- Toncoin saw a sharp decline in interest for Swaps on TON DEX.

- TON has declined by 3.06% over the past 24 hours.

Since the Christmas Eve upswing, Toncoin [TON] has traded sideways. Therefore, since hitting a high of $6, TON has retraced to $5.6.

TON’s lack of an upward momentum has left analysts talking. Inasmuch, CryptoQuant analyst Joao Wedson has cited the continued decline in interest for Swaps as one of the factors affecting the altcoin.

Decline in Interest for Swaps

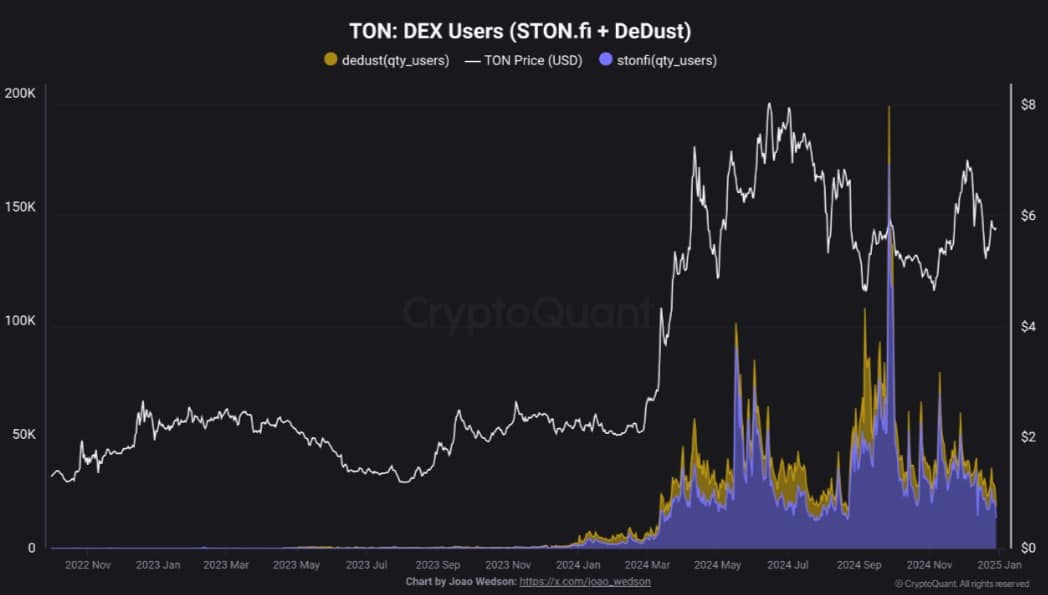

In his analysis, Wedson observed that the number of swaps on the Toncoin network decentralized exchanges has experienced a sharp decline.

Source: CryptoQuant

According to him, the average daily users on STON.fi has declined to 13,300 and on DeDust to 5250.

This is a massive drop from September levels, when the altcoin saw almost 200,000 daily users on two platforms.

