[ad_1]

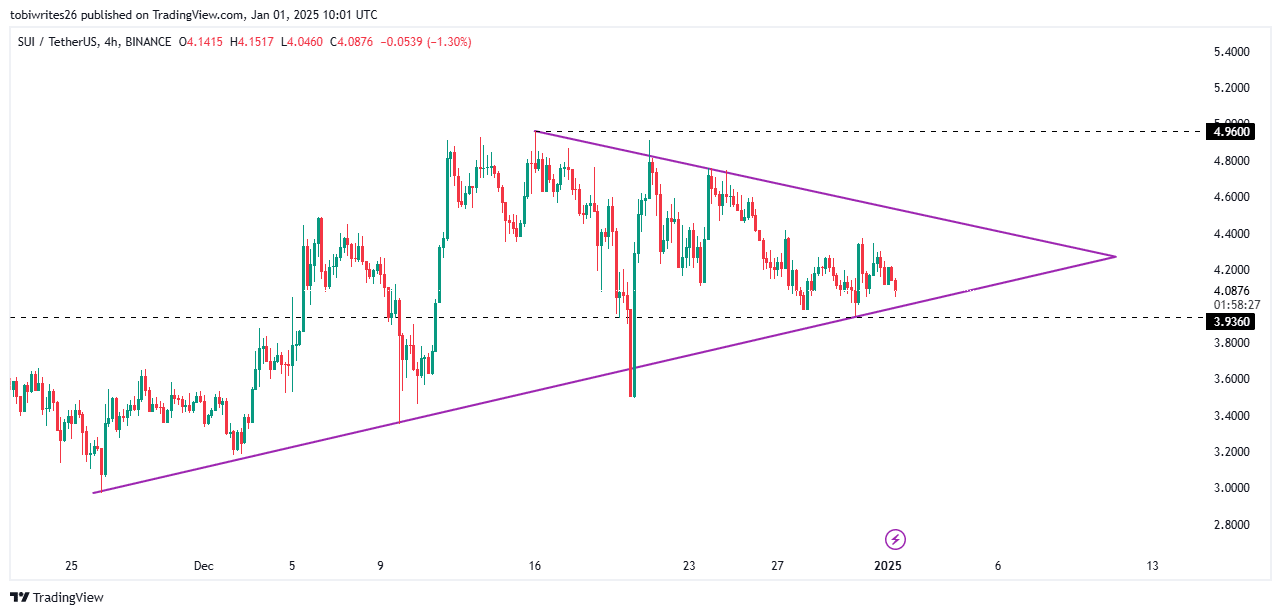

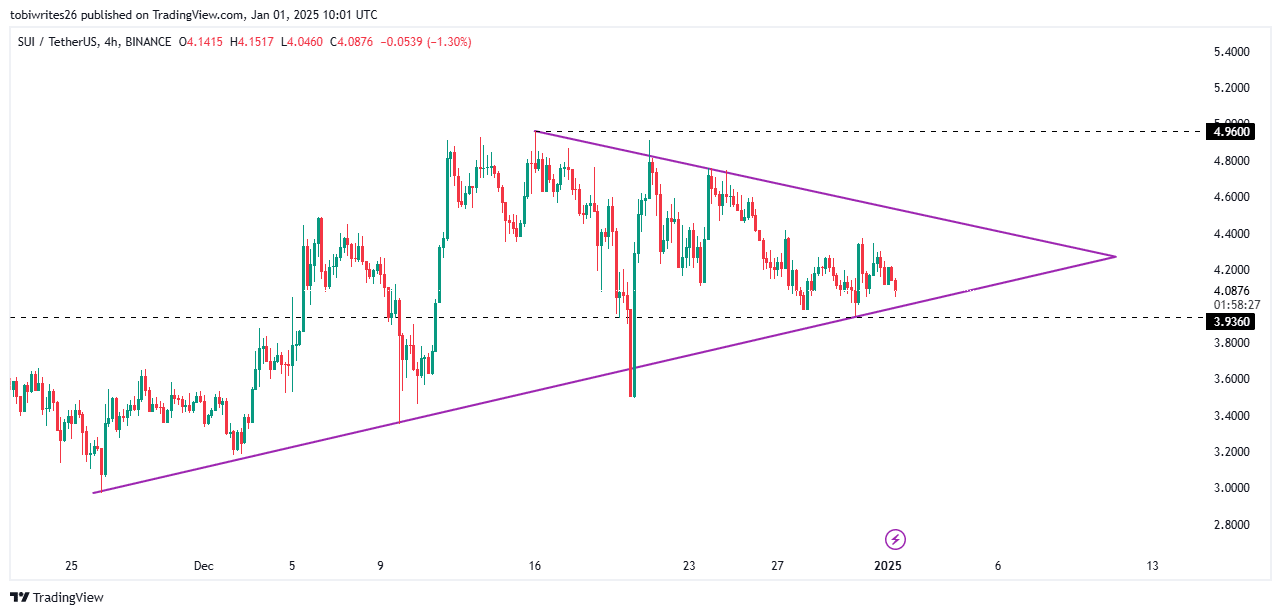

- SUI was trading within a symmetrical triangle pattern, with a key support level to provide a potential base for upward momentum.

- A slight dip remains possible as the coin sought stronger support before resuming its bullish trajectory.

Over the past 24 hours, SUI has declined by 4.89%, suggesting further downside risk in the short term. Despite this, the asset’s monthly gain of 24.75% highlights its broader bullish trend.

Based on technical indicators and on-chain data, SUI may soon break out of its current range and rally toward a higher price zone, potentially reaching $4.96 in the near term.

SUI trades within a symmetrical channel

On the 4-hour chart, SUI appears to have entered an accumulation phase and is forming a symmetrical triangle. This pattern suggests market participants are buying at lower levels, which could lead the market to swing higher.

This phase is characterized by two converging trendlines: the upper line as resistance and the lower as support. For a rally, SUI might need to drop to establish sufficient support at two key levels.

First, SUI could test the support on the lower trendline. Alternatively, it might decline further to a historical level of 3.926, which could trigger a move to the $4.96 level. Beyond that, the price will likely trend higher.

