- Exchanges have recorded an outflow of PEPE worth $161.36 million.

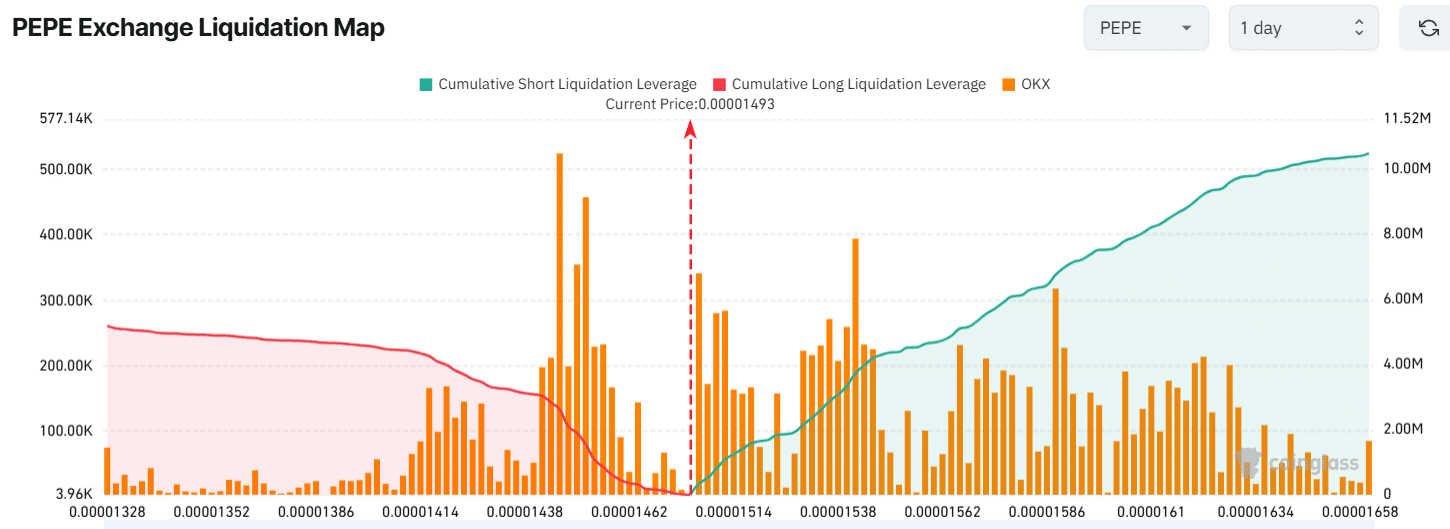

- Traders are over-leveraged at $0.00001446 on the lower side and $0.00001542 on the upper side.

Since December 2024, Pepe [PEPE], the popular crypto memecoin, has experienced a price decline of over 45%, and appeared to be struggling at press time.

The current market outlook is insufficient to reverse PEPE’s market trend, as major cryptocurrencies, including Bitcoin [BTC] and Ethereum [ETH], are facing similar challenges.

Based on the daily chart and on-chain metrics, PEPE’s downtrend appeared to be nearing a reversal.

