- While THORChain’s price increased, its trading volume also surged.

- Metrics revealed that whales were having higher exposure in the market.

THORChain [RUNE] has showcased commendable performance over the last 24 hours as its value surged in double digits. While that happened, the token also witnessed a major surge in its trading volume.

Let’s take a closer look at what allowed the token to begin this bull rally and whether this trend would last.

THORChain begins a rally

CoinMarketCap’s data revealed that RUNE’s price had increased by over 16% last week. Things got even better in the past 24 hours, as the token’s value surged by more than 13%.

At the time of writing, THORChain was trading at $3.70 with a market capitalization of over $1.2 billion, making it the 55th largest crypto.

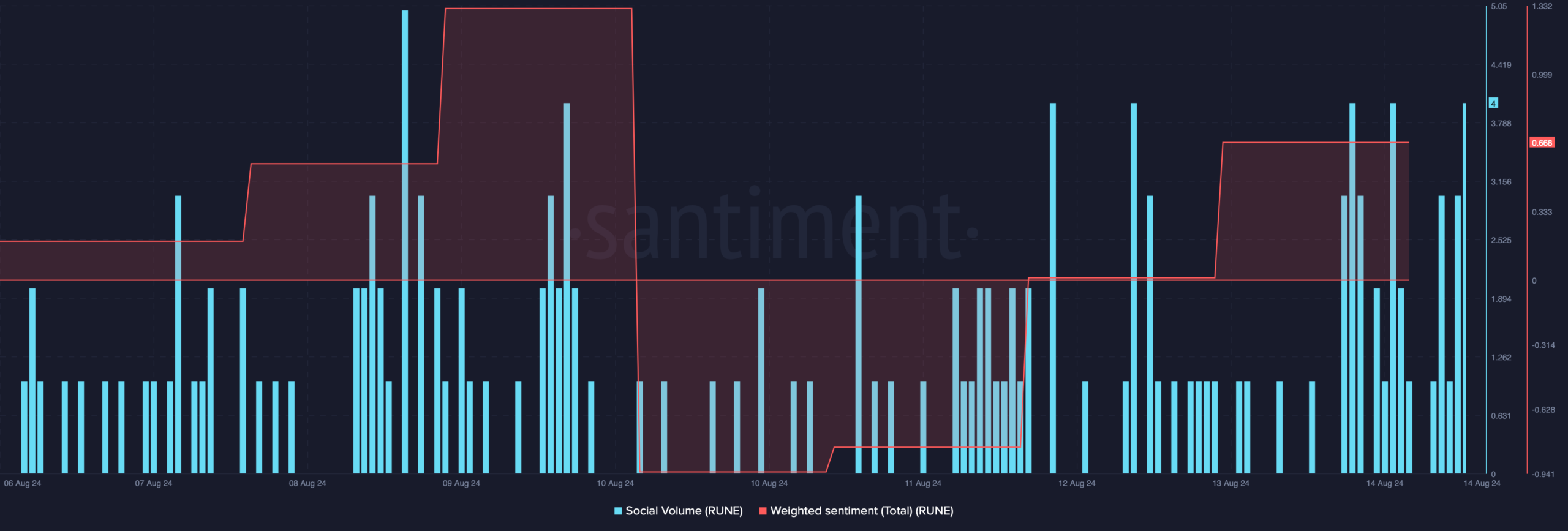

Thanks to the price increase, the token’s Weighted Sentiment went into the positive zone, meaning that bullish sentiment around it was dominant in the market.

Its Social Volume also remained high, reflecting an increase in RUNE’s popularity in the crypto space.

