[ad_1]

- The cup-and-handle formation signals a potential breakout, targeting $0.00003 in the near term.

- Positive metrics like rising address activity and Open Interest strengthen Pepe’s bullish outlook.

Pepe [PEPE], a trending cryptocurrency, has caught the market’s attention with its promising price action and increasing investor activity.

At press time, PEPE traded at $0.00001987, reflecting a 5.84% gain in the last 24 hours.

Moreover, its trading volume has skyrocketed by 120.60%, reaching $2.75 billion, signaling growing market confidence.

With such strong momentum, the question arises: can Pepe maintain this trajectory and ignite a significant bullish rally in the coming days?

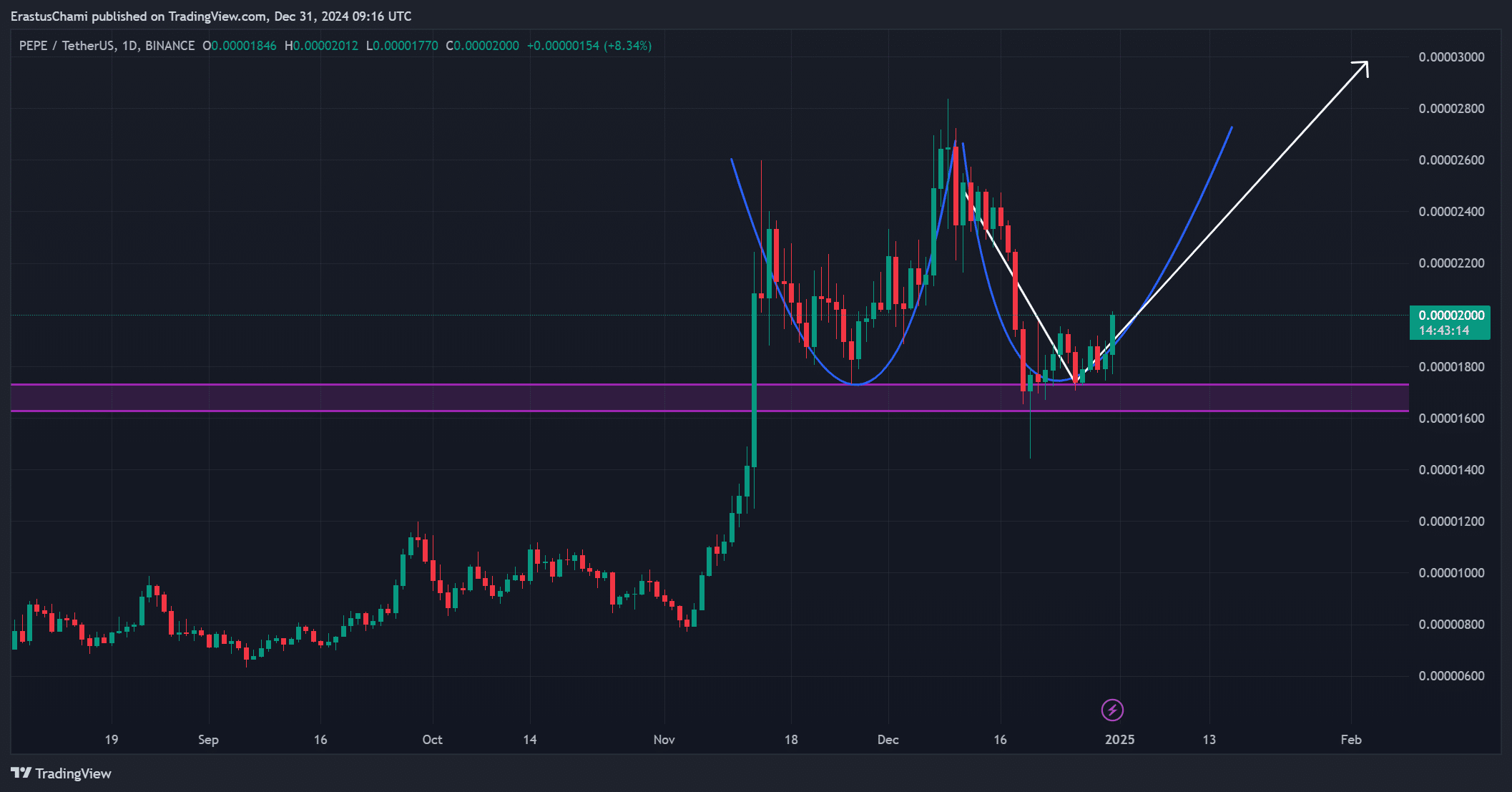

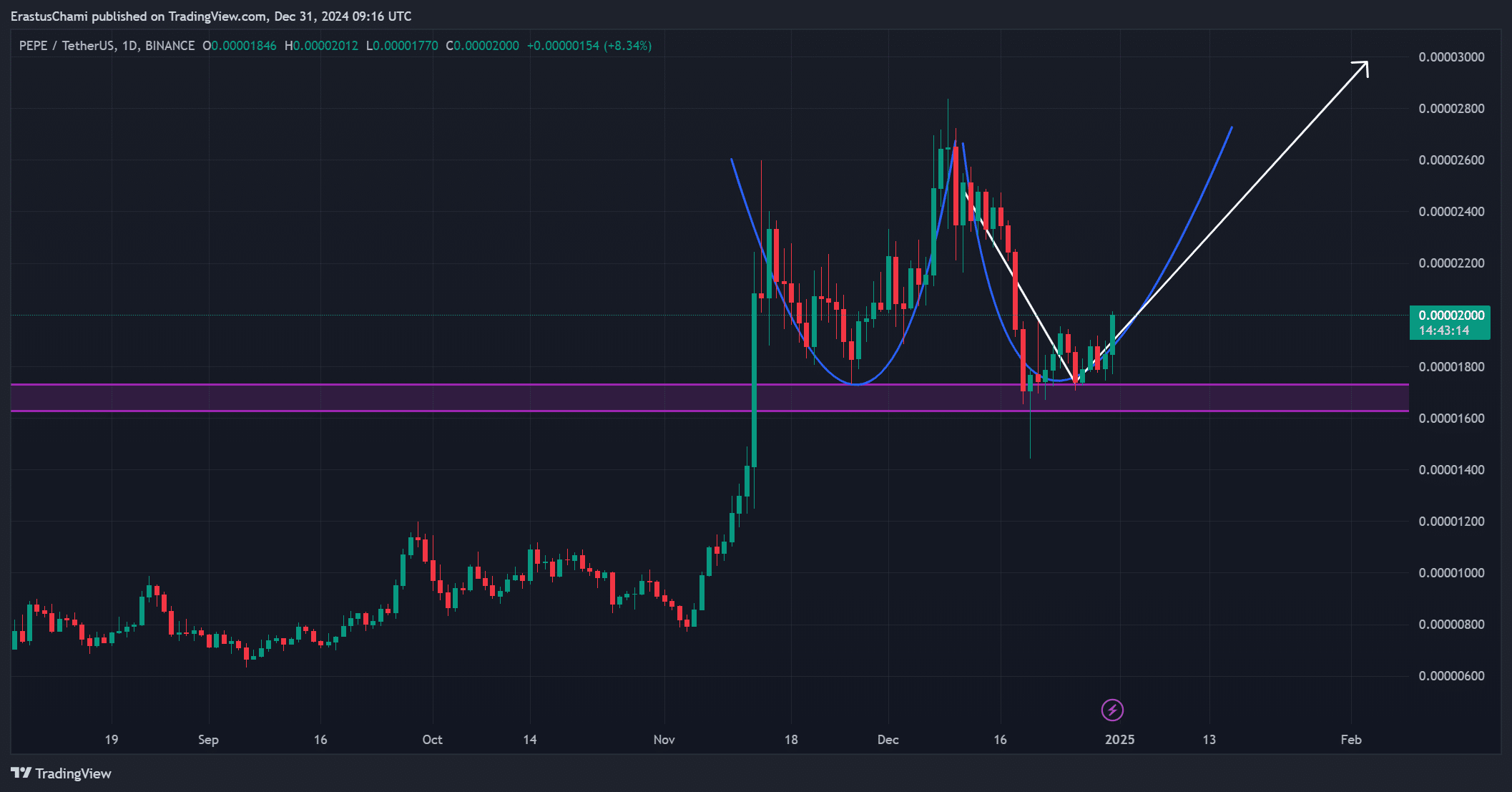

PEPE: Bullish cup-and-handle formation

The chart revealed a textbook cup-and-handle pattern, which is often regarded as a precursor to bullish breakouts.