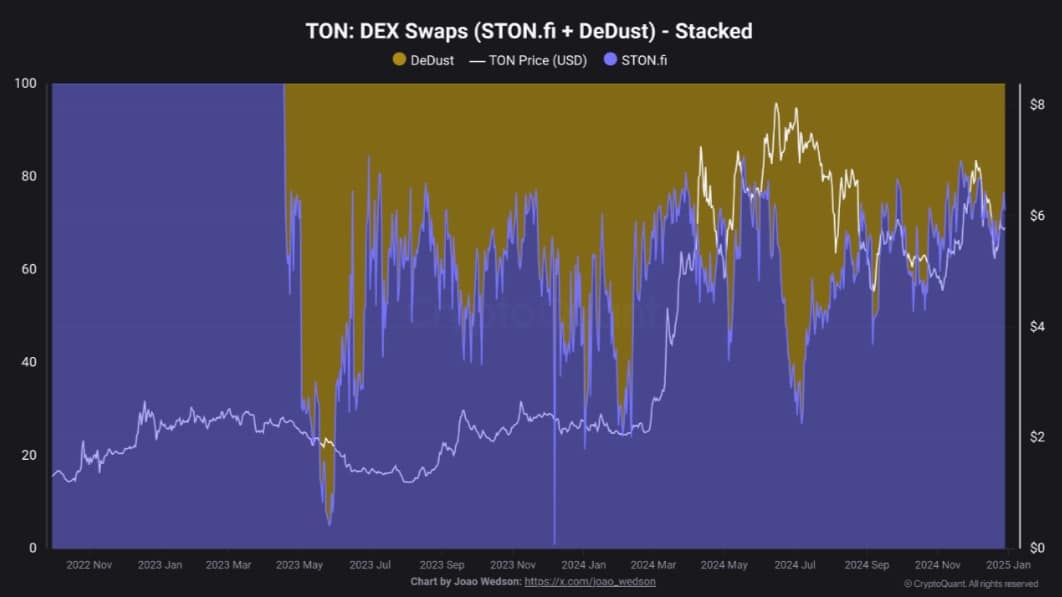

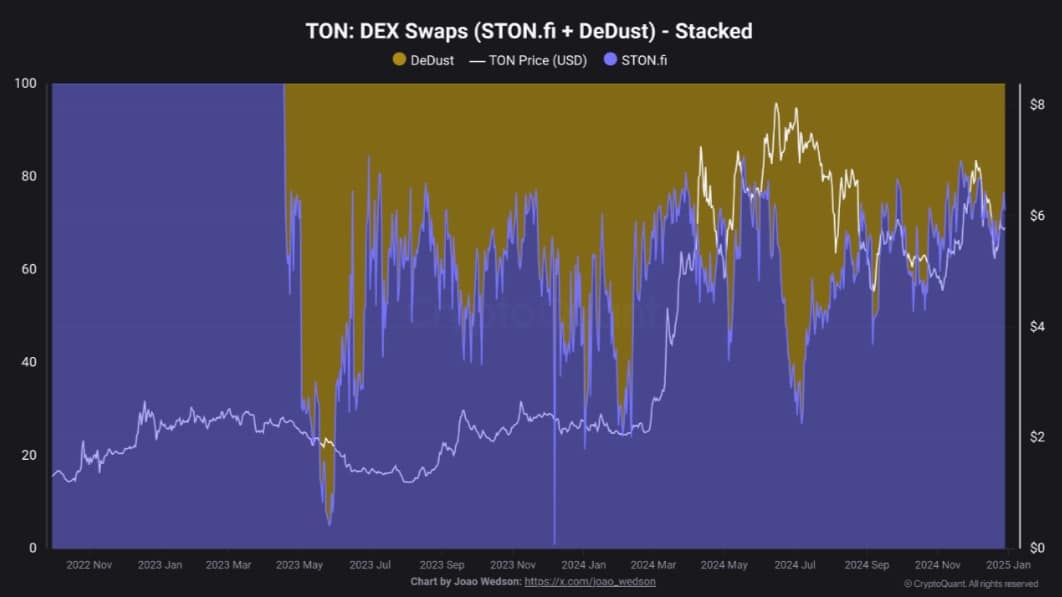

Source: CryptoQuant

The decline in users has been affected by three main factors. First, the reduction in open positions, with many traders liquidating or reducing their exposure to decentralized exchanges.

Secondly, the TON community has experienced uncertainty over the legal issues since the arrest of its founder months ago, thus impacting participation and trust in network-based platforms.

Finally, the overall crypto market has experienced unfavorable conditions since the last FED rate cuts, with lower trading volumes and reduced risk appetite.

With TON seeing a decline in swaps, investors are shifting in interest from decentralized trading towards staking.

While this decline may seem challenging, it can also provide a strategic opportunity. Historically, periods of low interest and market inactivity have served as attractive entry points for investors.

