- Quant’s open interest has surged to its highest level in eight months.

- As more bullish signs around QNT emerge, the altcoin could rally to the 1.618 Fib level.

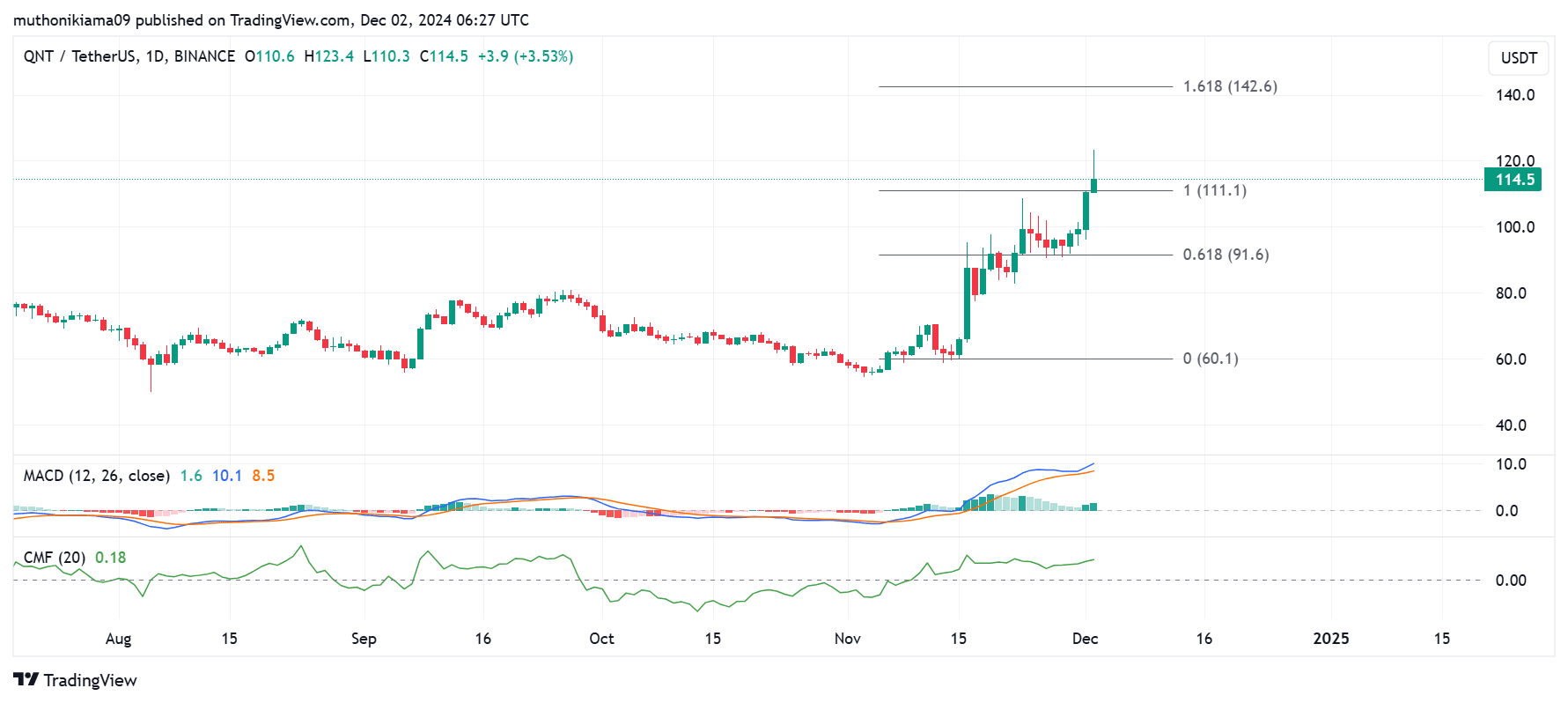

Quant [QNT], at press time, traded at $114 after outperforming most altcoins with 24-hour gains of more than 15%. During this time, trading volumes surged by 130% per CoinMarketCap, suggesting that interest in the altcoin was notably high.

Quant’s uptrend could continue due to several bullish signs. The Chaikin Money Flow (CMF), with a value of 0.18, shows high buying pressure. Moreover, the CMF is tipping north, indicating more buyers are entering the market.

At the same time, the Moving Average Convergence Divergence (MACD) shows that the momentum is bullish. The MACD line has been trending upwards since mid-November and maintained its position above the signal line as the price gained.