The pattern is supported by a strong retest of the critical demand zone, confirming buyers’ dominance at this level.

Furthermore, the token is consolidating just below its projected target level near $0.00003, indicating potential for a breakout.

If Pepe manages to reach this target, it could trigger a sustained rally, making it an attractive prospect for both short-term traders and long-term holders.

However, failure to sustain momentum could result in temporary price consolidation.

Source: TradingView

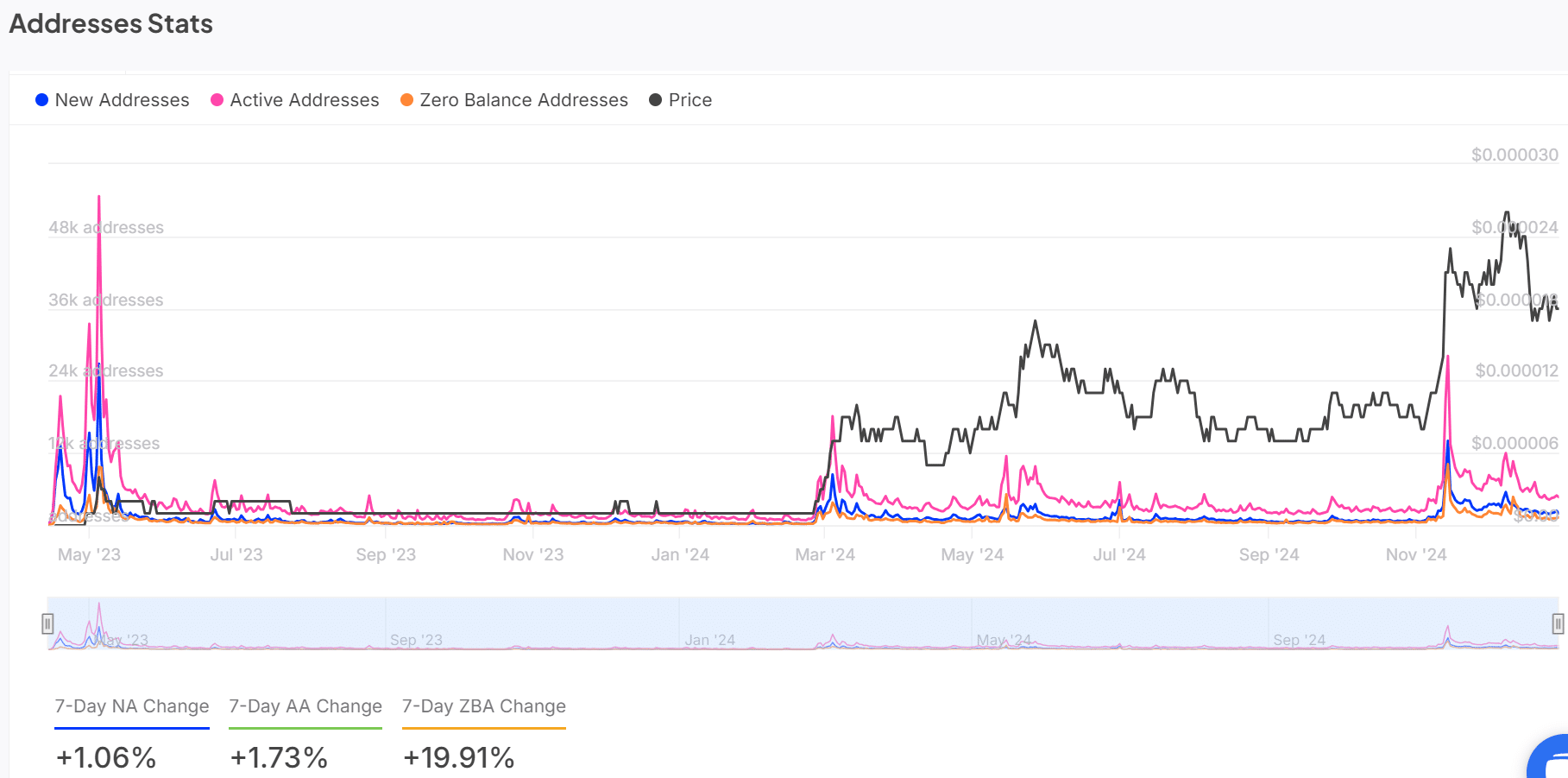

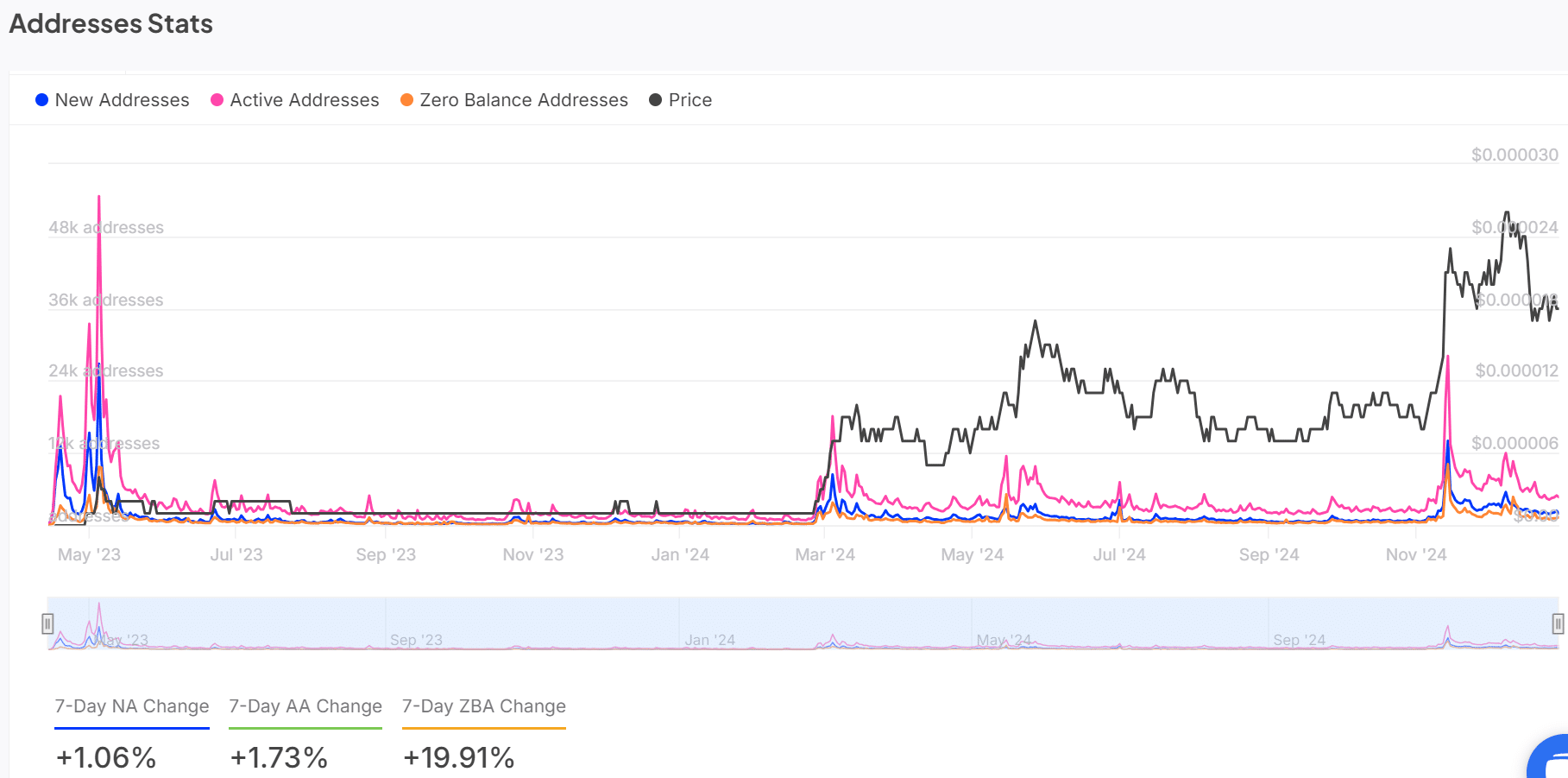

PEPE addresses stats indicate growing interest

The on-chain metrics reinforce its bullish narrative, as address activity has shown a consistent increase. Over the past week, new addresses grew by 1.06%, while active addresses climbed by 1.73%.