What it means for TON

Notably, a sharp decline in interest for swaps reflected declining buying pressure as investors expressed uncertainty about the market direction, thus reducing their risk exposure.

As such, Toncoin was seeing a sharp drop in demand amidst market uncertainty as investors take cautions positions.

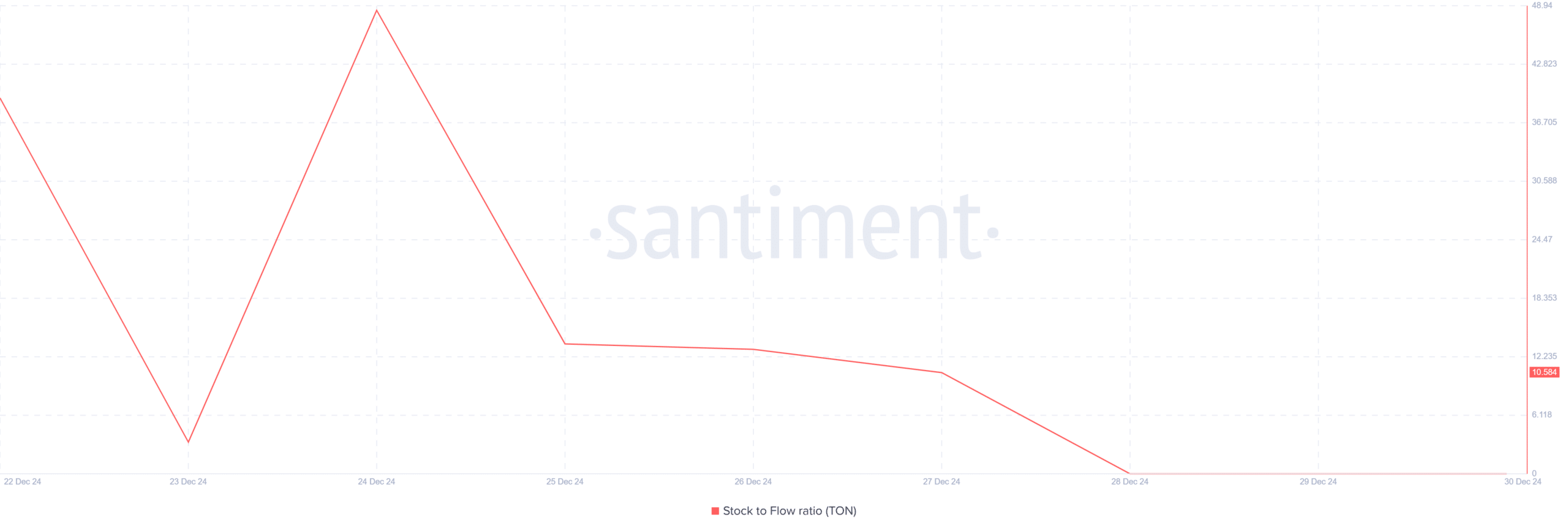

