- Count of XRP whales has risen over the past month

- This, despite the fall in the crypto’s value

The number of XRP investors who hold between 1,000 and 1,000,000 tokens has risen over the past month, despite the decline in the altcoin’s value. This, according to Santiment’s data for the aforementioned period.

Source: Santiment

In fact, Santiment found that this cohort of XRP holders totalled 860,000, having climbed by 0.23% in the last 30 days.

This growth, albeit minute, is noteworthy, as it follows a sharp decline in the number of XRP whales that make up this category of its investors.

Data also revealed that towards the beginning of the year, the number of XRP whales who held between 1,000 and 1,000,000 XRP tokens was 867,000. This number gradually fell to a year-to-date low of 858,000 by 3 April, after which it began to climb.

XRP and its potential

The hike in an asset’s whale count is significant, as it often precedes a rally in its price. While the recent market downturn has affected XRP and caused it to suffer a 7% value loss, demand for the altcoin persists among market participants.

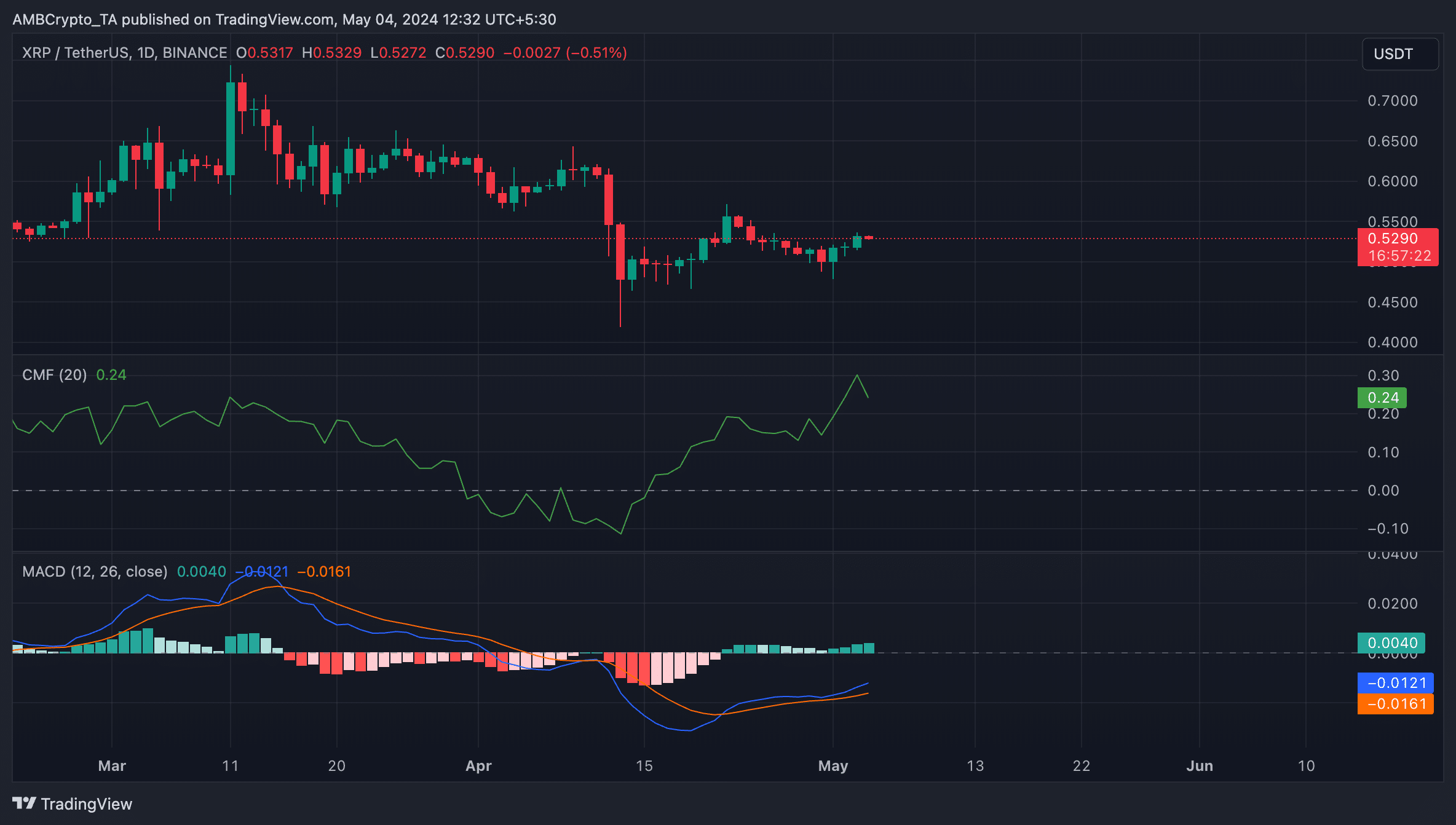

Its key momentum indicators on the daily chart confirmed this. For example, the Chaikin Money Flow (CMF) has trended upwards despite the decline in price.

Realistic or not, here’s XRP’s market cap in BTC’s terms

This indicator tracks the flow of money into and out of an asset. When it rises while an asset’s price declines, a bullish divergence is formed. It means buyers are accumulating the asset despite the price dropping. This might be because they believe the price decline is temporary or represents a buying opportunity.

Now, XRP’s decline did reveal that selling pressure has been high. However, the rising CMF signalled that if buying momentum continues to build, it could eventually outpace the token’s sell-off, triggering a price hike.

Source: XRP/USDT, TradingView

The possibility of this happening in the short-term was confirmed by the position of XRP’s MACD line (blue) at press time. It crossed above the signal line (orange) on 21 April and has since moved in an uptrend. When an asset’s MACD line rests above its signal line, it is bullish. It indicates that market momentum is increasing in a positive direction.

However, XRP’s MACD and signal lines remained below the zero line at press time – A sign that bearish influence was still significant across the market.