The Relative Strength Index (RSI) sits at 61.54, suggesting previously overbought conditions have eased, which could allow room for a renewed rally.

Meanwhile, the MACD remains in bullish territory, supported by a positive crossover that indicates upward momentum is still intact.

Source: TradingView

Trading volume has seen a slight decline during the pullback, showing reduced activity after recent strong price action.

However, traders will be watching for a recovery in volume to confirm the continuation of the uptrend as the price approaches its next resistance levels.

On-chain data point to accumulation

On-chain data revealed a mixed picture for NEAR. Futures Open Interest has dropped by 12.97% to $393.88 million, reflecting reduced leveraged positions as traders lock in profits or close positions.

Despite this decline, the elevated Open Interest signaled that market participation remains high, keeping NEAR in focus for further moves.

Read NEAR Protocol’s [NEAR] Price Prediction 2024–2025

Additionally, spot netflows indicate a $6.39 million outflow, suggesting that tokens are being withdrawn from exchanges.

Source: Coinglass

This behavior often points to accumulation by holders and reduced selling pressure, which aligns with NEAR’s bullish trajectory.