Additionally, zero-balance addresses surged by 19.91%, indicating heightened network participation.

This steady growth highlights an influx of new users, which often correlates with increased demand and upward price pressure.

Therefore, the address activity suggests that Pepe’s ecosystem is expanding, adding to its bullish case.

Source: IntoTheBlock

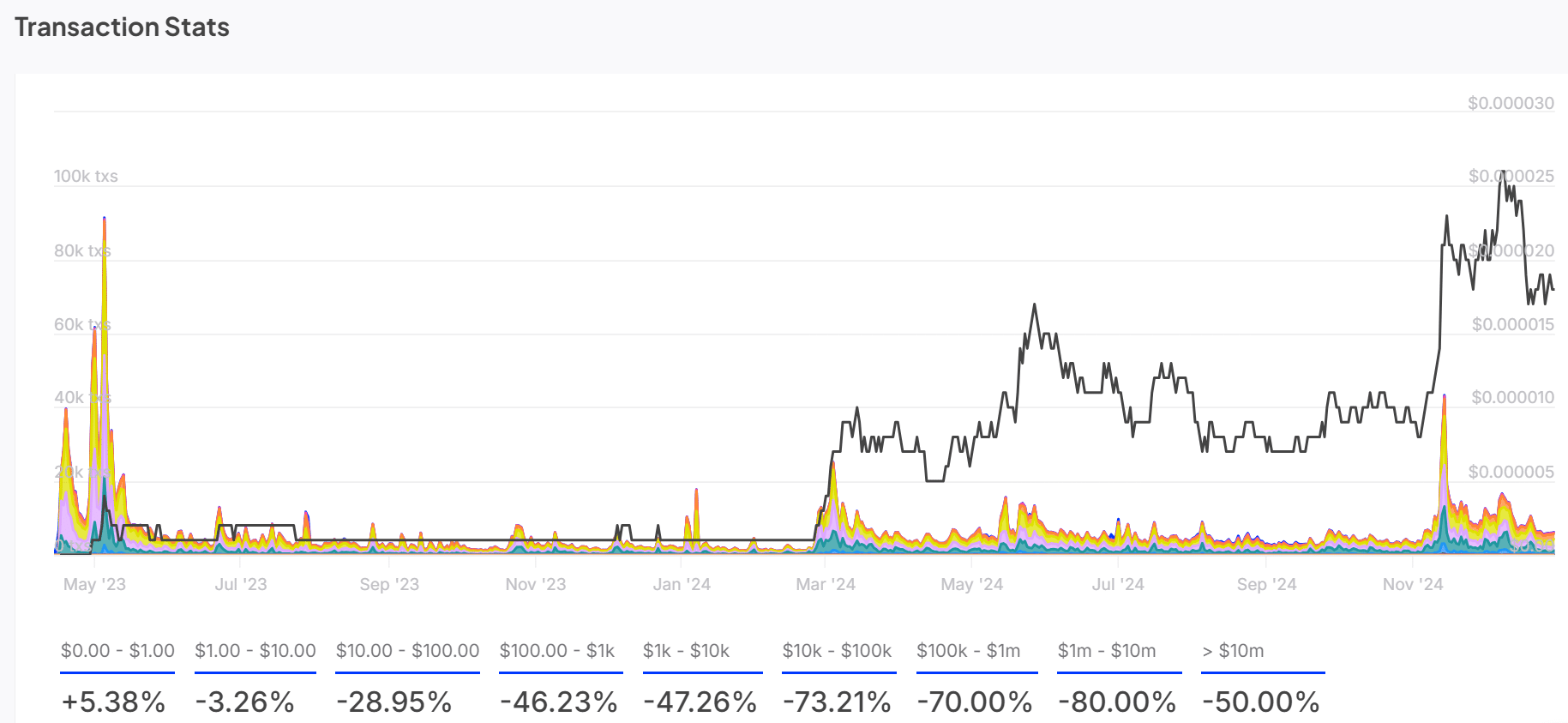

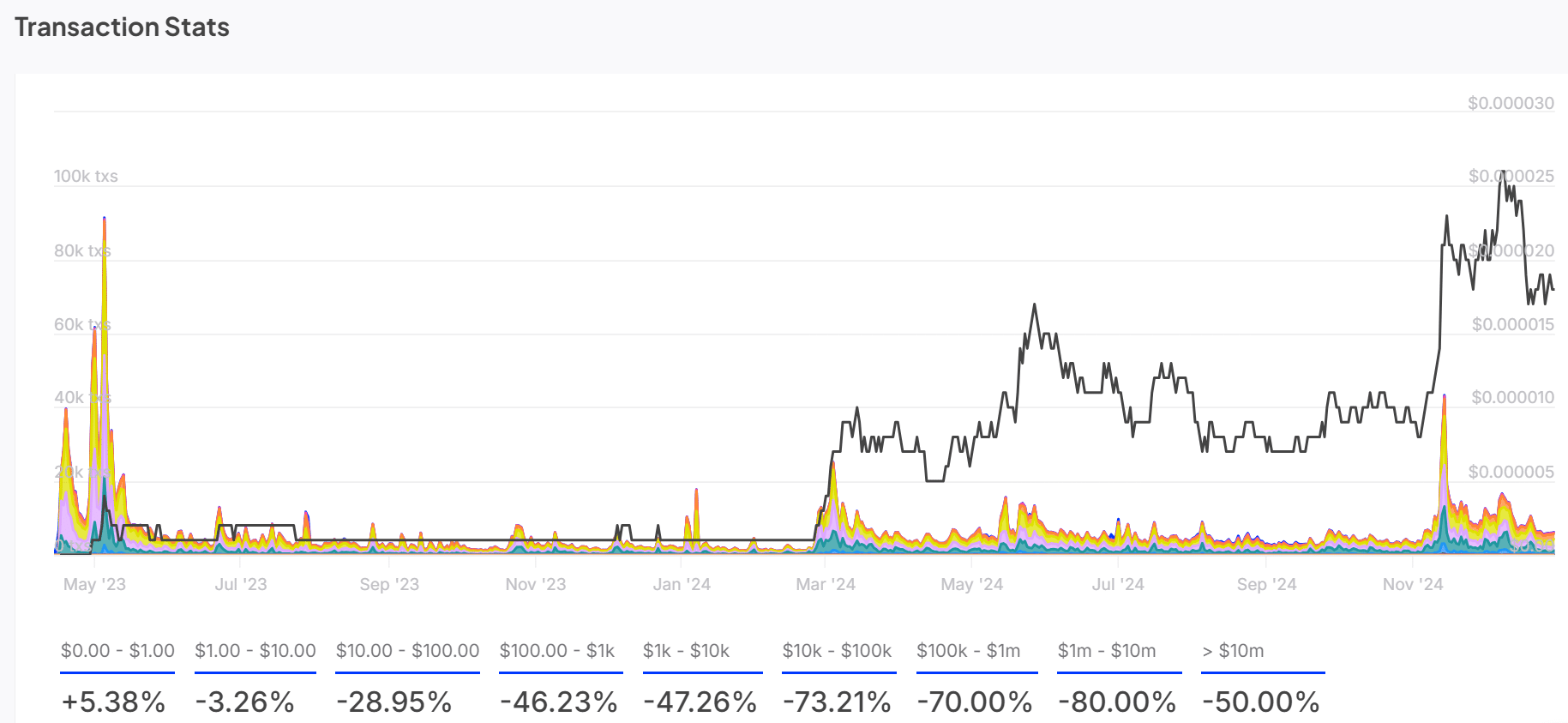

Transaction stats highlight shifting investor behavior

Transaction data shows notable engagement across the network, particularly among smaller investors. Transactions valued under $1 rose by 5.38%, demonstrating growing interest from retail participants.

However, larger transactions above $10,000 have declined, which could suggest a cautious approach among institutional players.

Despite this, the rising volume of retail transactions underscores heightened activity on the network, which often precedes significant price moves. Therefore, this trend could play a pivotal role in supporting Pepe’s rally.

