- XRP’s active addresses have declined steadily, suggesting reduced engagement and potential price volatility ahead.

- A key support level is under pressure, and if broken, it could face further downsides despite broader market conditions.

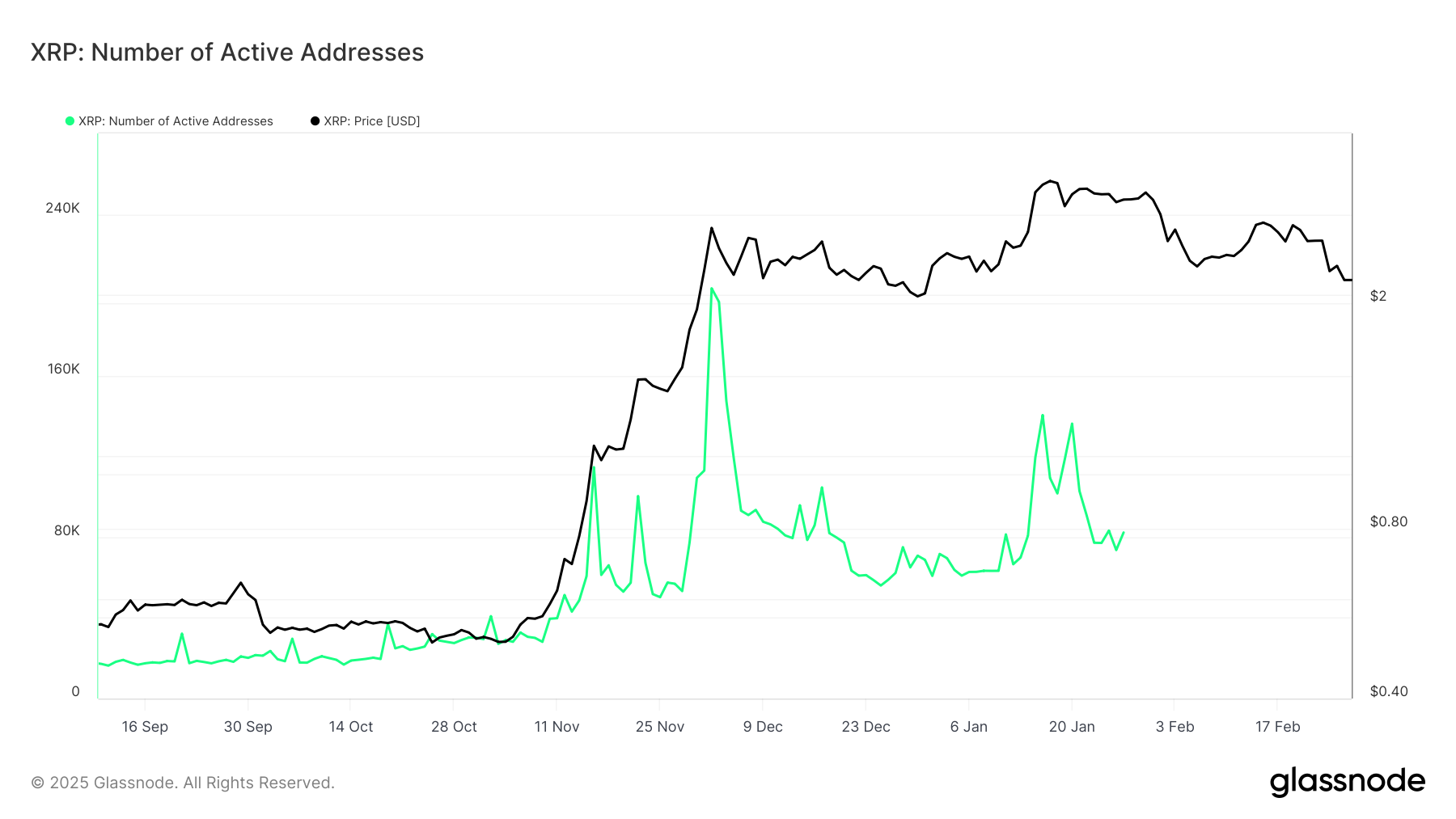

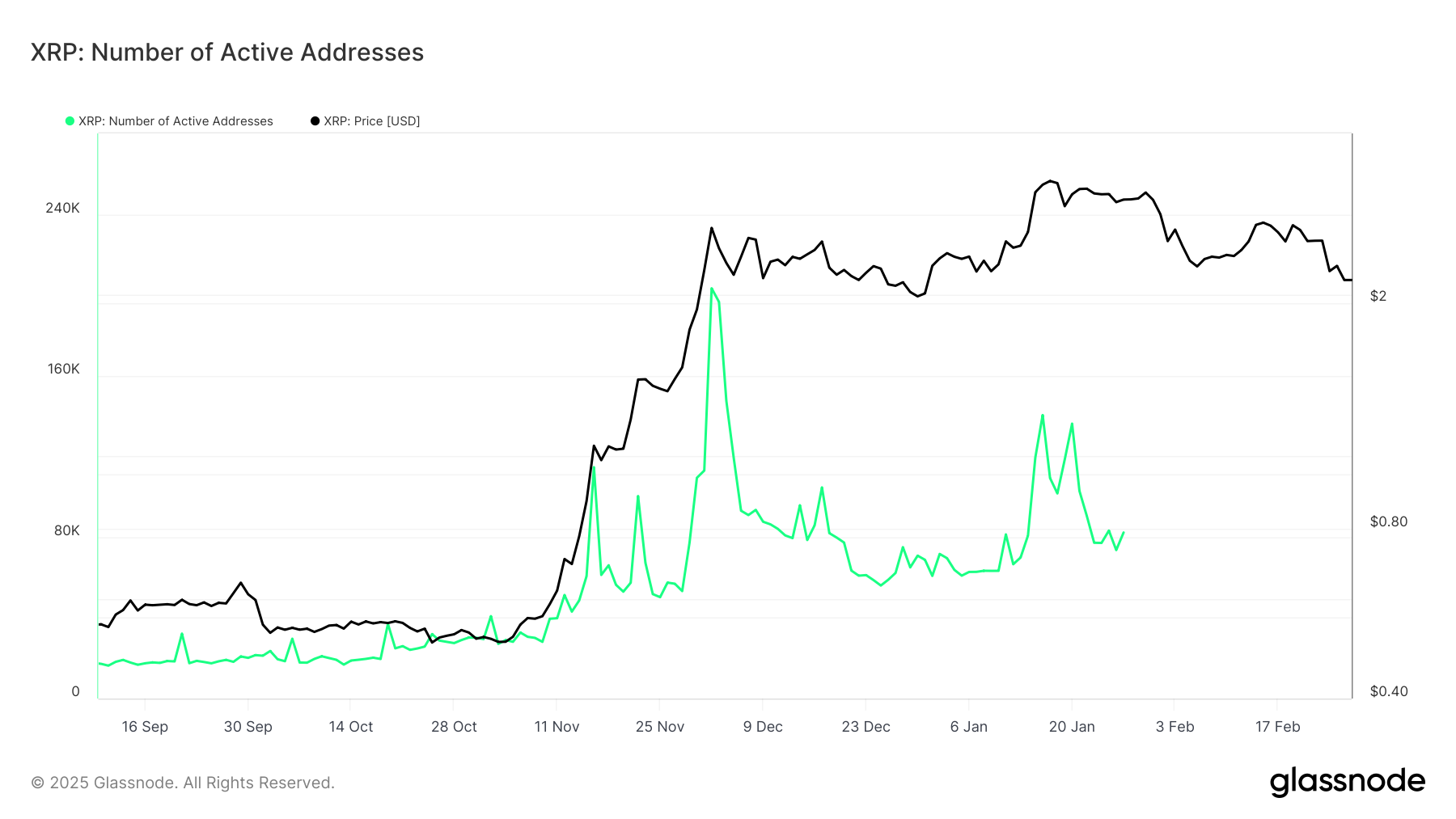

The number of active Ripple[XRP] addresses has significantly declined over the past three months, raising concerns about reduced network activity and its potential impact on price trends.

This drop in engagement has coincided with a broader price correction, leading to speculation about the future trajectory.

XRP active addresses and market sentiment

Glassnode data shows that XRP’s active addresses peaked in early December 2024 before beginning a steady decline. Analysis showed that the number spiked to over 203,000.

Source: Glassnode

The latest data reveals a significant drop in active wallets, which typically indicates lower transaction volumes and reduced market participation. As of this writing, the number was around 82,000, signaling over a 50% drop.

