- Trump proposes a strategic Bitcoin reserve, positioning it with traditional commodities as national reserves.

- Peter Schiff warns Bitcoin reserve could lead to U.S. hyperinflation and dollar devaluation risks.

In July, former U.S. President Donald Trump made headlines by pledging to establish a strategic Bitcoin [BTC] reserve.

This bold initiative, if executed, would position BTC alongside traditional commodities like petroleum, natural gas, and uranium as part of the U.S. national reserves.

Designed to protect against unforeseen supply disruptions, this move underscores BTC’s growing role in the nation’s economic strategy and its shift toward digital asset integration.

That being said, the potential creation of a strategic Bitcoin reserve by Trump could influence BTC’s price movement, though whether it will lead to a bullish or bearish trend remains uncertain.

Polymarket trend on US Bitcoin Reserve

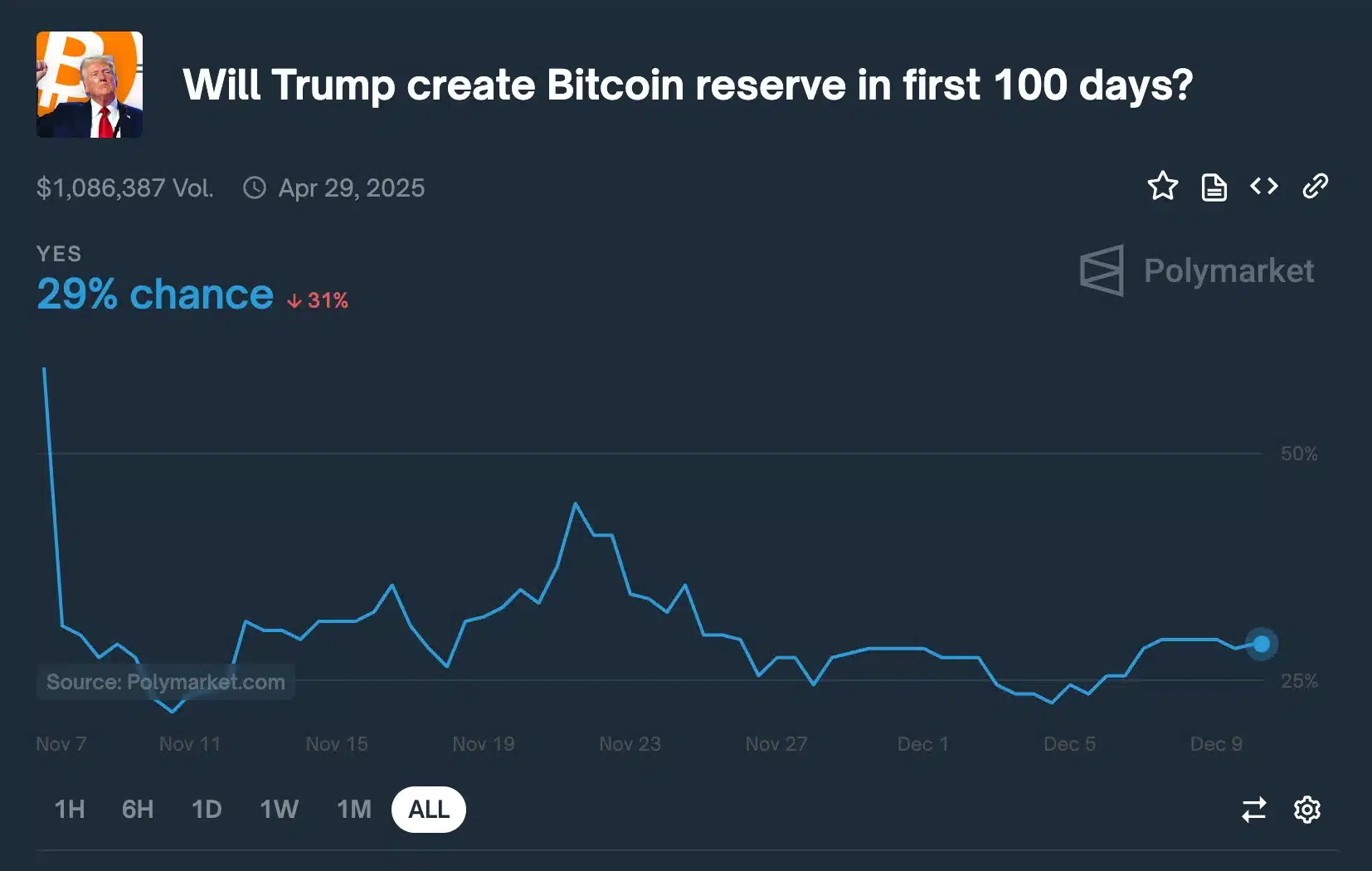

However, according to predictions from Polymarket on the question, “Will Trump create a Bitcoin reserve in the first 100 days?” the likelihood stands at 29% as of the latest update.

This is a slight increase from the previous 27%, though it previously touched a peak of 45%.

Source: Polymarket

The current trend suggests that investor confidence in the reserve’s realization is still cautious, with fewer than 50% betting on its establishment, reflecting uncertainty within the crypto industry.

Execs weighing in

Yet, several key figures and entities are actively supporting the idea of a strategic Bitcoin reserve.

For instance, Senator Cynthia Lummis, a prominent advocate for digital assets, has strongly recommended that the U.S. move forward with establishing such a reserve.

Mathew Siggel, head of digital assets research at VanEck, has also expressed full support for the proposal, highlighting its strategic potential.

Additionally, Anthony Pompliano, founder and CEO of Professional Capital Management, has proposed that the U.S. should immediately print $250 billion and use it to invest in BTC, emphasizing its value as a hedge in uncertain financial times.

“The United States should print $250 billion on the first day of Donald Trump’s presidency and put 100% of the proceeds into Bitcoin.”

Not all shared the same boat

As expected, not everyone shares the same perspective on the proposal.

For instance, Peter Schiff recently raised concerns, arguing that its approval could have implications for both the U.S. dollar and Bitcoin.

He stated,

“Ultimately, so many dollars would be printed to buy Bitcoin that the U.S. would experience hyperinflation, rendering the dollar completely worthless. Once the dollar is worthless, the U.S. could no longer keep buying Bitcoin.”

Adding to the fray was former US Secretary of the Treasury Larry Summers who said,

“Of all the prices to support, why would the government choose to support by accumulating a sterile inventory, a bunch of Bitcoin? There is no reason other than to pander to generous special interest campaign contributors.”

Thus, with uncertainty lingering among investors, it remains to be seen whether Trump’s plan will materialize or remain a mere vision.

Meanwhile, as of the latest data from CoinMarketCap, BTC is trading at $98,451.73 following a 1.43% decline over the past 24 hours.