Source: Santiment

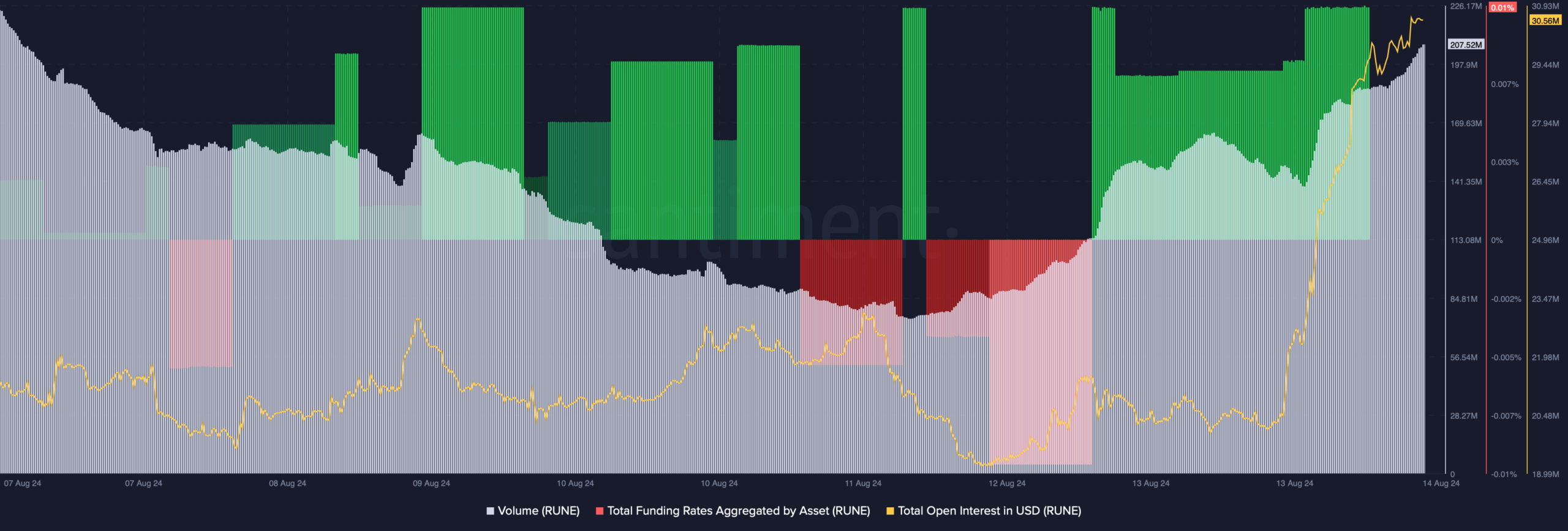

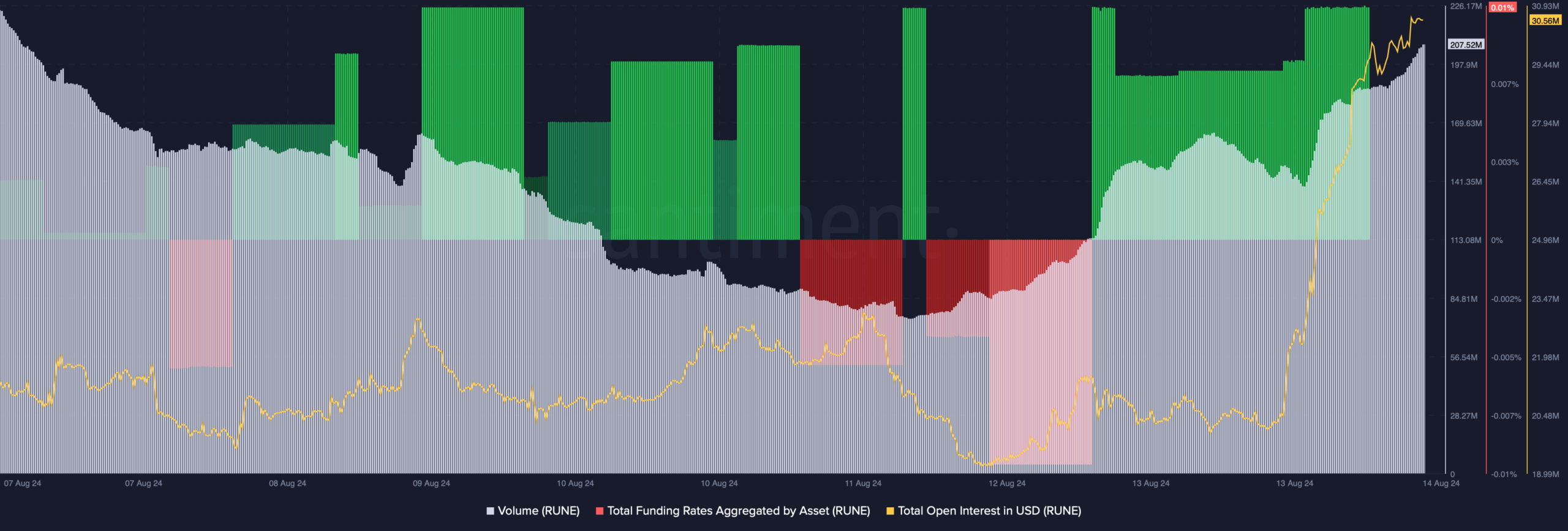

Upon further inspection, AMBCrypto found that the token’s trading volume also surged along with its price. Usually, a rise in volume amidst a price increase acts as a solid foundation for the bull rally.

Its Open Interest went up, indicating that the chances of the bull rally continuing further were high. However, RUNE’s Funding Rate increased.