PEPE price prediction

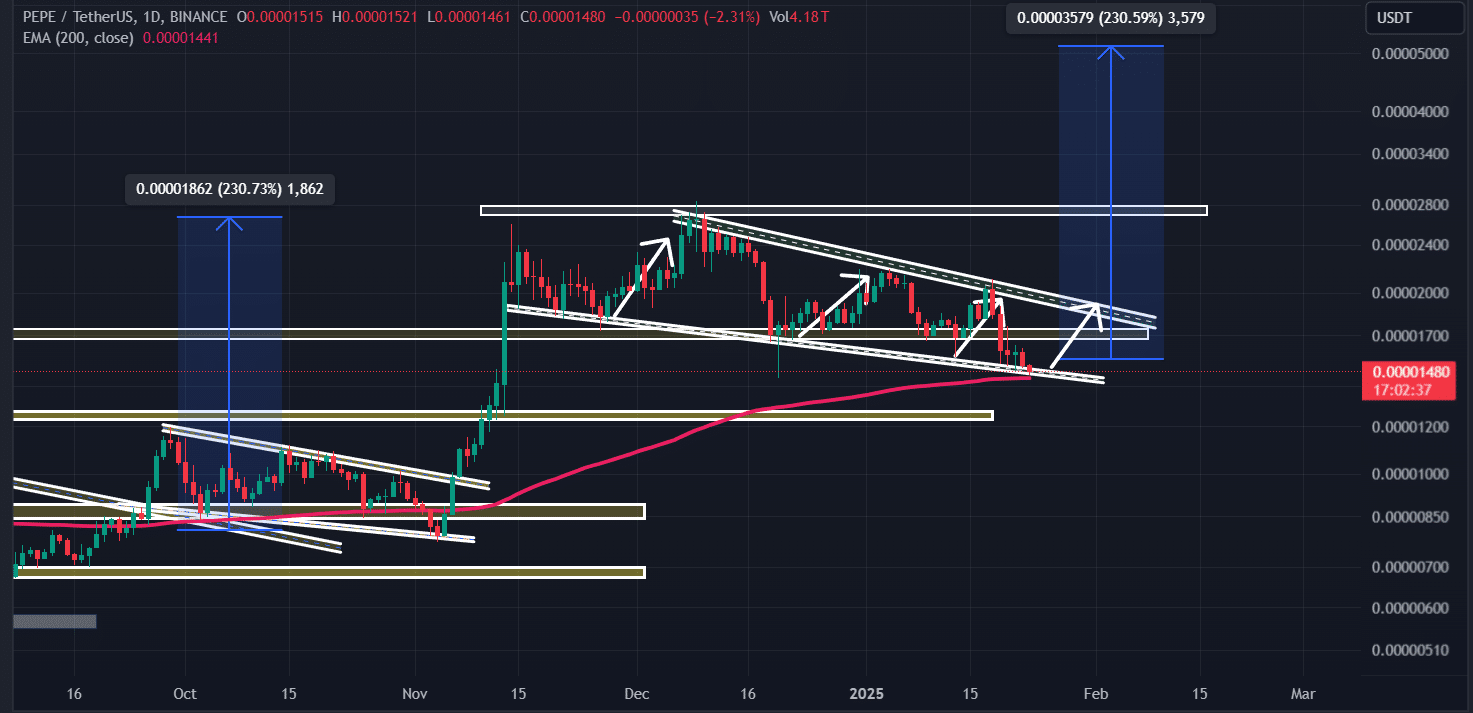

According to AMBCrypto’s technical analysis, PEPE has been in a continuous price decline over the past few weeks, and has formed a bullish falling wedge pattern on its daily time frame.

The falling wedge pattern is similar to the descending channel pattern, but its width narrows after a certain period.

Source: TradingView

The memecoin was at the lower boundary of this pattern, where it has historically shown an impressive reversal.

Since December 2024, PEPE has reached this boundary more than four times, and each time it has shown an upward momentum.

If PEPE holds this lower boundary of the falling wedge, there is a strong possibility that it could soar by 30% to reach the $0.000019 level in the coming days.

THIS is strengthening PEPE

However, the current level is supported not only by the lower boundary of the pattern but also by the 200 Exponential Moving Average (EMA) on the daily time frame, which strengthens its ability to hold this level.

The retest of the 200 EMA is bullish for the asset, indicating that it is in an uptrend. Meanwhile, the Relative Strength Index (RSI) is close to the oversold area, suggesting that PEPE could soon experience upward momentum.

Mixed sentiment from on-chain metrics

Analyzing the price action, long-term holders have shown strong interest and confidence in the memecoin, according to the on-chain analytics firm Coinglass.