If the MACD line continues to slope upwards and the MACD histogram bars remain above the signal line, QNT could rally further. Traders should watch for the exhaustion of this rally if the MACD line creates a sell signal by falling below the signal line.

Source: TradingView

If buyers remain active and the uptrend continues, QNT could soar by 27% to its next target at the 1.618 Fibonacci level ($142).

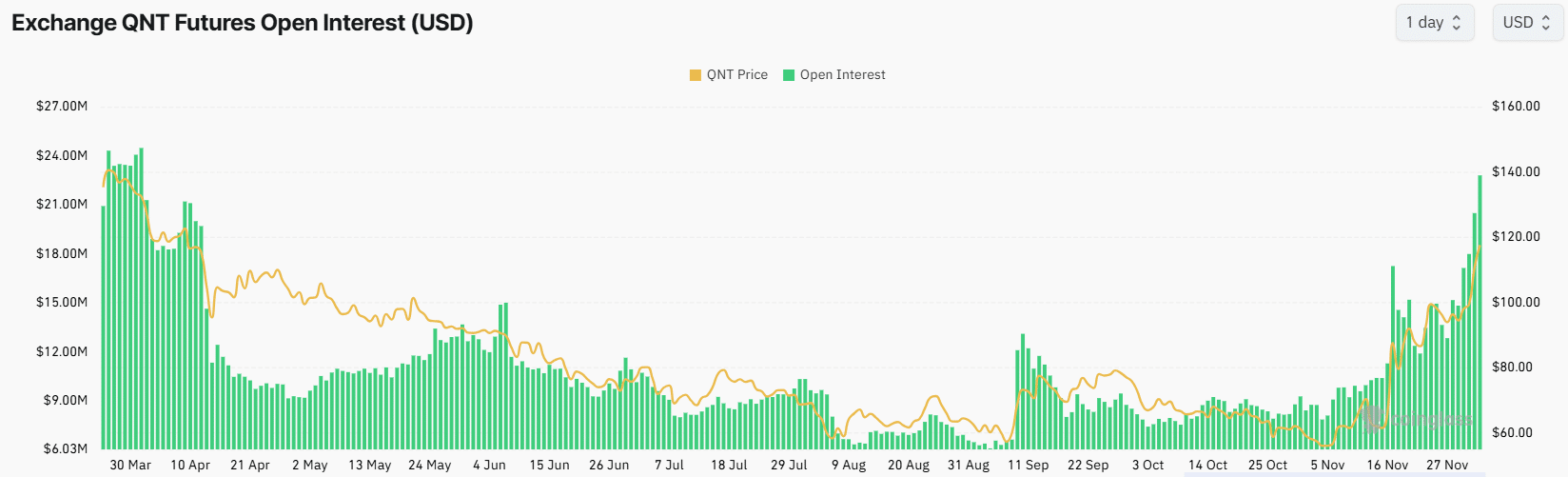

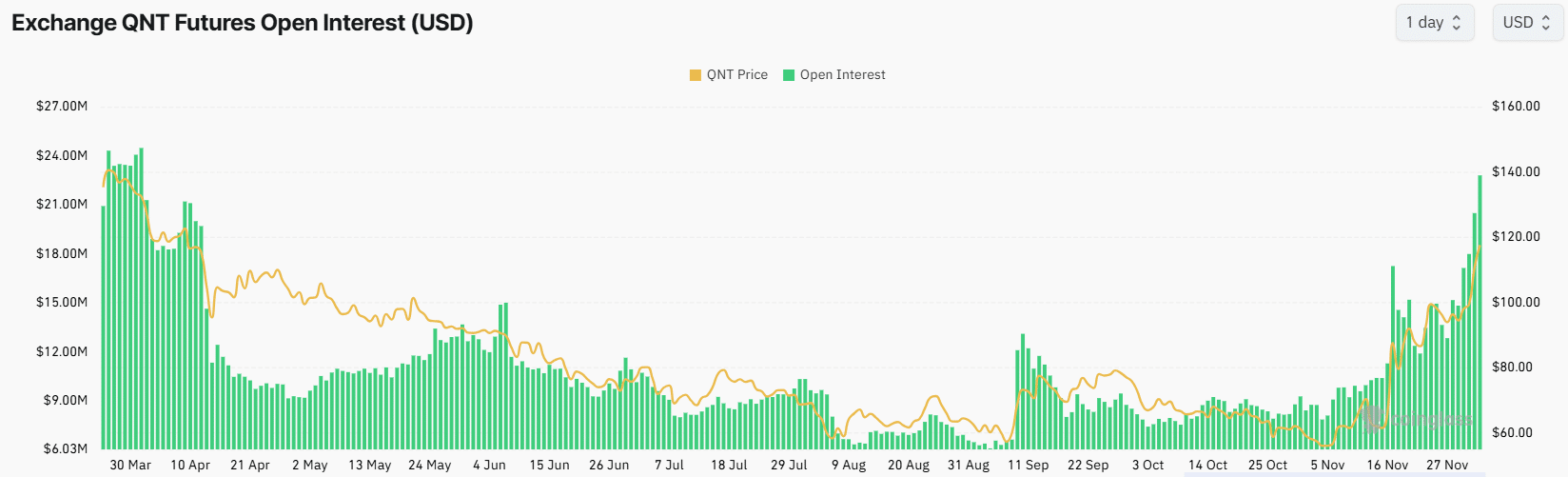

Open interest reaches 8-month high

Besides technical indicators, activity in the derivatives market supports the bullish thesis after Quant’s open interest (OI) reached $22 million at press time, marking its highest level since April.

Source: Coinglass

Going by past trends, Quant’s OI tends to rise when the price increases. Therefore, as more traders open new positions on QNT, it could lead to an upward momentum. At the same time, traders should watch out for a drop in this metric as it could suggest that QNT has reached a local top.

Quant’s funding rates have also been positive since mid-November suggesting that long traders are behind the surging OI.