Source: TradingView

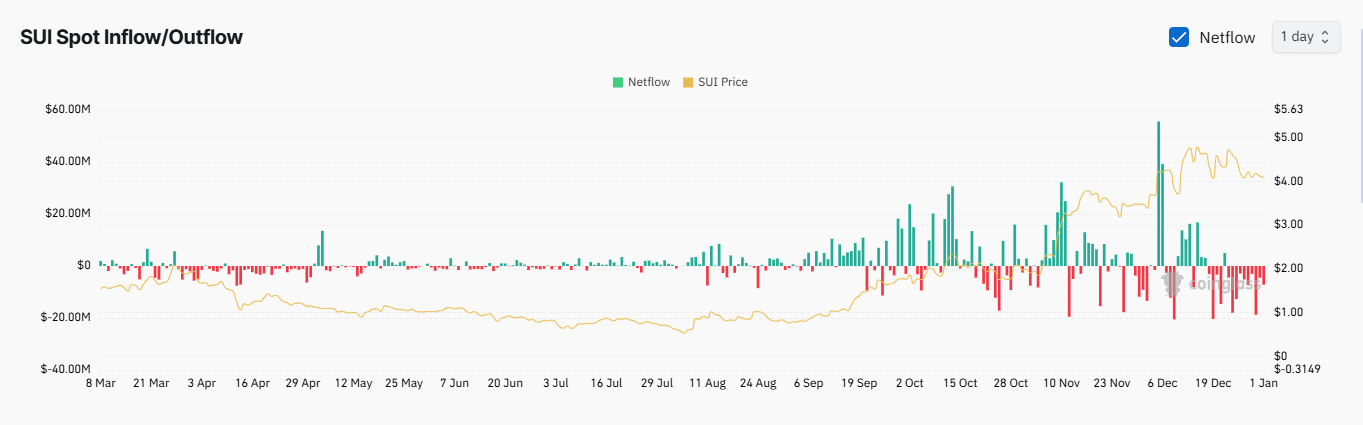

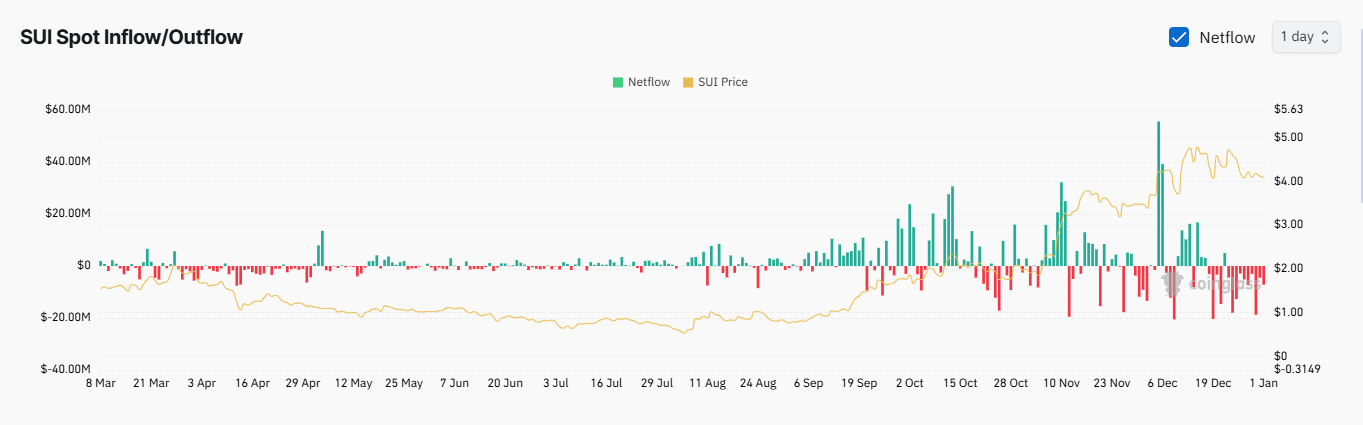

Currently, the bullish momentum is supported by a continued negative net outflow, as recorded by the Exchange Netflow metric on Coinglass. Negative net flow, where more assets leave exchanges than enter, often positively impacts the price.

Approximately $26 million worth of SUI has been withdrawn from exchanges, with $7.11 million withdrawn in the past 24 hours.

Source: Coinglass

Although the altcoin was trading in a generally bullish environment, AMBCrypto has identified other confluences that suggest the price could see short-term downward pressure.

Open Interest declines

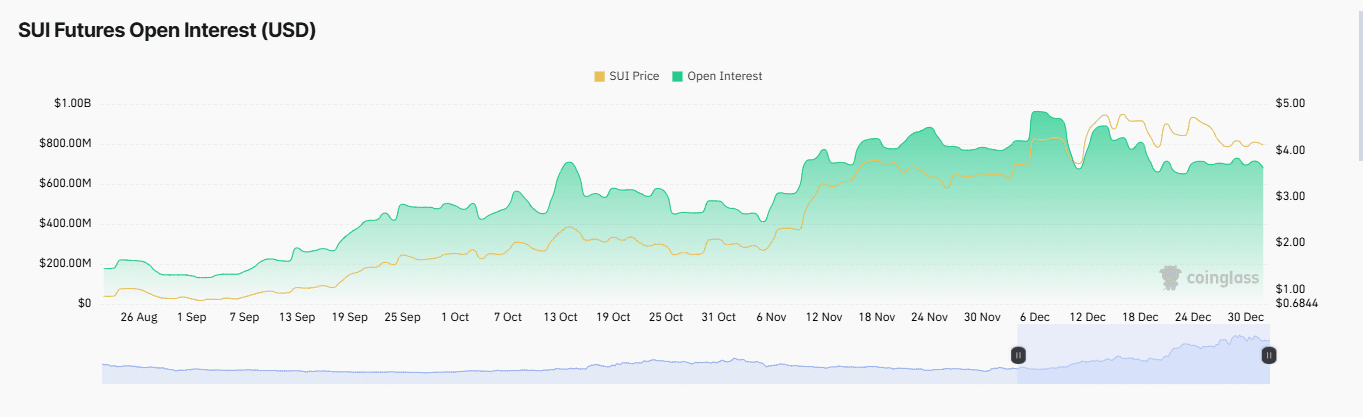

SUI’s Open Interest(OI) in the market has dropped by 5.68% in the past 24 hours, falling to $677.82 million.

A decline in OI often indicates waning participation from market players, as the number of unsettled derivative contracts decreases.

This trend is further supported by a significant drop in trading volume, which has fallen by 48.84% in the same period, landing at $1.15 billion.

Source: Coinglass

The reduced trading activity and selling pressure suggest the price of SUI could fall further, potentially testing support at the $3.96 level based on current chart patterns.

SUI surpasses SHIB in market capitalization

SUI has become more valuable than SHIB by market capitalization. At press time, SUI’s market cap stood at $12.54 billion, compared to SHIB’s $12.45 billion.

Read Shiba Inu’s [SHIB] Price Prediction 2025–2026

With an anticipated rally for SUI, the margin between the two assets is expected to widen further, potentially pushing SUI’s market cap even higher.

[ad_2]

Source link