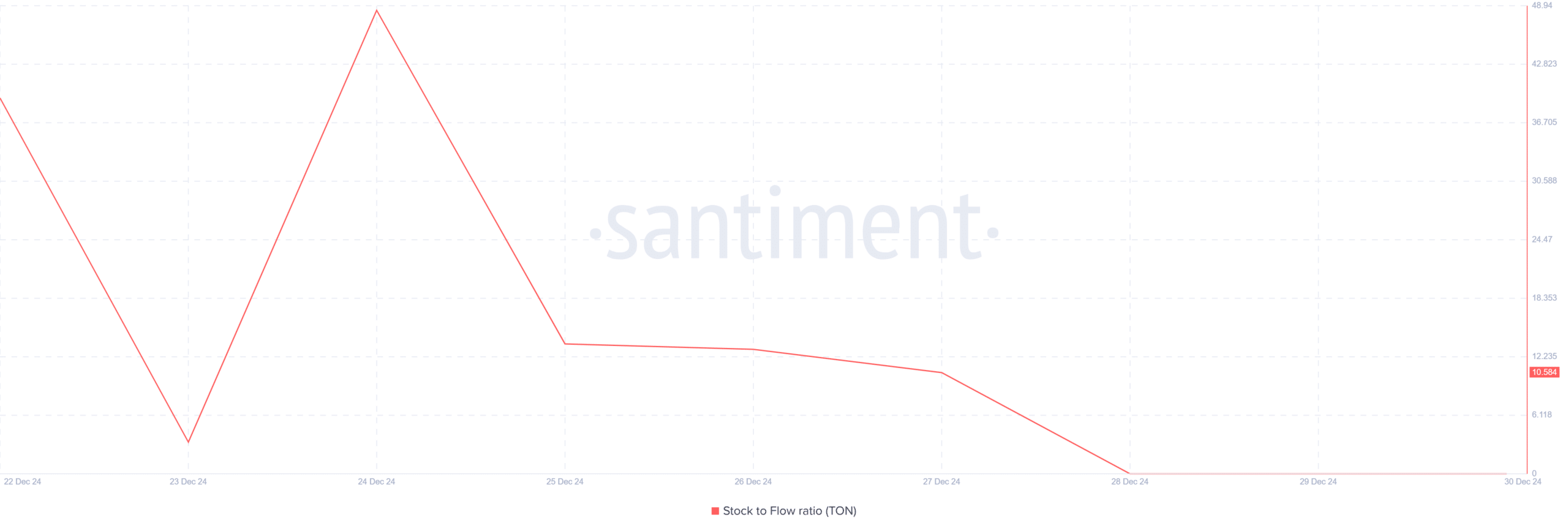

Source: Santiment

We can this decline in demand through TON’s stock-to-flow ratio. According to Santiment, the altcoin’s SFR has experienced a drop over the past three days to zero.

When SFR drops like this, it signifies oversupply and reduced scarcity. With increased supply, the altcoin risks selling pressure causing downward pressure on prices.