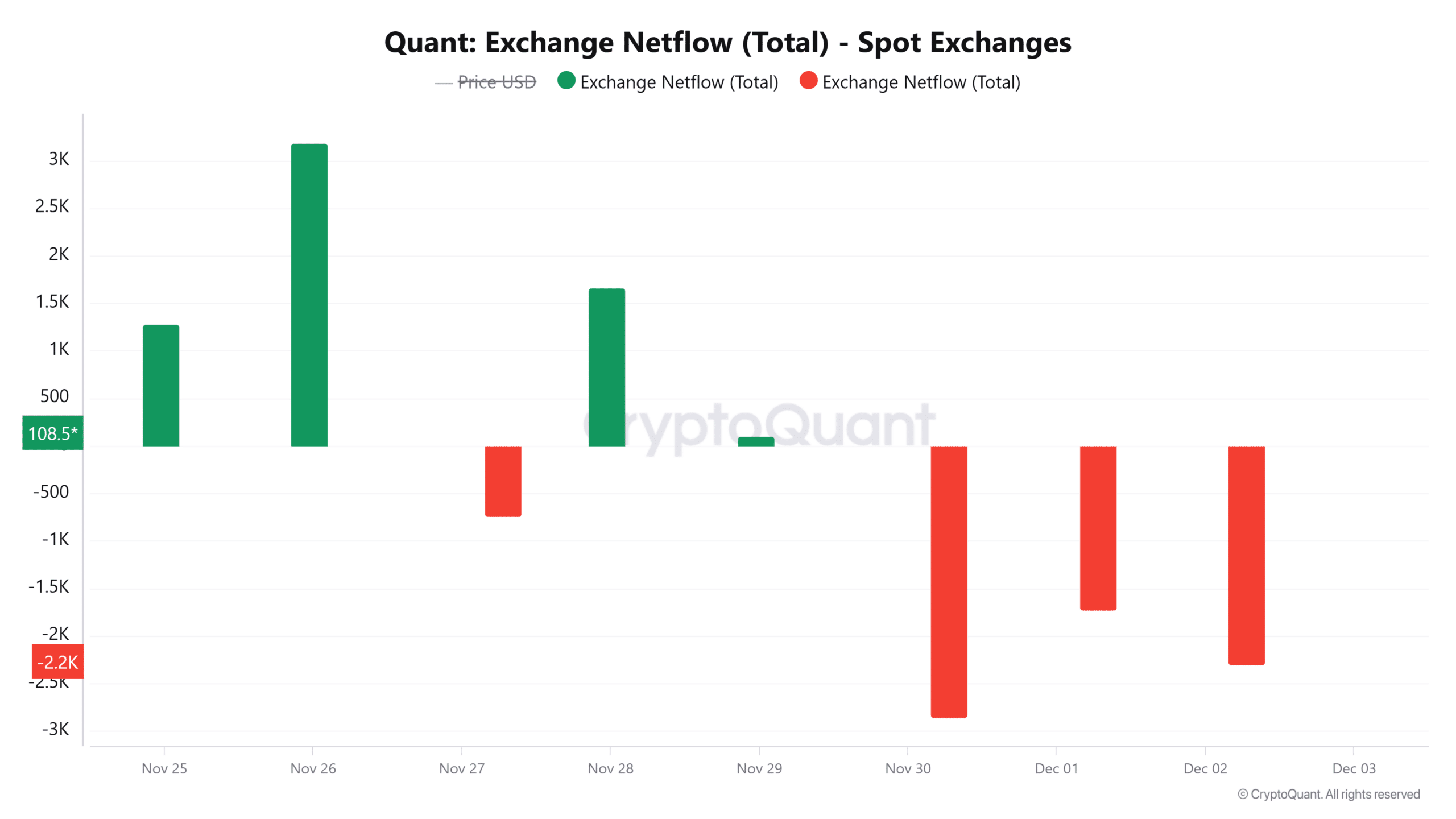

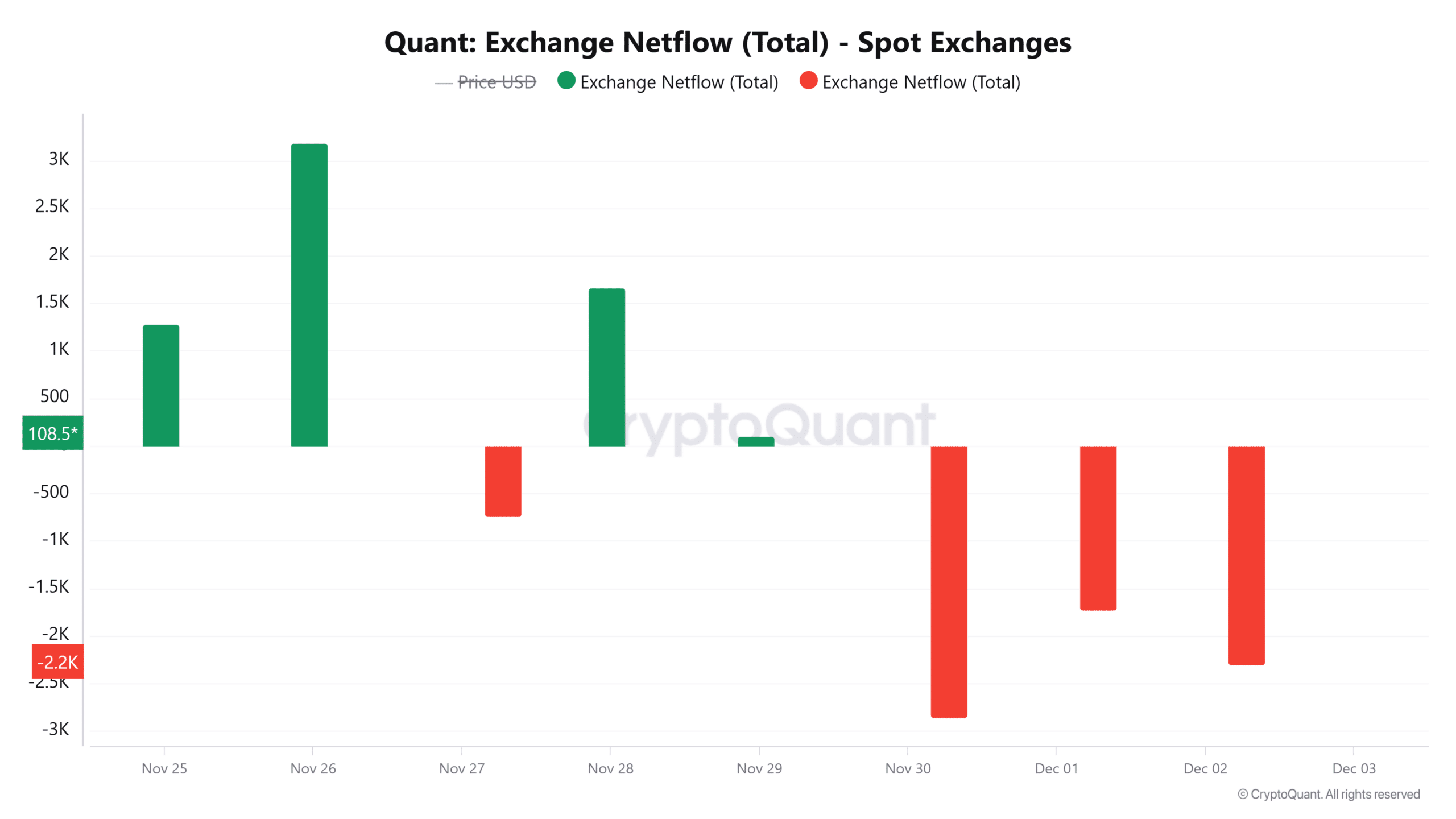

Quant’s exchange netflows show THIS

Exchange flow data shows that profit-taking is not high enough to disrupt Quant’s uptrend. This is after holders withdrew more than 18,400 QNT, valued at around $1.8M, from spot exchanges over the weekend.