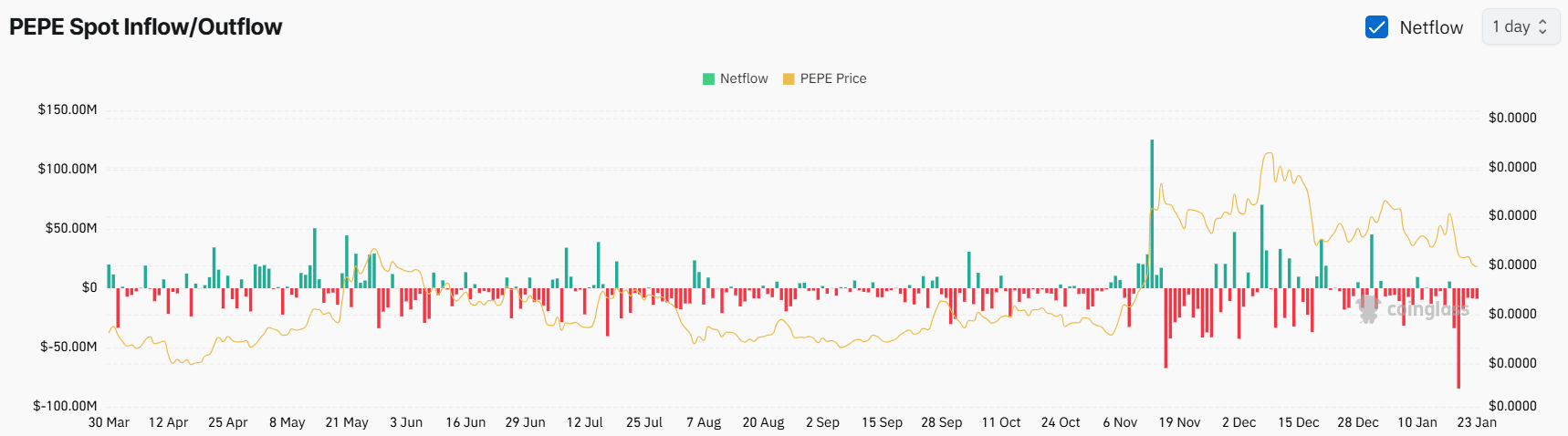

Data from spot inflow/outflow revealed that exchanges have recorded an outflow of PEPE worth $161.36 million over the past six days.

Source: Coinglass

This continuous outflow from exchanges indicated that investors and long-term holders were withdrawing assets, which could lead to a price increase and further amplify buying pressure.

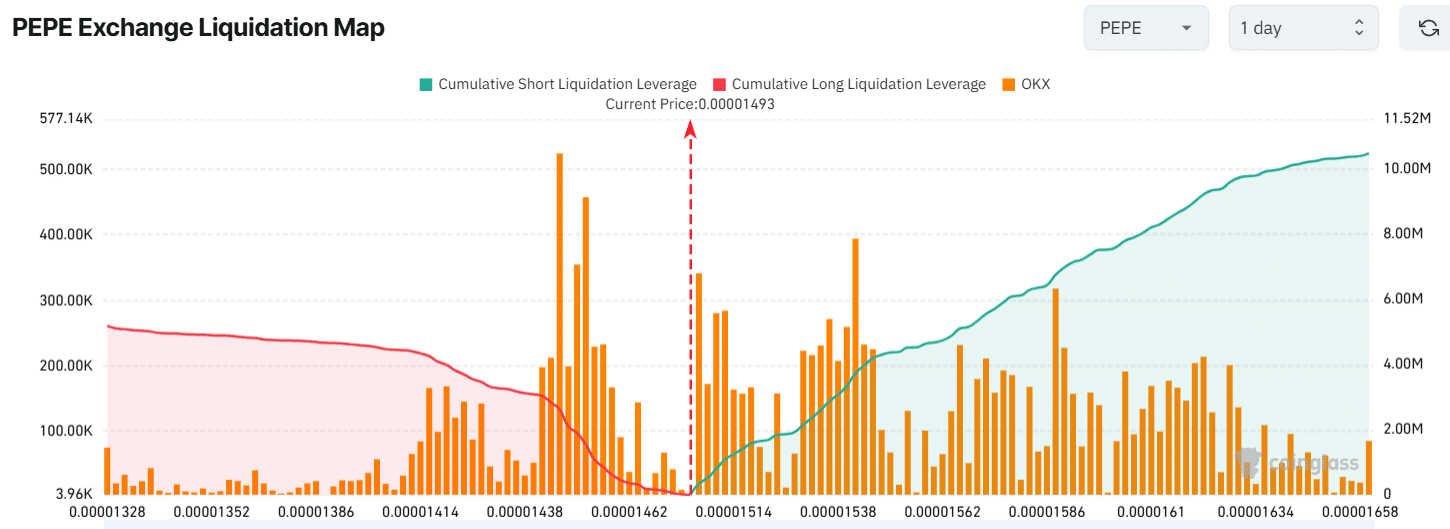

In addition to these activities, traders were over-leveraged at $0.00001446 on the lower side, where they have built $2.62 million worth of long positions.

Conversely, at $0.00001542 on the upper side, sellers have built $3.73 million worth of short positions. However, these significant positions could be liquidated if PEPE’s price moves in either direction.

Source: Coinglass

However, short sellers’ bets are significantly higher than the long positions held by traders, indicating that intraday traders’ sentiment is bearish due to the current market conditions.

Read Pepe’s [PEPE] Price Prediction 2025–2026

At press time, PEPE was trading near $0.00001494, having experienced a price decline of over 4.50% in the past 24 hours.

This price decline has impacted trader and investor participation, leading to a 35% drop in trading volume.