Historically, sustained declines in active addresses have correlated with price stagnation or downward movements, as fewer transactions suggest waning investor interest.

Price trend and technical indicators

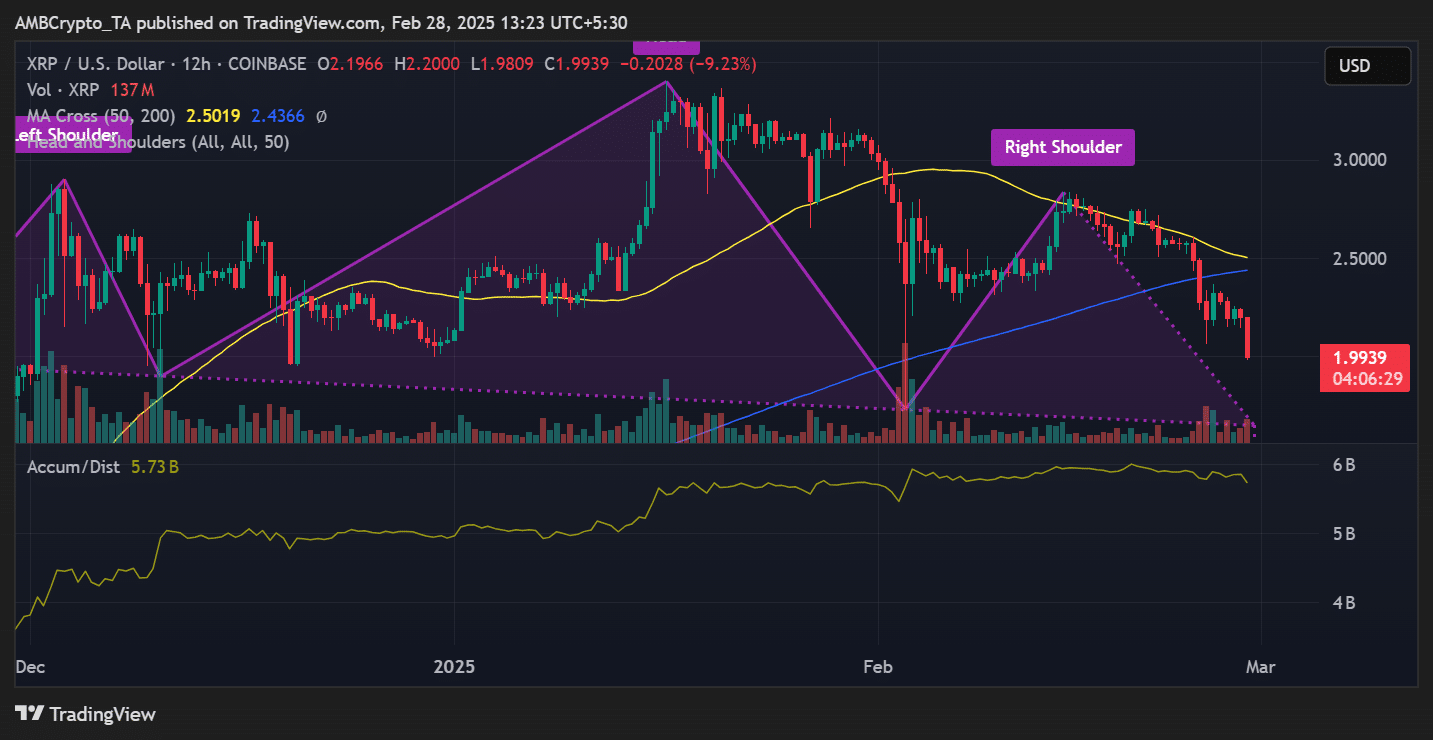

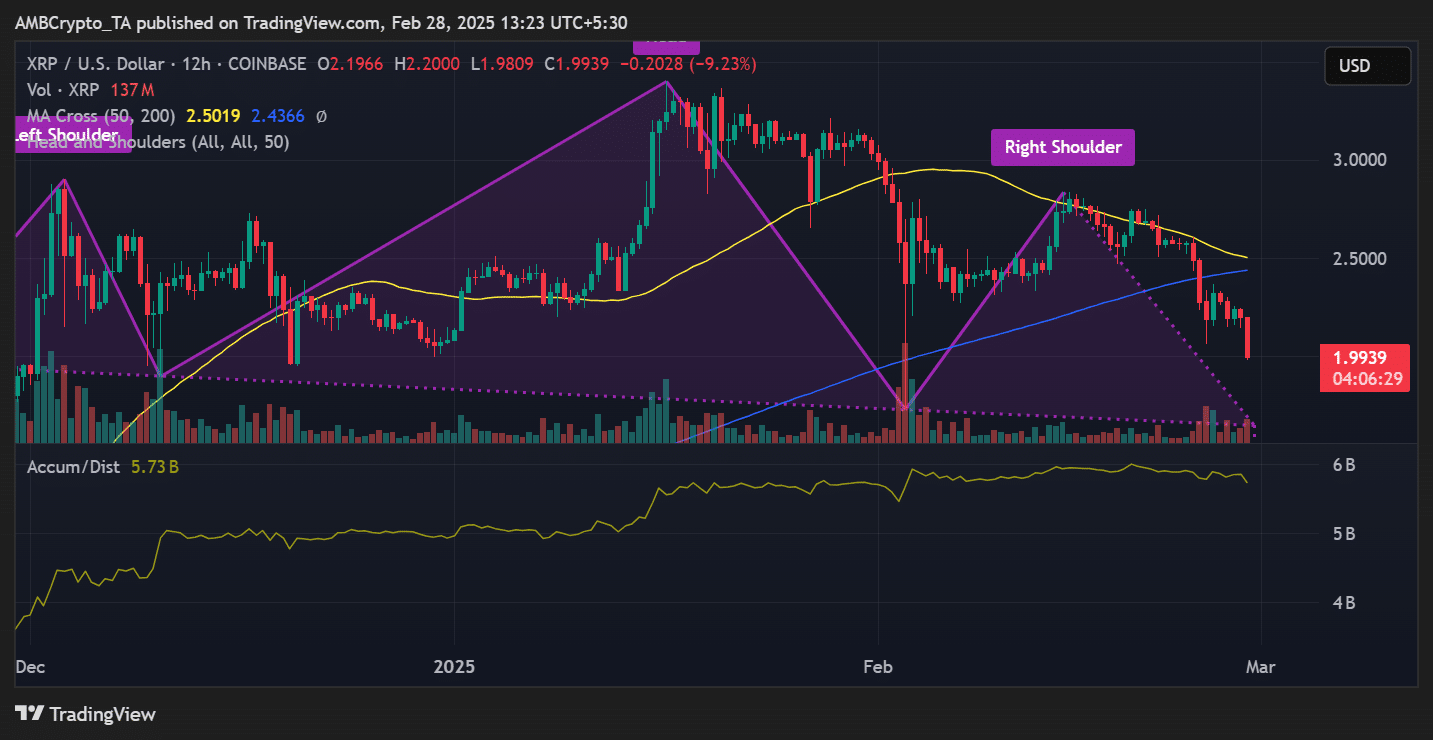

XRP has followed a bearish trend, reflecting the drop in network activity. The 12-hour chart shows a well-defined head and shoulders pattern, a classic bearish reversal indicator. This formation suggests that XRP could continue its downtrend if key support levels fail to hold.

At the time of writing, XRP was trading at $1.9939, reflecting a 9.23% decline in the last 24 hours.

The 50-day Moving Average (MA) was $2.5019, significantly above the current price, signaling persistent selling pressure.

Source: TradingView

Meanwhile, the Accumulation/Distribution (A/D) indicator showed a downward trend, reinforcing the view that large holders are exiting their positions rather than accumulating.

What this means for XRP’s future

With declining network participation and bearish price action, XRP needs a resurgence in active wallets to establish a recovery trend. If active addresses continue to drop, XRP could face further downward pressure, possibly testing the $1.80-$1.85 range as the next support zone.

However, a sharp increase in active addresses could signal renewed investor confidence, potentially stabilizing prices and setting up a reversal. For a bullish scenario, XRP must reclaim $2.20-$2.25 as a key resistance zone.

Conclusion

The current downtrend in active addresses and prices indicates caution for XRP investors. Monitoring on-chain activity will be crucial in assessing whether the asset is poised for further declines or if a turnaround is on the horizon.

Until then, XRP remains in a vulnerable position, heavily dependent on a resurgence in network activity to regain upward momentum.