Data from CryptoQuant shows that in the last three days, exchange netflows for QNT have been negative indicating that more traders are withdrawing their funds from exchanges.

Source: CryptoQuant

The reduced selling pressure could bode well for the QNT token as it suggests that traders are anticipating more gains for the altcoin despite a spike in profitability.

Read Quant’s [QNT] Price Prediction 2024–2025

Per IntoTheBlock, the percentage of QNT wallets in profits has increased from 4.96% to 26% in one month.

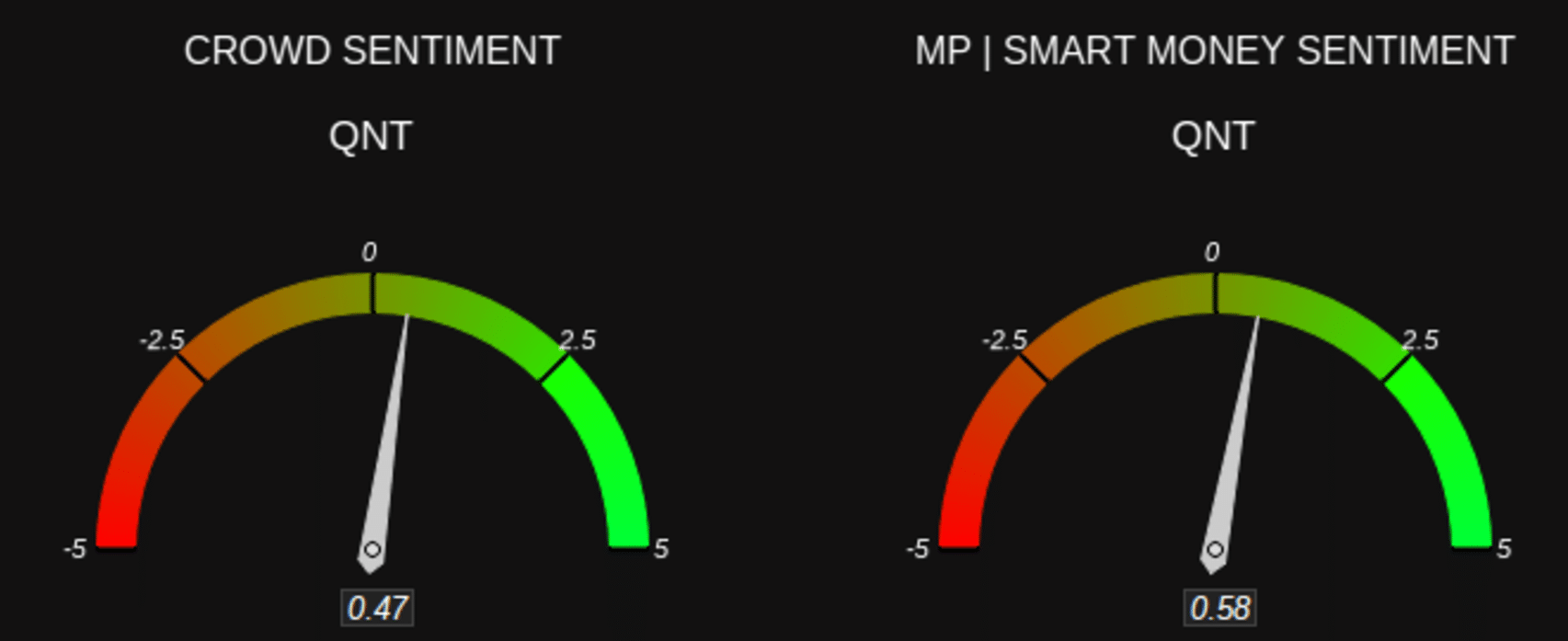

These bullish signs have improved the market sentiment around QNT with Market Prophit showing that both the crowd and smart money sentiment around the altcoin is bullish.

Source: Market Prophit