Source: IntoTheBlock

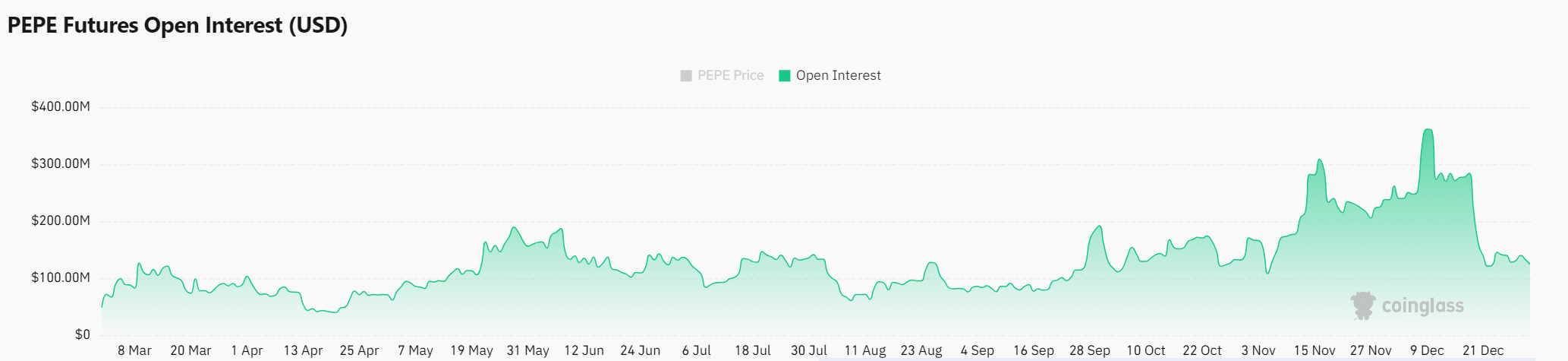

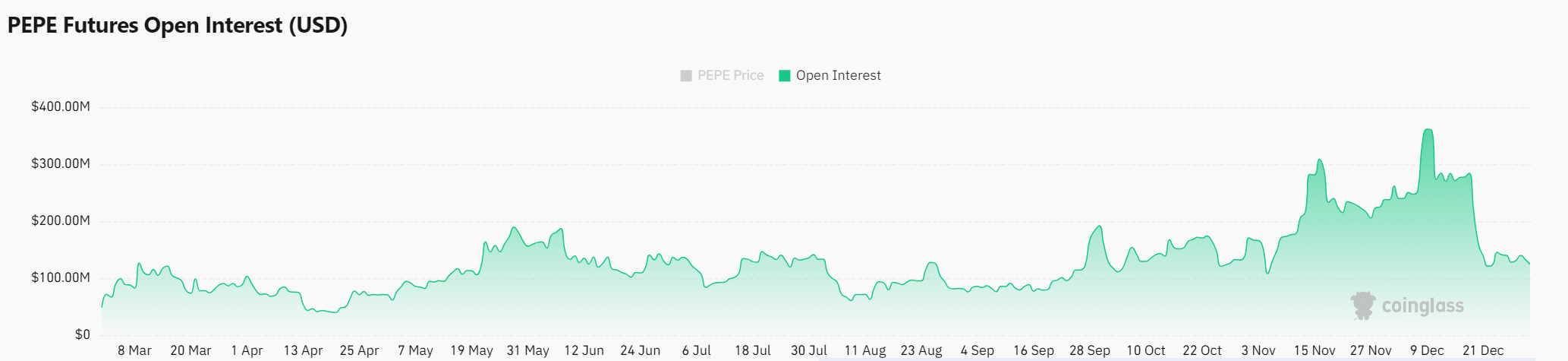

Open Interest surge supports PEPE’s bullish outlook

Open Interest has climbed by 18.83%, totaling $156.56 million. This surge indicates an influx of capital into derivatives markets, often signaling increased confidence among traders.

Additionally, rising Open Interest often accompanies heightened volatility, which may amplify any potential breakout.

Combined with Pepe’s chart patterns and trading volume, this metric further solidifies its bullish outlook. Therefore, all signs point to the possibility of a substantial price movement soon.

Source: Coinglass

Read Pepe’s [PEPE] Price Prediction 2025–2026

Pepe’s bullish indicators across chart patterns, address activity, transaction stats, and open interest strongly suggest an imminent rally.

Given the current momentum and market sentiment, Pepe is well-positioned to deliver a significant breakout in the near term.

[ad_2]

Source link