Generally, prices tend to move the other way than Funding Rates, which is a bearish notion.

Source: Santiment

Will the bull rally last?

AMBCrypto’s look at Hyblock Capital’s data revealed that at press time, THORChain’s whale vs. retail delta had a value of 96.

This indicator ranged from -100 to 100, with 0 representing whales and retail positioned exactly the same.

Since the value was much closer to 100, it meant that whales were having higher long exposure than retail investors.

Source: Hyblock Capital

Apart from that, Coinglass’ data revealed that RUNE’s Long/Short Ratio registered a sharp increase.

This suggested that there were more long positions in the market than shorts, which indicated that bullish sentiment was dominant in the market.

Source: Glassnode

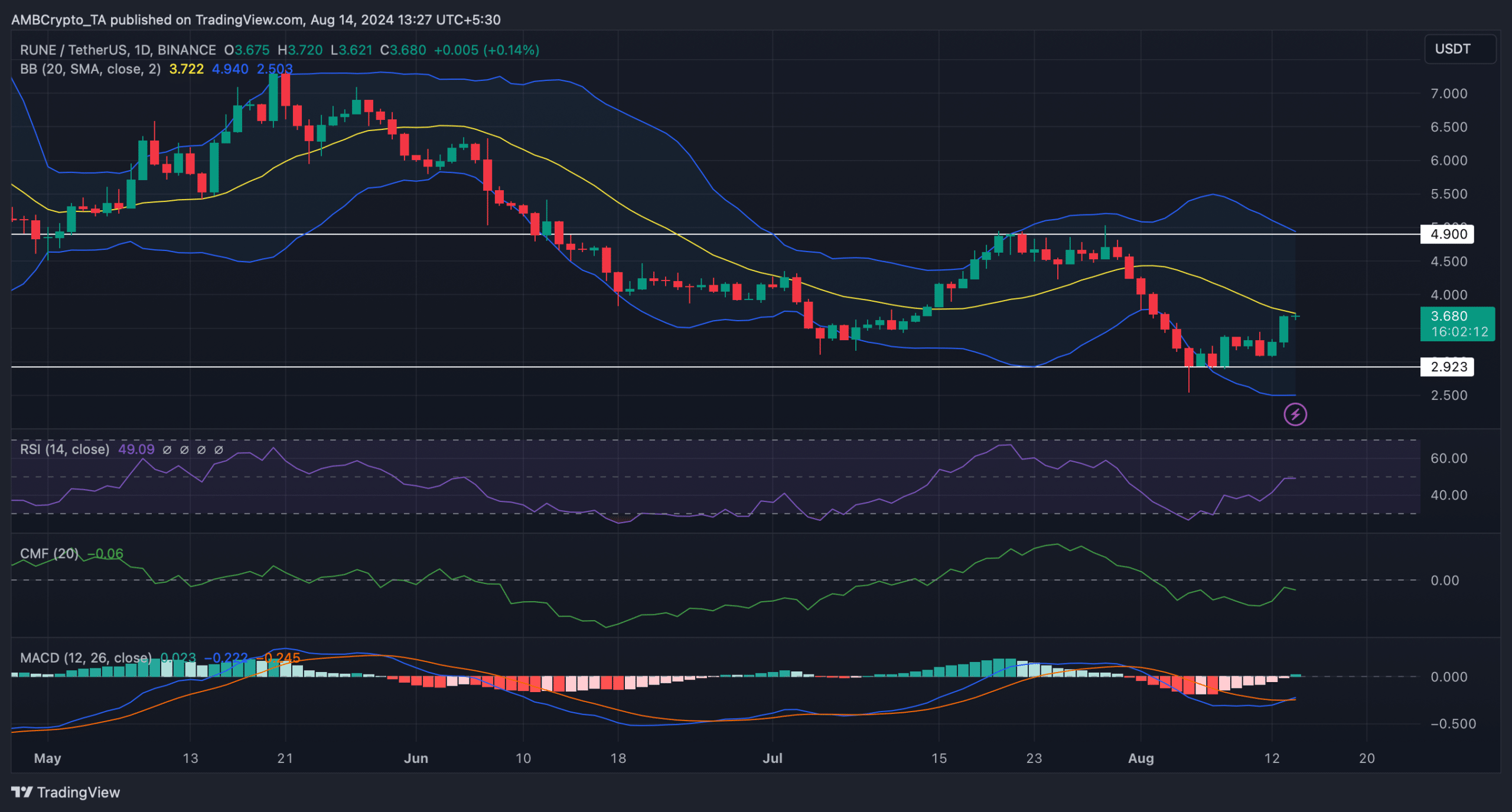

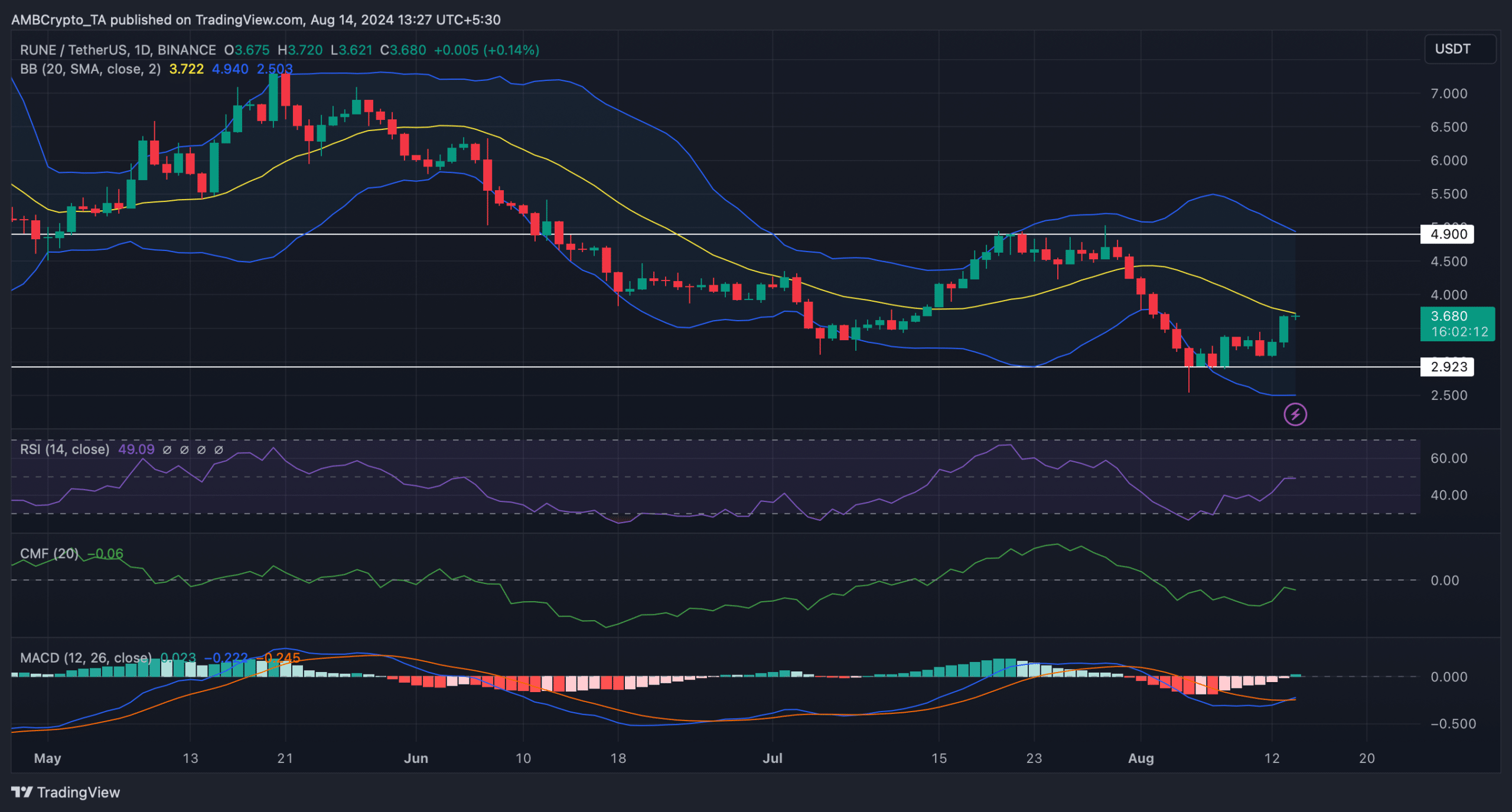

We then planned to check THORChain’s daily chart to better understand whether this uptrend would continue. The technical indicator MACD displayed a bullish crossover.

Read THORChain [RUNE] Price Prediction 2024-25

RUNE’s Bollinger Bands revealed that the token’s price was testing its resistance near the 20-day Simple Moving Average (SMA). A successful breakout above that would allow the token to reclaim $4.9-$5.

However, both its Relative Strength Index (RSI) and Chaikin Money Flow (CMF) registered slight downticks, indicating that the bull rally might come to an end soon.

Source: TradingView