- Bitcoin, at $52,000, could represent the last golden opportunity to purchase.

- Large traders offloading their BTC holdings could drive the price down to this critical support level.

Since the beginning of the month, Bitcoin [BTC] has failed to exhibit any significant market movements. After reaching a peak of $59,844.10, it has declined to $56,855.25, a clear indicator of the market’s growing bearish trend.

The persistence of bearish pressures may ultimately serve as a strategic advantage for investors looking to accumulate at lower prices.

Golden opportunity at $52k

Crypto analyst Carl Runefelt has identified a critical pattern in BTC’s recent trading activity. According to his analysis, BTC was oscillating within a descending channel, characterized by a sideways and downward trajectory.

Historically, when an asset trades within such a pattern, a further decline is anticipated.

True to form, BTC has recorded a 4.62% drop over the last week, with indications that it may continue to slide to the channel’s lower boundary.

What makes this scenario particularly compelling is the convergence of the channel’s bottom with a major support zone at $52k.

Should BTC’s price hit this level, it could trigger a significant breakout from the descending channel and propel the asset toward new highs.

Source: X

Runefelt views this scenario as a critical buying opportunity, remarking,

“It could be our last golden opportunity to accumulate it this cheap.”

So, BTC is unlikely to revisit these levels once it begins its upward trajectory. This prompted AMBCrypto to examine the probability of BTC’s price dipping further.

Investors heed Bitcoin’s bearish call

AMBCrypto’s analysis revealed that large holders and institutional traders were anticipating a further drop in BTC prices, as evidenced by significant sell-offs in the market.

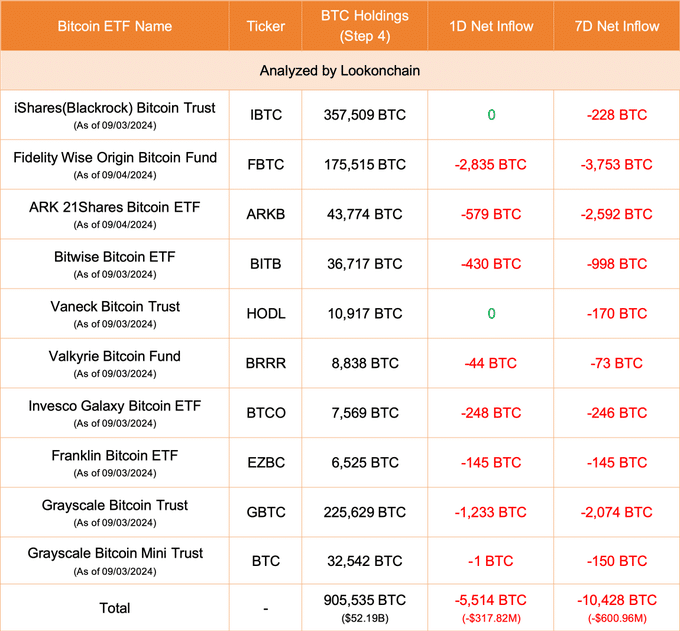

Data from Lookonchain indicated a substantial outflow from BTC spot ETF companies—primarily catering to institutional investors—over the past 24 hours and week.

Specifically, withdrawals totaled 5,514 BTC ($317.82 million) and 10,428 BTC ($600.96 million), respectively.

Source: X

Further reporting by Lookonchain highlights actions by Ceffu, a digital asset management firm, which transferred 3,063 BTC worth $182 million last week into Binance [BNB].

This suggested a strategy that endorses sales over long-term holdings.

Such moves signal a shift towards less volatile assets, like USD, as investors seek to preserve capital value.

If these trends continue, a dip for BTC to the critical $52k level, aligning with the bottom of the trading channel, appears increasingly probable.

Larger holders in a bearish outlook

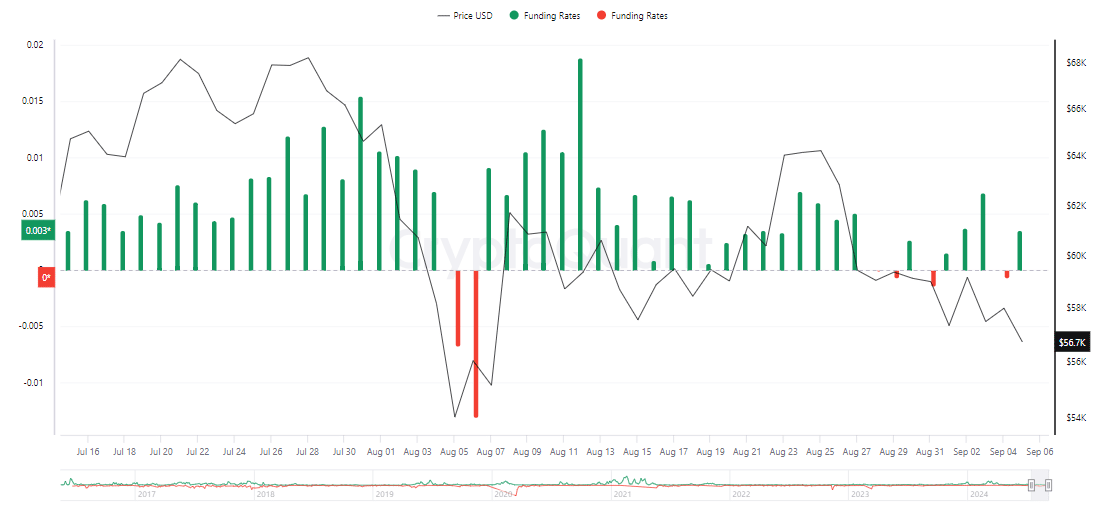

CryptoQuant reported a growing bearish sentiment among retail traders. The Funding Rate has steadily declined since the 3rd of September, dropping from 0.006839 to a press time reading of 0.004357.

Source: CryptoQuant

If this trend continues over consecutive days, it could signal a further decrease in BTC from its current level.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The Open Interest supported this perspective, showing a decline toward the lowest point recorded on the 1st of September. According to Coinglass, at press time, there has been a modest 0.58% drop in the past 24 hours.

Persistent bearish pressure is likely to reduce further the Open Interest, which would directly impact BTC’s price, potentially driving it lower from its current position.