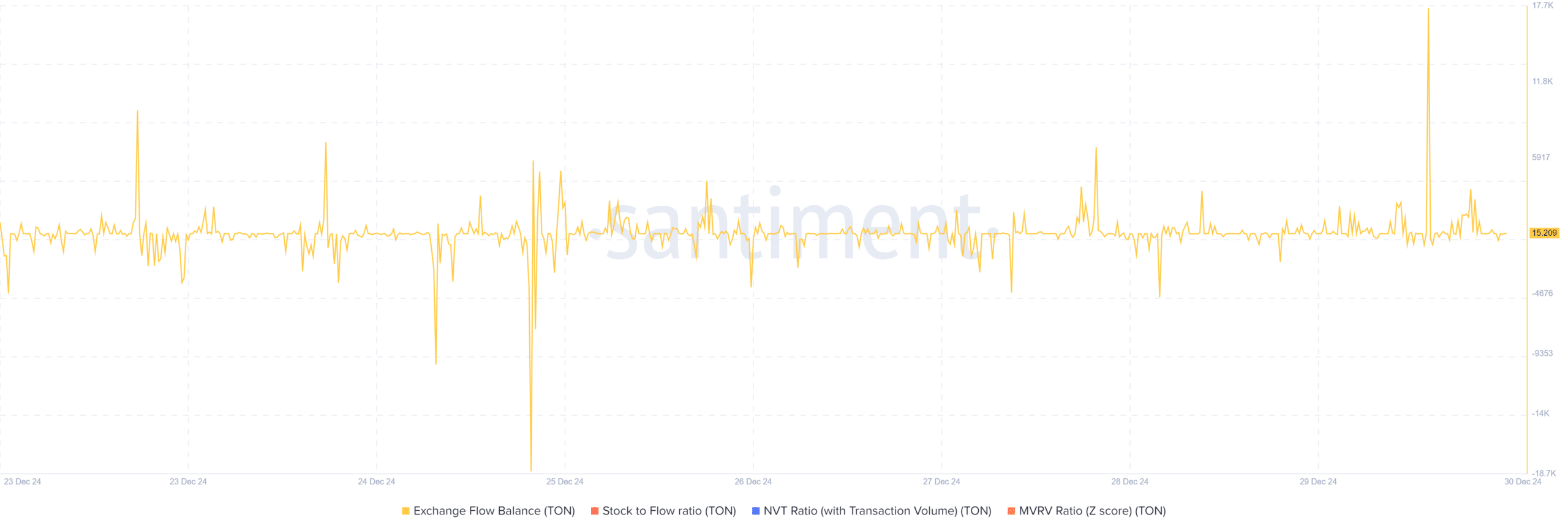

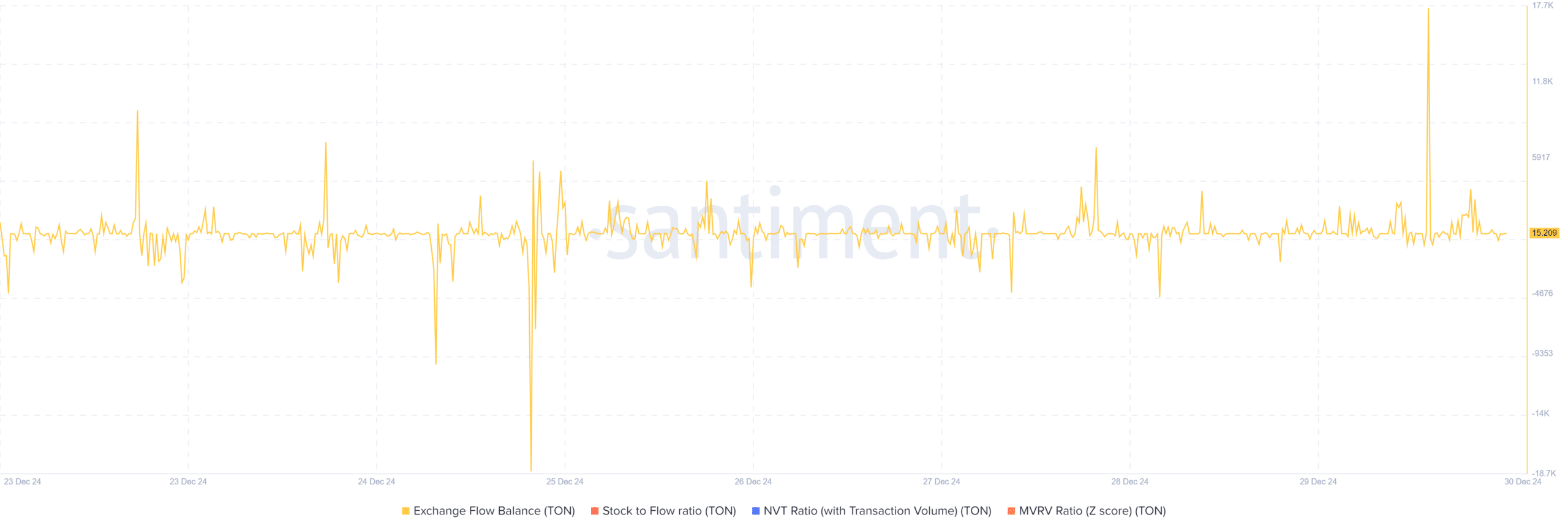

Source: Santiment

This oversupply is further evidenced by a spike in TON’s supply on exchanges. As such, the exchange flow balance has surged to 3459. This shows that investors are sending more assets to exchanges.

Read Toncoin’s [TON] Price Prediction 2025–2026

Simply put, TON is currently reducing demand, and investors have turned overly cautious. This shows that investors lack confidence in the market, with most closing their positions while reducing their risks.

Therefore, if these conditions persist, TON could drop to $5.2. However, if investors view the decline as a buying opportunity, the altcoin could break out of the consolidation range to $6.1.