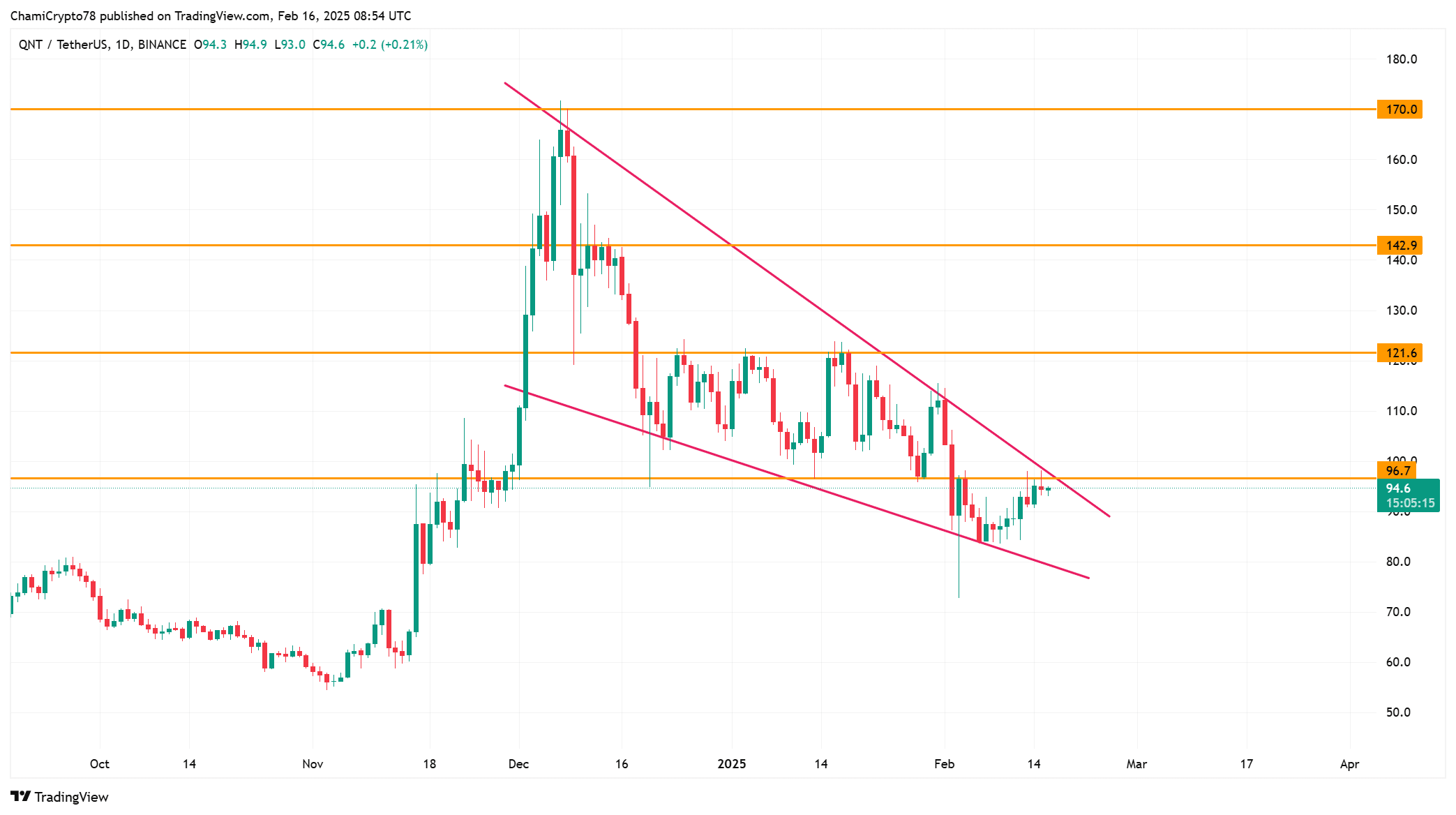

- QNT is testing $96.80 resistance, and a breakout could trigger a rally toward $121.60.

- Exchange reserves signal potential selling pressure, but liquidations above $98 could drive a sharp move.

Quant [QNT] is testing a key resistance level at $96.80, and a breakout could spark a strong rally. At press time, QNT traded at $94.68, down 1.28% in the last 24 hours.

Bulls need to reclaim this level to confirm a trend shift. However, failure to break through could lead to a decline. Will QNT push higher or face another rejection?

QNT price at a turning point

QNT has been moving inside a falling wedge, a bullish reversal pattern. The $96.80 resistance has repeatedly rejected price surges, making it a key level to watch.

If bulls manage to push above it, momentum could build, driving QNT toward $121.60. A further breakout could extend gains to $142.90 or even $170.00.

However, failure to break above could cause a pullback toward $85.00, where strong support exists. Additionally, Bitcoin’s movement will influence QNT’s direction.

Buyers need to maintain pressure to prevent another downturn. If volume increases near resistance, QNT could confirm a breakout soon.

Source: TradingView

What do the metrics reveal?

On-chain data presented mixed signals. Net network growth was up by just 0.29%, reflecting weak adoption. Without new users, bullish momentum could weaken.

However, 1.11% of holders remained in profit, suggesting some positive sentiment.

Additionally, concentration levels remained unchanged, meaning whales were neither accumulating nor selling significantly. Meanwhile, large transactions have dropped by 3.61%, showing reduced institutional participation.

If whales enter the market aggressively, QNT could gain the push needed for a breakout.

Source: IntoTheBlock

Increasing supply or hidden accumulation?

Exchange reserves have slightly increased by 0.02%, signaling a potential rise in selling pressure.

When reserves climb, more coins are available for trading, increasing volatility. If this trend continues, Quant may struggle to hold support levels.

However, if reserves decline, it could indicate accumulation, reducing selling pressure. Additionally, market participants should watch reserve changes closely.

A drop in reserves would confirm that investors are holding rather than selling. This could strengthen the bullish outlook.

Source: CryptoQuant

Will forced liquidations drive volatility?

The Binance liquidation heatmap showed significant liquidation clusters between $96 and $98. If Quant moves into this zone, forced liquidations could trigger rapid price movement.

A breakout above $98 could push QNT toward $100 as short sellers get liquidated.

However, if rejection occurs, Quant could retrace toward $90, where strong liquidity support exists. Additionally, traders should expect volatility near these levels.

Large liquidation clusters often result in sudden price swings. If bulls maintain momentum, QNT could confirm a breakout.

Source: Coinglass

Quant is at a critical point, and breaking $96.80 will determine its next move. A successful breakout could push the price toward $121.60. However, if rejection happens, QNT may drop to $85–$90.

Bulls must push through resistance with strong volume to confirm a bullish trend.